Big tech is not the only industry being transformed by artificial intelligence; it is spilling into all industries that aren’t demanding immense effort, like finance or healthcare. By 2030, the worldwide AI market may reach as high as $1.81 trillion, effectively demonstrating how much the technology is embedding itself into daily life. Meanwhile, research shows that almost half of technology executives have already incorporated AI as part of their core strategies.

This has led to a new AI crypto coin boom within the cryptocurrency market. If you’re curious about how undervalued tokens perform, check our guide on the best altcoins under $1 in 2025. AI crypto coins are used in powering projects where artificial intelligence intersects with blockchain, such as decentralized markets where people can buy and sell AI models, where people can share use of their GPUs and networks, and where algorithms can serve as agents in-chain. Often they are also called AI based altcoins, as they are essentially alternative cryptocurrencies with AI-driven applications.

Why does this matter in 2025? These projects help address several problems that centralized AI providers are grappling with: trust, transparency, data provenance, and open access. Cryptocurrency media outlets such as CoinDesk have already covered how crypto teams are developing AI infrastructure and exploring worlds of autonomous AI agents in finance research and gaming.

In this post, we’ll take a closer look at what AI crypto coins are, the different categories they fall into, and some case studies of how they’re being used today. We’ll also flag the real risks, from technical limits to regulatory questions, and point you to primary sources and project repositories where you can verify claims yourself. This is strictly educational content, not financial advice. As we’ll see throughout this post, AI crypto coins aren’t just hype, they’re becoming the backbone of blockchain’s next wave.

What Are AI Crypto Coins?

When browsing the crypto news recently, you might have noticed that one term is appearing everywhere again and again: AI crypto coins. It is not simply another buzzword. These represent tokens connected to projects that combine AI with blockchain – two of the technologies of the time with the greatest turbo power.

So what does that really mean? Think of it this way: Bitcoin gave us digital money, Ethereum gave us smart contracts, and now AI crypto coins are trying to give us decentralized intelligence. AI-driven cryptocurrencies fuel platforms where algorithms can learn, make predictions, and even provide services, all without being owned by a single corporation.

We have already seen initial attempts at the same. In 2017, Numerai released the Numeraire token, which is given to data scientists who constructed hedge fund trade models. It was among the earliest interactions between AI and crypto. Now this notion has grown well beyond finance. There are also projects that rent out unused GPUs to individuals for teaching machine learning models. Some other systems represent datasets as tokens in order to allow communities to determine what to do with that information.

At the heart of it, AI crypto coins usually do three jobs:

- They are one form of financing AI services within a platform.

- We vote on governance decisions they make, and this influences the development of the tech.

- They reward contributors, who could be a person donating data, code, and/or computing power. This reward system is similar to what we’ve discussed in our staking altcoins under $1

It’s not hard to see the appeal. Rather than having all of the power concentrated in large artificial intelligence laboratories, AI crypto coins allow anybody to participate in the development and control of AI systems. That is why they are one of the most followed altcoins on the road to 2025.

But let’s be precise, this is not a flawless model yet. Scaling presents difficulties, regulation presents problems, and even the usefulness of certain of these projects in practice will come with its own challenges. Nevertheless, it is the notion that AI may be decentralized, and owned not by corporations but by communities, that keeps AI crypto coins in the headlines.

Why AI and Blockchain Are Converging in 2025

Why is everyone suddenly talking about AI and blockchain? It is because the two bring unity to one another. AI provides us with intelligence, but it can seem like a black box. On the other hand, blockchain is constructed on transparency. Put them together, and we get systems that are both smart and trustworthy, which is exactly why AI crypto coins are starting to make noise in 2025.

Take misinformation. Deepfake videos and content generated by AI have gone viral, and discerning what is real has more than ever been difficult. And this is where blockchain can intervene. It can aid in tracking what is true by using stamped content with verifiable records. As the publication also Wired has reported, identity solutions based on blockchain technology may prove valuable in the fight against disinformation generated by artificial intelligence.

