Whenever we transfer money using Bitcoin or Ethereum, it hurts our wallets; each confirmation can take an agonizingly long time, and the expense of transactions may easily dishearten us when attempting to spend even the smallest amount of money. That is precisely why the best payment altcoins under $1 are raising our eyebrows. These are fast, reliable, and incredibly low transaction fee cryptocurrencies that work best when it comes to day-to-day transfers, sending money back home, or even just getting a cup of coffee.

In this post, we’re looking at the best payment altcoins under $1, tokens that combine fast finality, low fees, and real-world utility, all while staying affordable. We have no promotional interest in it, just an educational one. We are not here to counsel or promote a coin of any sort, but to give tips based on some useful knowledge about live, verifiable data.

This is how we selected the coins we wanted to include: they should have speed, must have low fees, must provide signs of adoption, and must have enough liquidity to be usable. These factors shaped our list of the best payment altcoins under $1. Of interest: prices are volatile. To use an example, by the time of writing (September 3, 2025), XLM will be around $0.36 and HBAR will be about $0.22, but these will change by the time you read this article.

So, in and out we go, and discuss some of the most believable proofs of the best payment altcoins under $1, driving genuine payment frameworks in the contemporary world. This guide will help readers understand why the best payment altcoins under $1 are gaining traction in payments.

The Importance of Payment-Focused Altcoins under $1

To most amateurs, the main concept to understand is thus: when paying with a big-name cryptocurrency such as Bitcoin or Ethereum, it can take a long time to get it confirmed and charge substantial fees, large sums that can cancel out the utility of small transactions. That is why the best payment altcoins under $1, can prove much more reasonable to use when transferring money overseas or purchasing a cup of coffee. These are the payment options that the majors fail at: almost instantaneous payment, low price, and useful functionality.

We are in the middle of an actual turn, based more on utility than on speculation. It is not only the price spike in the crypto market, but the current growth is based more on the real use of transactions. Blockchains are now becoming practically valuable in their own right, as people use them to send money across borders, as a means to pay for services, or as a way to micropay, and so on. This practical shift is changing the story of altcoins. This practical shift is changing the story of the best payment altcoins under $1.

These payment altcoins are best in the following ways:

- Micropayments: Small payments – such as rewarding content producers or making in-game purchases – become possible when the fees are negligible and responses are rapid.

- Transfers between countries: Conventional remittance services can be as expensive as 5-7% in commissions and can take a couple of days to complete, as noted in a Cointelegraph article on crypto remittances.

- On-chain commerce: Blockchains with fast, low cost sales are empowering merchants, decentralized applications (dApps), and user communities to exchange value effectively – without using additional financial rails.

This practical shift is changing the story of the best payment altcoins under $1, much like the top utility altcoins under $1 that emphasize real-world applications over speculation.

In Short: When you need to remit or simply send money with crypto, payment-oriented altcoins below $1 provide a viable, accessible tool to do so, which few larger tokens can replicate.

Methodology & Selection Criteria

In examining the top payment-oriented altcoins with lower values than one US dollar, we use objective, transparent standards to evaluate the best payment altcoins under $1 so that readers can know why the project is important. All of the metrics below represent live or current data. (timestamped as of September 3, 2025)

Throughput & Finality: The payment coins have to be fast and dependable. Some projects can report the performance of thousands of transactions a second, but the important thing is the speed at which transactions are being completed. An example of this is research by Avalanche on ‘time to finality’, which suggests that the speed of settlement is less frequently relevant. Still, when it matters, the speed of settlement is a more useful measure than crude TPS to the user.

Transaction Fees: Real-world payment transactions can never be made cheaply. New coins such as Stellar and TRON are often seen to have sub-cent transaction fees. Based on the fee comparison dashboard created by Coinmetrics, the core distinction between a payment token and the largest blockchains, such as Bitcoin or Ethereum, lies in the efficiency of fees.

Network Uptime and Reliability: A payment system cannot be useful if it does not work at all. The quarterly reports by Messari focus on uptime as one of the best predictors of reliability in any network when the data is measured over several years.

Adoption & Partnerships -Real life integration brings about credibility. To illustrate this point, the cross-border remittance case studies published by Stellar with MoneyGram demonstrate how partnerships can be extended through strategic adoption.

Developer Activity: The presence of ongoing GitHub commits and ecosystem development indicates project health. In its annual developer report, Electric Capital has repeatedly shown the alignment between developer activity and the success of payment-oriented blockchains in the long term.

Token Design & Treasury: Token stability is influenced by inflation schedules, circulating supply, and the management of the treasury. Binance Academy describes the dynamics of tokenomics that determine whether a coin is good to pay with, or belongs among the best payment altcoins under $1, such as its supply and burn mechanics.

Exchange Listings & Liquidity: A token should be easy to obtain, trade, and spend internationally. According to the analysis of exchange listing practices performed by Coin360, the larger the listing, the better the liquidity is and the higher the trust invested in the exchange.

Adding all of this together, we filter out hypothetical projects and only show best payment altcoins under $1 that have good fundamentals and can actually be used, similar to how you can learn to spot them yourself in our guide on how to find altcoins under $1 before they pump.

