The 2025 Crash That Was Both Hard and Harsh, But Neutered the Reset

It was one of those years in the crypto industry that are likely to be remembered. The cut-throat crash of the 2025 market annihilated months of speculation in a few days. Even portions of the largest of the tokens dropped over 60 percent, and the business community became decidedly two-sided on the negative side.

However, the point is that not all projects failed as we closely examine them. Certain altcoins under $1 were actually performing better than most blue chips during the confusion, with good bases and developing systems.

Wiston Capital states that approximately $560 billion (13.1%) of the total crypto-market worth were lost between the 6th and 10th of October, 2025. However, within several days, we began to notice some recovery signs in the projects with actual implementation and active development. Earlier this year, we highlighted some of the top-performing altcoins under $1.

In this post, we’ll go over the top 5 altcoins under $1 after crash that have not only survived the recent meltdown but are quietly setting up for a strong rebound into 2026. We are going to examine the performance of each project at the time of the crash and what helps them to be resilient, as well as why one of them may end up having a better-than-ever outcome.

And just in case we should mention, this is not financial advice. It represents an informative overview of data, basics, and on-chain measurements to figure out which networks are coping with the storm the most.

Since in such a market, it is much more important how a token is understood to survive than it is to guess which token will pump next.

TL;DR: The 5 Altcoins Under $1 Standing Strong After the Crash

Before diving deep, here’s a quick snapshot of the five altcoins under $1 after crash that showed strength when most of the market went red. Every project features a solid base, a dynamically evolving project, and apparent real-world applications that make it remain stable even during turbulence.

| Altcoin | Approx. Price (Oct 21–22, 2025) | Performance Since Crash | Key Strength | Real-World Focus |

| VeChain (VET) | ~ $0.0172 (CoinLore) | Much lower drawdown than many – shows resilience in enterprise use cases | Supply-chain DLT | Real-world partnerships (VeChainThor ecosystem) |

| Hedera (HBAR) | ~ $0.17 (CoinLore) | More stable than many altcoins through the recent volatility | Enterprise-grade ‒ Hashgraph tech + governing council | Used by big companies like Google, IBM |

| Stellar (XLM) | ~ $0.324 (Twelve Data) | Held up decently during the crash; payment-rail strength | Cross-border payments + stablecoin rails | Facilitates remittance corridors and microtransactions |

| Polygon (POL / MATIC) | ~ $0.182 (Investing.com) | Strong use-case momentum, lower bounce risk | Ethereum scaling | Supports thousands of dApps, gaming, DeFi |

| Cardano (ADA) | ~ $0.65 (Exchange Rates UK) | Research-driven project showing continued developer focus | Proof-of-Stake + academic rigor | Social good, identity solutions, global projects |

Market Crash Recap – What Happened & Why It Matters

The Spark That Triggered It

The crypto crash of October 2025 did not come out of the sky; it was the outcome of the macroeconomic shock, combined with systemic leverage. On October 10, 2025, the market became violent following the announcement by the U.S. President Donald Trump to introduce 100% tariffs on exports of Chinese technology, which triggered panic in the global risk sentiment. According to CoinDesk’s market analysis, over $560 billion was wiped from crypto markets during the early October crash.

The Domino Effect of Leverage

Leverage made the fall worse. Ainvest analysts said that billions in long positions were sold across most major exchanges in 48 hours based on margin calls closing in the market. When liquidations cascaded, forced sales became a fact, and platforms like Coincu said that over-levered traders using yield-bearing tokens as collateral experienced contagion loops when those were de-pegged.

Liquidity Dried Up

The market makers withdrew, and within hours, order books reduced on big exchanges. The XT Exchange insights blog commented on the effect the event had on exposing a secret liquidity weakness, in which liquidity per se was the meet-or-buy risk factor and not merely a declining price trend. As early as that weekend, more than 19 billion USD in crypto positions were liquidated, as per the data provided to The Economic Times.

Why This Crash Matters for Altcoins Under $1

The shake-out served as a stress test as well. With a strong basis, practical use cases, and business collaborations, like VeChain, Hedera, and Stellar, exhibited worse effects than hype meme coins. The stronger the ecosystem and practical utility of any token, the more likely it is to survive the crash caused by macro factors than tokens with weak ecosystems and limited utility, as observed in the CryptoRank market overview.

Key Takeaway

This is not only a crash on price falls, but it was a lesson on the interplay of macro risk, leverage, and liquidity fragility. For investors looking at altcoins under $1 after crash, understanding which networks remained stable under pressure can reveal which ones are truly built to last.

Mini Case Study: How VeChain & Hedera Weathered the October 2025 Crash

Not all altcoins under $1 dropped the same even during market-wide sell-off. VeChain (VET) and Hedera (HBAR) are two examples.

