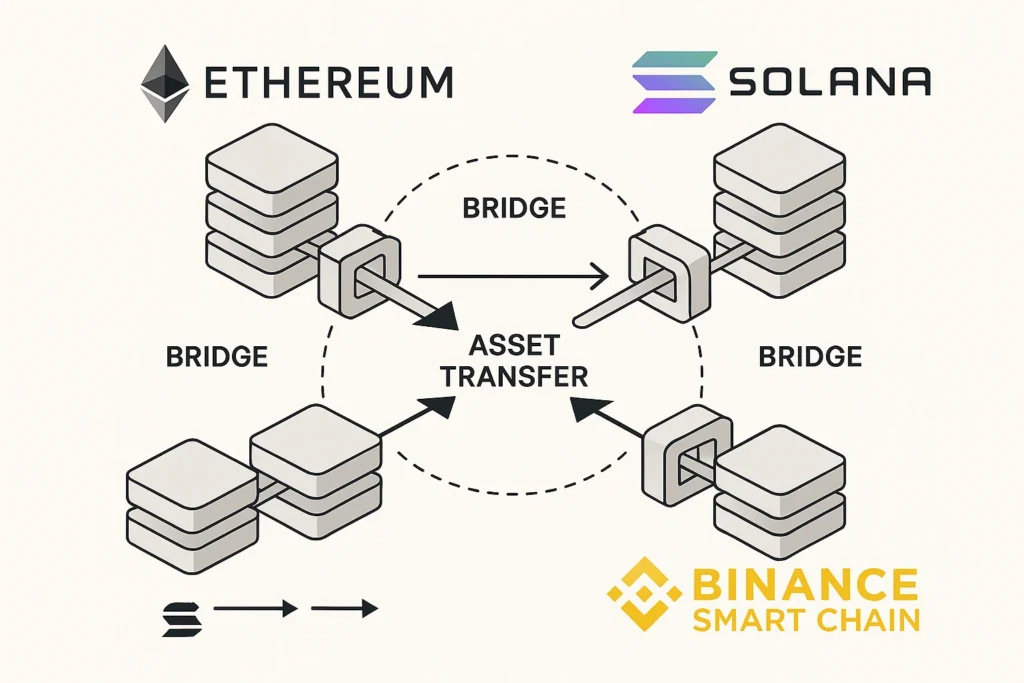

In 2025, the Best Cross-Chain Altcoins Under $1 are emerging as some of the most watched projects in crypto. Why? Because they’re tackling one of blockchain’s biggest roadblocks: interoperability. Instead of keeping assets trapped in isolated ecosystems like Ethereum, Solana, or Binance Smart Chain, these affordable cross chain cryptocurrencies are building bridges that let tokens, smart contracts, and data flow freely between networks.

This matters because cross-chain interoperability is fast becoming essential to Web3. DeFi protocols depend on moving liquidity between blockchains, while NFT platforms are experimenting with cross-chain ownership models. Analysts already estimate that the blockchain interoperability market could reach $4.5 billion by 2030, underscoring how critical this layer of infrastructure may become.

For everyday users, the appeal goes beyond technology. Sub-$1 altcoins are often favored thanks to “unit bias”, the psychological pull of owning thousands of tokens at a low cost rather than a fraction of one expensive coin. It makes these projects feel more accessible, though price alone never guarantees long-term success.

Before we dive deeper, a reminder: this article is purely educational, not financial advice. We’ll explore what cross-chain altcoins are, why tokens under $1 matter, and how leading projects like Stellar, Hedera, and VeChain are building toward a multi-chain future. Along the way, we’ll weigh the risks as well as the opportunities.

If you’re exploring affordable crypto opportunities beyond just interoperability, our deep dive into the top altcoins under $1 to watch in 2025 expands on projects with strong fundamentals across different niches.

Quick Summary – What to know right now

- ● What they are: Cross-chain altcoins under $1 make interoperability affordable, letting assets and data move between chains.

- ● Top picks: XLM, HBAR, VET, ROUTE, CKB, ICX, and PHA, chosen for price, dev activity, and adoption.

- ● Use cases: DeFi liquidity routing, cross-chain payments, confidential compute, and enterprise traceability.

- ● Key risks: Bridge security, low liquidity, token volatility, and regulatory uncertainty — DYOR required.

- ● Quick take: Affordable access + genuine utility — promising but higher risk; research only, not investment advice.

What Are Cross-Chain Altcoins?

Blockchains are powerful but isolated. Imagine they are separate Nations with different currencies, regulations, and even infrastructures. Transferring value between them often necessitates a central source of exchange, which incurs friction, expense, and risk. The altcoin attempts to resolve this dilemma with cross-chain altcoins that will exist to provide direct pathways between ecosystems in the form of highways to transfer assets and data.

Understanding Blockchain Silos and Interoperability

Ethereum can’t natively “talk” to Solana. Avalanche can’t easily share liquidity with Polygon. These are blockchain silos, isolated ecosystems that limit growth. Cross-chain interoperability will provide blockchains with a shared language system, which will ease the transfer process and smart contract execution among networks. This allows more optimised DeFi, NFTs, and payments.

Key Concepts

- Bridges

The core of this system is blockchain bridges. They are essentially locking tokens on one blockchain and minting a copy on another- akin to putting gold in a vault and being issued a certificate that can be redeemed elsewhere. The most famous examples of projects are Wormhole and Multichain. But bridges also come with risks: the 2022 Ronin bridge hack resulted in over $625 million in losses, underscoring security concerns.

- Interoperability Protocols

This is what the rules enable smart contracts to operate across chains. The runner can execute a trade on DeFi on Ethereum while simultaneously gaining access to liquidity on Polygon. Cross-chain discussions are underway to mint an NFT on Solana, allowing for interaction within the Ethereum market. Protocols like Cosmos’ IBC and Polkadot’s parachains enable this, enhancing NFTs liquidity across multiple ecosystems and DeFi scenarios.

- Why It Matters

Walled gardens are what blockchains are at the moment. Cross-chain technology addresses these chain silos, allowing assets and data to move freely. The result? Reduced cost of payments, quicker payment speed, and scale. And with sub-$1 altcoins, it changes the game: they are making these formerly elite-only tools available to retail consumers, putting powerful tools in the hands of newer investors.

Why Look at Cross-Chain Altcoins Under $1?

