In the unpredictable world of cryptocurrency, altcoins under $1 in 2025 are attracting massive attention from everyday investors. Their attractiveness is understandable: these cheap tokens provide the psychological rush of having thousands of units at the cost of a lunch, alluding to the hope of returns that will be oversized. However, experts point out that it is not only the price that determines the value, but also that a great number of the cheap tokens will never attain sustainable growth.

Nevertheless, the story is changing. Once dismissed as meme-driven outliers, altcoins under $1 are increasingly viewed as serious players in diversified crypto portfolios. As Web3 adoption increases, the rise of tokenized real-world assets and regulated compliance begins to reassure, the 2025 cycle among followers is likely to favour smaller, more nimble blockchain projects.

The guide is not an indicator of what coins will go to the moon but rather profiles seven tokens that were selected under transparent fees: liquidity, utility claims, team credibility, and community strength. One is to assist small investors in assessing whether such speculative gamblers spark a slot in their watchlists – and to remember risk in perspective.

Want to discover these altcoins before everyone else? Here’s how we find altcoins under $1 before they pump.

What Are Altcoins & How Are They Different from Bitcoin?

What Are Altcoins?

The abbreviation altcoin is merely an alternative coin- any cryptocurrency besides Bitcoin. Although Bitcoin is the most well-known and widely used digital currency, thousands of other altcoins are currently in existence, each attempting to upgrade Bitcoin’s systems or fulfill a specific target in the crypto world.

What distinguishes Altcoins and Bitcoin?

The purpose of Bitcoin was to create a decentralized alternative currency and store of value. A large number of altcoins, however, have a particular purpose, including smart contracts, games, payment, or governance.

Technology: Bitcoin utilizes a self-proof-of-work blockchain. As an alternative, in many cases, sets of alternative consensus mechanisms (Proof-of-Stake, Delegated PoS, DAG, etc.) are experimented upon in altcoins to provide higher speeds or reduced costs.

Supply: There is a limited supply of 21 million Bitcoin coins. The range of altcoins is diverse: some have depreciated, others have a burning feature, and others count on activity in the ecosystem.

Main Types of Altcoins

- Stablecoins: They are tethered to fiat (e.g., USDT, USDC) for price stability.

- Utility Tokens: They provide access to the blockchain (e.g., ETH for gas fees, BNB for Binance).

- Governance Tokens: Holders of such Tokens are permitted to vote on project decisions (e.g., UNI, AAVE).

- Meme Coins: They are community-driven, activity-driven coins that are frequently fueled by social hype (i.e., DOGE, SHIB).

- Security Tokens: Represent ownership of non-digital assets, which are regulated as securities.

- DeFi Tokens: Power decentralized finance protocols (e.g. LINK, MKR, or CAKE).

- NFT/Game Tokens: They are applied in gaming ecosystems and digital collectibles.

Interpreting these types will help investors make informed judgments about whether a coin priced under a dollar is a speculative investment or a display of a larger, long-term, and sustainable crypto pattern.

Why Investors Are Focusing on Altcoins Under $1 in 2025

The rising attention on altcoins under $1 in 2025 is not merely a product of their perceived affordability; it reflects deeper shifts in how retail investors approach risk, diversification, and early-stage opportunities within the crypto landscape. While coins priced below a dollar often carry reputational baggage commonly associated with hype, vaporware, or short-term pump cycles the narrative has gradually evolved.

In recent quarters, platforms like CoinGecko and CoinMarketCap have reported a noticeable uptick in search volume and watchlist activity for altcoins under $1, particularly among non-institutional users. Analysts suggest that part of this interest stems from “unit bias,” the psychological tendency to prefer assets where one can own thousands of units, even if market cap and fundamentals don’t support intrinsic value growth. source: Investopedia.

However, there’s more to this trend than behavioral economics. Many altcoins under $1 now serve genuine technical or social functions, from powering layer-1 blockchains and governance DAOs to enabling micropayments, NFT transactions, and data storage. As of mid-2025, several altcoins under $1 have begun appearing in institutional watchlists due to their utility-focused roadmaps, token-burning mechanisms, and developer transparency, albeit with cautious position sizing.

Retail investors especially those working with modest portfolios are also turning to these tokens as a low-barrier way to experiment with diversified baskets. Because many larger-cap assets like ETH, LINK, or even SOL have already seen outsized runs, smaller altcoins under $1 are perceived as providing higher “asymmetric upside” despite the accompanying volatility. This idea has been echoed in Reddit’s r/AltcoinDiscussion threads, where traders routinely post curated baskets of microcaps for peer feedback.

Still, seasoned researchers warn against mistaking price for value. A coin trading at $0.03 with a 50 billion circulating supply can be far more inflated than one at $2 with strict emission caps. This is why evaluating tokenomics, liquidity depth, and on-chain activity is critical when engaging in this space.

In short, the growing interest in altcoins under $1 isn’t a bubble it’s a reflection of how financial inclusion, speculative appetite, and blockchain innovation intersect. But as this guide will repeatedly emphasize, low price is never a guarantee of low risk, and due diligence must precede allocation.

Methodology: How We Selected the 7 Altcoins Under $1 for 2025

Identifying promising altcoins under $1 in 2025 demands more than just scanning prices. While low cost might appeal to budget-conscious investors, true potential often lies beneath surface-level metrics. While researching for this guide, we adopted a multi-dimensional approaches to keep things clear, useful for small investors, and relying on real data from both blockchain and non-blockchain.

Price Threshold (Under $1)

Each token had to be trading under $1 at the time of writing (July 10, 2025), using price data from CoinGecko and CoinMarketCap.

Minimum Liquidity and Trading Volume

We excluded illiquid or delisted tokens by applying filters:

- Minimum 24h volume of $1M (flexibly lowered for niche tokens with ongoing dev activity)

- Presence on at least one centralized or popular DEX with real order flow

Active Development / GitHub Signals

We checked for signs of ongoing development, such as:

- Active GitHub commits

- Roadmap updates or testnet releases in 2024–2025

- Recent Medium blog posts, forum discussions, or ecosystem integrations

Use Case Relevance

We selected tokens across diverse blockchain categories, including:

- DeFi infrastructure

- Supply chain and payments

- Privacy and identity

- Quantum resistance

- Civic governance and data ownership

- Location-based services

This ensured the final list was thematically diversified, not just a ranking by price.

Community and Social Sentiment Checks

Using LunarCrush, X/Twitter, and Reddit, we evaluated:

- Presence of an active, non-botted community

- Frequency and quality of updates

- Whether discussion focused on technology and development, not just price

Smart Contract Transparency & Audit Status

We gave preference to tokens that had:

- Published audit results (e.g. via CertiK or Hacken)

- Open-source smart contracts

- No known rugpull flags (verified via TokenSniffer, GoPlus)

Exclusion of Meme Tokens with No Utility

Tokens that had no identifiable roadmap, team, GitHub , or published whitepaper were disqualified, even if they had temporarily high volume.