VeChain (VET)

VeChain was somewhat resilient, with its emphasis on tracking the enterprise supply chain. VET did not go as low as it should have, but dropped by a comparatively insignificant amount of about 15% during the crash, versus decreases of more than 60% by mid-tier altcoins.

This strength was facilitated by the continuous enterprise associations. The existing companies, such as Walmart China and BMW Group, still deploy VeChainThor to provide transparency to their supply-chain processes and to establish a stable token utility regardless of turbulent environments.

Hedera (HBAR)

Hedera managed to be stable in its operations as it used a special Hashgraph consensus mechanism, with the support of a council of multinational companies. The drawdown (approximately 12%) and a quick recovery of HBAR were less prominent since then. Companies like IBM, Google Cloud, and Dell Technologies would still be running their applications on Hedera, and this would force the network to remain active.

Key Insight

These illustrations indicate that those projects that are supported by the venture, with active networks and their applications into practice, are more robust in the shocks of the market on a global scale. For anyone exploring altcoins under $1 after crash, such case studies highlight the importance of fundamentals and utility over hype.

Why the 2025 Crash Created the Perfect Setup

Fear Cycles -Opportunity: A Familiar Pattern

In times of market panic, we are in a way prone to two impulses: freeze or find a way out. The crypto market has proved in the past that most massive crashes preconditioned successful recoveries. Remember March 2020? Bitcoin defied many odds by briefly going below the price of $4,000 only to spearhead an unprecedented recovery in a year and a half. Following the 2022 collapse around Terra and FTX, a number of already beaten-down networks have re-taken actual momentum as teams and communities re-formed. That pattern, fear followed by selective rebuilding, is why we’re watching altcoins under $1 after crash more closely now: it’s where durable projects can become visible again.

Macro triggers that mattered this time

Not just a crypto story, but macro and geopolitical, the tumble in October. The rapidity with which the tariffs were announced and the tension in trade were an obvious shock to risk appetite, and multiple venues showed how the events were a blow to trading desks. In the case of the rates picture, we can refer to the action of yields in the US Treasury market – when yields increased, the risk assets were put under stress, as reported in the most recent market news of US 10-year yields. That change contributed to the conversion of marginal positions to forced sales. Simultaneously, institutional flows were not all heading to the exit doors: the weekly report of CoinShares funds outflows measured about US dollar 513 million after the liquidity run on October 10, but it also related to regional purchasing across such destinations as Germany and Canada, indicating that at least some investors already considered the sell-off a purchasing opportunity.

Halving, flows and sentiment – the cocktail that follows a crash

On the supply side, the Bitcoin halving that is set to occur in 2026 (already being monitored by market participants). Findings by industry analysts have indicated more than once that halvings squeeze the supply dynamics and could trigger a broader market rotation. We do not take that as an assurance, but one structural feature that in the past has allowed markets to level off after dark plunges. The supply aspect of that dynamic is helpful in the research given by Messari on the advantages of halving cycles.

Meanwhile, sentiment indicators went into deep fear in mid-October. Crypto Fear and Greed Index fell to the low-teens to twenties, which has been a contrarian indicator in agreement with cycle bottoms. When sentiment is this negative, the market sometimes rewards networks with real utility and steady development, precisely the kind of traits we focus on when scanning for altcoins under $1 after crash.

Why this matters for our selection

Combining these elements, macro stress, institutional buying with partiality, a half cut in sight, we have an archetypal reset environment. It does not make the market secure. What it does mean is that altcoins under $1 after crash with ongoing real-world usage, predictable tokenomics, and active developer activity have a more straightforward path to stand out. In brief: the crash has skinned a lot of froth off, utility and fundamentals are more than ever before.

Deep Dive on Each Altcoin Under $1 After Crash

Since we have disaggregated the reasons the crypto market crash in 2025 presented uncharacteristic opportunities, we should consider five altcoins whose price is below one dollar, which have been very resilient, innovative, and have actual applications.

All these projects, both enterprise oriented blockchains and payment oriented ecosystem provide their own distinctive fundamentals that might trace the story of recovery by 2025.

In this section, we’ll look at:

- After the crash, their present position and price performance.

- Major factors that have made them volatile in the recent past.

- Practical processes and evolution of the ecosystems.

- Possible catalysts that can propel the market in the next few months.

- And lastly, a recommendation on their endurance and break even prospect.

Let’s get into the details.

VeChain (VET): The Trading Supply Chain Under $1

Overview & Current Status

As of October 22, 2025, VeChain (VET) trades around $0.017, with a market capitalization of nearly $1.48 billion, making it one of the most stable altcoins under $1 after crash. The last year has seen VET fail to rise above $0.05, yet it has remained around the $0.02 mark, and this is the area that has been serving as a base since the middle of 2023. According to on-chain information provided by the VeChain overview created by CoinMarketCap , the daily trading volumes in the market are relatively stable between $60 and 70 million, indicating that volatility did not stop participants in the market.