In-Depth Reviews of Top Payment- focused Coins Under $1

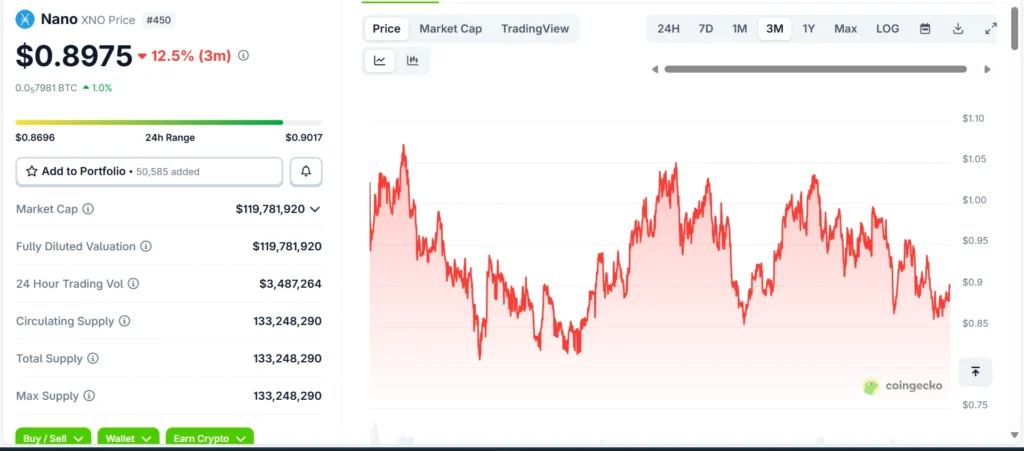

Nano (XNO)

- Snapshot (at publication)

You can imagine what it feels like to send Bitcoin when everything is running smoothly, and see the fees climb and the confirmations crawl. Nano flips that script, firmly in the best payment altcoins under $1 list. As of September 3, 2025, Nano (XNO) trades around $0.89, with a circulating supply of roughly 133 million XNO and a market cap of about $119 million. Transactions consume just less than one second, and no money is spent at all – though, like with any crypto, figures might change rapidly.

- Why it’s great for payments

Nano has built its entire identity around payments. No gimmick staking, no DeFi layers, but speed and zero-cost transfers. That is why it is an extraordinary instance of crypto to the extent that the daily routine of tipping via the internet, remittances, or buying online services just seems to work.

- Key features

Instead of a single chain, Nano uses a block-lattice design, where each account runs its own lightweight blockchain. It seems complicated, but the impact is not complicated: each user can send or receive without queuing on a global bottleneck. The answer is confirmed by Open Representative Voting, a thin-sliced consensus mechanism that maintains the network is cheap and energy-saving.

- Real-world use

The payment focus at Nano is not theory only. In the Philippines, Nano was adopted by Coins.ph, one of the largest Philippine exchanges, as a tool to support zero-fee transfers and micro-transactions, a move that the Nano team explicitly targeted at the overflowing remittance market in the Philippines. That is a practical application of low cost and immediate finality.

- Developer & Ecosystem signals.

Nano is not a showy toy, and its development pulse is gradual. Its GitHub repositories remain active, and community updates show an ongoing focus on protocol stability and node performance. Nano has not yet entered the hype cycle for projects like theirs.

- Risks & trade-offs

What makes Nano appealing is also its weakness: the same purity limits its potential. And it lacks the sprawling ecosystem of Ethereum or the depth of exchanges of TRON. Liquidity is thinner, and merchant adoption, while growing, is still niche.

- Bottom line

Nano reminds people of what crypto intended to accomplish in the first place: transfer money very quickly, free of charge, anywhere. It possibly never commands the headline, but among payments under $1, few altcoins trade as well on their promise. Nano remains one of the best payment altcoins under $1 for remittances.

XDC Network (XDC)

- Snapshot (at publication)

The payments world does not simply require speed, but also requires infrastructure that banks and businesses will actually utilize. That’s where XDC comes in. As of September 3, 2025, XDC trades at about $0.078, with a circulating supply of 17.7 billion tokens and a market cap close to $1.3 billion keeping it among the best payment altcoins under $1. Instead, transactions can be made within a few seconds, and the fee charged is minimal and nearly insignificant. Like usual, these numbers fluctuate fast in crypto markets.

- Why It’s Great for Payments

What makes XDC different is that it focuses on trade finance and cross-border settlements. XDC will not pursue memes or retail hype: it establishes itself as business-level plumbing on the basis of global value transfer. That translates into quicker letters of credit, real-time settlement of import/export payments, and remittance corridors not dependent on slow SWIFT rails.

- Key Features

XDC will carry the ISO 20022-conformant message, and institutional participants will have access to those standardized financial communication protocols that corporate institutions are accustomed to using. Its decentralized public-private blockchain architecture and Delegated Proof-of-Stake consensus provide both speed and scalability as well as regulatory consistency.

- Real-World Use

XDC also achieved publicity, as it became the first blockchain ecosystem to become a member of the Trade Finance Distribution (TFD) Initiative, a banking and finance consortium dedicated to digitalizing the finance of international trade. That is a tough coin that is a sub-$1 coin in the institutional world.

- Developer & Ecosystem Signals.

The XDC Foundation has sustained the ecosystem with grants, developer toolkits, wallets, and bridge infrastructure. GitHub activity and frequent ecosystem updates suggest ongoing technical momentum.