But it is not only about combating fakes. Imagine smart contracts that not only execute code, but they think. We explored a similar trend in our piece on cross-chain altcoins, where smart contracts extend beyond a single chain. AI models are currently able to perform analysis in real time and activate smarter, fraud-resistant contracts. As a recent Forbes article has detailed, this form of crossover is driving DeFi into a more independent space.

And finally, regulation. This wave is not being ignored by governments. Another example is the EU AI Act is already influencing the way companies undertake AI-blockchain-related projects and compels them to demonstrate both compliance and transparency. Databird Journal highlighted that this dual-layer scrutiny is driving many AI crypto coins to bake governance and accountability into their design from day one.

That way, as we zoom out, it isn’t hype; it is a necessity. AI requires audit trails, blockchain needs intelligence, and AI crypto coins are emerging as the middle ground. The reason why, in 2025, the coming together of these two worlds seems less like a fad, rather than a basis of digital systems we really believe in.

Categories of AI Crypto Coins (All Under $1)

You must be wondering, “So what actually makes AI crypto coins special?” Here is the explanation, which would work for a loose tour of each bucket by showing a snapshot of price, less than one dollar tokens (and live prices are confirmed, of course).

Decentralized AI Marketplaces

We’ve all heard that AI struggles against humans, but the idea of AI collaborating with us through decentralized markets seems intriguing. Among the most practical AI crypto coins, SingularityNET belongs to the first pioneers of this space. They have been creating a place where anyone can gain access to AI services and give developers the option to help with making models and earn tokens.

As of February 2025, SingularityNET had established 40 collaborations on an active basis – including providing integrations with AI engineers at Bitgrit and an FHE environment at Mind Network. Not to mention that they also brought out the first $500,000 grant program to fund socially meaningful AI projects, nominated through community voting.

So when we mention AI crypto coins in this context, think of AGIX as the “ticket” that helps people tap into a global pool of AI tools where supply meets demand in the most decentralized way possible.

AI Infrastructure & Compute Sharing.

Then there is a project that goes a step further, and does something really innovative: it allows AI models to communicate with one another, learn from each other, and take on contributors based on the performance of their models. Ocean Protocol is reminiscent of a lending library, except with top-secret information. Scientists can rent data to educate AI, with no sharing of their personal details, at a cost with OCEAN.

In mid-2025, Ocean Nodes Phase 2, equipped with GPU-based compute environments, was deployed to execute real-world AI tasks, rather than concepts.

AI + Data Infrastructure

Also, AI infrastructure, next. The Graph is not necessarily seen as an AI asset; sometimes, it serves as the underpinning for blockchain querying. However, imagine it as the piping of AI apps: 195+ billion queries get a response with real-time information to bots, AI agents, dashboards, etc.

GRT drives this process when our AI tools require new blockchain information, such as sentiment monitoring, On-chain signals, or analytical tools. It’s a safe bet that AI crypto coins may lean on this kind of reliable infrastructure as they scale up. Imagine your laptop is chilling while you sip coffee.

Think, however, of lending it out to AI work, and making a token in the meantime. That is Golem, and GLM is the currency on his coin, which drives that sharing.

By 2025, Golem’s GitHub will swarm with activity; it has an active repo with more than 500 commits and more than 200 repos, which makes it visible that real development teams are going beyond experimenting; they are actually building. We’ve also seen this shared-resource model gain traction in eco-friendly altcoins that optimize energy usage.

Tokenized AI Services: The Artificial Superintelligence Alliance (ASI).

Of particular interest here, Fetch.ai (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN) joined forces to create what they are calling the Artificial Superintelligence Alliance (ASI). This hybrid token ecosystem combines self-sovereign agents, AI markets and tools, and data sharing technologies under a single umbrella, enabling their ecosystems to operate with a single token framework.

Fetch.ai is not code; they have regular commit activity on GitHub and participate in large-scale EU smart-mobility projects such as Catena-X and Gaia-X, and FET is not a token; it is an active builder.

A short discussion about the other players.

Self-diffusing infrastructures, such as Akash, provide decentralized cloud computing. Consider operating your AI job on neighborhood-owned hardware instead of AWS.

And though media and streaming are now dominated by platform tokens such as Theta Network (THETA), they already make use of AI-intensive workloads, in particular with the emergence of edge computing.