Top 7 Promising Altcoins Under $1 in 2025

Finding good altcoins under $1 in 2025 requires looking beyond price predictions. We need to study their usefulness. We should check signs of adoption. We also must look at their long-term potential. While the affordability of such Altcoins under $1 may appeal to retail investors, especially those with limited capital. It is precisely this psychological attraction also warrants caution. Below are some projects that, based on recent data and analysis, seem worth looking into. They are not sure bets, but they could be good opportunities despite the market’s ups and downs.

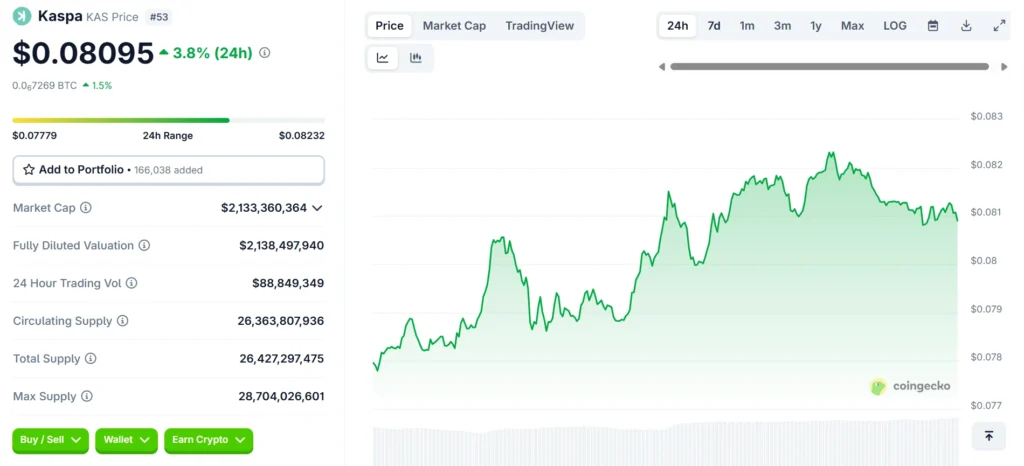

Coin 1: Kaspa (KAS)

Current Price: $0.080

24h Trading Volume: $88.8M

Market Cap: ~2.13B USD

(Data validated via CoinGecko as of July 10, 2025)

Kaspa has quickly become a well-known name among altcoins under $1 in 2025. It is often brought up in conversations about scalable proof-of-work (PoW) infrastructure. Kaspa uses a blockDAG architecture, which is a directed acyclic graph that lets blocks live together and be confirmed at the same time. This is different from Bitcoin, which uses a linear block-by-block model. This lets more transactions go through and confirmations happen faster without losing the decentralized security that comes with traditional mining models.

Kaspa was first released in 2021 and is popular because it is fast and decentralized. The protocol currently has a confirmation time of one block per second, but it wants to increase this throughput so that more people can use it, especially in places where people depend on mobile-first blockchain apps. Kaspa’s GitHub says that as of Q2 2025, the project is still one of the most actively developed PoW ecosystems, with hundreds of commits across its node and wallet repositories.

Kaspa’s community has been unusually united when it comes to feelings. On sites like X (formerly Twitter), $KAS is often trending in altcoin subcategories, usually because people are talking about how proof-of-work is still relevant after Bitcoin. It’s also important to note that the token is available on major exchanges like KuCoin and MEXC. This makes it easier for small investors to buy it without having to deal with hard-to-find DEXs.

Kaspa’s value, which is already in the billions, may limit its potential for growth compared to smaller microcaps, even though it has architectural advantages and a lot of community support. Some researchers say that Kaspa is now in a “hybrid zone” because it is still priced under $1 but is no longer a “undiscovered gem.” Also, its use of PoW mechanics may come under long-term scrutiny as energy-efficient consensus models become more popular in mainstream policy discussions.

Still, for people who want to build a balanced altcoin portfolio with coins that cost less than $1, Kaspa is a rare mix of technical credibility, liquidity, and visible developer momentum. It might not give you a 100x return from where it is now, but it could be a “blue chip” altcoin in the sub-dollar category, which makes it worth a close look.

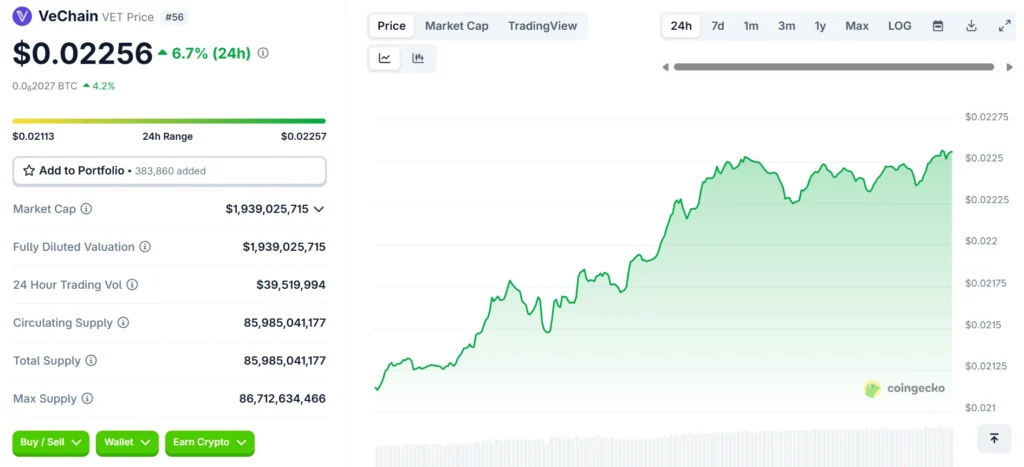

Coin 2: VeChain (VET)

Current Price: ~$0.022

24h Trading Volume: ~$39.56M

Market Cap: ~$1.9B

(Data source: CoinGecko, as of July 10, 2025)

VeChain is one of the most well-known altcoins under $1 in 2025. What sets it apart from the rest is its long-standing commitment to enterprise-grade blockchain adoption, especially in the logistics and supply chain industries. The platform started in 2015 and was renamed VeChainThor in 2018. It uses two tokens: VET for sending value and VTHO (VeThor) for paying transaction fees and running smart contracts.

VeChain’s main strength is that it works well with industries in the real world. Its blockchain infrastructure has been used for a lot more than just crypto-related things, like verifying luxury goods with LVMH and tracking food safety in China. By 2025, VeChain will have released several blockchain-as-a-service (BaaS) tools to help traditional businesses use decentralized ledgers without having to completely change their tech stacks. Updates from the VeChain Foundation on GitHub say that the protocol is still making progress with SDK improvements, developer grants, and compliance integrations.

People in the community still feel strongly about VeChain, but their opinions are a bit split. Long-term holders like its real-world uses and partnerships, but some crypto-native users criticize it for being too centralized because it focuses on businesses. Still, VeChain has a strong network of validators, and VET is available on almost all major CEXs, such as Binance, Coinbase, and KuCoin. This makes it easy for small investors to get in and out of the market.

