Whether you’ve been following crypto markets lately or not, one thing’s clear: the altcoin space is heating up again. But unlike previous cycles, hype alone isn’t driving price action, now it’s competing with real data, utility, and traction.

That’s why this August, we’re not just spotlighting any low-priced coins. We’re after the best altcoins under $1 that show signs of strength, innovation, or community momentum, specifically over the next few weeks.

There’s always been a certain charm to the best altcoins under $1. They’re cheap, within reach, and full of asymmetric upside, but also cluttered with noise. Thousands fly under a dollar, but few are grounded in fundamentals or real-world use.

To make your life easier, we’ve done the heavy lifting. This isn’t a hype list or speculation piece, we’ve researched each project’s tokenomics, exchange volumes, listings, and most importantly: August-specific catalysts that could move the market.

Each coin comes with a clear narrative, real-time context, and links to verify what we found. This guide is educational, not financial advice, and reflects our own research as we navigate this jungle alongside you.

Already saw our full-year forecast? This is different.

Our earlier piece covered top altcoins under $1 to watch in 2025. This list is laser-focused on what’s heating up right now, in August.

Let’s dive in.

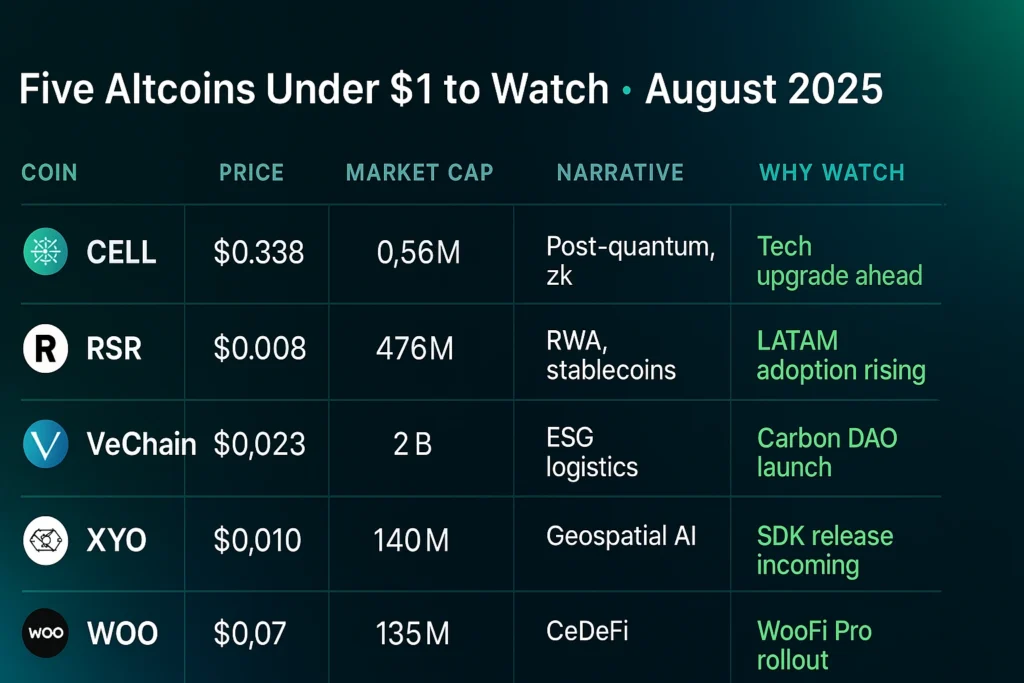

Quick Glance: 5 Best Altcoins Under $1 to Watch in August 2025

| Coin | Price | Market Cap | Narrative | Why Watch |

| CELL | $0.338 | $9.56M | Post-quantum, ZK | Tech upgrade ahead |

| RSR | $0.008 | $476M | RWA, stablecoins | LATAM adoption rising |

| VET | $0.023 | $2B | ESG, logistics | Carbon DAO launch |

| XYO | $0.010 | $140M | Geospatial AI | SDK release incoming |

| WOO | $0.070 | $135M | CeDeFi | WooFi Pro rollout |

What Makes These Best Altcoins Under $1 Worth Watching

Being under a dollar or a dollar does not necessarily mean that the token is of good value to investors. What sets the best altcoins under $1 apart is a combination of strong fundamentals, real-world relevance, and upcoming catalysts that could trigger momentum in the weeks ahead.