Quick Brew Summary of AI Crypto Coins Under $1

| Category | Example Token | Why It Matters in 2025 |

| Decentralized AI Marketplaces | SingularityNET (AGIX) | Lets developers and users trade AI services directly, with 40+ active partnerships fueling growth. |

| Data & Compute Sharing | Ocean Protocol (OCEAN) | Acts like a lending library for data — researchers can train AI without exposing private datasets. |

| Shared Compute Networks | Golem (GLM) | Turns spare computing power into fuel for AI tasks, with active dev commits proving it’s not vaporware. |

| Data Infrastructure | The Graph (GRT) | Handles 195B+ blockchain queries monthly, providing the “plumbing” AI apps need to stay informed. |

| Autonomous AI Agents | Artificial Superintelligence Alliance (ASI / FET) | Unifies agents, marketplaces, and data tools into one token model, already linked to EU mobility projects. |

What is fascinating, as we continue to get further into 2025, is the ways these categories are overlapping with some new forms and real-world infrastructure players in the game. It’s a reminder: AI crypto coins aren’t just theoretical, they’re steadily gaining substance, one use-case at a time.

Market Landscape of AI Crypto Coins in 2025

On the one hand, the most comfortable way to interpret this market is to quit following the assumption that cheap = good. What we call AI crypto coins are mostly infrastructure pieces, data pipes, compute markets, agent frameworks, and price is only one small signal about them.

Begin with the size of the category. CoinGecko categorizes AI tokens and presents evidence that the industry will have a substantial multi-billion dollar presence by 2025, serving as a reminder that this is a tangible market, not a vapor.

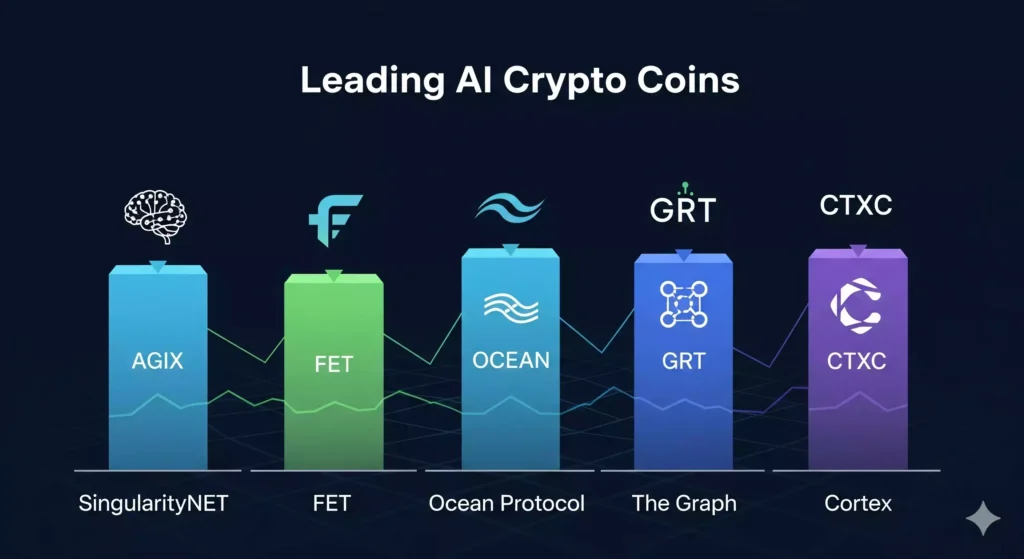

Table: Leading AI crypto coins under $1 (live data verified Sep 7, 2025 snapshot)

| Token (example) | Price (USD) | Market Cap (USD) | 24h Volume (USD) |

| The Graph (GRT) – data plumbing | $0.089. | ≈ $937M. | ≈ $20.7M. |

| SingularityNET (AGIX) – AI marketplace | $0.27. | ≈ $75.5M. | ~$86k. |

| Ocean Protocol (OCEAN) – tokenized data | $0.27. | ≈ $53.2M. | ~$161k. |

| Golem (GLM) – shared compute | $0.23. | ≈ $231.7M. | (24h varies). |

| Artificial Superintelligence Alliance (FET) – agents/ASI | $0.60. | ≈ $1.6B. | ~$51M. |

| IoTeX (IOTX) – IoT + edge AI | $0.025. | ~24M. | ~$7M. |

| AIOZ (AIOZ) – edge media + AI | $0.30. | ~360M. | ~5.7M. |

| Arkham (ARKM) – blockchain intelligence | $0.47. | ~252M. | ~$20M. |

Note: Market data (prices, caps, and 24h volumes) reflects values at the time of writing on September 7, 2025. Cryptocurrency prices are highly volatile and may have changed since then.