The potential of VeChain is that it constitutes a supply chain tracking network, which allows real-life applications to blockchain technology, logistics, retail, and sustainability applications. The two-token approach of the project (VET to transfer value, VTHO to spend money) still ensures that it remains among the handful of altcoins suitable for use in businesses at all.

Why VeChain Crashed

The decline of VeChain in October 2025, when the entire market plummeted, was a replica of the action. Liquidity dissipated within a short duration of time as the U.S. Treasury yields shot high and risk assets were sold. Altcoins in large caps did so together, and VET was not an exception. VET, as shown in the historical price chart by CoinGecko alone, fell almost 18 percent during the period between October 10 and 15, largely due to ETF institution trading off and poor liquidity over the weekend.

Notably, the drop was not caused by protocol-level bugs or hacks; the selling was macro-driven, rather than basic. That difference counts: in the case of a crash caused by outside pressure but not lack of confidence, the recovery chances tend to be higher.

Recent Developments

VeChain has continued to expand enterprise work and ship protocol improvements. The project’s official newsroom documents the VeChain Renaissance roadmap and real-world case studies pointing to enterprise pilots and product integrations. For a canonical view of active partnerships and product milestones, use VeChain’s official newsroom. On the developer side, VeChain’s GitHub shows active commits across SDK and core repos, which indicates ongoing engineering momentum. These developments are why VeChain continues to be considered among practical altcoins under $1 after crash rather than a speculative token.

Outlook & Potential Catalysts

In the future, adoption is the key driving factor. The X-2-Earn program by VeChain, which is a framework that compensates users based on sustainable behaviors recorded through NFC-tagged products, was recently launched and may widen mainstream awareness ( VeChain 2020). The other important factor is that it will be implemented in Chinese carbon-credit markets due to state-sanctioned blockchain tests. According to the coverage of VeChain released by Cointelegraph, these linkages may provide a volume of transactions and regulatory legitimacy.

If broader market sentiment stabilizes post-crash, VeChain’s utility narrative may resonate again, particularly as investors search for altcoins under $1 after crash that already have active real-world deployments.

Resilience & Fundamentals

Basic but good fundamentals of VeChain have been maintained. It is based on a Proof-of-Authority 2.0 consensus model that can provide greater finality, speed, and reduced energy consumption vital in enterprise partners. Between the choice of exchanges such as Binance and Coinbase, liquidity is ensured, and the community is actively present, with 600k+ people following X (previously Twitter), and the active engagement in the DAO can be observed in VeChain Stats dashboards.

It has also shown conservatism in managing its treasury by having stablecoin runway reserves over multiple years, as affirmed by the financial transparency report of the VeChain Foundation. The latter enables it to continue shipping in the bear phases, which in the past, preceded outperformance in the subsequent cycle.

Final Take

VeChain stands out as one of the few altcoins under $1 after crash with proven enterprise use, disciplined development, and real revenue-linked activity, a credible recovery play for 2025’s reset market.

Hedera (HBAR) – The Enterprise Blockchain Quietly Poised for a Comeback

Overview & Current Status

Today, we are discussing Hedera: a network that is being developed centrally around the new hashgraph consensus system, a high-speed, low-cost network, and heavily enterprise-supported. Its official site states that the administration of Hedera is led by a council of big corporations such as Google and IBM.

By mid-October 2025, HBAR had a price of approximately US$0.1659 (as at 19 October) and a circulating supply of almost 42 billion tokens.

In the context of altcoins under $1 after crash, HBAR is firmly in that bucket making it accessible, yet backed by serious infrastructure.

Why Hedera Crashed

HBAR was not spared when the crypto crash in October 2025 occurred. To a larger extent, the decline was the result of a general sell-off tendency in the market, and not a loss of the Hedera flaws. As a case in point, it dropped on 10 October to approximately $0.097 in a single day, one of the fastest moves, largely because of low liquidity over the weekend, and selling in haste.

Since HBAR is also traded with a large supply and is vulnerable to macro sentiment shifts, the increase in Treasury yields and the decrease in risk-appetite were hard blows. With that said, the leadership and ecosystem were not hacked or governed down, and this makes its case to return.

Recent Developments

Here is the point where the remnants of stamina begin to show. On 8 May 2025, the project revealed that the HBAR Foundation would change its name to the Hedera Foundation and a renamed Governing Council, an action to bring simplicity to its business-focused appearance.

Also, the Standard analysis helped demonstrate that the enterprise development of Hedera is gaining momentum: the council members, including Boeing and LG, open the way to the application of the real world in the sphere of supply chain, telecom, and sustainability.