- Risks & Trade-Offs

Enterprise focus cuts in both directions. While XDC’s bank-centric strategy could pay off, it also exposes the token to regulatory oversight and dependency on slow-moving institutional adoption. Liquidity is moderate, but not as deep as majors like TRON or Stellar.

- Bottom Line

XDC is one of the altcoins with payment-related applications under $1 that have a chance of actually becoming a part of the trade finance system. Its standards-level tooling and consortium-level recognition allow it to be among the few projects that are bridging the infrastructure gap in crypto. XDC is one of the best payment altcoins under $1 for trade finance.

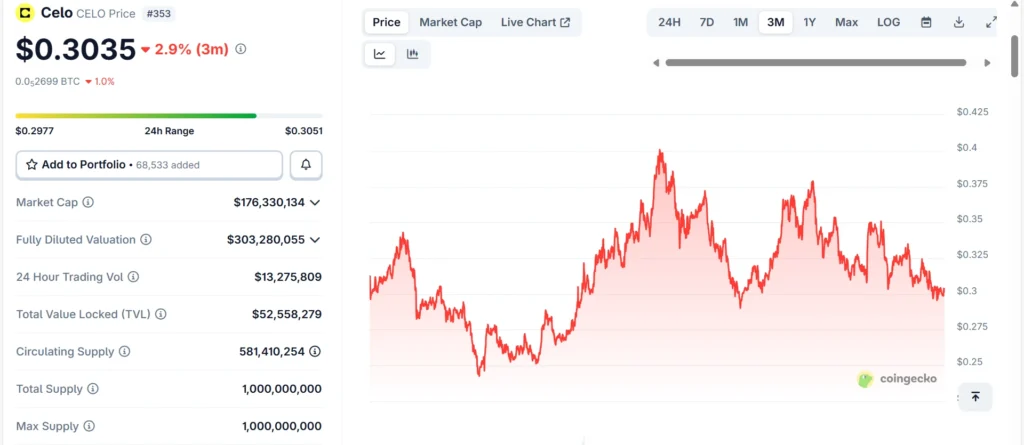

Celo (CELO)

- Snapshot (at publication)

Consider sending money with only your phone number- no bank account or wallet set up required. That’s Celo in action. As of September 3, 2025, CELO trades at around $0.30, with a circulating supply of ~581 million, a max supply of 1 billion, and a market cap near $176 million. The transaction costs tend to remain at less than $0.01. These values can vary, and it is a good idea to look at live sources such as CoinGecko.

- Why It’s Great for Payments

Celo simplifies crypto payments to the equivalent of a text message, no long text strings, human-readable names. Daily transactions made with native on-chain stablecoins such as cUSD, cEUR, and cREAL become quick, cheap, and consistent. Making it one of the best payment altcoins under $1 for mobile-first payments.

- Key Features

Celo makes sending money intuitive instead of relying on cryptic addresses using linked wallets, which are based on the use of phone numbers. It also supports multiple native stablecoins, enabling fiat-pegged transactions with sub-cent fees, an ideal setup for micropayments and low-friction transfers.

- Real-World Use

The design is not only ingenious, it is in operation. In Colombia, cREAL, the stable currency of Celo pegged against the real Peso, in its retail transactions and Cashback programs to enable small enterprises and everyday users to perform transactions without friction.

- Developer & Ecosystem Signals

The ecosystem of Celo is still alive. Its GitHub organization, celo-org, hosts active repos like the core blockchain, governance tools, and starter kits for dApp development. This constant movement is an indication of good project upkeep. On the innovation front, Celo has officially transitioned to Ethereum Layer 2 on the OP Stack and EigenDA to scale operations, letting its block times drop below those of Ethereum, which aligns with broader trends explored in our guide to layer 2 altcoins in 2025.

- Risks & Trade-Offs

The phone-first UX of Celo is brilliant–only its use of stablecoins implies that any depeg or governance problems will affect payments. The liquidity and the complexity of the protocol are also lower than those of powerhouse chains, such as TRON or Stellar.

- Bottom Line

Celo, with its mobile-based strategy, fixed rails, and UX, is a completely accessible payment-oriented altcoin, with a value of less than one US dollar. It is a utility meeting innovation, which crypto will be oriented towards a useful purpose in the real world, but only time will tell whether it will be responsible in scaling. Celo deserves its place among the best payment altcoins under $1.