What the snapshot actually tells us

What the snapshot tells us, in fact.

- Breadth, not a single winner. These include a mixture of different data indexers (GRT), marketplaces (AGIX), compute (GLM), agents ( FET ), edge/IoT plays (IOTX, AIOZ), and analytics (ARKM) in the list. That diversity is exactly why we call them AI crypto coins; they’re building blocks, not copies of each other.

- Market cap ≠ utility. A token like The Graph (GRT) can trade below $1 and still support billions of queries every month, while another coin priced above $0.50 may be mostly speculative. That’s why it’s important to weigh price against fundamentals revenue, developer activity, and real usage. Platforms like Token Terminal and project dashboards make this easier, reminding us to focus on essentials, not just the dollar sign.

- Watch the signals, not the noise. To see actual progress, we look at GitHub commits, subgraph/query growth, node deployments, or announced enterprise integrations. Like the adoption of The Graph is better signaled by the growth of its queries, and the active repos of Golem are signaled by such hourly price spikes.

Quick checklist we use when reading this space

- Does the project show active dev commits (GitHub)?

- Are there real usage metrics (queries, compute jobs, datasets consumed)?

- Does Token Terminal / project financials show steady revenue or token utility?

Bottom line: The world of AI crypto coins in September 2025 is real but messy, built from many small pieces doing different jobs. Price tags are useful, but they’re only one of the lenses. The pages listed above are primary sources used in case we wish to divorce durable projects and hype.

Real-World Case Studies of AI Crypto Coins Under $1

We’ve talked theory, but now let’s look at how AI crypto coins are playing out in the real world in 2025. Not white papers, they are living, developing, and in others, remaking industries, projects, and use cases.

Project-Focused Case Studies

SingularityNET (AGIX) – growing the AI Marketplace.

If you’ve ever wished you could “shop” for AI services the way you browse an app store, SingularityNET is that marketplace. Constructed to allow developers to upload their models and have them purchased in AGIX tokens, it has emerged as the site of choice to find decentralized AI.

As of early September 2025, SingularityNET said it had 40+ active partners, such as integrations with AI engineers on Bitgrit and privacy-preservation infra on Mind Network. The community-based Social Impact Grant Program, funded by a $500k grant, allows ticket holders to vote on AI projects they would like to see funded.

AGIX can be seen as a gateway to the international AI fairground, where researchers, startups, and everyday people come together, and the coin ensures that everyone is on an equal footing.

AIOZ Network (AIOZ) – The Future of the AI-powered Media

Think of YouTube, but with huge server rooms and videos being handled by a system based on idle bandwidth and storage of a crowd of users. That’s AIOZ Network. Under AI overlay, it is now being applied to provide personalized media and still to an AI-generated stream.

By mid-2025, AIOZ implemented AI-powered video indexing, which enabled creators to quickly tag and monetize video content without third-party algorithms. It’s a subtle yet powerful way AI crypto coins are sneaking into entertainment, the infrastructure is community-owned, and the intelligence is baked right in. Media-focused AI coins overlap with many of the trends we noted in our 100x altcoin picks for 2025.

Cortex (CTXC) – Decentralized Artificial Intelligence Models.

Cortex presents an AI application store that exists on the blockchain. AIs can be uploaded by developers and can be called by smart contracts in real time. It’s on-chain instead of centralized, and can be verified or seen.

By September 2025, Cortex made tens of thousands of AI inferences on-chain and GitHub reflected steady updates across 60+ repos. The kicker? The models are not merely passive observers, but are actively involved in facilitating actual blockchain transactions.