VeChain’s market cap is still pretty big, which may limit its potential compared to smaller, more speculative microcaps. Critics also say that the use of enterprise blockchain has moved more slowly than expected, with many partnerships still in the exploratory or pilot stages. Also, VET’s price action over the past two years has shown these mixed signals, with prices staying stable but not breaking out.

That being said, VeChain is still an interesting choice for investors who want to take risks and find cheap altcoins under $1 that have real-world uses and are backed by well-known companies. It might not give you huge returns in a short amount of time, but its unique position could help you protect yourself from the noise and churn of riskier investments.

If real-world DeFi adoption is your focus, explore our picks for the top DeFi altcoins under $1 with practical use cases.

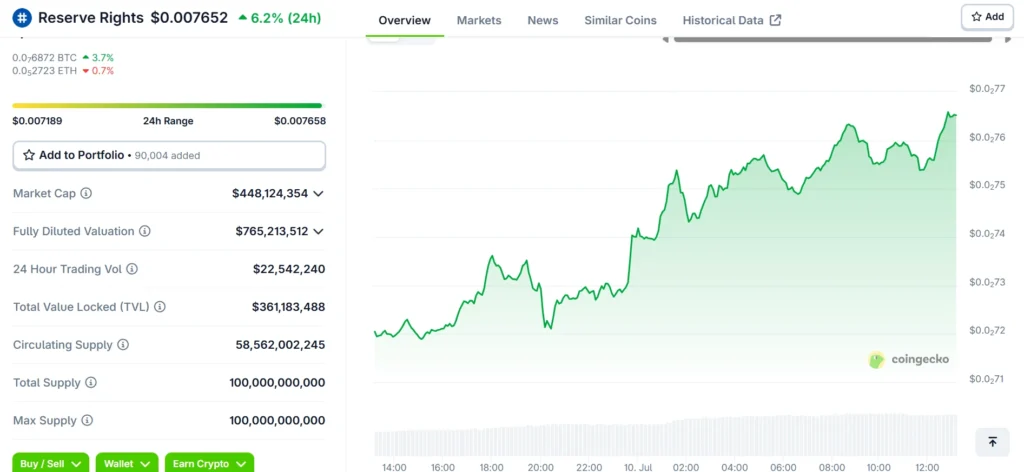

Coin 3: Reserve Rights (RSR)

Current Price: $0.0076

24h Trading Volume: ~$22.5M

Market Cap: ~$450M

(Data source: CoinGecko, as of July 10, 2025)

Reserve Rights (RSR) is a popular altcoin under $1 to keep an eye on in 2025, especially for investors who are interested in the intersection of stablecoins, inflation in emerging markets, and decentralized financial sovereignty. There are two tokens in the Reserve Protocol: RSV, a stablecoin backed by a basket of crypto assets, and RSR, the governance and insurance token that keeps RSV stable when the market is volatile.

Reserve started out as a response to hyperinflation problems in Latin America. Its bigger goal is to create a network of asset-backed stablecoins that are resistant to censorship and fit the needs of local economies. Investments from Coinbase Ventures and Peter Thiel have brought a lot of attention to the team behind Reserve in the past. Venezuela and Argentina were the first places where the protocol gained a lot of traction. However, its roadmap shows that it wants to build a global stablecoin infrastructure through Reserve-branded RTokens, each backed by a variety of on-chain assets (source: Reserve Protocol Documentation).

The Reserve team is now working on launching modular, community-governed stablecoins that can be customized for different economic areas. The RSR token’s job is to manage these deployments, protect against over-collateralization failure, and take part in yield distribution systems. There are still active contributions to many repositories on GitHub, but updates seem to be coming slower in 2025 than they did in 2021–2022.

People have different feelings about RSR. The token still has a loyal group of users who are ideologically motivated, especially those who support financial sovereignty. However, some retail investors think its tokenomics are hard to understand and too reliant on RSV adoption. But RSR is always liquid on Binance, Gate.io, and MEXC, so even small investors can easily get in without much trouble.

Still, you should be careful. The low price of the token may make it seem valuable, but RSR has a circulating supply in the tens of billions, which lowers its price-to-market cap ratio. Also, its main selling point—off-chain stablecoin utility—needs a lot of regulatory work, especially in places that don’t trust privately issued money.

If you’re putting together a low-cap altcoin portfolio worth less than $1, RSR could be a high-risk, mission-driven asset with asymmetric potential. This is especially true if decentralized stablecoins become popular in places where fiat systems are unstable. The token’s future, on the other hand, depends a lot on Reserve’s ability to operate in many places while keeping economic trust on-chain.

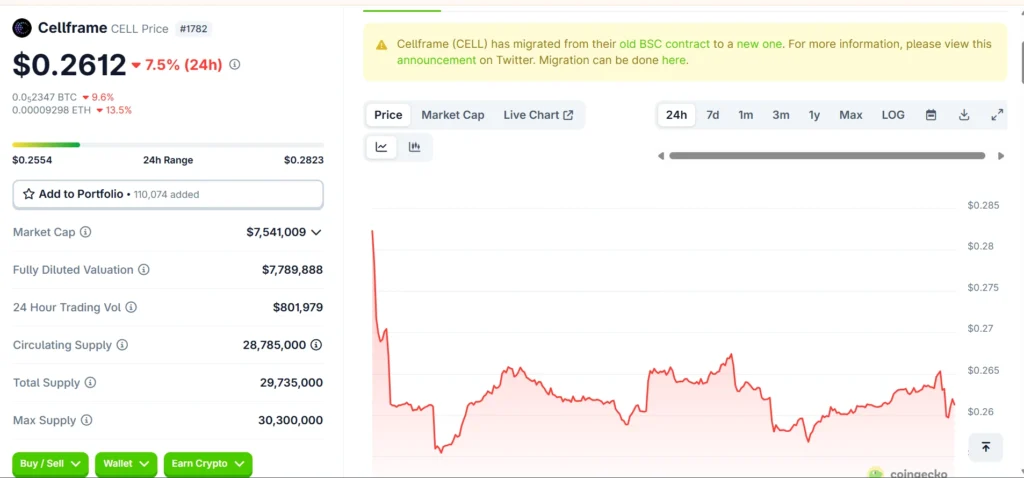

Coin 4: Cellframe (CELL)

Current Price: ~$0.261

24h Trading Volume: ~$801K

Market Cap: ~$7.54M

(Source: CoinGecko, as of July 10, 2025)

Quantum computing is still a new idea in the world of cryptocurrencies, but Cellframe has set itself up as a forward-looking blockchain platform that will protect against the threat of quantum decryption. The native token, CELL, is worth about $0.18, which puts it squarely in the low-cap altcoin category for high returns in 2025, but it’s at the upper end of the sub-$1 category.