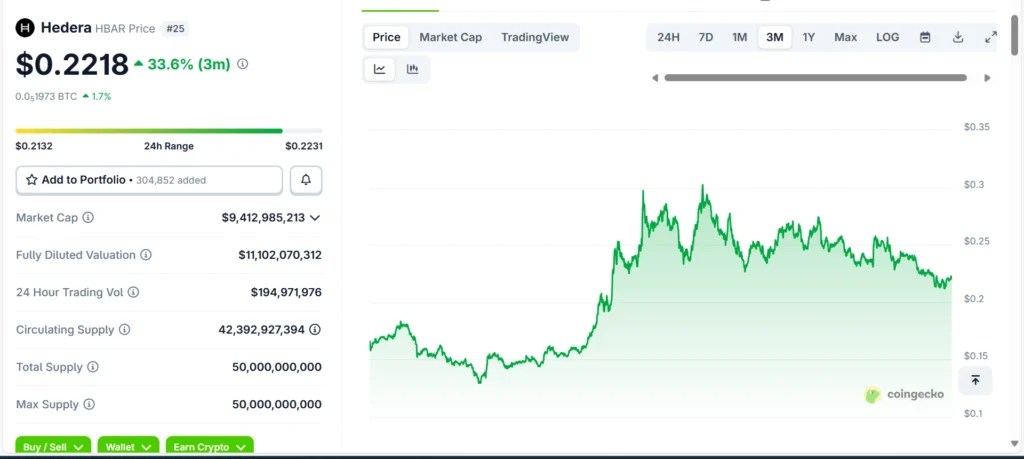

Hedera (HBAR)

- Snapshot (at publication)

When your app requires payments that are as seamless as VISA but operate on open networks, Hedera provides an attractive choice. As of September 3, 2025, HBAR trades at approximately $0.22, putting it in the best payment altcoins under $1 category. With stable transaction fees, enterprise-grade security, and consensus powered by hashgraph, distinct from traditional blockchains. The real fee schedules and throughput are public and transparently priced.

- Why It’s Great for Payments

Hedera is designed to support applications such as micropayments, remittances, and high-frequency interactions, eliminating both the congestion and unpredictability common to blockchain networks due to ultra-fast transaction finality, low fixed charges (usually less than 1¢), and very high scalability.

- Key Features

What made Hedera special is its hashgraph consensus, which is driven by aBFT technology and allows it to achieve high throughput and use less energy to validate. It also provides Hedera Token Service (HTS), which enables anyone to issue and manage stablecoins or other tokens with built-in compliance functionality (such as freezes and KYC flags) on the ledger itself.

- Real-World Use

Hedera has gained legitimate credibility – Mondelez, the international food group, has become a member of the Governing Council, and it is rapidly extending its applications beyond governance to active payments infrastructure. Meanwhile, Hedera’s tooling on real-time FX payments was applied by Shinhan Bank in Korea to support bridging traditional finance and crypto rails.

- Signals of Developer & Ecosystem.

Hedera keeps providing, under-the-radar data indicate that it is always one of the busiest deployed networks, speeding up development rates compared to some of the most popular layer-1 chains. That continuity and motion are key to long term strength.

- Risks & Trade-Offs

The permissioned mode of governance in Hedera will concern certain decentralization purists. And even though big business will carry its weight, it will signify slower adoption curves. Liquidity is solid albeit still far behind more consumer oriented networks.

- Bottom Line

Hedera comes out of the payment-centric altcoins under one dollar by having enterprise clients, super-fast settlement, and transparent and low-cost token emission. It is a utility platform defined by practical use, not hype, ideal when developers need scalable, high-performance money-moving rails. Hedera is one of the best payment altcoins under $1 for enterprises.

Stellar (XLM)

- Snapshot (at publication)

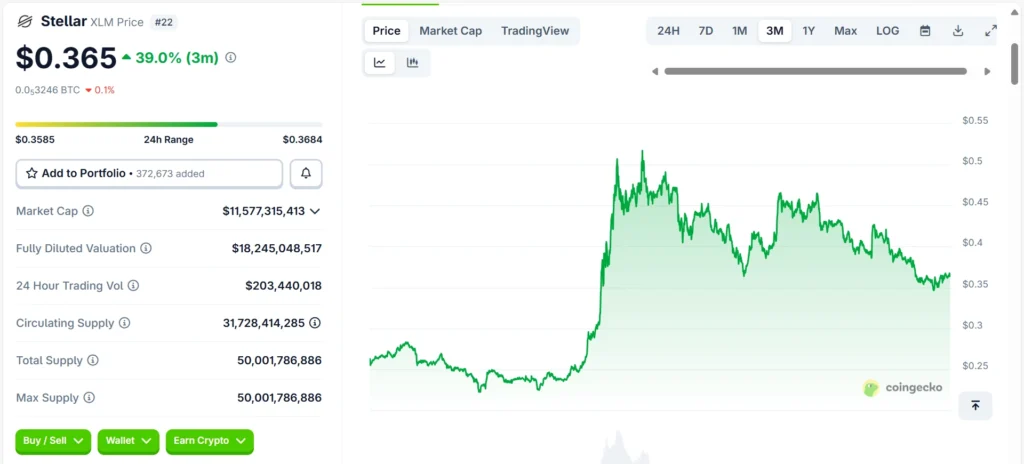

Stellar is never another altcoin, but a network that is designed to transport value across the world and do it fast and cheaply. As of September 3, 2025, XLM trades approximately at $0.36, well below a dollar. Its ledger can transact thousands of transactions a second at a low cost and deterministic confirmation time, though market forces can change these numbers.

- Why It’s Great for Payments

The key is efficiency: Stellar is almost free to settle, low cost, and built with stablecoins in mind, making it perfect for micropayment use, remittance, and trading, without the snarl-up that can slow down Ethereum or other networks.