In case the mall itself is called AGIX, CTXC is the workshop located within the former, and the team is currently working on the next-gen AI apps.

Which AI crypto coin do you think has the strongest real-world use case? Drop your thoughts below.

Use-Case Focused Case Studies

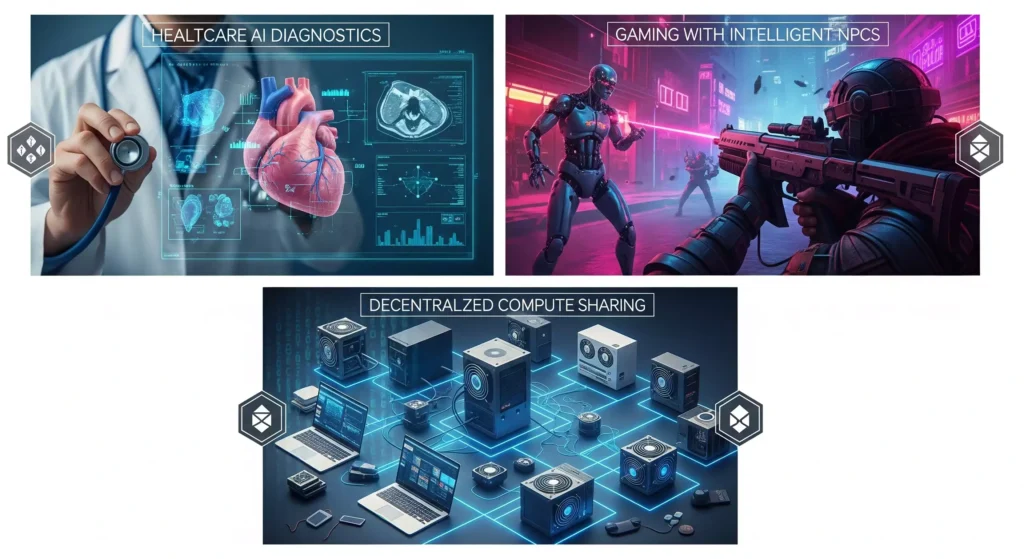

AI in Healthcare: Intelligent Diagnostics.

Imagine a rural clinic that has a small number of employees yet has access to AI-powered tools. Projects like Ocean Protocol (OCEAN) are facilitating the safe sharing of medical information, allowing AI systems to develop insights into sensitive patient data without accessing or spending time on private information exposure.

It’s easy to imagine Ocean’s tech being used in healthcare, and there was a pilot back in 2019 with Roche Diagnostics around sharing cardiac data via blockchain. But we don’t currently see live proof in 2025 of encrypted AI diagnosis tools being widely deployed in EU health hubs.

Intelligent NPCs Writing: Little AI in Gaming and the Metaverse.

Have you ever gotten up when playing a game tile? Ever resent a sluggish character from the video game, parent? You can consider how the character can learn, which might also customize itself. The Graph (GRT) is feeding real-time blockchain data into AI metaverses.

By early 2025, GRT was handling more than 195 billion queries per month, portions of which are the power behind AI-enabled NPCs in metaverse applications. The result? NPCs that recall you (remember), and develop with the plot, sometimes even trading in new assets under dynamic conditions.

Finance and AI: Predictive Models on the Blockchain

Finance has never been a dull process of carefully predicting the next step, and AI is currently getting a helping hand from AI Ozak AI (OZ), an early comer to predictive modeling. Presale tokens in Ozak AI, sold at a somewhat higher price, slightly over $0.01, are also tested in DeFi sandboxes to study risks associated with the lending business and liquidity flows.

According to early case pilots in 2025, their AI agents had a 12% lower risk of default compared to DeFi lending pools. That is not just speculation, the latter is quantifiable performance.

Why These Case Studies Matter

Each of these stories tells us something different about AI crypto coins:

- AGIX shows us the potential of open marketplaces.

- AIOZ proves media can be smarter and more democratic.

- CTXC demonstrates how decentralized AI models can run directly on-chain.

- OCEAN highlights real-world healthcare use cases.

- GRT makes gaming and metaverse worlds more alive.