And when it comes to the most attractive cross-chain altcoins below one dollar, the possibility of accessing the cross-chain innovation without significant expenses comes to the fore. Here is why cost-effective interoperability is a key aspect of the current crypto space.

Affordability and Accessibility

Most of the time, costly tokens and expensive fees are another barrier for many retail investors and newcomers. Affordable cross-chain cryptocurrencies open up access to cross-chain tools, to bridge assets, test DeFi across networks, or play around with NFTs. As the primer on cross-chain technology by CoinDesk notes, these bridges are redefining the world of decentralized finance by making their assets mobile across otherwise siloed chains.

Innovation from Humble Origins

Being cheap doesn’t mean being insignificant. Numerous low-cost interoperability tokens are experimenting with new-edge cross-chain infrastructure, such as smart contract interoperability, liquid routing, and multi-chain liquidity. The potential to do this is precisely what cross-chain altcoins in 2025 are now starting to do, and this is why they are exciting- even when they currently cost only a few dollars each.

While cross-chain altcoins focus on interoperability, many affordable tokens also shine through practical adoption. Check out our breakdown of the top utility altcoins under $1 with real-world use cases.

Risks of Low-Cap Cross-Chain Tokens

Of course, there’s a flip side. Low-cost cross-chain tokens are highly volatile, tend to have low liquidity, and otherwise may not have comprehensive security audits. According to Chainalysis, more than $2 billion was stolen on the bridges in 2022 alone, showing just how vulnerable cheap interoperability coins have become to attack.

At a Glance: Why They Matter and Why Caution Pays Off

| Factor | What It Means for Investors |

| Affordable access | Enables experimentation in cross-chain tools for beginners |

| Innovation potential | Cheap tokens may lead to infrastructure breakthroughs |

| Elevated risk | Thin liquidity and security vulnerabilities demand due diligence |

Selection Criteria for the Best Cross-Chain Altcoins Under $1

Creating a list of the most promising cross-chain altcoins under $1 is crucial for ignoring hype and focusing on the fundamentals. Inexpensive is not necessarily useful, but some cheap interoperability tokens are experimenting in ways that could transform DeFi, NFTs, or multi-chain infrastructure. These are the rules that we used to find out projects that really shine in the year 2025:

- Price Below $1 (as of August 2025)

Affordability remains the central theme. All the coins that we mention have trading values below the mark of $1, so they are affordable to the retail market and newcomers interested in exploring budget-friendly cross-chain cryptocurrencies. Prices are accrued through the use of live market trackers, such as CoinGecko and CoinMarketCap.

- Strong Cross-Chain Features

We focused on tokens with actual interoperability protocols, where those exist via bridging (like Wormhole’s use of lock and mint mechanics) or the actual interoperability systems (like Cosmos KMS’s use of IBC or Polkadot’s use of parachains). These are important due to the decreasing fragmentation and increased fluidity of multi-chain DeFi.

- Market Cap, Trading Volume & Liquidity

Liquidity is a guardrail against volatility. Coins with decent trading volumes and sustainable market caps indicate a greater trust curve and support on the exchange. An example is reported by Messari that the low-liquidity altcoin will experience manipulation and slippage when used in cross-chain operations.

Some cross-chain coins are also among the most undervalued altcoins under $1, showing room for growth based on market cap and adoption metrics.

- Community Strength & Governance

Cross-chain ecosystems thrive on developer and user participation. A bustling ecosystem not only helps to impart suggestions to governance tests but also helps to hasten network speeds. As an example, projects that have high GitHub activity and active DAO voting systems are more resilient to down market environments.

- Real-World Adoption & Growth Signals

We ignored things like price and market caps and focused on those signals that indicate real-world adoption, such as partnerships, protocol upgrades, and exchange listings. A tie-in to DeFi protocols, NFT platforms, or enterprise blockchain pilots beefs up an altcoin as an investment. In 2025, adoption patterns are one of the outstanding variables between initiatives that will persevere and those that will fail to achieve long-term success.

- Data from Reputable Analytics Platforms

Our methodology relies on transparent data sources. We compared data on the prices, volumes, and supplies of coins as presented in CoinGecko and CoinMarketCap and used the data and analyzed in Messari and DeFiLlama to assess the level of robustness in the ecosystem. This allows us to have a balanced list with respect to the affordability and at the same time have a list of credible, verifiable fundamentals.

Top 7 Best Cross-Chain Altcoins Under $1 in 2025

The following are seven sub-dollar tokens that have truly been on the rise in the interoperability sphere, each offering real cross-chain features, proven adoption, and credible growth trails.

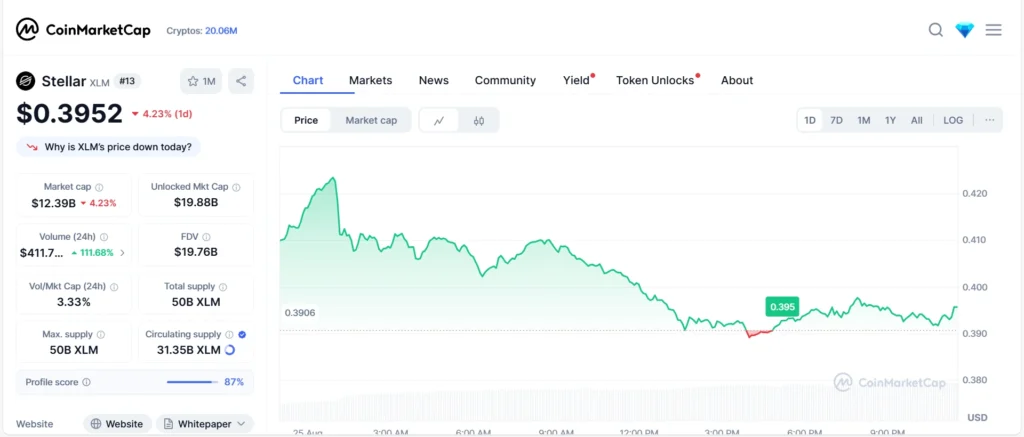

Stellar (XLM)

Quick snapshot (As on Aug 25, 2025), XLM is selling below a dollar (≈ $0.39 as of today), as shown in real-time on the CoinMarketCap XLM page. Rolling out its smart-contract system on-chain with Protocol 20 in 2024 placed Stellar on a more interoperable platform, capable of launching on-chain apps as well as payments.