- Key Features

Stellar’s rapid innovation overview could be summarized in a nutshell. Stellar is built around the Federated Byzantine Agreement (FBA), a consensus system that allows quick and energy-efficient confirmations of transactions, making it a standout among eco-friendly altcoins. A built-in decentralized exchange (DEX) is also embedded into the platform that enables asset swaps on-chain without involving external parties. Along with its fledgling smart contract system, Soroban, Stellar has the technology underpinnings to do more than payments.

- Real-World Use

Stellar has found its way into humanitarian and fintech. The United Nations (through UNHCR) relied on Stellar to disperse aid to refugees (via the Disbursement Platform) so that refugees could cash in with USDC at MoneyGram locations (a futuristic, real-world application of blockchain payments). IN the meantime, the Stellar + IBM partnership under the brand World Wire also allows banks and financial organizations to transfer across borders faster. This shows Stellar belongs to the best payment altcoins under $1.

- Developer and Ecosystem Signals.

Stellar is still making investments in the future. The Enterprise Fund of the Stellar Development Foundation has invested more than $75M in start-ups developing upon Stellar, and Soroban is moving out of testnet and on to mainstream usage, suggesting a resurgent developer ecosystem.

- Risks & Trade-Offs

Stellar has pitfalls even with good fundamentals. Governance continues to be centralized to the Stellar Development Foundation, and its smart contract layer is still infantile compared to Ethereum or Solana. And, although the scope of its applications is impressive, it continues to lag behind consumer-dominated blockchains in terms of scale.

- Bottom Line

Stellar is among the most mission-driven altcoins that are less than one dollar, with speed and affordability, and committed partnerships in finance and humanitarian aid. Stellar provides content instead of rhetoric to readers who want to implement crypto to process payments today. Stellar is one of the best payment altcoins under $1 today.

TRON (TRX)

1) Snapshot (at publication). TRX is trading at approximately $0.341 as of September 3, 2025 – find out the latest prices of TRON at live TRON price on CoinMarketCap.

TRON offers a resource model in which simple resource transfers can be billed to free daily bandwidth, and smart-contract calls (such as USDT transfers) billed to Energy; users generally pay extremely low fees compared to other chains. TRON’s own developer documentation on its resource model explains how bandwidth and energy fees are allocated.

In late August 2025, the network passed a governance proposal to reduce the Energy unit price by about 60% (210 to 100 sun), which reduced on-chain costs further; see the discussion in the TIP #789 on GitHub and coverage that the fee-cut passed via SR vote. Prices/metrics may not be the same; make sure you look at the most recent ones prior to taking any action.

2) Why it’s great for payments. TRON is widely considered one of the best payment altcoins under $1. Chances are good that if you have ever transferred USDT to a friend, it was carried on the rails of TRON, as Chainalysis displays stablecoins as some of the most issued and the most used rails on both Ethereum and TRON, and CoinDesk reports that most of that activity is done on TRON. Fast confirmations and small fees combine to make TRON an everyday horse in the emerging-market corridors where every cent counts.

3) Key features. The delegated proof-of-stake in TRON is rotating 27 super representatives in order to come up with a block; users gain bandwidth and Energy through staking to cover fees, which are all defined under the official resource model and protocol docs. In the case of stablecoins, the large head is the supply concentration: the transparency dashboard of Tether displays the highest quota of USDT issued on TRON, and that is why the chain appears so frequently at the point of payment.

4) Real-world use. In reality, retail USDT is going to TRON, as mentioned by CoinDesk and Chainalysis, who note the disproportionate presence of TRON in the transfer of stablecoins and particularly in remittances and on-chain trade in LATAM, Africa, and South Asia. In August 2025, with a drop in fees, on-chain trackers captured exploding numbers of daily active addresses and daily transaction volumes; you can check the current live numbers on the TRON dashboard on DeFiLlama.

5) Developer/ecosystem indicators. Payments-first is not builder-light. TRON is EVM-compatible, has strong liquidity in its stablecoins, and, according to DeFiLlama, is regularly reporting millions of transactions a day and millions of active addresses, as well as huge TVL -indicators that people and apps are actually settling value here and not merely speculating. Builders continue to base their network mechanics and fee budgeting on the formal dev specs.

6) Risks & trade-offs. Governance is being centralized around 27 Super Representatives, a factor some consider a centralization risk; the plus side is known predictable throughput and rapid blocks. But there is also the regulatory overhang: in March 2023, the U.S. SEC had sued Justin Sun and related parties, and the process and discussions have rolled into 2025, an uncertainty factor that we cannot ignore with a payments stack. Last but not least, the excessive use of the USDT is a counterparty risk (actions by the issuer or regulators can spill over).

7) Bottom line. For readers hunting the best payment altcoins under $1, TRON is hard to skip: it’s where stablecoin payments already happen at scale and at low cost. Simply walk in with eyes open to the centralization of governance and regulatory environment, and verify live metrics before making rail selections.

