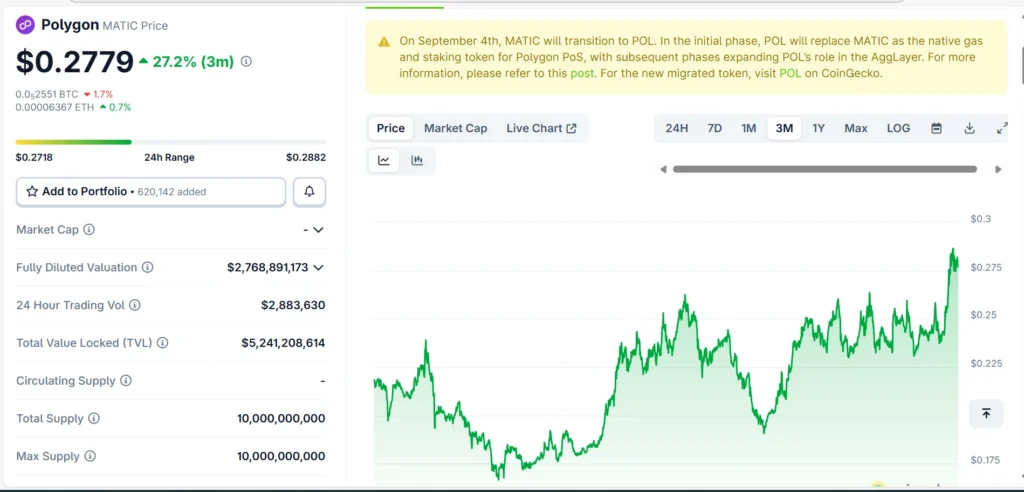

With Bitcoin trading over $100,000 in August 2025 and an altseason on the horizon, the focus of savvy investors is shifting to Polygon altcoins under $1, where inexpensive tokens still drive creativity. The native POL token is currently priced at around $0.28, despite a total value locked (TVL) in Polygon of a whopping $1.23 billion this year. If you followed our earlier guide on Layer 2 altcoins such as POL, Optimism (OP), and Arbitrum (ARB), this post builds on that by spotlighting the best Polygon altcoins under $1 in 2025. We will target projects indigenous to Polygon PoS or a emerging zkEVM, including tokens that integrate both cost-effectiveness and off-the-block usefulness in DeFi, gaming, and NFTs.

Mainstream projects already run on low-fee infrastructure at Polygon. Starbucks rolled out its Odyssey NFT loyalty system based on Polygon to manage scalable rewards and Reddit onboarded more than 10 million users with Polygon collectible avatars, introducing hundreds of millions to Web3. Those case studies underline the fact Polygon has turned into the place of adoption much more than simply scaling Ethereum.

Disclaimer: This article is for educational purposes only. Cryptocurrency markets are volatile, and token prices fluctuate rapidly. The tokens referenced here are less than a dollar at the time of writing, 00:00 UTC on September 1, 2025. Always, do your own research (DYOR) and validate live data on sites like CoinGecko or CoinMarketCap before making a decision.

TL;DR – Best Polygon Altcoins Under $1 in 2025

- Polygon (POL): ~$0.28 – Native token with staking & governance power.

- QuickSwap (QUICK): ~$0.05 – Leading Polygon DEX for low-fee swaps.