Cross-chain value proposition: Stellar’s core strength is fast, low-fee settlement of assets such as USDC, which natively runs on the network and is created to flow cross-border and on/off-ramp into fiat (USDC on Stellar by Circle; additional details using the Stellar USDC/EURC product page. The introduction of Soroban smart contracts means that developers can now create DeFi and payments applications that can connect to other existing ecosystems via third-party interoperability layers (e.g., Axelar integrations highlighted in the Stellar cross-chain developer docs).

2025 catalysts:

- Smart-contract maturity: The maturity ladder: The protocols released after Protocol 20, and before the Flare Network commenced operation, continue to harden the Stellar network of smart contracts.

- On/off-ramps at scale: The network focuses on cash-to-crypto rails and disbursement tooling, which expand real-world penetration potential of tokenized money.

- Developer roadmap: Stellar is working to direct teams to build cross-chain experiences with supported messaging/bridge layers.

Adoption & real-world usage:

- USDC rails:Circle documents native USDC on Stellar to perform near-instant and low-cost transfers, cross-border payouts.

- Humanitarian disbursments: Stellar used the Stellar Aid Assist program to demonstrate transparent, quickly disbursed cash aid using its disbursment tooling.

Risks & caveats:

- Bridge/security exposure: Interoperability usually relied on external bridge/messaging layers; this has been an ongoing attack surface in crypto. Teams are encouraged to review the security assumptions of any connector that they use.

- Ecosystem rivalry: Payments-centric chains and EVM-based chains are competing over the same cross-chain activity; developer interest is the bullseye.

- Execution risk: The larger design space may be great to explore, but again, gaining traction comes down to strong application usage and stable cross-chain connectivity.

Why it fits this list: The XLM is below the cost of one dollar with a suitable proximity to interoperability organic growth, including the ability to denominate, through assets that provide fiat-like treatment (USDC) and expanding smart-contract usability, as well as a demonstrated plan to bridge to also-rans (Oxen), by virtue of their projected interrelations and links. For readers exploring the Best Cross-Chain Altcoins Under $1, Stellar offers a pragmatic mix of payment rails and emerging cross-chain composability grounded in verifiable, real-world usage.

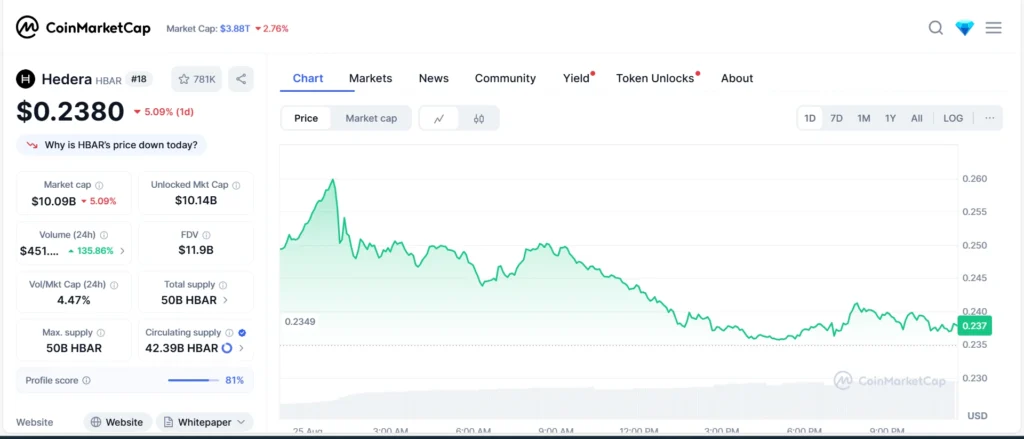

Hedera (HBAR)

As on Aug 25, 2025: HBAR is below a dollar ($0.23) (see current price on the Hedera page at CoinMarketCap). The network has a worldwide council of blue-chip companies, Google, IBM, Boeing, and more, which provides a unique combination of being radically decentralized but at the same time having a level of oversight that is enterprise.

Cross-chain value propositions: Using its EVM compatibility, Solidity applications can be ported easily to Hedera, effectively bridging some of the multi-chain options already available in Ethereum. Inter-ecosystem asset movement: Hedera utilizes inter-ecosystem utilities, such as Hashport, a bridge between Hedera and other networks like Ethereum and Polygon. Stablecoin rails provide another cross-chain building block: USDC is native to Hedera and accessible to enterprises through Circle.

2025 catalysts:

- EVM maturity + integrations: The further stabilisation of the EVM stack and JSON-RPC relay tooling helps to make it easier to port or compose multi-chain apps.

- Payments + asset tokenization: Hedera is primed to support cross-border payments as well as the tokenization of assets.

- Enterprise credibility: Durable council stewardship maintains a regulatory- and compliance-friendly demeanor sought by many cross-chain builders.

Adoption & real-world usage:

- Supply-chain sustainability: integration through Hedera into avery.io enabled Avery Dennison to help track product-level carbon information at large scale across billions of items, business-scale validation of throughput and cost profile.

- Business rails: Circle provides details of direct mint/redeem access to USDC on Hedera, which supports settlement-intensive business uses.

Risks & caveats (YMYL perspective):

Bridge exposure: Interoperability often hinges on third-party bridges. Exploits on bridges have remained one of crypto-related biggest systemic risks since several major precedences, the bridge category in which most stolen funds was hacked during 2022 record year of hacks.

Competitive pressures: Both EVM L2s and Cosmos IBC are appealing as the default interoperability mechanism, as well as Polkadot parachains; developer interest can easily move in different directions.

Governance trade-offs: council model will ensure credibility albeit lack of attraction among users interested in a maximalist decentralization.

Why it fits this list: For readers comparing the Best Cross-Chain Altcoins Under $1, Hedera brings a credible mix of EVM-compatible smart contracts, live bridging via hashport, and enterprise-grade adoption (USDC rails, supply-chain integrations). It is not a “bridge chain” as such but its structure and collaborations enable it to serve as a fair trade on-ramp to creating cross-chain experiences.