There are three of the most important pillars that were employed as a strict filter:

1. Real-World Narrative Fit

Each of the best altcoins under $1 featured in this list ties into a broader macro trend, whether it’s stablecoins solving inflation in LATAM, quantum-resistant cryptography, or ESG-linked logistics. It is not meme tokens that are on speculative chase; they are solving real problems.

2. Upcoming Technical or Ecosystem Catalysts

The catalysts we focused on in the near term included mainnet upgrades, the release of an SDK, an increase in token utility, or any other protocol milestone that was easier to see. Such occurrences are a common factor in capturing developer interest and sparking speculation among traders, and these are key in the price movement.

3. Community Strength + Exchange Liquidity

Any good story in the world means nothing if people are not buying or building it. The best altcoins under $1 we’ve picked show vigorous community activity (not just bot traffic), daily volume across top exchanges, and steady liquidity on both CEXs and DEXs.

To eliminate false positives, we also evaluated:

- GitHub activity (real updates vs. zombie repos)

- Tokenomics health (no sudden unlock cliffs)

- Transparent teams or backers

- Market depth and slippage resilience

In short, these best altcoins under $1 stood out not because they’re cheap, but because they have a reason to grow. They are reasonably good to monitor in the month of August 2025 due to a combination of price, potential, and positioning.

The Psychology of “Cheap Coins”

The appeal of the best altcoins under $1 often starts with price illusion, the belief that a coin priced at a few cents is more likely to “10x” than one already trading at $100. It is inspirational. As a new, small investor, we find it more concrete to purchase 10,000 units of a token than to own 0.01 of a high-priced coin like ETH.

Such an attitude is, however, not simply novice deprivation. Behavioural finance demonstrates that when it comes to making decisions, a person is biased toward whole units, creating a situation in which the decision-making process is skewed. That is why so many traders rush into sub-dollar altcoins hoping to become rich overnight by betting on supposedly undervalued assets.

Price alone, however, is meaningless as far as value or potential is concerned. A token may be below $1 due to its enormous token supply and the poor foundation that lacks actual traction. On the flip side, some of the best altcoins under $1 are priced low simply due to early-stage adoption, not because they lack merit.

Smart investors do not view price tags. These are market cap, circulating supply, catalysts in the future, and real-life applications. They often offer a great risk-reward when they do line up. Low-cost altcoins might become a great risk reward, especially when a bull run or a good mood in the sector.

Why Price ≠ Value?

The prevalence of new investors who provide credence to a low token price, believing it to be a good deal, is one of the most widespread misconceptions. But in the case of crypto, price is contextless.

Just two tokens:

- Token A trades at $0.005 with a 100 billion supply.

- Token B trades at $5 with just 10 million tokens.

The point over here is, which is cheaper?

As a matter of fact, Token A is trading at a market capitalization of $500 million, whereas Token B has only $50 million. And thus, whereas A appears to be a lowly company when it comes to price, B could be more promising.

That’s why experienced investors digging into the best altcoins under $1 don’t chase low numbers blindly, they focus on undervalued projects where the fundamentals outweigh the hype.

The value of the coin comes from

- Market cap relative to potential TAM (total addressable market)

- Team, tokenomics, and development roadmap

- Ecosystem traction and partnerships

- Narrative strength (e.g., AI, DePIN, RWA)

Some of the best altcoins under $1 have robust tech, real adoption, and are only priced low due to early-stage development or lack of mainstream exposure, not because they lack value.

It is the understanding of the difference and distinction between price and valuation that makes the difference between speculation and strategy.

How Low Caps Offer Asymmetric Upside

Traditional markets can hardly give 10x or 100x returns. But in crypto, especially when researching the best altcoins under $1 with low market caps, those kinds of gains are still possible.

Asymmetric upside refers to the fact that the potential reward of a bet is tremendously disproportionate to the risk. You would take the risk of 100, but the coin would be in the format with the story that it could bring back 5000 or higher. That is what attracts intelligent money to undervalued tokens that have a value of less than a dollar.