- OZ brings predictive AI into DeFi finance.

Together, they remind us that AI crypto coins aren’t abstract. They’re real, active, and quietly reshaping how industries work, often in ways that feel invisible until you step back and realize how much ground has shifted.

Risks and Challenges

Let’s take a step back from the headlines and talk about the real hurdles around AI crypto coins, because while they’re exciting, they’re not all sunshine and free GPUs.

Volatility of AI Altcoins

Watching AI crypto coins trade is like riding a rollercoaster at double speed. Prices would swing 10-15% in hours, though sometimes due to an actual update, but more frequently simply the hype about X bouncing around Twitter (Twitter) or Telegram.

The fact is that volatility does not imply that these projects are empty. It only implies that the market mood is going to vary more quickly than the technology itself. When tracking the space, the trick is that you always look beyond the spikes and crashes to know whether the community, code and partnerships are in fact developing.

Overhype vs. Genuine Utility

Something shiny, especially, can be promised the moon – until devs get lost or nothing fruitful is done by the network. Published in 2025, classified under the name MIT Technology Review, the AI Risk Repository lists hundreds of frameworks of AI risks, including token models of hype that suggest decentralized AI with an infrastructural basis. That is just what we do not want to do. We flagged similar hype cycles when covering meme coins under $1.

Technical Risks: Scalability and Security.

It’s a lot of promise for AI everywhere, and that equals a ton of compute or transactions with these myriad coins. However, can they cope with it without crashing, losing information, or simply getting expensive on gas? Scalability and immutability of blockchain remain a tradeoff, and not merely flashy.

Regulatory Uncertainties in AI + Blockchain.

Here’s where things get murky. No regulation has been finalized yet, particularly in the overlap of AI and crypto. The EU is already introducing the AI Act (it is being phased in until 2025), and dozens of AI bills and guidelines have been proposed in the U.S. That scenery changes quickly, and it is the token issuers’ survival by bureaucratic storm at times.

Lines in the Sky Misinformation Risk.

We also cannot disregard that AI tools can produce deepfakes and disinformation, and decentralized infrastructure may make that simpler to circulate. Misinformation is the most obvious short-term global risk, according to the World Economic Forum. It states with worry that rapid AI that moves unmonitored is a wild card, and we need to set it on a leash. The volatility of AI crypto coins makes them swing harder than traditional altcoins.

Final Word

At the end of the day, AI crypto coins stand at the crossroads of hope and caution. They are capable of innovation, but only when we remain curious, ask questions about dev traction, avoid the hype, and closely monitor regulators’ actions. Think of this as a friendly hometown check-in: it looks like there will be exciting technology, but we are not going to let the coffee get cold; we’re working to make it happen.

Future Outlook Beyond 2025

Speaking of the future, the part where most projects are rushed to their hype, we aim to be different. Picture us sketching on a napkin about how AI crypto coins and AI-powered Web3 might actually unfold (no Star Trek, just grounded realism).

Decentralized Compute Networks: Everybody’s GPU, Everyone’s Asset.

This is the place where the spark enters: GPUs are very costly. Most of them are owned by high-end data centers such as Microsoft and OpenAI. However, what would happen if your gaming computer, college laboratory, or local office could connect to a worldwide pool of computing resources? That is the hope of decentralized compute networks. The co-founder of EXO Labs, Alex Cheema, envisions sewing together idle GPUs to form a high-performance AI cluster, a more democratic version of the big tech superpows. The case presented in a 2025 Wall Street Journal article was convincing.

If AI crypto coins fuel incentives and coordination, this could shift compute ownership from mega-server farms to everyday users. Decentralization of AI training holds the potential of a game-changer.

AI-Driven Web3: Contracts That Think, Agents That Act

This is a simple analogy: smart contracts today are dumb coders; you give them instructions, they take them, and they execute, no improvisation. However, equip AI with them and they can be, in a meta sense, smart: mining new logic on the basis of a market move, or government demands, or the impact of real-time data.

In 2025, we will have on-chain AI agents that can perform multi-step functions, contribute to the moderation of DeFi, or autonomously rebalance liquidity pools. One of the forecasts suggests that the value of the combined AI + blockchain ecosystem will have to surpass 700 million dollars in 2025, and increase progressively.