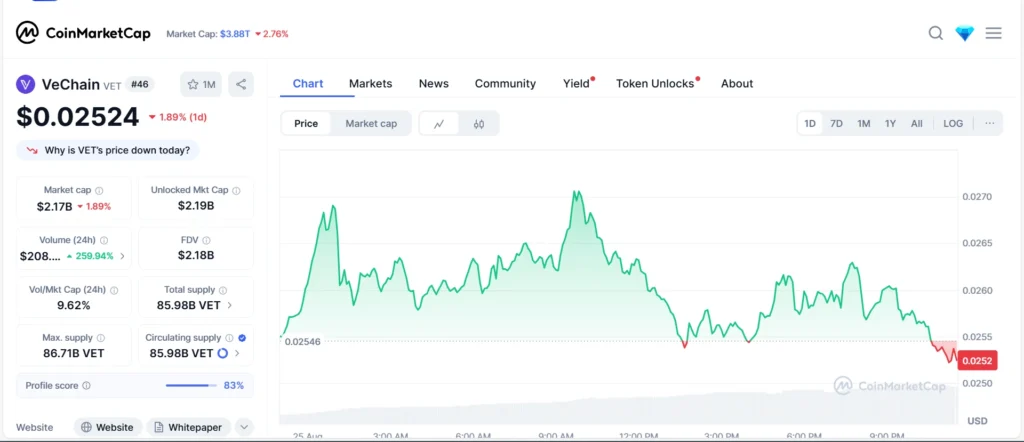

VeChain (VET)

Quick Snapshot (As on Aug 25, 2025):

VeChain (VET) is still well under the $1 mark at the time of this writing trading in the vicinity of a quarter-cent ($0.025). VeChainThor also uses a dual-token model where it uses VET as a means of transferring value and VTHO as transaction fees, which can effectively separate volatility and cost of usage, a concept that Investopedia found to be innovative to enterprise-level blockchains.

Cross-Chain Value Proposition:

VeChain has also made audacious moves in cross-chain interoperability: its May 2025 agreement with Wanchain announced the first full cross-chain bridge, connecting VeChainThor to over 40 chains- including Bitcoin, Ethereum, Solana, and Polkadot. This creates an opportunity of greater DeFi access, stable coin inflows, and multi-chain liquidity in VET, VTHO and B3TR tokens.

2025 Catalysts

- Interoperability Magnification: Wanchain enables asset transfer and composability previously not available on VeChain, which bridges it to platforms with existing DeFi offerings.

- Compliance & Infrastructure Upgrade: VeChain is developing Web3 infrastructure that supports enterprise requirements and complies with regulations, thanks to its Renaissance upgrades and MiCAR alignment.

Adoption & Real-World Use Cases

VeChain’s adoption story spans global enterprises:

- VeChain has been adopted by PwC, Walmart China, BMW, DNV GL, and others to track supply chains and verify authenticity and compliance.

- The potential applications include blockchain logistics, carbon tracking, and other tracking applications, which are particularly useful in the retail, pharmaceutical, and manufacturing industries.

Risks & Caveats

Bridge Security: Although the Wanchain integration is exciting, bridge security is the most worrying factor; in 2022, cross-chain exploits still comprise the bulk of DeFi losses.

Enterprise Versus Consumer Orientation: VeChain is enterprise-oriented, and that fits with its long-term adoption. In that case, it cannot support mass-market DeFi or NFT users, in comparison to more developer-focused chains.

Token Structure Complexity: There is the potential for the dual-token to cause confusion to the newcomers and may impact the dynamics of value accrual between VET and VTHO.

Why It Fits This List

For investors looking at the Best Cross-Chain Altcoins Under $1, VeChain brings enterprise-grade interoperability with an affordable entry point. Its in-depth practical implementations, clever token construction, and savvy bridge tech all make it a practical option, particularly when it comes to readers looking at cost-effective tokens with practical use cases.

Router Protocol (ROUTE)

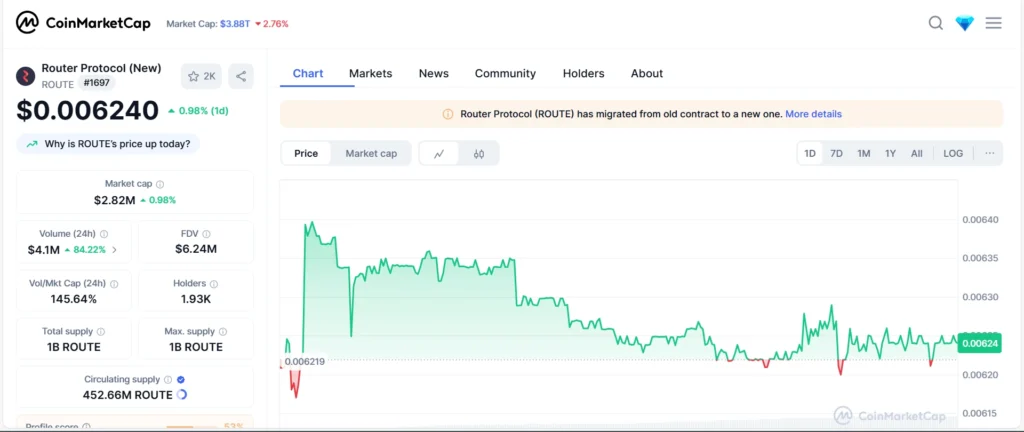

Quick Snapshot (as on Aug 25, 2025):

According to CoinMarketCap’s live prices page, OUTE is traded well below $1, at a price of about $0.0062. It is a micro-cap with a modest daily trading volume ($4.1M) and a market cap ($2.8M).

Cross-Chain Value Proposition:

Router is not another bridge, as it is an entirely new Layer-1 blockchain (Router Chain) that is built on the Cosmos SDK with Tendermint consensus. It powers true chain abstraction via the Router CrossTalk framework, enabling secure, decentralized messaging across contracts on different chains. The architecture breakdown is shown in their Router Protocol documentation on CrossTalk. Router also features Router Nitro, a low-latency non-custodial engine to perform cross-chain swaps of assets with composite execution routes across ecosystems.

2025 Catalysts:

- Launch of Nitro on mainnet, pushing high-speed, modular interoperability. See coverage in their announcement recap.

- Building more integrations with chains like Solana, it is now connected to 30+ ecosystems via Router Chain and allows fast bridging and messaging. The integration post of the Routing Bridge provides details of the pipeline and audit procedure of that bridge.

- Increased standards-based developer tooling through the Router ecosystem, including the CrossTalk library and SDKs, that make it easier to build interoperable dApps.

Adoption & Real-World Use Cases:

- Cross-chain stablecoin routing: Router Chain enables stablecoins to move across chains without centralized wrapping, ensuring uninterrupted access for end users.