The reason why low-cap coins have this advantage is as follows:

- They are off the radar. They are overlooked by institutions and whales until there is a massive volume.

- Less capital is required to push the price. A 10 million dollar market cap coin needs 1M inflows to 10% pump the coin.

- Narrative-driven pumps. Many of the best altcoins under $1 ride powerful themes like AI, RWA, and zk-tech, giving them viral breakout potential.

Naturally, the risk is also increased. However, given that it can be researched adequately by exploring the supply of tokens, roadmap, community engagement, and catalyst schedules, retail investors can get in early before big incoming listings or influencer hype.

It is already in history that the low caps can be turned into giant projects tomorrow: Solana, MATIC, and even DOGE used to be traded below 0.01 at the time of writing. The thing is to separate signal and noise.

August 2025 Macro Overview – ETH ETF Rumors, Altcoin Season Signals

Timing is everything in crypto, especially when betting on the best altcoins under $1. As important a month as this is considered in the crypto community, August 2025 is turning out to be a critical moment when all the macro indicators align that could set up serious altcoin action.

1. Gossip ETF ETH Is Hotting Up

Speculation has re-emerged that a Spot Ethereum ETF will become legal in the U.S. SEC before the end of 2025. According to VanEck analysts, political momentum and Bitcoin ETF success may compel the SEC to approve Ethereum as the next.

Once this moves onward, it may unlock the floodgates of institutional capital not only into Ethereum, but into the related Layer 2 ecosystems, which can be called a rising tide that can be easily regarded to lift many below-dollar altcoins that are linked up with Ethereum-founded scalability.

2. Altcoins Dominance Turnaround Map

According to TradingView records, Total Altcoin Market Cap (TOTAL2) achieved a breakout following a 14-month period of making sideways movements between accretion. Simultaneously, Bitcoin exertion (BTC.D) has already begun to weaken, a technical configuration that has been followed by prevailing altcoin torment in the past.

The camps of smaller caps are taking the initiative, indicating that altcoins may do particularly well in the near future compared to majors.

3. The Re-Entry and Liquidity Supercharge in Global Retail

Going by the words of Glassnode, there has been a sustained increase in the number of active addresses or wallet inflows, particularly in the low-cap segment.

At the same time, the regulatory green lights of other areas, such as Singapore and Hong Kong (HKMA), have taken place, encouraging the influx of capital into altcoins and tokenized assets. The outcome: a new breed of retail investors entering the arena again, mostly via the tradable available coins that are below $1.

4. Full Swing Narrative Rotation

Crypto lives by the story, and the churning is already being made to August 2025:

- Geospatial AI & IoT – XYO

- ZK & Post-Quantum Infrastructure – Cellframe

- Real World Assets & Stablecoin Rails – Reserve Rights (RSR)

These micro-narratives typically ignite faster in low-cap, sub-$1 altcoins, fueled by viral discussions across crypto X, Discord, and YouTube. With capital rotating into newer themes, early exposure matters.

1. Cellframe (CELL) – Post-Quantum Privacy Chain

What then are Cellframe?

Cellframe is Layer-1 blockchain to be used in the era of quantum computers. In contrast to the traditional cryptographic networks, Cellframe employs post-quantum encryption, a future-resistant system that helps secure blockchain information against the possible quantum attack. It is developed in Rust and has two layer system built-in sharding mechanism; enabling high throughput smart contracts to be deployed as well as keep data private and decentralized.

Cellframe was launched by a cryptography graduate and former engineer of Kaspersky lab, Dmitry Gerasimov, in 2017 and has since established a developer-based ecosystem in the background.

Website: https://cellframe.net

Explorer: https://explorer.cellframe.net

Why It’s on Our August Watchlist

CELL is priced under $1 and ranks outside the top 500 by market cap, making it one of the best altcoins under $1 with asymmetric upside potential.

What sets it apart:

- Quantum resistance: Most chains will eventually need a security overhaul; Cellframe is already built for it.