All of this reinforces that HBAR belongs on the radar when scanning altcoins under $1 after crash with genuine enterprise use-cases.

Perspectives and Likely Drivers

In the future, Hedera has a number of levers that may advance it. First, when the wider crypto market comes out of the crash and liquidity returns, enterprise-backed networks can win interest once again.

Second, the proprietary technology, hashgraph vs traditional blockchain, provides Hedera with a story of enterprise-tier DLT to actual business. According to a current analysis by OKX, HBAR is trading close to critical areas of support and, potentially, a break into high territory at almost 0.21 would indicate a significant change.

Last but not least, since HBAR is under 1 dollar, it occupies a rather neglected niche. That contrast enterprise infrastructure + under-$1 price tag + crash reset is exactly what our altcoins under $1 after crash thesis banks on.

Resilience & Fundamentals

The architecture of Hedera is different. The hashgraph protocol boasts of exhibiting greater throughput and reduced latency to most blockchains.

In addition, its governing system, the Hedera Council, provides stability and enterprise confidence (but there is some disagreement about its decentralization characteristics). Governance centralization is a risk, but a trade-off to enterprise integrations, as it is given by analysts at InvestingHaven.

Liquidity is strong: HBAR is traded in the largest exchanges with high daily volumes, and the developer ecosystem is also being created (mirror nodes, smart contract development). All these put it in a position to survive the after-effects of the crash better than speculative penny coins.

Final Take

Hedera (HBAR) stands out as a rare enterprise-backed altcoin under $1 after crash that ticks both utility and resilience boxes, a credible contender for the recovery phase of 2025.

Stellar (XLM) – The Payments Rail That Is Continuing to Appear

Overview & Current Status

That is why we refer to Stellar as the layer of payments that leaves the lights on in blockchain finance. The XLM was trading at about $0.315 on October 22, 2025, and had a market cap of approximately $9 billion with average daily volumes. The design of Stellar enables cross-border payments and transfers of stablecoins at low costs and almost instantaneously, which is one of the reasons why it has outlived several bear markets.

According to the Stellar Development Foundation’s Protocol 24 upgrade notes, the network has improved transaction parallelization and throughput, allowing developers to process higher-volume payments efficiently, an important upgrade for a project consistently ranked among the most active altcoins under $1 after crash.

Why Stellar Crashed

When the market cleaning was in 2025, Stellar would have dinged with the rest of the mob. Nothing was wrong inside; it was all due to liquidity compression of the system. The continued high-yield outlook and the actions taken by the Fed to liquidate leveraged crypto markets also generated liquidation cascades.

Nevertheless, historical records at Investing.com indicate that Stellar has been relatively robust; its average monthly drawdown trigger was less intense than that of hypothesis altcoins, highlighting the usefulness of a working use case.

Recent Developments

Execution was what prevented Stellar from disappearing after the crash. In the Meridian 2025 conference talk, particular focus was on institutional adoption, particularly the real-world asset (RWA) tokenization and cross-border compliance frameworks.

What is more visible to the naked eye is the MoneyGram Ramps product that operates on Stellar rails and allows users to move between fiat and USDC currencies without any issues. It is not vaporware, but an operational infrastructure that is interacting with retail payments. Add to that the Visa announcement expanding stablecoin settlement to Stellar, and you get real enterprise validation that few other altcoins under $1 after crash can claim.

Prognosis & Future Driving Force(2025 2026)

In the future, Stellar may gain momentum in 2026 by adopting a mix of enterprise settlements alongside on-chain issuing assets. With the integration of Archax and Stellar, tokenized securities begin to trade on regulated exchanges, which is a definite move into institutional finance.

In the event that macro conditions become better and stablecoin volume grows, the Stellar network may reap greater settlement fees and volumes of transactions. This is especially significant since the distribution of validators and the foundation management of Stellar has enhanced transparency in both aspects, which are aligned with the regulatory preparedness.

If you’re focused on altcoins with strong real-world use cases, check out our detailed review of top utility altcoins under $1.

Resilience & Fundamentals

Unlike many micro-cap altcoins under $1 after crash, Stellar boasts consistent development, liquidity, and a foundation that publishes open reports. The transparency report of the SDF reveals apparent management of the treasury and the allocations made to the funds. The top exchanges are healthy in their liquidity, and developers have been active on the Stellar GitHub repositories.

Community sentiment has also improved since Meridian 2025, with users observing real applications, not just promises, being revived in the network. Such a combination of basic and implementation essence renders Stellar as a shining star among sub-1 projects.