Cellframe’s main new feature is its dual-layer, post-quantum secure architecture, which is made with low-level C code instead of Solidity or Rust. The developers say that this makes Cellframe faster, better at controlling memory, and harder to attack with quantum-based attacks. It also lets you make decentralized applications (dApps) that can work together safely across trust-minimized channels and use multiple chains. Cellframe’s GitHub says that recent commits have made the wallet SDK better and improved the way nodes talk to each other.

Cellframe has a small but technically savvy following in the community and in terms of sentiment. On sites like Reddit and X (formerly Twitter), people often talk about its long-term value as a security-focused infrastructure layer, especially for institutions or high-sensitivity use cases like IoT and defense systems. But people still don’t know much about it in the wider crypto space, and its market visibility is often overshadowed by platforms that are more heavily advertised.

Exchanges like KuCoin and MEXC offer liquidity, but it’s still not as much as it is for more popular DeFi tokens. The daily trading volume of just under $3 million is relatively low, which suggests that people are only interested in it for speculation and not for long-term use in the ecosystem, at least as of mid-2025.

There are big risks. Some people say that quantum computing is not a threat right now, and that creating an ecosystem around a risk that is so far away may slow down adoption and make it hard to tell if the product fits the market. Cellframe also doesn’t have any partnerships with big dApps or business projects, and it hasn’t published any peer-reviewed audits of its cryptographic stack yet. The tech stack is ambitious, but it’s still not clear if it will be used or accepted.

Cellframe could be a long-term hedge for small investors who want to get an asymmetric view of deep-technology stories. It’s not a bet on today’s problems, but on tomorrow’s weaknesses. It could be a candidate for watchlists because it is affordable, has a unique design, and has a visionary framing. However, you should be both curious and careful when you look at it.

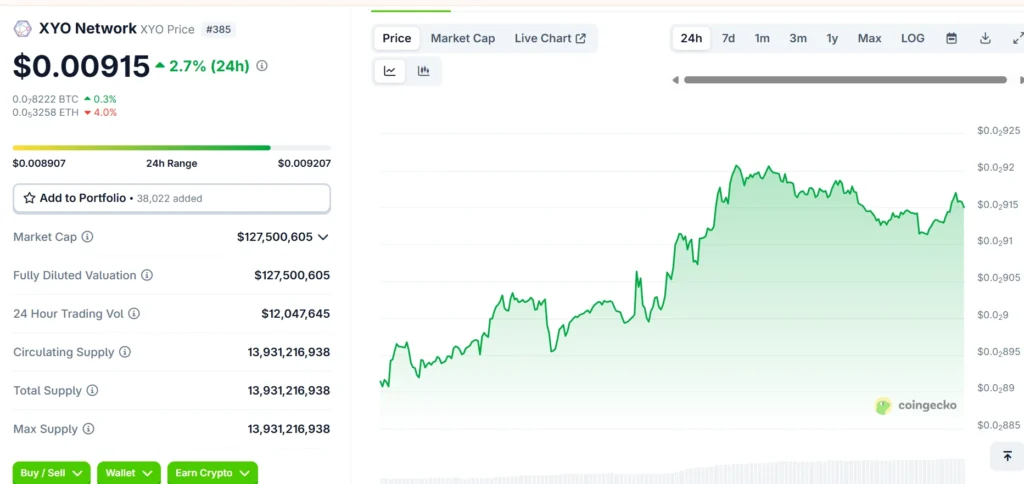

Coin 5: XYO Network (XYO)

Current Price: ~$0.009

24h Trading Volume: ~$12M

Market Cap: ~$127M

(Source: CoinGecko, as of July 10, 2025)

XYO Network works in a small but interesting area of the blockchain ecosystem: location-based cryptographic verification. Sometimes called a “proof-of-location” network, XYO lets devices check and record their geospatial position on-chain without needing to talk to each other. This can be useful in logistics, e-commerce, urban planning, and even insurance.

In this decentralized location oracle network, the XYO token serves as an incentive. People who give verified location data, called Sentinels and Bridges, get paid in XYO, but people who ask for data, like businesses and developers, have to pay for the service. This means that XYO is one of the few new altcoins under $1 in 2025 that has a real-world utility layer based on data and hardware interaction.

The idea has gained some traction, especially during the NFT boom and early metaverse experiments, when digital assets needed location anchors or ways to verify them. Recently, XYO has started to focus more on use cases for the Internet of Things (IoT) and geospatial data integrity. Development on XYO’s GitHub is still going strong. Recent updates have been mostly about SDK tools and adding more ways for third-party apps to work with XYO.

People have different feelings about XYO. On Reddit and X, the project has a cult following among regular people, and many small investors are interested because of its low price and sci-fi-like branding. But mainstream influencers don’t often talk about the token, probably because it doesn’t have a financial use case and the exchange volumes aren’t very high.

You can buy XYO on Coinbase, Gate.io, and KuCoin. This makes it easy for small investors to use standard wallets and fiat onramps. That being said, its low daily trading volume (about $1.1 million) and lack of use in well-known DeFi protocols may make people wonder about how quickly it is being adopted right now.

Some people say that XYO’s mission is still unclear and too technical for most people, and that for location-oracle infrastructure to work on a large scale, not only does software need to be adopted, but hardware also needs to be compatible and data verification standards need to be strong. These are problems that go beyond tokenomics. Also, competition from more general oracle networks like Chainlink makes its long-term competitive edge even harder to keep.

Still, XYO is an unusual but smart choice for investors who want to build a speculative altcoin basket worth less than $1. It uses blockchain, geospatial computation, and IoT principles in a way that no other project does. This makes it a possible hedge for people looking for low-profile utility projects with big upside.

Several of the above coins are still undervalued despite strong fundamentals. For a deeper look at micro-cap plays, see our list of undervalued altcoins under $1 with market caps under $50M.

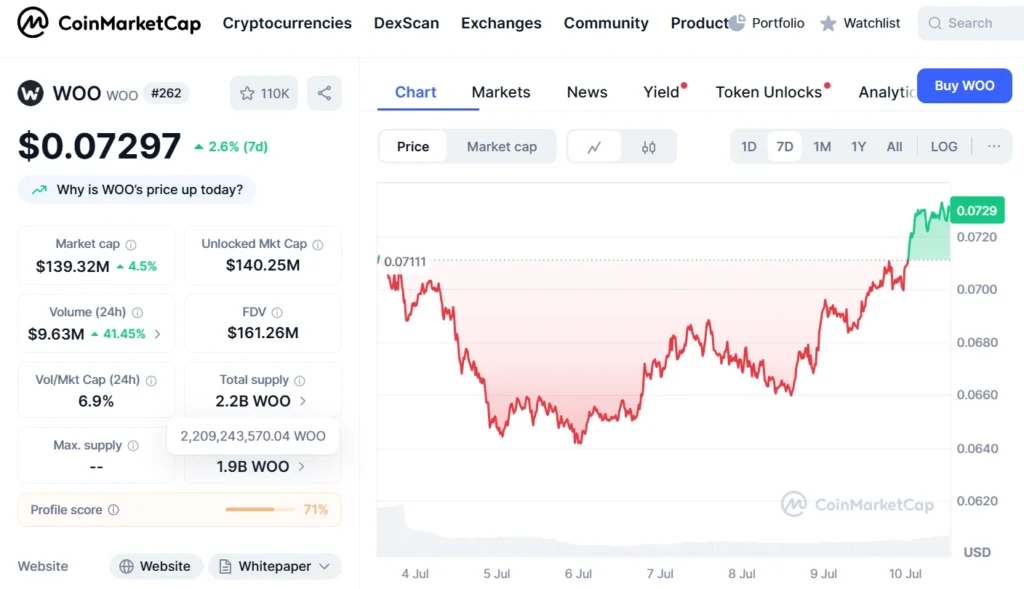

Coin 6: WOO Network (WOO)