- Governance bridging: Using their middleware, protocols can spill across chains via governance contracts, such as voting on Ethereum and execution elsewhere via Router Chain.

- Wider chain connectivity: The mesh network of the Router can have any new chain connect to its super-mesh liquid infrastructure, thereby increasing liquidity and composability to scale.

Risks & Caveats:

- Micro-cap: ROUTE has a small market cap, placing the company at a higher risk of price volatility and speculation.

- Complexity and early-stage technology: The multi-layer chain abstraction proposed by Router is still in its experimental stages at this time, with security and early infrastructure drawing much attention, but the history of vulnerability in the early layers shows that serious attacks do exist.

- Competition: Axelar, LayerZero, and Cosmos IBC are some of the ecosystems competing in the same niche as an interoperability layer.

Why It Fits This List:

Being among the most ambitious cheap interoperability coins, ROUTE has an underlying architecture that is deeply innovative. It’s an affordable bet on modular cross-chain infrastructure, making it a strong contender among the Best cross-chain altcoins under $1.

Nervos Network (CKB)

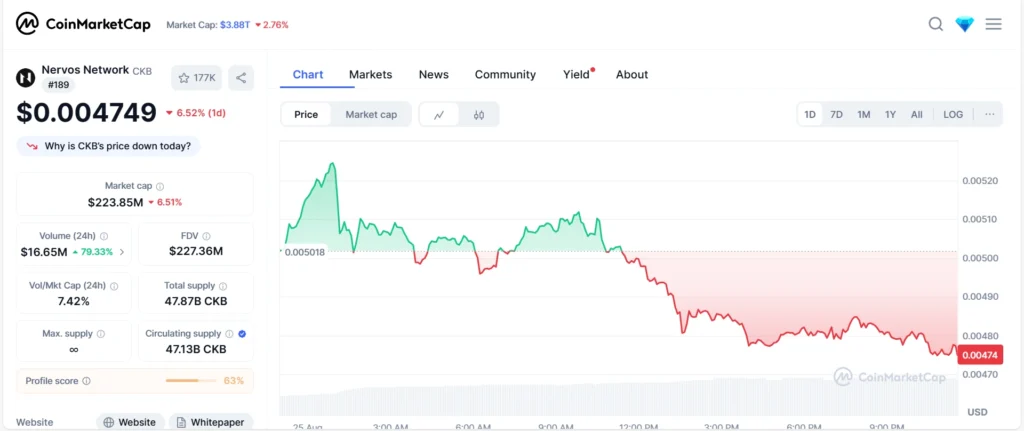

Quick Snapshot (as on Aug 25, 2025):

KB is trading below $1- it was quoted to be around $0.0047 on CoinMarketCap Nervos price page. The market cap of CKB is around 224 million dollars. In contrast, the daily trading volume is at 17 million dollars, indicating that the token belongs to the micro-cap segment and is nevertheless rather visible and has sufficient liquidity.

Cross-Chain Value Proposition:

Modularity and interoperability are the fabric of the Nervos Network. It has a layered approach- a combination of the UTXO and account model through a more flexible Cell model, and a RISC-V-based CKB-VM, which helps it to provide future-proof cross-chain logic and composability (Nervos on layered design).

Its proprietary cross-chain solution, Force Bridge, allows cross-chain asset transfers between CKB and Ethereum, as well as BSC (Force Bridge launch announcement details). In addition to cross-chain bridging, Nervos has RGB++, a new protocol that offers bridgeless interoperability with UTXO-based systems, the ability to transfer Bitcoin assets across chains without central intermediaries through isomorphic binding using CKB cells.

2025 Catalysts:

- Improving infrastructure, the CKB ecosystem is growing to include more advanced infrastructures, such as the BTCKB initiative in support of RGB++ assets that allow trading on-chain assets, on-chain token issuance, and decentralized identity tools like JoyID and Spore.

- Nervos is also actively researching decentralized techniques of bridging through Rosen Bridge, which would allow connecting CKB to Cardano and Ergo in a fully permissionless manner, but should be ready by Q2 2025.

Adoption & Real-World Use Cases:

Nervos’ architecture attracts modular dApp development:

- Projects such as Godwoken (EVM-compatible rollup), Polyjuice, and Axon Layer 2 modules all transport interoperability and performance driven use cases.

- The newly introduced Fiber Network payment-channel network to support multi-asset off-chain payments is up and running on the mainnet, with further scaling planned.

Risks & Caveats:

- Nervos has solid technical underpinnings but has a niche architecture, which might restrain mass appeal among developers as compared to more mature ecosystems.

- Bridging solutions, such as Force Bridge and RGB++, are decentralized, but their novelty still makes them risky, whereas bridgeless solutions are fraught with unseen vulnerabilities.

- Other technologies competing to be used in interoperability (e.g., Cosmos IBC, Polkadot parachains) are fighting over developer adoption and ecosystem development.

Why It Fits This List:

Nervos is an economically sustainable interoperability solution based on a layered architecture, modular smart contracts, and abstracted UTXO logic, and with multiple bridging options (Force Bridge, RGB++), as well as an active ecosystem community. For readers looking at the Best Cross-Chain Altcoins Under $1, CKB marries accessibility with technical sophistication, making it compelling for long-term infrastructure watchers, not just speculative buyers.

ICON (ICX)

![]()

Quick Snapshot (As on 25 Aug 2025):

As per CoinMarketCap ICON page ICON trades currently around $0.128, with a market cap near $137 million and daily volume around $6.8 million.

Cross-Chain Value Proposition:

The aim behind Coin is to bridge the gap between separate blockchain networks, making them scalable and interoperable communities of networks. It uses its Blockchain Transmission Protocol (BTP) and xCall framework to enable secure cross-chain messaging between assets and smart contracts across networks. This renders ICON a potent case study of an affordable cross chain cryptocurrency.

2025 Catalysts:

- Integration with Injective Protocol to increase DeFi usage and cross-chain asset routing.

- Launch of ICON General Message Passing (GMP), which offers developers tools to make multi-chain dApps effortlessly.

Adoption & Practical Usage / Applications:

The solutions of CCON also integrate with other industries such as finance, healthcare, and education, where interoperability allows secure and effective cross-chain crypto investment.

Risks & Caveats:

- Market volatility: ICX is a low-cap token and thus it is prone to quick price fluctuations.