- Enterprise focus: Strategic partnerships in the cybersecurity and IoT sectors (e.g., with Post-Quantum and Tardigrade.io).

- Revenue-ready: Offers real-time bandwidth rental via its decentralized network, giving it utility beyond speculation.

Upcoming Catalysts

- Mainnet 2.0 Launch (Q3 2025): With dynamic node staking, native NFTs, and WebAssembly support.

- Quantum VPN rollout: Their private net-layer tool (a Tor + VPN hybrid) enters closed beta in August.

- Binance Innovation Zone Rumor: A Cellframe dev hinted at talks with top-tier CEXs during a recent AMA on X.

Each of these events could drive a re-rating of CELL — especially during an altcoin season surge.

Verdict: We cannot say what the market will be, but Cellframe is one of the projects that should be followed through its quantum resistant focus and will be launching Mainnet 2.0 soon. At a price beneath $1, and having a niche application, it may be of interest in speculative altcoin swings, but any exposures should be researched heavily by a prospective investor and with accurate risk estimation in mind before pursuing.

2. Reserve Rights (RSR) — Stablecoin Ecosystem with LATAM Use Case

What is RSR?

Reserve Rights (RSR) is the governance and utility token of Reserve Protocol, a two-token stablecoin platform that will offer inflation-resistant currencies in emerging markets, particularly in Latin America. Whereas the stablecoin itself can be referred to as RTokens, RSR will play a vital role in terms of collateral governance, staking, and voting on parameters of the protocol.

RSR holders contribute to the stability of RTokens and decentralization of RTokens by being included in the process of selecting diversified, yield-bearing assets to be used in backing of each stablecoin. Its purpose is very well aligned with the de-dollarization movements a portion of LATAM has seen (Argentina and Venezuela currently experiencing inflation of 140%+ and an unstable FX regime).

Why it matters: This is in contrast to failed algorithmic stablecoins, such as Basis, because it implements over-collateralization and real-yield governance- a model that would have been followed by lessons on the Terra blow up and the success of MakerDAO.

August 2025 Development Milestones

Another development is taking place in the third quarter of 2025, which consists of the shipping of a significant upgrade of the mobile application by Reserve Protocol, furthering the utility of RPay to more nations in Latin America, such as Ecuador and Peru. This follows after RToken was recently introduced successfully in Colombia and Argentina in January of this year.

The official Reserve Protocol roadmap also indicates future improvements in DAO modularity, such as smart contract composability, which has the potential to unlock permissionless creation of RTokens by third parties.

It fits into the greater vision of Reserve to bring on board the next 10 million users into a non-USD stablecoin system, and that in hyperinflationary economies in particular.

Whale Wallet Movement

In mid-July 2025, on-chain analysts at SpotOnChain announced the sudden awakening of inactive whale wallets that stored RSR. Such wallets were last used in 2021 and are slowly but surely accruing in DEXs such as Uniswap and MEXC. Also, the RSR was experiencing over 120M tokens in inflows on the Binance RSR hot wallet within 48 hours, a trait that sometimes predicts price volatility.

Hypothetical or Signal? In the past, the price of RSR has responded to the movement of whales in a window of 10-14 days. Though no assurances can be made, this trend is in progress with the further implementation of permissionless RTokens, so it is one of the trends that can be observed in the short term.

At the end: Reserve Rights (RSR) stands out among the best altcoins under $1 for its real-world use case, strong tokenomics, and growing presence in emerging economies. Coming together with whale movement and protocol upgrades, it can be very interesting to pay attention to it, at least, potential investors who cares about stablecoin infrastructure development and worldwide fintech adoption.

3. WOO Network (WOO) — Liquidity Layer for CeDeFi

What is WOOFi & WOO Network?

Final Conclusion: CeDeFi could take off this time around, and in that case, WOO is one of the best altcoins under a dollar in August 2025. It is also an infrastructure stock that provides premier level liquidity due to its future implementation of Pro and high exchange footprint as well as its continuously growing user base numbers.

Why August Could Be Huge (WOOFi Pro)

August 2025 is shaping up to be a key inflection point for WOO. The team is rolling out WOOFi Pro, a new institutional-grade DeFi platform built on Arbitrum and BNB Smart Chain, targeting high-volume traders and funds.