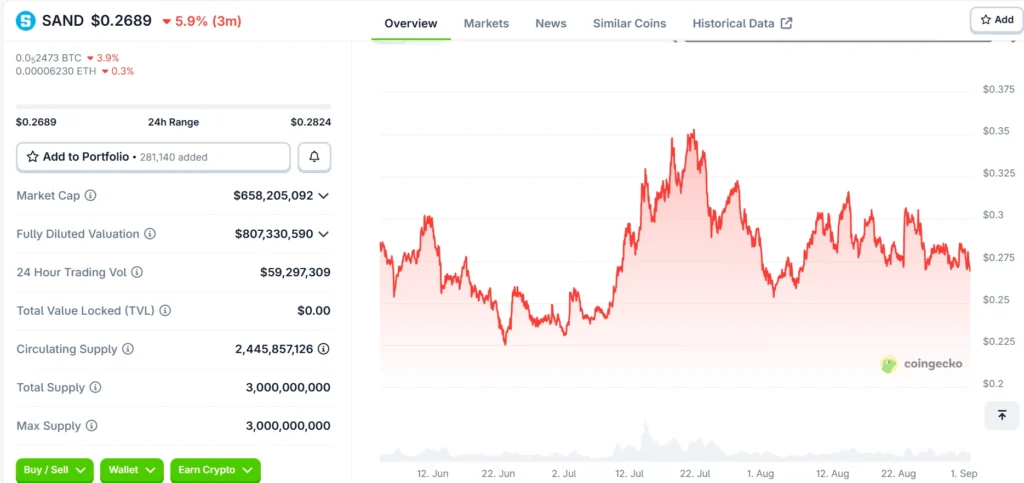

- The Sandbox (SAND): ~$0.28 – Metaverse land and gaming ecosystem.

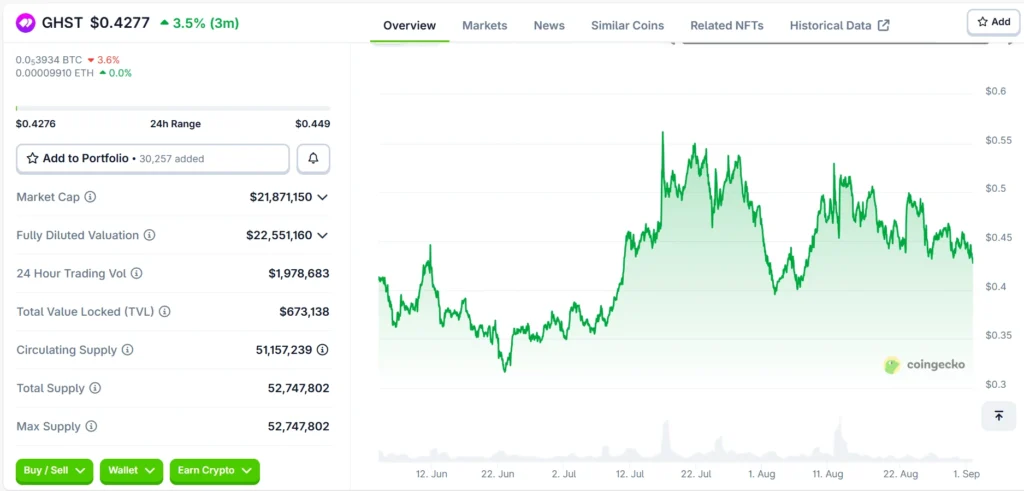

- Aavegotchi (GHST): ~$0.42 – NFT + DeFi gaming with staking yields.

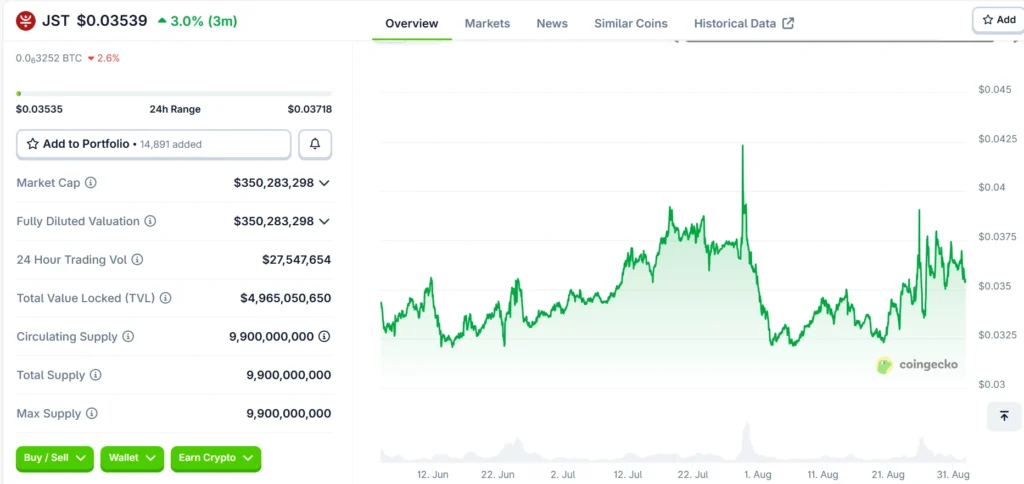

- Just (JST): ~$0.03 – Lending and DeFi bridge between Tron and Polygon.