- Competition: There exist other interoperability projects, and the two that compete with it are Polkadot and Cosmos.

- Regulatory Uncertainty: There are changes in the global regulations that may affect adoption or development.

Why It Belongs on This List:

One of the most interesting aspects of this story is the author’s introduction of important future elements, depicting the future of a band.

For readers exploring the Best Cross-Chain Altcoins Under $1, ICON offers interoperable altcoins under $1 with a proven cross-chain framework, real-world adoption, and developer-friendly infrastructure. It strikes a good balance between accessibility and high interoperability, so it might make an excellent choice in terms of budget altcoins that beginners can use to explore multi-chain DeFi and dApps universes.

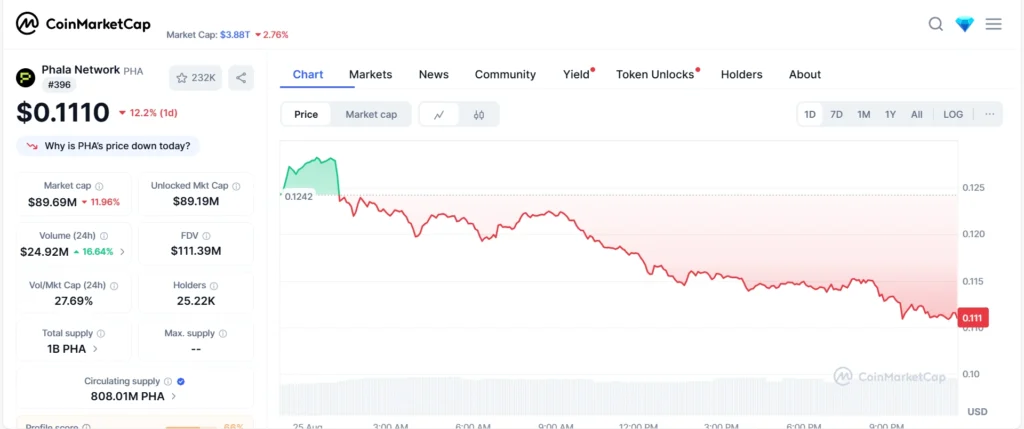

Phala Network (PHA)

We consider Phala Network (PHA) one of the most unique cross-chain altcoins with a price below 1 dollar in 2025, its distinguishing aspect being the emphasis on privacy-preserving cloud computing and confidential smart contracts. Phala is a parachain built on Substrate and runs on Polkadot, meaning it is inherently interoperable and cross-chain, ensuring scalability and security.

Fundamentally, Phala Network presents Phala Confidential Compute, a design that relies on Trusted Execution Environments (TEE) to safeguard confidential user and enterprise information. This makes it particularly relevant to sectors such as DeFi, AI, supply chain, and Web3 applications, where secure off-chain computation is becoming increasingly important.

Per the official documentation of Phala: The project allows developers to execute privacy-guaranteed smart contracts, bridging the gap between the privacy and transparency of smart contracts.

Regarding market positioning, Phala Network is likely to interest retail traders due to its price below $ 1, relatively low market capitalization, and significant growth prospects in the privacy altcoin niche. By August 2025, Phala will have grown the number of partnerships on the Polkadot ecosystem, extending to cross-chain bridges and decentralized applications. With the growing importance attached to privacy, analysts state that networks such as Phala may become essential to the blockchain sector if the regulator pays greater attention to privacy.

PHA proves to have a number of benefits in relation to investment:

- Cross-chain utilization: Is functional within the Polkadot ecosystem, whilst having the ability to utilize chains that it is outside of it.

- Privacy-first: The company is among the rare initiatives that are gaining traction under-$1 and offering the practical value of confidential computing.

- Scalability: With cloud-based computation, there is a high throughput of decentralized apps.

- Community and roadmap of active development: Regular updates and development into Web3 partnerships.

Yet still, there are concerns. The project is in competition with other privacy-centred blockchains, such as Secret Network and Oasis Network, as well as the technology of TEE-based computation, with which it is necessary to expand the acceptability of the industry. Nonetheless, Phala maintains its brand identity as a specialized yet scalable cross-chain altcoin that fits within the positioning schema of the 2025 identity of privacy, interoperability, and enterprise adoption.

For investors researching cross-chain altcoins under $1, Phala Network represents a long-term speculative bet on the privacy + cloud computing trend, a sector that could grow exponentially as Web3 matures.

Comparison Table of the Best Cross-Chain Altcoins Under $1

| Token | Price (Live) | Market Cap | Cross-Chain Features | Use Cases | Risks | |

|---|---|---|---|---|---|---|

| Stellar (XLM) | $0.39 | $12.3B | Native USDC rails, Soroban smart contracts, cross-chain messaging via Axelar | Low-cost payments, humanitarian disbursements | Relies on external bridges; competition from EVM chains | |

| Hedera (HBAR) | $0.23 | $10.1B | EVM-compatible Smart Contracts; hashport bridge; native USDC | Enterprise tokenization, supply chain tracking | Bridge exposure; regulatory/developer competition | |

| VeChain (VET) | $0.02 | $2.1B | Wanchain bridge to 40+ chains, dual-token model | Enterprise logistics, traceability, carbon tracking | Bridge risk, enterprise centralization, dual-token confusion | |

| Router Protocol (ROUTE) | $0.006 | $2.8M | Own Layer-1 Router Chain, CrossTalk messaging, Nitro routing engine | Chain-agnostic DeFi, liquidity routing, governance messaging | Micro-cap volatility, early-stage tech, interoperability competition | |

| Nervos Network (CKB) | $0.004 | $223M | Force Bridge (ETH/BSC), RGB++ “bridgeless” cross-chain, modular architecture | Modular smart-contract dev, rollups, Lightning-like payments | Complex developer stack, niche appeal, early tech with potential vulnerabilities | |

| ICON (ICX) | $0.12 | $137M | BTP, xCall messaging layer, General Message Passing framework | Cross-chain DeFi, data sharing, institutional interoperability | Competitive landscape, regulatory risk, lower liquidity | |

| Phala Network (PHA) | $0.11 | $89M | Confidential Compute via TEE, Polkadot parachain interoperability | Privacy-preserving smart contracts, AI and Web3 dApps |

|

Case Studies of Cross-Chain Adoption

DeFi Protocols Leveraging Cross-Chain Tech

The biggest factor promoting the rise of the subset of cross-chain altcoins trading below $1 has been their use in the DeFi protocols. Multi-chain liquidity pools are already becoming a reality with systems like SushiSwap Trident AMM and Curve Finance supporting it and allowing liquidity to move between Ethereum, Polygon, and Avalanche. This growth contributes to minimizing liquidity fragmentation– a longstanding problem hampering the maturity of DeFi.