WOOFi Pro is designed to:

Enable advanced trading tools with zero slippage swaps

Offer multi-chain access to deep liquidity

Integrate cross-margin and real-time price feeds

This launch could drive new user segments to the ecosystem, especially as DeFi volumes rise across L2s. According to DefiLlama, WOOFi’s TVL has been steadily increasing in Q2–Q3 2025.

Price Recovery Since Binance Delisting

WOO has already been through an ordeal in 2023, being temporarily delisted by Binance due to legislation rearrangement, but has since risen out of the water and actually increased its listings.

July, 2025:

- The active users of Arbitrum WOOFi are above 25,000 users per day

- WOO token recorded a 37 percent boost week over week in terms of volume

- Development activity on GitHub was growing with the finalization of smart contracts of WOOFi Pro

This rebound tale is good evidence of good fundamentals and product-market fit – more so, in a niche like CeDeFi where not many players are doing it well.

If you’re looking for more options in the decentralized finance space, check out these DeFi altcoins under $1 with real-world use cases worth watching.

Final Conclusion: CeDeFi could take off this time around, and in that case, WOO could be the best altcoins under $1 in August 2025. It is also an infrastructure stock that provides premier level liquidity due to its future implementation of Pro and high exchange footprint as well as its continuously growing user base numbers.

4. VeChain (VET) – Supply Chain Leader with Enterprise Adoption

What Is VeChain?

VeChain (VET) is a Layer-1 blockchain that is expected to be adopted by enterprise-sized applications in supply chain, carbon tracking, and product authentication. It is bipolar in combination of tokens: VET (value transfer) and VTHO (gas/ fee utility). The project is centered on the incorporation of blockchain + IoT in an end-to-end traceability.

Throughout the years, VeChain has been able to enroll some of the key partnerships, such as BMW, PwC, Walmart China, and DNV. It has been memorable by being the only one to have been shipping real-world products rather than riding hype cycles.

VeChain remains one of the few utility altcoins under $1 in 2025 that’s actually solving real-world supply chain and ESG problems.

Why It’s on Our August 2025 Watchlist

VeChain is receiving another impetus due to:

- European ESG Pilot by DNV – The companies operating on the supply chain in Europe have partnered with DNV and VeChain to incorporate ESG data onto their blockchain through tokenization.

- VORJ No-Code Smart Contract – The new VORJ platform was giving companies that lack coding knowledge the opportunity to build and develop smart contracts seamlessly on VeChain.

- US Expansion Clues – Adverts and foundations- Are pointing to the idea that VET is planning a US enterprise expansion.

VeChain could stand out as a price point of less than 0.03 as a potentially good value exposure to the real-life blockchain applications, particularly in the ESG and sustainability marketplaces.

Metrics Snapshot (as of July 31, 2025)

| Metric | Value |

| Price | $0.0237 |

| Market Cap | $2.04 Billion |

| Circulating Supply | 86 Billion VET |

| 24h Volume | $59 Million |

| Exchanges | Binance, KuCoin, Gate.io |

Final Thought : VeChain (VET) down at less than a dollar in August 2025 is also doing some good work with giants such as Walmart, BMW, and PwC in trying to bring efficiency to supply chain and add transparency. Real things are driven by their blockchain technology, e.g., tracking goods between factory and shop, and they are very concerned about sustainability, such as VeBetterDAO. VET is a candidate when it comes to eyeing altcoins that have a real business application. But crypto is wild: it goes up and down, and policies change, and there is a huge risk of losing. Before leaping in, do homework, and consult an expert in finances.

5. XYO (XYO) – Geospatial Data Oracle for Real-World Crypto Integration

What is XYO?

XYO (XY Oracle Network is a non-centralized protocol to provide geospatial information, which is linked to the physical world and smart contracts by a network of IoT-based devices. It consists of a combination of real-sensorial sensors and node verification, as well as location-based proofs to build a trustless data layer on applications such as tracking, verification of delivery, and location-based advertisement.