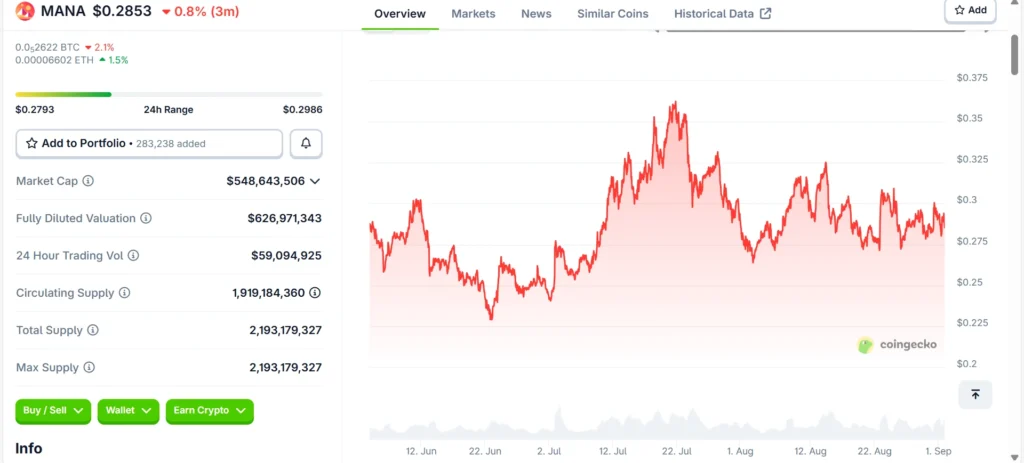

- Decentraland (MANA): ~$0.28 – Virtual assets and VR metaverse play.

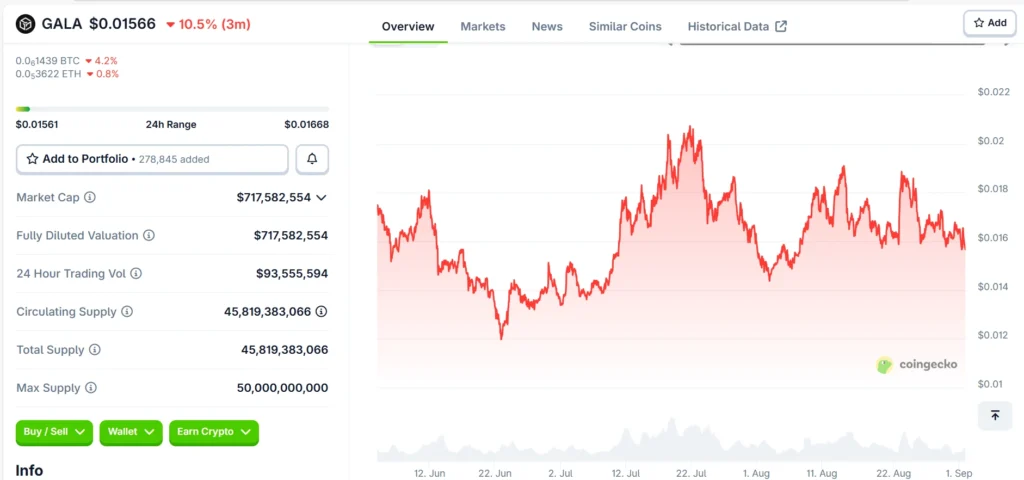

- Gala (GALA): ~$0.016 – Expanding play-to-earn gaming ecosystem.