Current Price: ~$0.072

24h Trading Volume: ~$9.63M

Market Cap: ~$139.32M

(Source: CoinMarketCap, as of July 10, 2025)

WOO Network is a unique liquidity layer for both centralized and decentralized exchanges in the decentralized finance (DeFi) and trading infrastructure space. Kronos Research, a company that makes markets and does quantitative trading, made WOO to link institutional investors with everyday people who use crypto. It does this by letting you trade without paying any fees, sending your orders in the best way possible, and supporting a wide range of trading protocols.

WOO has two main products: WOO X, a centralized exchange for professionals, and WOOFi, a decentralized app that lets people pool their money and use yield strategies. The WOO token has a purpose in this ecosystem: it lets users stake, vote on governance issues, get liquidity incentives, and lower fees. At the moment, it costs about $0.20, which is on the high end of altcoins that will cost less than $1 in 2025. But it’s still cheap enough for investors with small and medium-sized portfolios.

From a development point of view, WOO has always added new features and made old ones better. They worked on making staking and cross-chain compatibility better in 2025, as shown by their activity on GitHub. WOOFi can now work with a number of chains, such as Arbitrum and Optimism. It wants to make swaps cheaper by lowering slippage in pools of liquidity that aren’t very big.

The mood in the community is still strong, but it’s stronger among experienced traders and liquidity providers than it is among casual retail investors. A lot of the time, when people talk about DeFi infrastructure, cross-chain yield, and Layer 2 strategies, they bring up WOO on X. The project is also more credible because it works with Avalanche, Arbitrum, and BNB Chain. These partnerships keep bringing more money into its DEX modules.

Some people, on the other hand, say that WOO’s model mixes centralized and decentralized models, which could turn off users who are strict about DeFi. Also, trading without fees sounds great, but it won’t last long unless Kronos Research keeps providing liquidity and the network keeps getting new users. Changes to the rules that govern centralized exchanges and custodial services could also have an effect on WOO X’s future operations.

WOO Network is a great place for people who want to buy a lot of different altcoins that cost less than $1. It has a lot of useful features, is always being worked on, and has a lot of liquidity. It may not have the huge upside of micro-cap tokens, but it is a “blue chip under $1” because it helps the DeFi ecosystem grow. This is especially true for investors who are more interested in actual use than in stories that are just for fun.

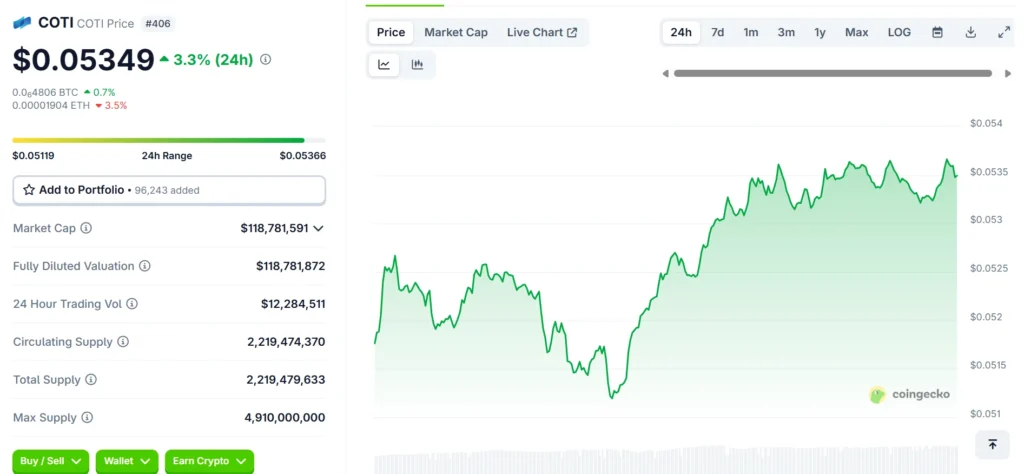

Coin 7: COTI (COTI)

Current Price: ~$0.053

24h Trading Volume: ~$12.2M

Market Cap: ~$118M

(Source: CoinGecko, as of July 10, 2025)

COTI, which stands for “Currency of the Internet,” is a blockchain protocol that focuses on fintech and aims to power payment networks for businesses. COTI is at the crossroads of stablecoin infrastructure, DAG-based consensus models, and white-label fintech solutions. It wants to help businesses, governments, and payment providers that want to issue and manage digital currencies without having to build the backend from scratch.

COTI uses a directed acyclic graph (DAG) instead of a traditional blockchain. It is built on its own Trustchain architecture. The team says that this structure makes it possible to settle transactions right away and keeps costs low, which makes it perfect for point-of-sale and merchant-oriented apps. One of COTI’s biggest accomplishments was helping Cardano launch its official algorithmic stablecoin, Djed. This made COTI a key player in the new ecosystem of blockchain-native stable payment rails.

COTI is still working on its treasury and developer tools, and you can see active commits on GitHub. In 2025, the project will add compliance frameworks and centralized finance partners to its list of things to focus on. Depending on your point of view, this move could either make it more legitimate or make its decentralized position less clear.

People’s feelings about COTI are mixed, but most of them are positive. When a new product comes out or there are updates to the Cardano ecosystem, conversations on X tend to get really busy. COTI, on the other hand, doesn’t have the same viral momentum as coins that are more speculative. This is probably because it focuses on B2B solutions and has documentation that is more technical.

Regulatory headwinds around algorithmic stablecoins are a risk, especially in the U.S. and EU, where frameworks are still being worked out. COTI’s success may depend more on macroeconomic and geopolitical events than on community engagement or tokenomics alone because it relies on adoption from institutional partners and national-level projects.

That being said, COTI has an institutional-grade story that is hard to find in this price range, making it a good choice for investors looking for cheap altcoins under $1 that could be useful. It probably won’t appeal to meme coin traders or short-term speculators, but it does have a place in a portfolio that balances speculative and utility-driven tokens.

If you’re looking for crypto gaming projects with serious upside, don’t miss our roundup of the top gaming altcoins under $1 with 10x potential.