VeChain (VET)

1) Snapshot (at publication)

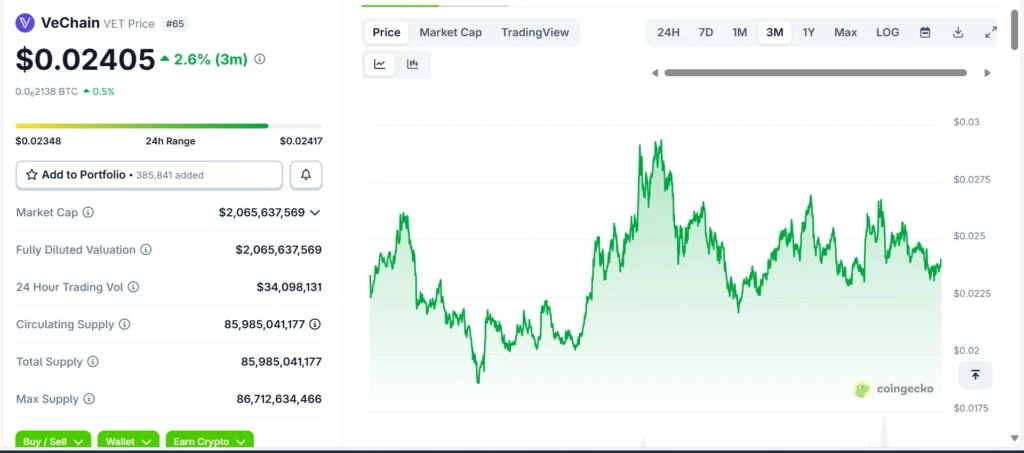

VeChain is a supply-chain-oriented and enterprise-level micro-payment blockchain. VET is trading at about $0.024 on September 3, 2025, which features about 85.9 billion individual tokens circulating, putting its market capitalization just under the $2 billion limit. There are small fees, but these may vary, so use live information on the VeChain page at CoinMarketCap to be aware of them.

2) Why It’s Great for Payments

Instead of pursuing speculation, VeChain has concentrated on coding business logic in the real world at the level of the ledger (authentication, traceable transfers, and digital twins). That renders it powerful in trust-based microtransactions in realms where authenticity counts.

3) Key Features

VeChain relies on a Proof-of-Authority model, a faster but more centralized way to process transactions, that provides swift, inexpensive confirmations with efficiency, a standard that many enterprises have chosen over cost-intensive proof-of-work algorithms. This is through its ToolChain platform that enables businesses to onboard blockchain workflows, such as asset tracking or payment reconciliation, without constructing infrastructure.

4) Real-World Use

Such use cases are not just theoretical:

Walmart China’s rollout cements VeChain as one of the best payment altcoins under $1. Walmart China leverages VeChainThor to enhance food safety and traceability of supplies via IoT and blockchain- a massive implementation that introduced transparency to tens of millions of products.

At the car front, BMW and Renault partnered with VeChain to create tamper-resistant maintenance records – assisting owners and purchasers to verify vehicle history.

5) Ecosystem & Developer Signals.

The GitHub repos of VeChain are still active, and its ecosystem continues to grow with grants and enterprise tools. There are various verticals that are being piloted or operated on its chain, such as healthcare to logistics.

6) Risks & Trade-Offs

The enterprise-first model of VeChain will require a slow uptake by the mainstream. Its PoA model brings with it the risk of centralization. Although successful, it has a relatively small ecosystem compared to mainstream blockchains dominated by consumers.

7) Bottom Line

VeChain provides real value in trust, traceability, and enterprise micro-payment. When studying payment-centered altcoins under $1, be sure to look into one that is already resolving the hard bottlenecks in the real world, but not making a noise about it. VeChain is one of the best payment altcoins under $1 for supply chain payments.

Comparing the Best Payment Altcoins Under $1: Fees, Speed, and More

| Coin | Current Price* | Transaction Speed | Avg. Fee | Market Cap* | Key Use Case |

| Nano (XNO) | ~ $0.89 | Under 1 second finality | $0 (feeless) | ~$119M | Instant micropayments |

| XDC (XDC Network) | ~ $0.078 | Thousands of TPS (high throughput) | ≈ $0.00001 per tx | ~$1.3B | Trade finance infrastructure |

| Celo (CELO) | ~ $0.30 | ~ 1 second per block | ~$0.0004 (on-chain), $0.001–$0.005 wallet fee | ~$176M | Mobile, fiat-pegged payments |

| Hedera (HBAR) | ~ $0.22 | ~ 3–5 seconds, up to 10,000 TPS | ~$0.0001 average, capped at $0.001 | ~$9.4B | Enterprise-grade fast payments |

| Stellar (XLM) | ~ $0.36 | Under 5 seconds | ~ $0.00000001 per tx (fraction of a cent) | ~$11B | Cross-border remittances |

| TRON (TRX) | ~ $0.34 | 3–5 seconds per block; 2,000+ TPS | ~$0.0003 average | ~$32B | Stablecoin remittances at scale |

| VeChain (VET) | ~ $0.024 | ~ 10 second block time; ~50 TPS | Very low, often paid in VTHO | ~$2B | Supply chain and enterprise payments |

*As of on 3rd September, 2025 at the time of writing

How to Find & Evaluate Your Own Payment Altcoins Under $1

Our list is not a complete one. New projects are created almost every hour, and as crypto investors or interested students, it is crucial to understand how to identify both the best payment altcoins under $1 that are actually useful and those that follow the hype. The following is a framework to judge them.

Project Purpose

Begin with the question: what actual pain point in payment is this coin fixing? Is it charging high remittance rates, slow confirmation rates, or bad settlement? As an example, the World Bank estimates average global remittance fees to remain in the range of 6%, an area of opportunity where low-cost blockchain rails can matter.