Mini Case Study MoneyGram Ramps

Partnerships, we have mentioned a lot; however, the MoneyGram Ramps rollout is worth taking the spotlight. It is an active demonstration of how blockchain necessarily modernizes old finance, where retail users deposit or withdraw cash via MoneyGram agents and send it instantly as USDC transacted over Stellar. That is not hypothetical, but a reality that can be on-chain measured.

This case embodies why we track altcoins under $1 after crash that are solving tangible problems rather than chasing hype cycles.

Final Take

Stellar (XLM) remains one of the few altcoins under $1 after crash that pairs real-world traction with disciplined network growth. It does not raise its voice the most, but simply makes bridges between money and virtual currency. When adoption persists and RWA tokenization expands, the quieter story of 2025, where Stellar is ruling out the noise, could be achieved.

Polygon (POL / MATIC) – The Scalability Toolbox Developers Continue to Choose

Overview & Current Status

We have been a fan of Polygon since the early MATIC Network days, and now the transition to POL is almost over. According to CoinGecko, POL is trading at approximately $0.19 and has a market capitalization of almost $2 billion as of October 22, 2025. That keeps it squarely within the realm of altcoins under $1 after crash, yet still one of the most actively developed Ethereum scaling solutions.

The new POL will signify a modular future – a future with many chains and a single ecosystem. The Polygon SDK is still utilized by developers, and more than 2,000 decentralized applications are operating within their L2 and sidechain platform.

Why Polygon Crashed

POL was not spared in the October 2025 crypto selloff. No protocol vulnerability was the cause of the move, but instead macro pressure, risk-off attitude, illiquid liquidity, and liquidation cascades through DeFi markets. The historical chart of CoinMarketCap demonstrates that intraday volatility was sharp as the crash occurred between the ranges of $0.17 and $0.23.

To worsen the situation, merchants were still absorbing the MATIC to POL migration. There were exchanges that were slow in changing tickers, which caused a momentary misconception on the part of liquidity providers. Such uncertainty increased the selling pressure, although no fundamental network problem had arisen.

Recent Developments -Why We are Continuing to Watch

In September 2025, the Polygon team announced the official completion of the token migration, which happened at 99% and eliminated a significant technical overhang. This implies that POL is now the common gas, staking, and governance token on all the Polygon L2s between Polygon PoS and zkEVM.

Momentum by developers is strong. The GitHub repository represents dynamic commitments on core repos, whereas the Polygon chain page of DappRadar reveals that there is a robust activity of users, specifically in the gaming and NFTs industry.

That’s critical for investors scanning altcoins under $1 after crash, sustained developer activity signals resilience and long-term potential beyond short-term price moves.

Prospects and Future Driving Forces

We identified three major drivers that may inform the POL pathway by year-end 2025:

- New On-Chain Revenue Models – Higher gaming, AI, and social dApps volume in the network may lead to higher network fees. Due to their emphasis on zk-rollup integrations, Polygon will save money, although it will not reduce security.

- Tokenomics Simplification – And since the migration is complete, the new staking structure of POL ensures rewards and inflation of supply are more predictable.

- Institutional Adoption – As Polygon partners with institutions like Stripe to enable its crypto on-ramp to support Polygon transactions, the adoption of Polygon may increase the utility and perception amongst developers and enterprises.

These fundamentals are more significant than hype in a post-crash market. If liquidity returns to quality infrastructure projects, Polygon (POL) could outperform other altcoins under $1 after crash.

Resilience & Fundamentals

Polygon is an execution-driven company. Millions of transactions are still cleared by the Polygon PoS chain. The team is also known to regularly provide technical releases via their official documentation portal. Importantly, POL hosts solid exchange liquidity in Binance, Coinbase, and OKX, which guarantees in-depth retail and institutional penetration.

Through community governance through the Polygon Improvement Proposal (PIP) process, it introduces transparency, although the Polygon Foundation remains an open-source tooling and cross-chain bridge fund.

Final Take

Polygon (POL) remains one of the most fundamentally sound altcoins under $1 after crash, not because of hype, but because it continues to power real usage. Its designer nature, dedication of developers, and an active presence in its governance have allowed it to survive in a speculative market with a few other instances.

In the event that the greater market turnover in Q4 2025 is in favour of utility and fee-generating ecosystems, Polygon might be one of the first low-priced assets to regain significance.

Cardano (ADA) The Research-Driven Layer-1 Intended to Rise Once More

Overview & Current Status

Cardano is a project that we have been in for so many cycles, and currently, it is at an interesting crossroad. As of October 22, 2025, Cardona, ADA is trading at approximately $0.63 under the CoinMarketCap price chart.

While that puts it just under the “under $1” category, many are watching what matters more: ADA remains one of the most credible major chains with serious development, making it a notable pick among altcoins under $1 after crash.

Cardano operates a proof-of-stake consensus known as Ouroboros and focuses on an approach covered by peer-reviewed research in its roadmap: something still attractive to institutional investors and risk-taking people.