In the meantime, THORChain (RUNE) was the first to introduce native cross-chain swaps, thus allowing trustless transfers between major chains, such as Bitcoin and Ethereum or BNB Chain. These interoperability solutions demonstrate that the low-cost interoperability tokens are no longer fungible bets, but they are the future of multi-chain DeFi.

Real-World Example: Wormhole Integrations in Solana & Ethereum

A standout case of interoperability is the Wormhole protocol. The network, which connects more than 30 blockchains, including Solana, Ethereum, Polygon, and Aptos. Essential to the development of multi-chain dApps, Wormhole allows the seamless movement of tokens and non-fungible tokens across blockchains.

In 2024, Solana-based DeFi experienced significant inflows, facilitated by Wormhole’s liquidity bridge technology. This enabled stablecoins like USDC and USDT to integrate into Solana-based DeFi connectors, including Raydium and Orca. This cross-pollination increased the on-chain TVL of Solana and also demonstrated in practice the utility of cross-chain bridges in mainstream DeFi.

Lessons from Struggles: Multichain’s Collapse & Bridge Hacks

Not all cross-chain experiments have succeeded. The failure of MultiChain in the middle of 2023 reaffirmed the systemic hazards of concentrated bridge actors. Following the loss of leadership and assets valued at over 125 million dollars, liquidity in several ecosystems became an unreality, leaving users helplessly stranded.

Such events, as well as the frequent bridge hacks (e.g., the Ronin Network exploit that drained 600M), point to the fact that though cross-chain altcoins with a current price of under $1 are significant opportunities, security is the most important challenge. According to experts, next-generation cross-chain projects should focus on decentralized sets of validators, formal audits, and strong slashing mechanisms to regain confidence in these cross-chain solutions.

Key Risks to Keep in Mind

As with any other altcoin, cross-chain altcoins below 1 USD can be promising in terms of innovation and accessibility, but the risks of investing in this market should be taken into consideration. The imbalance of bridge security, the volatility of the token, and regulatory uncertainty have led to a situation that requires careful consideration.

Security Concerns in Bridges

Bridges are a common mechanism of cross-chain interoperability. Unfortunately, these systems are highly vulnerable to cyberattacks. According to a report from Chainalysis, during 2022, more than $2 billion was stolen in bridge hacks, making them one of the most serious vulnerabilities related to crypto infrastructure.

One recent example is the Wormhole bridge hack, which cost more than 320 million in wrapped ETH to attackers. The incident shows that even well-financed projects are vulnerable to smart contract risks as well as the centralization risks of validator nodes. This is important to investors in the sense that verification of audits of a project, security, and insurance covers must be assessed before the investors can finalize their capital commitment.

Token Volatility & Liquidity Issues

Altcoins with a price below a dollar remain low-capitalization assets, and thus, they are particularly vulnerable to sharp price volatility and liquidity constraints. As an example, a precipitous decline may result in double-digit percentage declines in a matter of hours, especially when the order depth on an exchange is shallow.

Such projects include Router Protocol (ROUTE) and Nervos Network (CKB), in which the token prices have continued to draw down consistently during bear market times. According to analysts of Messari, interoperable tokens are high in volatility, highly correlated to the cryptocurrency market (notably Bitcoin and Ethereum), hence they increase the risks of small-cap investments by retail investors.

Liquidity also becomes an issue in times of crisis. Lack of depth of markets implies that even selling a large position may result in slippage, and subsequent exit prices may not be as good as desired. This is why risk management tools such as stop-loss orders and portfolio diversification are essential when trading such coins.

Regulatory Uncertainty Around Interoperability Tokens

Beyond the technical and market-related risks, a regulatory uncertainty parameter also affects interoperability tokens. Regulatory agencies like the U.S. Securities and Exchange Commission (SEC) have put more weight on projects enabling cross-chain transfers, hinting that some of these approaches would come under securities regulations.

The failure of Multichain in 2023, which turned into frozen assets and legal problems, only confirmed the importance of avoiding the pitfalls associated with jurisdictional imbalance and absentee governance. According to CoinDesk, the ambiguity surrounding compliance frameworks poses a challenge to investors, who struggle to assess the viability of proposed projects.

With tighter rules on anti-money laundering (AML), Know Your Customer (KYC), and cross-border capital controls changing by governments in the U.S., EU, and Asia, it remains to be seen whether the future of many cross-chain altcoins under $1 will be possible to remain compliant without losing their decentralization.

How to Research Cross-Chain Altcoins Yourself

The net worth of investing in cross-chain altcoins with a value of less than one dollar is profitable, as long as your procedural due diligence is followed. As the hype around influencers and price forecasts overflows both X (Twitter) and Telegram groups, research that is based on sound data analysis is the only thing a buyer can rely on. Here are the three pillars of evaluating cross-chain projects:

Tracking GitHub & Developer Activity

A healthy cross-chain project is nothing without the developer community. The frequency of commits and pull requests on GitHub, as well as the closing of issues, will be a sign that the team is not idle or passing through a period of silence.

As an example, both Hedera (HBAR) and the ecosystem projects of Polkadot regularly occupy the highest positions in the developer activity rankings suggested by Santiment in a developer-tracker list. By contrast, the then-collapsed cross-chain bridges pointed to declining traffic months in advance of their crash.

On-Chain Metrics & Tokenomics Review

Besides price, investors should consider studying the on-chain data, such as:

- Total Value Locked (TVL): Shows real adoption in DeFi.

- Active Wallets & Transactions: Indicates actual usage.

- Bridging Volume: Reflects cross-chain demand.

Tokenomics is equally important. A project with a large amount of inflationary supply or VC unlocks (such as in Multichain (MULTI)) is dangerous as it is subject to large amounts of dilution. In comparison, other coins such as Stellar (XLM) and Router Protocol (ROUTE) have more predictive ramifications of token modeling.

If you want to learn the methodology behind spotting these coins early, our guide on how to find altcoins under $1 before they pump walks through practical strategies.