Team & Governance

An effective project has names behind it. Are founders and developers transparent? Is it on-chain governance or run by a foundation? Projects that publish their treasury reports, voting models, and government mechanisms can be considered more reliable, as is the case with Ethereum and its open governance documentations.

Community/Developer Activity.

Natural ecosystems assure prosperity based on active developers and users. You are able to monitor indicators such as GitHub commits, contributors, and release frequency. Sites such as CryptoMiso prioritize projects based on activity on GitHub, so you can tell whether the code is under active development.

Tokenomics

Supply design is critical. Do you have a capped or inflationary token? What is the utility- is it protecting the network, or is it charging the transaction fees, or is it an incentive to use it? Easy-to-read emissions plans, stakeholder returns, and candid whitepapers are signs of a healthier economy, and marks the best payment altcoins under $1, especially if they offer opportunities like staking altcoins under $1 for passive income. Messari has crypto profiles that tend to include tokenomics breakdowns of key altcoins.

Listings & Liquidity

Liquidity answers the question: Is a token usable in practice? Examine whether it trades on good exchanges, whether it has stablecoin pairs, and the size of bid-ask spreads. Simply put, thin liquidity can result in a coin that is difficult to get out of and is cheap, so once you’ve evaluated them, check our recommendations on where to buy altcoins under $1 safely on trusted exchanges. On-ramps, Spreads, depth, and fiat-supported on-ramps are displayed in the markets tab of websites such as CoinGecko.

Adoption Signals

Practice and theory are divided by real usage. Find merchant integrations, developer SDKs, or enterprise partners. As an example, BitPay provides a list of supported cryptocurrencies in payments at retail outlets and indicates which networks already support them with merchants.

Red Flags

Lastly, be cautious. Opaque reserves, stalled GitHub repos, aggressive marketing promises, and tokens being listed only on fringe exchanges all indicate trouble. A wise maxim: when the activity presented in a project appears thin, or the claims it presents sound too good to be true, then it is.

👉 The Takeaway: When you assess the value of the best payment altcoins under $1 on this spectrum (purpose, governance, activity of developers, tokenomics, liquidity, adoption, and red flags), you can form a more balanced opinion that highlights utility over hype.

Real-World Case Studies of Payment Altcoins Under $1

The worth of payment altcoins less than $1 is evident when we put them to work. Outside whitepapers and roadmaps, these deployments prove how the best payment altcoins under $1 work in reality.

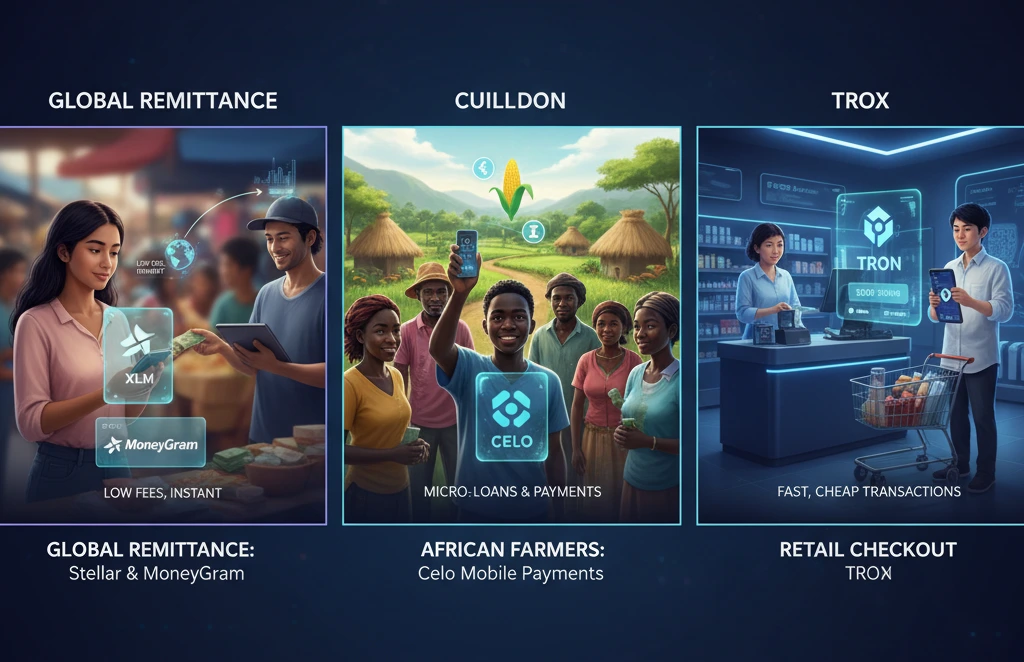

- Stellar + MoneyGram: Remittances, Reinvented

The fees that cross-border remittances may consume include 5 to 7 percent. That changed as MoneyGram integrated with Stellar and was able to settle in USDC in real time. Pilots enabled the immediate remittance of digital dollars, which could be cashed out in a flash, radically reducing the cost and wait time. Showing Stellar is one of the best payment altcoins under $1 for remittances.