Why Cardano Crashed

In the event of the crash of October 2025, Cardano became a victim of the wider tide of apprehension and sell-offs. Since ADA is more of an altcoin, the macro factors impacted its price: increased U.S. treasury yields, risk-off, and exhausted liquidity.

Furthermore, certain recent upgrades provided by Cardano, e.g., the new staking decrease and a halving-like structure in reward adjustment, presented ambiguity. According to an analysis conducted by The Currency Analytics, the APRs staked on ADA fell by close to 5% after the supply adjustment, and this could have led to a sell-off effect.

Thus, the crash was less about Cardano failing its promise and more about risk assets broadly resetting, a key reason why we’re tracking it among altcoins under $1 after crash.

Recent Developments

There are some aspects of 2025 that indicate that Cardano is set to roll its gears. As an example, Blockchain News indicated that Cardano has partnered with Apex Fusion and Well-Typed to make its smart-contract stack formal and a pointer to institutional maturity.

Also, adoption statistics indicate high levels of staking participation: The Currency Analytics reported that out of the total supply of ADA in circulation, some 67% of ADA circulating is staked, indicating community participation.

These are the kind of fundamentals we look for when assessing which altcoins under $1 after crash have staying power beyond hype.

Prospects and Possible Drivers

In the future, the directives of Cardano may be persuasive. The first one is the wider of its Hydra layer-2 based scaling solution, which is really designed to increase the throughput and cost reduction dramatically, as noted in the recent infrastructure roadmap.

The other one is institutional flow: when ADA finally finds a seat in regulated crypto trusts or ETFs, then it may draw capital that has long been held back.

We don’t promise outcomes, but from our view, ADA’s mix of research-driven development and sophisticated staking ecosystem gives it a credible shot among altcoins under $1 after crash.

Resilience & Fundamentals

The ability of Cardano to withstand is due to its long-term architecture. It is an academic network with a developer community globally and freely accessible treasury and governance data. Indicatively, its model of staking, its dispersal of staking among thousands of pools, and its protocol upgrades all incline towards sustainability and not a temporary hype.

Liquidity is healthy (in large exchange centers), and the brand remains effective with institutions and states. That provides it with a significant structural edge over lower-profile under-a-dollar projects.

Final Take

Cardano (ADA) stands out among altcoins under $1 after crash because it combines institutional-grade infrastructure, a committed community, and a credible roadmap, making it one of the more compelling recovery prospects in the current market environment.

Post-Crash Outlook: Q4 2025 Recovery Scenarios

Our initial reactions are to seek stability when markets go down, and in crypto, it appears humanity is more often than not sown with disorder, leading to salvation. The recent correction that dragged Bitcoin below $55 and sent dozens of altcoins under $1 after crash into panic territory is not unprecedented. Every significant crash since the pandemic sell-off in 2020 to the post-Terra crash in 2022 was preceded by a steep 60- to 90-day backlash as soon as fear turned into accumulation.

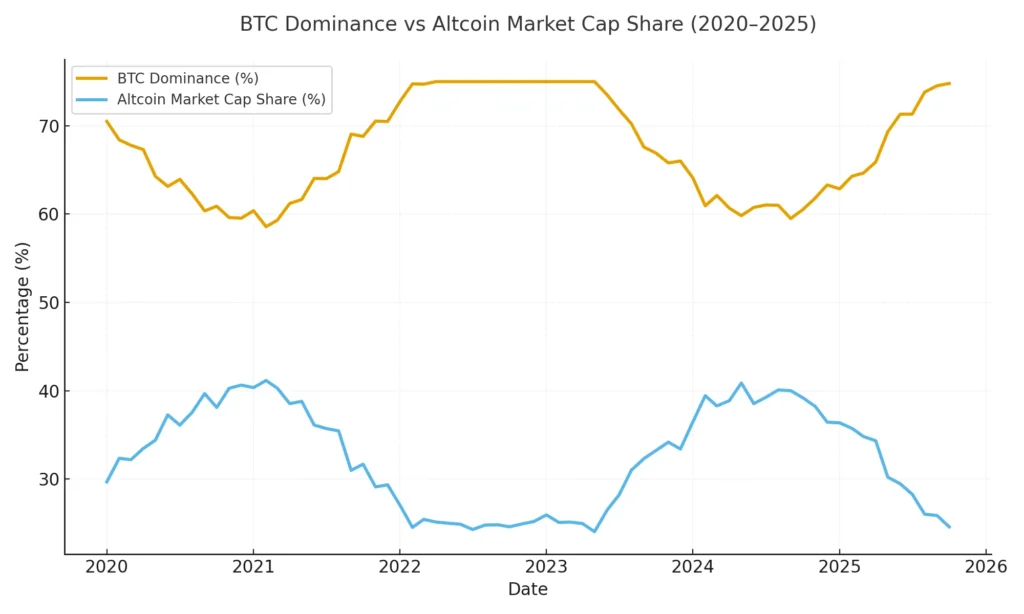

Based on the historical drawdown data of CoinMetrics, the average duration of recovery of the top-50 altcoins once deeply corrected has been approximately 78 days. Likewise, the Glassnode on-chain trend report is pointing out that the Bitcoin dominance arrived as the first move on the way up in the rebounds in 2020 and 2022, followed by the capital being redirected towards higher betas, which is an archetypal risk-on pattern that could repeat as 2025 approaches.