Roadmap, Partnerships, Adoption Signals

Lastly, look to see whether the project is establishing practical collaborations or only exuding nonspecific commitments. Tokens that span between chains and are most likely to be used by enterprises or institutions have better long-term prospects.

As an example, VeChain (VET) is profoundly tied into the field of supply chain logistics, whereas Phala Network (PHA) has collaborations in the sphere of privacy-oriented computing in the cloud. Conversely, projects, such as Multichain, which promised interoperability, were not resilient in their governance and were therefore subject to attack.

Checklist for adoption signals:

- Is the roadmap realistic and updated regularly?

- Does it have integrations with key ecosystems (Ethereum, Solana, Binance Smart Chain)?

- Has the project attracted institutional or enterprise partners?

Key Takeaway: To determine the most promising cross-chain altcoins under $1, a person needs to shake off the hype cycles and consider such factors as developer activity, on-chain data, tokenomics, and real-world use. This strategy removes speculative noise and magnifies projects that have a true staying power.

How to Invest in These Altcoins (Safely)

The benefit of investing in cross-chain altcoins below $1 is rewarding, but it is also fraught with a specific set of risks. In contrast to Bitcoin or Ethereum, these tokens are yet to grow properly, and their volatility is usually significant. Here’s a structured approach to navigate this market safely:

Step 1: Research on CoinGecko & CoinMarketCap

Perform your own research. Use aggregators like CoinGecko and CoinMarketCap to analyze coin results with facts before investing. These websites offer real-time prices, past price charts, market cap development, trading volume, and community news. It is useful to examine token allocations, supply plans, and deep liquidity to narrow down flashes-in-the-pan to potentially sustainable ventures.

Step 2: Use Reputable Exchanges with Liquidity

Nevertheless, trade on regulated exchanges such as Binance, Coinbase, or Kraken that have good liquidity pools and high degrees of security. DO NOT use unverified decentralized exchanges (DEXs) unless you tolerate the risk of the smart contract. Liquidity is key to avoiding thinly traded coins that have large spreads and the possibility of price manipulation.

Step 3: Store in Secure Wallets

After the acquisition, transfer of assets to non-custodial wallets like Ledger, Trezor, or trusted hot wallets like MetaMask. Storing assets in exchanges makes you liable to counterparty risk due to the collapse of exchanges. Cross-chain tokens. Many of them need a multi-coin compatible wallet, so check compatibility before moving money.

Step 4: Diversify and Avoid Overexposure

Even though you are optimistic, avoid investing all your money in a token. The above-mentioned diversification by being exposed to different categories (Layer-1s, DeFi protocols, infrastructure coins) helps to reduce the project-specific risks. Since most interoperability tokens are still near the start of their life-cycle, put them at a tiny proportion of your portfolio.

Risk Disclaimer: DYOR First

Crypto is already a rather speculative product, and cross-chain altcoins are even more speculative, as they include technical complexity and depend entirely on the security of the bridge. Do your own research (DYOR), and check the sources; never risk money that you cannot afford.

Future of Cross-Chain Altcoins Under $1

The coming years would be defining in the case of cross-chain altcoins with prices below one dollar. On the one hand, the technology of interoperability is acquiring quite tangible momentum. Analysts estimate that the blockchain interoperability market will grow to USD 4.5 billion by 2030 due to the emergence of demand to seamlessly conduct transactions across blockchains. Even a small piece of this growth can turn into a huge profit for the low-valued altcoins operating in this area.

On the other hand, risks remain significant. The demise of Multichain, in which bridges suffered unofficial outflows of over USD 130 million, showed the vulnerability of certain cross-chain efforts. Unethical administration, contracting issues with smart contracts, and a dependence on centralized teams are easily able to drain investor confidence.

The future of cross-chain altcoins below 1 dollar will depend on how successful they are in balancing the question of innovation and security. The ones who can provide scalable, transparent, and secure services can become a significant part of the infrastructure in the second round of blockchain adoption. It also means an increased risk for the investor, but also opportunities.

Conclusion

Cross-chain altcoins below 1 dollar are one of best entry points in the Web3 interoperability narrative. They enable retail participants in the markets to get exposure to projects that are making significant infrastructure bets on a multi-chain world, but without the high cost of entry that is typical of a flagship token. ROUTE to PHA, both of these projects show how sub-$1 tokens can bring actual innovation in bringing ecosystems together, add value to DeFi and NFTs, and facilitate cross-chain interactions.

Meanwhile, accessibility has to be distinguished with safety. This poses radical risks in terms of high volatility, liquidity, security risks of cross-chain bridges as well as regulatory imponderability on the tokens. Their low price caps can be very vulnerable to the hype of speculation, but history tells that not all cross-chain projects have lasting interactions.

A general guideline to retail investors is balance: cross-chain altcoins under 1 dollar can also be an exciting way to approach exposure what will likely be a next-generation blockchain infrastructure, but should be approached with diligence and well-informed risk management. It is important to note that the present article is more of an educational one and not a piece of financial advice. Never put in more than you are willing to lose, always DYOR, and diversify.

Stay Updated on Emerging Altcoins

Want more deep dives like this? Follow AltcoinsNest for transparent, research-backed insights into emerging altcoin trends, cross-chain developments, and low-cost crypto innovations. Stay informed, understand the risks, and make learning about crypto both educational and engaging.

FAQ

Q1: What are cross-chain altcoins?

A cross-chain altcoin is a kind of cryptocurrency aiming to allow the free interaction between blockchains. This is instead of being trapped in a single ecosystem: they assist in the transfer of assets, data, or smart contracts between multiple chains, enabling Web3 interoperability.

Q2: Are cross-chain altcoins under $1 good for beginners?

Their low entry price may make them attractive to beginners, but a low price does not imply safety. Altcoins with a price under one dollar are high-risk coins prone to larger price fluctuations, so a new investor should begin by investing a small amount of money, diversifying, and conducting research before making any investments.

Q3: How do I research altcoins before investing?

Useful steps would be to monitor activity by developers on the blockchain network, use on-chain metrics such as metrics and tokenomics on websites like CoinGecko or Token Terminal, and look at the roadmap, partnerships, and adoption indicators. Always compare claims with actual progress.

Q4: What risks come with cross-chain projects?

Altcoins on cross-chain have particular risks, including vulnerabilities of the bridges, problems with liquidity, smart contract attacks, and the risk of regulatory uncertainty. Since a number of projects are still experimental, due diligence and safe storage are important.

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.