How to Vet and Track Altcoins Under $1 in Real-Time

For small investors navigating the volatile world of altcoins under $1 in 2025, the ability to vet and monitor assets in real time isn’t a luxury – it’s essential for risk management. Given that low-cost tokens often sit outside the analytical coverage afforded to top 50 cryptocurrencies, it becomes especially important to build a toolkit that combines on-chain data, social sentiment, and fundamental evaluation.

This section outlines a multi-layered approach to tracking and analyzing these assets without relying on hype cycles or unverified Telegram threads.

Check the Token’s Core Metrics First

Before considering any low-cost altcoin, begin by analyzing price, volume, and market cap but not in isolation. Look for:

- 24h Trading Volume

- A high price with low volume suggests illiquidity. Avoid coins with <$500k daily volume unless you’re confident in your exit strategy.

- Market Capitalization

- A token priced at $0.002 may sound cheap, but could have a $1B+ market cap. Focus on circulating supply vs. total supply, and use tools like CoinGecko or CoinMarketCap to cross-verify.

- Liquidity Score

- On CoinGecko, check the “liquidity score.” A score below 30 often implies slippage or limited exchange support.

Use On-Chain and Developer Activity Trackers

While not every project has public smart contracts or heavy GitHub commits, early-stage technical transparency is a positive signal. Here are the tools you can rely on:

- GitHub

- Check if the project has regular commits. Dormant repos may signal development stagnation.

- DefiLlama

- Useful for seeing if the token is part of any DeFi integrations or TVL metrics.

- Token Terminal

- For more advanced users, this aggregates revenue and protocol activity across chains.

- DexTools or GeckoTerminal

- Use these to check real-time DEX volume, slippage, and top wallet holders.

Evaluate Social Sentiment (But Stay Skeptical)

Buzz does not equal value, but sustained community engagement often precedes traction. Prioritize platforms where real users (not bots) discuss utility, updates, and product roadmap.

- LunarCrush

- Tracks social volume, engagement rate, and contributor counts across X, Reddit, and YouTube.

- X (formerly Twitter)

- Search for the token name and ticker. Are people discussing the tech, or just posting memes and rocket emojis?

- Reddit (r/AltcoinDiscussion)

- Look for long-form posts with technical analysis or comparisons, not just price predictions.

Examine the Token’s Use Case and Whitepaper

Always ask: what problem is this coin solving, and can that be done better elsewhere?

Look for:

- Clear roadmap milestones

- Identifiable team (linked to GitHub or LinkedIn)

- Transparent tokenomics (Are they inflationary? Premined?)

- Whitepapers that explain, not just market

Projects with legitimate goals often publish technical documents, blog updates, and open community calls. Avoid those hiding behind vague buzzwords like “next-gen,” “AI-powered,” or “revolutionary DeFi” without elaboration.

Watch Exchange Listings and Token Unlocks

Use CoinMarketCal to track:

- Upcoming exchange listings (Binance, KuCoin, etc.)

- Major vesting/unlocking events (which can create downward pressure)

- Roadmap upgrades or beta test launches

Also monitor token unlock schedules via platforms like TokenUnlocks especially for low-priced coins with large VC allocations. To dig deep about the best exchanges operating at present read our article on Where to Buy Altcoins Under $1.

Set Up Custom Alerts

Once you shortlist potential altcoins under $1, automate your tracking:

- CoinGecko Price Alerts

- TradingView Webhooks

- LunarCrush email alerts

- GeckoTerminal Watchlists

This ensures you’re notified about price movements, volume spikes, or new sentiment trends before they make headlines.

Most Important: Apply Common Sense

A token being “cheap” doesn’t mean it’s investable. Ask:

- Can you exit your position without major slippage?

- Are developers accountable and doxxed?

- Is the whitepaper specific or vague?

- Does social media praise come from real users or repetitive accounts?

Combining data literacy with intellectual caution is what separates crypto tourists from informed retail investors. And in the world of altcoins under $1, it’s not just about finding winners, it’s about avoiding traps.

When it comes to speed and affordability, some of the best payment altcoins under $1 are built specifically for fast transactions and low fees.

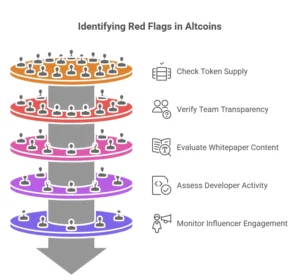

Identifying Red Flags – How to Spot Dangerous Altcoins Under $1

There are dozens of other low-cap crypto projects that are poorly built, overpromised, or meant to trick people. In the altcoin market where prices are below $1, investors may be tempted by what they think are “bargain” entry points. It is both a strategic and moral duty to tell the difference between hidden gems and hidden traps.

This part lists some real warning signs to look out for when looking at altcoins that cost less than $1 in 2025.

The Illusion of Value: Cheap Does Not Mean Undervalued

The most common mistake people make when investing in crypto is thinking that a low unit price means value. A coin that costs $0.002 might seem like a good deal, but then you find out it has a supply of 1 trillion tokens and no way to make them less valuable. Always look:

- Total supply vs. circulating supply

- Not just price, but market cap

- Schedules for token burn or emissions

- Cheap tokens with an infinite supply often lose value over time, which eats away at the small gains that early holders might make.

Teams that are anonymous or don’t own anything

It’s fine to have some privacy in crypto, but a completely anonymous team is a big red flag, especially when they’re in charge of treasury funds, making smart contracts, or running a DAO. Check for:

- No profiles on LinkedIn

- There are no bios for the team on the website.

- No GitHub commits with authors that can be traced

- When a project has no public accountability, it often disappears when people start to look into it more closely.

Whitepapers Full of Buzzwords, Not Systems

- A lot of scam tokens copy and paste technical terms to make themselves look “revolutionary.” Be careful if a whitepaper uses phrases like “next-generation DeFi ecosystem,” “AI-powered trading bot,” or “quantum blockchain disruptor” without explaining how.

- A real whitepaper doesn’t just talk about the vision; it also talks about logic, token flow, ecosystem dynamics, and limitations.

No Smart Contract Audits or Developer Activity

By default, projects that are inactive or closed-source are very risky. You can use tools like GitHub, TokenSniffer, or CertiK to help you figure out:

- When the last commit to the code was made

- If the smart contract was checked out

- If there are any honeypot functions or hardcoded rights to withdraw

- Walk away if you can’t find out who wrote the code or if no one is keeping it up.

Relying too much on paid influencers

It’s okay for real projects to do marketing, but if the only people talking about them are influencers and no one is asking hard questions or building with the protocol, it’s probably a pump. Some signs are:

- All tweets and posts are either giveaways or hype.

- Engagement looks fake (the same comments, emoji spam)

- The influencers have never done their homework before.

- If community excitement is all noise and no substance, it’s probably fake.

Trade Exclusivity on DEXes with No Liquidity

Many scams only happen on DEXes with low traffic, where there aren’t many people trading and the algorithms pump prices automatically. Here are some warning signs:

- Can only buy on hard-to-find DEXes

- Big price changes from small trades

- No centralized exchange listing even after months of “development”

- This is similar to how exit scams work, where early liquidity is used up and the token is left behind.