Short-Term vs. Long-Term Recovery Scenarios

| Period | Market Behaviour | Likely Catalysts | Implication for Altcoins Under $1 After Crash |

| Short-Term (Q4 2025) | Gradual stabilization with BTC dominance near 55%–58% | Cooling U.S. yields, ETF inflows, stablecoin reserves rising | Selective recovery — fundamentally strong sub-$1 altcoins rebound faster |

| Long-Term (H1 2026) | Renewed rotation into altcoins once liquidity returns | Bitcoin halving tailwinds, Layer-2 adoption, institutional re-entry | Broad-based rally favouring assets with utility and active communities |

(Data synthesized from CoinMarketCap macro dashboard, Messari Q4 2025 Market Update , and CoinDesk macro analysis on ETF flows)

What the Data Suggests

Currently, the BTC dominance is at approximately 57%, having risen to 48 percent in August, which represents defensive positioning. As it had always happened, as the dominance reached its peak, altcoins consequently followed the trend with a performance relative to the rest as traders rotated once more down the risk curve. A recent dominance tracker by Glassnode reveals the same situation as at the end of 2022, the period that was followed by a 35% mean jump in most of the mid-cap tokens over three months.

In the meantime, in his quarterly insight report, Messari notes an upturn in fundamental factors: the number of daily addresses of the major Layer-1s is flat, gas costs are still relatively low, and exchange withdrawals are accruing. This mix of calmer volatility and capital inflow has often marked the first stage of recovery for altcoins under $1 after crash.

Macro Triggers We’re Watching

The macro tailwinds might set the recovery story into Q4:

- ETF and Custody Flows Stabilizing: According to the ETF flow tracker of CoinDesk, BTC and ETH ETFs have reported positive net flows for the first time in 10 weeks. Liquidity returning to the top tends to trickle down to smaller caps.

- The Halving Countdown: Approximately 180 days within the next Bitcoin halving (assuming BTC Clock), the next Bitcoin halving can potentially be front-run in the markets as soon as December 2025.

- Developer Momentum: Electric Capital Developer Report 2025 shows that dev activity in the largest altcoin ecosystems is 20 times more output than the prior year, a very optimistic indication of strength despite falling prices.

All these aspects combine to signify a gradual, fact-based recovery period, as opposed to a speculative boom.

BTC Dominance vs. Altcoin Market Cap Share (2020–2025)

AltcoinsNest Take

We’ve seen this movie before. Following every panic, markets reward patience and fundamental analysis. The same might repeat itself all over again – utility coins, teams, and communities that are active could top the new resurgence. As it usually happens, it is not about predicting prices but the identification of the pattern.

Some of these projects also appeared in our list of undervalued altcoins under $1 with market cap upside. From our perspective, the current setup for altcoins under $1 after crash looks less like the end of a cycle and more like the quiet first chapter of the next one.

Risk Management: The Recovery Smart Game

When the market is bleeding, we are likely to follow up with the next green candle. But survival, not speculation, is the difference between the investors who make it through to the next crash and those who would have gone absconded. And how can we get through this recovery phase without taking undue risks?

- Diversification without Overextension

When the market sacks off, it is tempting to put the usual investment into a single undervalued alt. However, we witnessed concentration risk working out in previous cycles, particularly following the crypto winter of 2022, when more than 2,000 tokens fell out of use or went delisted, and that is how portfolios are ruined.

Balancing between Bitcoin, Ethereum, and 4-6 strong enough altcoins is a straightforward objective, continued diversification. According to a diversification paper by CoinMetrics, a typical diversified crypto-portfolio will reduce drawdown risk by as much as 35 percent during volatile months.

- The King Has to Be the DCA (Dollar-Cost Averaging)

The most successful traders are unable to capture the market at all times. That is why Dollar-Cost Averaging, or acquiring a specified sum at periodic intervals, is so effective for the majority of investors.

In 2023, Binance Research conducted a study that determined that DCA of Bitcoin and high liquidity altcoins such as Polygon (MATIC) and Cardano (ADA) over 18 months had superior returns in the recovery periods compared to lump sum investing.