- Celo + Kotani Pay: Banking Without the Bank

Celo collaborated with Kotani Pay to make DeFi accessible in rural Kenya (where smartphones are not prevalent) through SMS. Through feature phones, people could access loans and micro-payments and withdraw them in regular cash through mobile money, and almost all people (97) could have access to services without a bank. Celo earns its spot among the best payment altcoins under $1 for financial inclusion.

- Stellar + UNHCR: Aid Delivered Instantly

Speed and transparency were fundamental in Ukraine. The UNHCR collaborated with Stellar in order to pilot blockchain-based cash delivery. The system enabled the delivery of digital cash to displaced individuals almost immediately, much faster than the old system. Cementing Stellar as one of the best payment altcoins under $1 in humanitarian aid.

These case studies point to the reason why payment altcoins under $1 are becoming popular, where speed, cost, and accessibility are most important: remittances, mobile payments, and humanitarian aid.

Risks & Limitations

The fact that the payment altcoins below $1 are promising, however, even the best payment altcoins under $1 carry risks that cannot be overlooked. Inexpensive is not synonymous with secure, and most of these tokens have drawbacks that first-time users fail to notice.

Volatility

Even altcoins that are not among the top 20 in terms of market capitalization are likely to be extremely volatile. A coin priced at $0.02 now may fall as much as 50% within a few weeks. Even payment-oriented networks such as Stellar and TRON are susceptible to price volatility that can undermine the savings that users hope to achieve when transferring funds without high fees. So be sure to review common red flags in altcoins under $1 to avoid in 2025.

Regulatory Risk

One of the most regulated fields in finance is payments. Policy shifts in the U.S. or EU concerning stablecoins, exchanges, or unlicensed remittance providers may have a direct effect on adoption. According to the crypto regulation framework published by the Financial Stability Board, even technically sound projects are exposed to uncertainty should the winds of policy change. Regulatory shifts can affect even the best payment altcoins under $1.

SEC lawsuit against TRON founder Justin Sun → SEC charges Justin Sun and three of his companies with unregistered securities offering and market manipulation.

Bridge & Wallet Risks

Bridges, custodians, or third-party wallets are commonly used to circulate value over networks based on payment coins. A layer presents possible attack surfaces. The wormhole exploit of 2022 that emptied $321 million put into perspective the vulnerability of cross-chain bridges.

Centralization Trade-Offs

Other fast and cheap altcoins reach efficiency by having fewer or fewer validators, or by being controlled by fewer people. The council system in Hedera or the Proof-of-Authority architecture in VeChain makes both systems relatively low cost, albeit less resistant to censorship concerns and able to endure over time.

The takeaway: The best payment altcoins under $1 are not low risk. Such assets may be on a roll, have fluctuating regulations, and occasionally be dependent on wobbly infrastructure. Always do your own research (DYOR) before considering any of them as payment or portfolio candidates, treat them as experimental.

Final Thoughts

Stepping back, the bigger picture comes into focus: the best payment altcoins under $1 are carving out a niche as practical, low-cost rails for digital value transfer. They are not risk-free, and their volatility, depth of liquidity, and governance model can all affect their longevity. However, the measure to monitor is real-world adoption, be it in cross-border remittances, merchant transactions, or on-chain transactions.

If these networks can continue proving reliability at scale, the best payment altcoins under $1 could shift from being speculative assets to becoming core infrastructure in the evolving digital payments ecosystem. And that’s why the best payment altcoins under $1 remain worth watching in 2025.

Frequently Asked Questions (FAQ)

Q1. What are the best payment altcoins under $1?

The best payment altcoins under $1 are cryptocurrencies designed for fast, affordable, and reliable transactions. They are not speculative tokens in that they are fast, scalable, and cheap. Nano, Stellar, and Hedera can fit the examples as they can settle in seconds with almost no costs. They are also affordable, so they can be used in micropayments, remittances, and cross-border payments.

Q2. Are the best payment altcoins under $1 safe to invest in?

Not automatically. The best payment altcoins under $1 can still be volatile, and price alone does not determine safety. The major ones are liquidity, adoption, governance, and regulation. A large number of coins that are below 1 dollar are still on experimental stages and some will never move past that phase. One must never consider investing until they have done extensive research (DYOR), looked at developer activity, and evaluated real-world use cases.

Q3. What is the ultimately best cross-border payment altcoin?

Several contenders stand out among the best payment altcoins under $1. Stellar (XLM) has been used in association with money remittances, such as MoneyGram. Nano and XDC Network also compete well in low-fee and fast-settlement corridors. The most desirable one relies on the support of the corridors, integrations among the partners, and the liquidity in the exchange markets.

Q4. What are the criteria that I can use to measure the actual adoption of a payment coin?

Hyped adoption is not real. Indications are active wallet addresses, developer commits to GitHub, and partnering with merchants, NGOs, or fintechs. An example is that the ruling council of Hedera consists of international corporations, and VeChain is the supply-chain protocol. These signals help distinguish the best payment altcoins under $1 from projects with weak fundamentals.

Q5. Can I use the best payment altcoins under $1 for everyday purchases?

Yes, however, it is not widely adopted. Some of the best payment altcoins under $1, like Celo and TRON, are integrated into mobile payment apps and retail networks. Some fintech apps also allow users to preload segments of crypto onto prepaid cards to be used indirectly (on a daily basis). The mainstream merchant acceptance, however, remains far behind the traditional fiat systems.

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.