“Backdoors” in Smart Contracts

- Check to see if the admin can turn off trading with scanners like GoPlus or TokenSniffer.

- Tokens can be made at random.

- You can stop transfers.

- Malicious developers often add these features to trap or rug-pull users after the launch.

Discord and Telegram groups that don’t let you ask questions

- You should stay away from any project that censors criticism, kicks out users who are skeptical, or never answers questions about the roadmap.

- Being open means not deleting hard questions, but answering them in public.

Roadmaps that don’t make sense or none at all

- It’s probably not serious if a token says it will change finance, gaming, NFTs, and the metaverse all in one year.

- On the other hand, if there is no roadmap at all and the team brushes off concerns with vague optimism (“big news coming soon!”), that’s also a red flag.

No mentions from outside sources or the developer community

- Finally, look for proof from a third party:

- Are dApps being built on it?

- Are well-known analysts or developers looking at it?

- Are real journalists covering the story in the media?

- If a coin only exists in its own echo chamber, the project may be overhyped or just not ready for investment yet.

Last Word

Most altcoins under $1 aren’t scams by nature, but they are in a more speculative area where there isn’t much oversight and liquidity can disappear overnight. Small investors need to learn how to be discerning, not just hopeful.

Think about this: Would I still be interested in this project if no one talked about it on social media?

You might already know the answer if the answer is “no.”

Portfolio Strategy for Small Investors: Making a Balanced Altcoin Basket for Less Than $1

In 2025, small investors are interested in buying altcoins that cost less than $1 for one clear reason: they seem cheap and have the potential to go up a lot. But this same way of thinking, when not combined with structure or caution, can cause portfolios to be too spread out and too exposed to assets that are too volatile, too illiquid, or too hype-driven.

This part gives you a way to put together a diverse, high-conviction altcoins under $1. It’s especially useful for retail investors who want to balance risk and opportunity while staying within their budget.

First, figure out how you think about investing.

Before you choose tokens, think about how much risk you can handle, how long you plan to hold them, and what you want your portfolio to do:

- Do you want the chance to make 100 times your money or steady, small gains?

- Can you stay disciplined during times of volatility, or do you plan to switch things up often?

- Are you interested in new technology, passive income, or early hype cycles?

This level of self-evaluation will directly affect what “balance” means in your case.

Diversify by Use Case, Not Just Token Name

Merely owning 10 different sub-$1 tokens does not create meaningful diversification if they all serve the same function or operate within the same market segment. A balanced basket should ideally span distinct categories, such as:

| Category | Example Altcoins | Notes |

| Layer-1 Infrastructure | Kaspa (KAS), Conflux (CFX) | Core to ecosystem growth |

| DeFi & Liquidity | Velas (VLX), Reef (REEF) | Sensitive to regulatory shifts |

| AI/Data Economy | Ocean Protocol (OCEAN) | Speculative, but gaining attention |

| Privacy | Dero (DERO), Pirate Chain (ARRR) | Undervalued but controversial |

| Real-World Assets (RWA) | Centrifuge (CFG), Ondo (ONDO) | Fast-growing narrative |

| Gaming & Metaverse | Verasity (VRA), UFO Gaming (UFO) | Volatile but community-driven |

| Cross-chain Protocols | Synapse (SYN), Router Protocol (ROUTE) | Emerging with potential utility |

By organizing your picks around thematic bets, you improve the odds of at least one outperforming even if others stagnate or fail.

Note: This is not financial advice just a general risk-weighted conceptual framework

.

Weight According to Conviction and Volatility

Not all altcoins deserve equal space in a portfolio. A common mistake among small investors is overweighting highly volatile, low-liquidity tokens simply because they appear cheaper or trendier.

Instead, a sample allocation model might look like this:

- 30% Core Exposure: Higher-conviction projects with strong dev activity and real partnerships (e.g., Kaspa, Ocean)

- 20% Emerging Narratives: Smaller tokens in trending sectors like AI, modular chains, or RWA (e.g., CFG, CELL)

- 30% Moonshots: Very low-cap altcoins with < $30M market caps and limited exchange listings but plausible whitepapers

- 20% Rotational Capital: Set aside for short-term plays based on sentiment spikes or earnings seasons (optional)

Each position should also be reweighed periodically based on price movement, volume, and news flow.

Use Dollar-Cost Averaging and Limit Orders

Given the frequent price swings in low-cap altcoins, timing the market is nearly impossible, especially for beginners. This makes dollar-cost averaging (DCA) a valuable strategy.

Rather than buying a lump sum, spread your entries across several weeks or months, especially during market dips or project-specific retracements. For low-liquidity coins, always consider placing limit orders to avoid excessive slippage.

Moreover, tracking liquidity pools and market depth via platforms like CoinGecko, CoinMarketCap, or directly through DEX aggregators can help refine your entry and exit points.

Set Stop-Losses and Predefine Exit Scenarios

Hope is not a strategy. Even the most promising altcoin can become a dead asset. To manage this, apply risk ceilings and exit logic from the outset.

- For high-volatility coins, consider setting mental or automatic stop-losses at -30% or -40% from your entry.

- For coins that pump unexpectedly (say +150% in a week), take profits in tranches, even if you still believe in the long-term story.

- For long-term holds, reassess quarterly: Is the project still active? Are developers pushing updates? Has social sentiment cratered?

A simple spreadsheet or tracker app can support these checks and prevent emotional overreach.

Stay Flexible: Don’t Marry Your Coins

Perhaps the most under-discussed truth in altcoin investing is this: loyalty is not rewarded. The crypto market shifts rapidly, and narratives rotate fast. What’s hot today may be irrelevant in three months.

Therefore, remain willing to:

- Rotate out of projects that are underperforming or stagnant

- Swap allocations between sectors as new narratives emerge

- Replace a token if a more compelling, better-executed version of the same use case comes along

Even a balanced portfolio of altcoins under $1 is only as good as its responsiveness to changing data.

Last Reminder

Altcoins that cost less than $1 are cheap, but they aren’t always safe. When making a balanced altcoin basket, you need to take both capital protection and potential growth very seriously. That means:

Not getting too much exposure to one coin or sector

Checking for updates and revalidating your thesis on a regular basis

Getting out of losing trades quickly and letting winning trades grow

The goal is not to guess which coin will go up, but to give yourself a lot of chances to be right about the direction while keeping your losses small and manageable.

Tools and Apps for Tracking Altcoins Under $1 in 2025

Tracking altcoins under $1 requires more than just a watchlist on an exchange. Given their volatility, fragmented exchange listings, and often underreported metrics, you need a reliable stack of tools to vet fundamentals, monitor real-time sentiment, and spot red flags before losses mount.

What follows is a curated list of free and freemium tools organized by category for small investors managing a diversified crypto portfolio under $1.