It is not about being there at the exact bottom, but it is about making sure you are long enough in the game to make sure you get carried next time.

- Avoid institutions of Leverage – particularly after the crash

Profits can be increased through leverage, but it also increases errors. Based on Coinglass liquidation data, more than $900 million crypto longs had been disposed of during a single day after the April 2025 correction.

Leveraging 5 or 10 times following a significant crash is like driving on black ice, as you take one misstep and lose the entire business to liquidation. Those plays that should attract recovery are those centered on the long term, rather than the lottery tickets.

- Keep Track of Your Holdings

Monitor portfolio trackers to have a basis in the air, not merely to make the numbers rise, but to comprehend the depiction of the asset allocation and performance patterns. The apps such as CoinStats, Zerion, or Kubera facilitate the monitoring across wallets and exchanges.

For a step-by-step framework on spotting early altcoin opportunities, explore our guide on how to find altcoins under $1 before they pump.

Quick Checklist for the 2025 Recovery

- Diversify across 5-8 assets max.

- Adhere to a fixed DCA plan (weekly/biweekly)

- No leverage until the volatility subsides.

- Scan investments using quality apps on a regular basis.

- Hold back 10-15% cash in case of sudden falls.

Conclusion: Navigating the Road Ahead for Altcoins Under $1 After Crash

Cryptocurrency crashes are not the end but a restart. What we already experienced in 2025 can be compared to the previous cycles: the fear spikes, the prices decline, weak projects become stagnant, and the ones that have some practical use are silently built.

When we put this downturn into perspective, we can see it is less of devastation and more of a reallocation of funds, focus, and belief.

We’ve explored five altcoins under $1 after crash, VeChain (VET), Hedera (HBAR), Stellar (XLM), Polygon (POL), and Cardano (ADA). It is a story and a different one in each, though the essential common denominator is that all of it is about resilience. Be it VeChain taking sustainability data down transaction lines through integration with enterprises or Cardano adding to its DeFi ecosystem through opaque governance, it is a project that is still shipping, and not yelling.

As the Q4 2025 projection of CoinMarketCap indicates, the level of fear in the market today is in the same range that it was before the 2020 and 2022 corrections, which were then topped by 150% and even 300% gains in the strong altcoins in the quarter after. This is not the reason this should happen again, but it is an indication of how opportunity is found in the sack of pessimism.

Gaming-focused altcoins under $1 have also shown resilience post-crash, as explored in our list of top gaming tokens under $1.

With this said, one should be careful. Cryptocurrency is a highly volatile instrument, and we cannot apply the insights of education as investment advice. Conviction is the development of principles, rather than headbanging. If you’re exploring altcoins under $1 after the crash, focus on teams delivering real-world solutions, measurable adoption, and strong token utility, not just hype cycles.

The liquidity trends, ETF inflows, and developer activity will probably influence the first ones to bounce back as we head into the Bitcoin halving of 2026. We can only hope to be informed, be patient, and be diversified.

Due to the fact that the dust always settles as it always does, survivors of the storm usually stand first in the sunshine.

FAQ: Altcoins Under $1 After the 2025 Crash

Q1: Which altcoin under $1 is most likely to recover fastest after the 2025 crash?

VeChain (VET) and Hedera (HBAR) are experiencing the best on-chain recovery and recent momentum, although no one can be sure of any market. The on-chain analysis performed by Santiment indicated that both networks have been experiencing a gradual increase in the number of active addresses and transaction volumes since mid-October 2025, which speaks of a newfound investor confidence.

With that said, the pace of the recovery is frequently reliant on macro conditions such as Bitcoin dominance, inflows of liquidity, and development activity, not only on the short-term price action.

Q2: Are these altcoins safe to hold through 2026?

Cryptocurrency safety is not about prices or prices. Such projects as Cardano (ADA) and Stellar (XLM) have strong development roadmaps and high communities of validators. According to the developer metrics of Token Terminal, Cardano is regularly among the five active GitHub commits, which is a sign of long-term technical dedication.

Nevertheless, keep in mind that crypto is volatile in nature. To hold until 2026 would only work well if you know the technology of each project and can handle market volatility.

Q3: What’s the best way to buy these altcoins in the U.S.?

It is the safest way through controlled exchanges. Most of these tokens are available on major platforms such as Coinbase, Kraken, and Uphold, and can be purchased using USD deposits.

To ensure that the accounts are secure, it is always best to use two-factor authentication, never leave the assets on exchanges over a long period of time, and finally, it is a good idea to move holdings to self-custody wallets such as Ledger or Trezor.

On-chain DEX aggregators (like 1inch) can also be used to do decentralized swaps – although again, you must be careful to ensure compatibility with a network before making a transaction.

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.