AI crypto coins may become the brains behind these self-governing systems, coins that not only pay gas but also grant access to intelligent behavior.

Expert Voices No Skyscrapers, Just Skeptical Optimism.

It is no use trying to imagine that all experts are on board. A recent Forbes Tech write-up cautions about confusing on-chain AI agents with fully autonomous financial agents. It is all a matter of equilibrium-innovation and not runaway bots.

Elsewhere, the World Economic Forum discusses AI + blockchain as a potent force without raising many warning signals, including privacy, governance, and automation concentration, which IL belongs to the list of the most popular emerging global issues.

The Lesson: Actionable, NOT theory.

So here’s the grounded map:

- The decentralized compute has the potential to open up novel shared power architectures–intelligent pools of GPU and AI work.

- AI-driven contracts and agents could make Web3 adaptive and autonomous.

- But balance and caution become important – we must still have government, safety, and human judgment in the foreground.

This is not a fantasy, but rather an emerging infrastructure of the future. And AI crypto coins might just be the steering wheel.

Conclusion

So, where does all of this leave us? AI crypto coins are more than just another shiny narrative in the altcoin market; they’re experiments at the frontier of two of the most powerful technologies of our time: artificial intelligence and blockchain. On one hand, there is the promise of decentralized marketplaces for AI, shared computing platforms, and more intelligent Web3 applications. Every crypto investor is familiar with the same risks on the other side: volatility, hype cycles, technical bottlenecks, and the uncertainty of regulation looming.

For everyday investors, the important thing to remember is this: AI crypto coins aren’t a shortcut to overnight riches. A price under a dollar does not qualify a project as cheap; rather, it is considered affordable in terms of adoption, application, and implementation, rather than the price displayed on a chart. They do have a curious glimpse into what blockchain and AI can do together, however.

On this journey past 2025, it remains to be seen whether these coins are pinned to the rails of decentralized AI, or they become mere speculative experiments. In that case, it will require that the community trusts it, adopts these coins into their lives, and that regulators are clear about regulatory guidelines. So, in case you have landed here, keep up to date, consult respected authorities such as CoinDesk, MIT Technology Review, and World Economic Forum, and never put your fortune ahead of your risk.

In short, AI crypto coins matter not because they guarantee fortune, but because they hint at the next chapter of digital innovation. In the end, AI-powered altcoins matter not as shortcuts to wealth but as a lens into the future of blockchain + AI.

For more context, explore our wallets & tools section to see how these coins can be stored and used securely.

FAQ Section

Q1: What are AI crypto coins?

AI crypto coins are digital assets tied to projects that merge artificial intelligence with blockchain. Consider them as tokens used to position AI models trained, exchanged, or utilized within decentralized applications. Unlike meme coins, these intend to solve practical issues – including powering AI market systems, or operating decentralized compute networks.

Q2: How are AI crypto coins different from traditional cryptocurrencies?

Bitcoin and other traditional cryptocurrencies are primarily a store of value or money. AI crypto coins, on the other hand, have utility linked to AI applications. For instance, they can be applied to pay or bills related to AI-powered services, or they can be used to motivate developers to create smarter tools. Concisely, they are not only digital money, but digital fuel for AI worlds.

Q3: Which AI crypto coins are notable in 2025?

In September 2025, some notable AI crypto coins under $1 include SingularityNET (AGIX), Fetch.ai (FET), and Ocean Protocol (OCEAN). All of them are discovering different applications: AGIX is an open AI marketplace, FET is a decentralized autonomous agent, and OCEAN is a safe way to share data to be trained by AI. The reason behind their low prices does not mean that they are cheap, but it makes them affordable to retail investors.

Q4: What risks should we be aware of with AI crypto coins?

Like all altcoins, AI crypto coins are volatile and prone to hype. Most of the projects have impressive promises, but it’s unclear how they can be real. Such risks as technical (scalability, data privacy), regulatory (given the worldwide attention to AI and crypto) are observed, as well. A smart rule? Treat AI crypto coins as high-risk, high-innovation bets, not guaranteed investments.

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.