Market Data & Watchlist Trackers

These tools help track prices, market cap, trading volume, and real-time movement across exchanges.

| Tool | Purpose | Why It Matters for <$1 Altcoins |

| CoinGecko | All-in-one market tracker | Offers liquidity scores and community ratings |

| CoinMarketCap | Price, volume, and circulating supply | Helpful for catching early listings on minor exchanges |

| DexTools / GeckoTerminal | DEX-based real-time price charts | Critical for early-stage tokens only listed on DEXes |

| TradingView | Charting and price alert system | Set alerts for entry/exit levels based on TA setups |

Tip: Use CoinGecko’s portfolio feature to track holdings and set alerts for sudden volume spikes.

Developer Activity & Transparenc

Altcoins under $1 with no GitHub commits or roadmap updates is a gamble. These tools help you check who’s still building.

| Tool | Purpose |

| GitHub | View dev contributions, update frequency |

| Token Terminal | Protocol revenue and token fundamentals |

| DeFiLlama | TVL, integrations, dev score |

| ChainList | Chain compatibility & cross-chain data |

Look for regular commits, developer bounties, and SDK releases to gauge project momentum.

Token Health, Risk, and Smart Contract Scans

Before investing in any altcoins under $1 especially, one newly launched scan for rugpull risk and backdoor functions.

| Tool | Checks For |

| TokenSniffer | Minting functions, honeypots, liquidity locks |

| GoPlus Labs | Smart contract privileges and audit summaries |

| RugDoc | Security labels for DEX listings and presales |

| CertiK | Audit reports and security scores |

If the token can be paused, minted, or blacklisted by admins, it’s not safe for retail portfolios.

Sentiment, Hype Monitoring & Community Health

For altcoins under $1, social traction often drives short-term price moves. These tools track real-time buzz and fake engagement.

| Tool | Use Case |

| LunarCrush | Social volume, engagement, and community ranking |

| Santiment | On-chain and sentiment analysis |

| X.com (formerly Twitter) | Influencer trends, announcements |

| Reddit (r/AltcoinDiscussion) | Grassroots opinions and early research |

Red flags include: no organic discussion, only giveaway posts, or identical tweets from multiple accounts.

Portfolio Management & Token Alerts

Avoid checking prices 20 times a day. Let these apps do the tracking for you, with smart alerts, token unlock warnings, and position health.

| Tool | Function |

| CoinStats | Multi-wallet portfolio tracker |

| Delta / Zerion | Clean mobile interfaces for active monitoring |

| TokenUnlocks | Upcoming vesting dates and token releases |

| Notion or Google Sheets | Track thesis, entry points, performance |

Set rules-based alerts, not emotion-based panic reactions.

Extra Tools (Advanced or Optional)

| Tool | Niche Use Case |

| Messari | Deep token profiles (limited for <$1 coins) |

| Kaito AI (freemium) | Research assistant across X, Discord, docs |

| Glassnode | Macro indicators and wallet flows |

Final Thoughts

You don’t need to use every tool, but you should build a personal tracking system that mixes:

- Market data (prices, alerts)

- Sentiment signals (LunarCrush, Reddit)

- Code transparency (GitHub, TokenSniffer)

- Risk filters (audits, admin controls)

The strongest portfolios of altcoins under $1 are backed by repeatable research systems, not Reddit hunches.

For short-term movers, check our August 2025 altcoins Watchlist for coins with near-term catalysts.

Frequently Asked Questions About Investing in Altcoins Under $1

People are interested in altcoins that cost less than $1 because they are cheap, but that same quality can also lead to false information and unrealistic expectations. Here are five of the most common questions, along with clear, careful, and contextual answers.

Do altcoins that cost less than $1 have a better chance of giving you 100 times your money back than coins that cost more?

Not always. The price of a token is mostly based on how many are in circulation, not on how much they could go up. A coin that costs $0.01 may already have a market cap of billions of dollars, while a token that costs $10 may still be worth less than it is. Don’t just look at how cheap something is; always look at its market cap, tokenomics, and real demand.

Why do some altcoins that cost less than $1 have high market caps but not much use?

This is often because of too much hype, airdrop farming, or speculation before a launch. In a lot of cases, liquidity and token allocation are focused, which makes the value wrong. Don’t just listen to what people are saying on social media; do your homework by looking at GitHub activity, developer updates, and real-world use.

Is it safer to buy altcoins for less than $1 on big exchanges like Binance or Coinbase?

Top-tier listings may lower some of the risk of doing business with a project, but they don’t get rid of all of it. A lot of coins have failed even though they were on big exchanges. A listing might show liquidity, not legitimacy. No matter where a coin is traded, always look at the fundamentals.

How many altcoins should I keep in a portfolio that doesn’t cost much?

There isn’t a set rule, but for most small investors, having 8 to 12 carefully chosen altcoins that cost less than $1 lets them spread their risk without taking on too much. Don’t spread yourself too thin, especially on projects that don’t have much money or have roadmaps that don’t make sense. It’s better to slowly add money to conviction plays than to put all your money into them without thinking.

When is the best time to sell an altcoin that isn’t worth much?

It all depends on your investment thesis. Before you buy, you should have an exit plan in place. This could be a price target, a change in fundamentals, or a percentage gain. You might decide to de-risk after getting three times your money back, or you might decide to rotate out if the roadmap gets stuck. You shouldn’t let your feelings get in the way of making a sale.

Conclusion—Is it worth the risk to buy altcoins that cost less than $1 in 2025?

It’s easy to see why altcoins under $1 in 2025 are appealing to retail investors and people who are new to crypto: they seem easy to get into, could have huge returns, and are “early” in a way. But just being cheap isn’t enough to make up for quality, usefulness, or being ready for the market. In fact, many tokens in this group are still underpriced for good reasons, such as low liquidity, bad documentation, or stalled development.

That being said, our research shows that not all coins that cost less than $1 are the same. This guide talks about a number of projects, including VeChain, WOO Network, and Cellframe, that have real infrastructure, are actively being developed, and serve a specific purpose that fits with new ideas in DeFi, Web3 identity, and post-quantum cryptography. Some, like MDT or BOSagora, are early bets on themes that aren’t getting enough attention, like ethical data monetization and on-chain governance.

The market of altcoin under $1 may offer small investors who are disciplined, have the right tools, and are careful with their ideas and systems. These investors may not only get good returns, but they may also learn about new ideas and systems that will shape the next decade of blockchain. But for people who only care about price or think that low cost means low risk, the same area turns into a minefield of speculation, scams, and sunk cost bias.

In the end, whether these coins are “worth the risk” has less to do with the coins themselves and more to do with how you look at them. As this guide has said many times, do your research, spread your investments wisely, keep an eye on the fundamentals in real time, and think of each coin as a hypothesis to test, not a guarantee to believe.

The best altcoin portfolios are not based on hope or hype, but on curiosity, doubt, and a well-thought-out belief. That way of thinking, not timing the market, is what makes cheap tokens into long-term investments.

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.