XYO has an advantage over generic oracles such as Chainlink since it has a specific purpose, namely, verifying location data, i.e., it plays a major part in real-world asset (RWA) tokenization and integration of the Internet of Things (IoT) and Web3.

August 2025 Use Case Relevance

In August 2025, XYO’s relevance is growing due to:

- Partnership with FedEx – (Q2 pilot recap) to tokenize delivery logs for final-mile tracking.

- New staking utility enabling node runners to earn fees from enterprise data calls.

- Enhanced SDK for Android — devs can now build apps that track users’ location securely without compromising privacy.

These developments support XYO’s positioning in the real-world data economy, which is gaining traction across Web3 narratives.

Key Metrics (as of July 31, 2025)

| Metric | Value |

| Price | $0.0100 |

| Market Cap | $58 Million |

| Circulating Supply | 13.9 Billion XYO |

| 24h Volume | $11 Million |

| Exchanges | Coinbase, KuCoin, Gate.io |

Final Thoughts: XYO stands out among altcoins under $1 because it bridges the physical and digital world, offers a working oracle product, and has actual partnerships. In a market flooded with empty promises, XYO delivers real utility, and for investors who believe in IoT + blockchain convergence, it’s a high-conviction microcap to keep on your radar. However, cryptocurrency investments carry significant risks, including price volatility, regulatory changes, and market uncertainties. Always conduct thorough research and consult a qualified financial advisor before making investment decisions.

FAQs – Altcoins Under $1 in August 2025

Q1: Are altcoins under $1 worth buying in 2025?

Yes, but after conducting the proper research, Altcoins that will be below 1 US dollar in 2025 are very promising, yet there are risks associated with them. It is best to investigate the usefulness, team confidence, and the new activities that are being undertaken before investing.

Q2: What is the best strategy for finding low-cap altcoins?

Most of the time, the most helpful approach is the combination of on-chain tools (such as DexTools or Lookonchain) and GitHub activity and group participation. Altcoins with a small market cap and a value of under $1 with any upcoming catalysts and developers who are working.

Q3: Where can I buy these best altcoins under $1 safely?

Most of the altcoins under $1 are sold on reputable exchanges such as Binance, KuCoin, and CoinEx. Two-factor authentication and a non-custodial wallet should always be enabled to increase their security.

Q4: What makes an altcoin undervalued?

A low-valued altcoin is characterised by being undervalued, having a small market cap, having good fundamentals, active development, and potential utility or adoption. Low prices below 1 USD are not cheap on their own; it is the potential in the future.

Q5: Are these coins good for long-term holding?

Altcoins under a dollar have the potential to be good long-term wagers — especially those with practical utility or constructing infrastructure (such as L2s, privacy solutions, or business applications). Nevertheless, you should never settle on something and periodically update the basics.

Final Thoughts: Which Altcoins Are Worth It This August?

Trending through August 2025, there is beginning to be a fresh volatility of altcoin and particular momentum signatures. It depends on the principles, prospects, and niche strategy, so here are our five selected best altcoins under $1 to pay attention to:

- Kaspa (KAS) – High-throughput L1 with unique blockDAG architecture.

- Reserve Rights (RSR) – Real-world stablecoin use case in LATAM.

- COTI (COTI) – zk-based modular Layer 2 with private payment rails.

- VeChain (VET) – Enterprise adoption and logistics blockchain.

- XYO (XYO) – Real-world location data and IoT integration.

Risk vs Reward: Know What You’re Buying

These projects present great upside but are also exposed to a lot of liquidity as well as regulatory risks, particularly at micro-cap levels. Every altcoin is not a safe bet- and this is for less than a dollar. You need to invest smartly, and you should invest the amount you can afford to lose.

Stay Ahead with Real-Time Signals

The markets are dynamic. If you’re serious about catching early trends:

- Subscribe to Telegram cryptocurrency-alarming groups.

- Track the whales using DEX tools, whale trackers (examples: Lookonchain, DexScreener).

- GitHub allows you to track commits and social opinions you find interesting or to save your watch list.

It is possible to configure volume alerts on CoinGecko or CoinMarketCap when excessively large amounts of volume take part in the process or when something gets listed.

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.