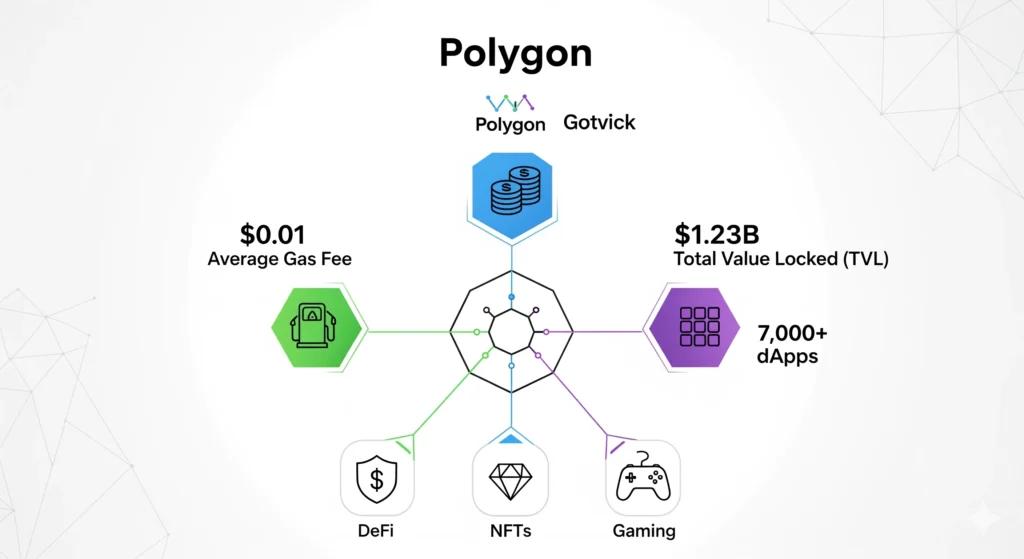

Why it matters: Polygon combines low fees, $1.2B+ DeFi TVL, and 7,000+ dApps, making it the best launchpad for under-$1 altcoins in 2025. POL leads the way, but gems like QUICK, SAND, and GALA are worth watching.

Note: Prices as of Sept 1, 2025. Crypto is volatile – always check live data on CoinGecko or CoinMarketCap before investing.

Why Polygon is a Goldmine for Altcoins Under $1 in 2025

Polygon has cemented itself as the best chain for Polygon altcoins under $1 in 2025. Being an Ethereum Layer-2 (L2) scaling solution, it is the cheapest option (fees are typically below $0.01 per transaction), has high throughput and is compatible with the EVM, which is paramount in projects with a low initial cost of token issuance.

Why Polygon Stands Out for Altcoins $1

| Polygon Feature | Benefit for Under-$1 Altcoins |

| Low Fees (~$0.01) | Cheap minting and trading for small-cap tokens |

| High TVL ($1.23B in 2025, +43 % YTD) | Deeper liquidity supports low-price tokens (CryptoSlate via DeFiLlama) |

| Ecosystem Size (7,000+ dApps) | Many protocols issue sub-$1 tokens (Polygon Ecosystem) |

| POL Price (~$0.28) | Affordable staking and governance access |

- Scalability Meets Affordability

Ether is still the workhorse of decentralized finance (DeFi), with its high gas prices making it unaffordable for many retail users. The Proof-of-Stake (PoS) and zkEVM rollups at Polygon resolve this bottleneck with speeds of up to 65,000 TPS and ultra-low fee charges (Polygon Docs). This allows under-1 tokens on Polygon to enter both developer and retail investor hype without incurring the prohibitive downside.

- Surging DeFi & TVL Growth

By August 2025, the Total Value Locked (TVL) in Polygon was over $1.23 billion, marking a ~43 % increase year-to-date. In the small-cap coins, which are less than one dollar, such a liquidity environment is the flight deck to more rapid and greater fixed value than separate ecosystems. Projects such as QuickSwap and Aave on Polygon have demonstrated that liquidity shines in this place and drags users closer to the ecosystem.

- On the ground, adoption spurring demand.

Polygon is not only DeFi, but the mainstream use of Web3. Starbucks also announced it’s Odyssey NFTs with rewards via the scalable infrastructure of Polygon and Reddit Collectible Avatars introduced millions to Polygon’s PoS chain. These collaborations emphasize the way Polygon helps brands to invigorate NFT and loyalty initiatives hassle-free. To investors, it implies that sub-$1 Polygon tokens indexed to said verticals might have two demand sources: crypto-natives and intended consumers around the world.

- Network Effects of Being an Ethereum Ally.

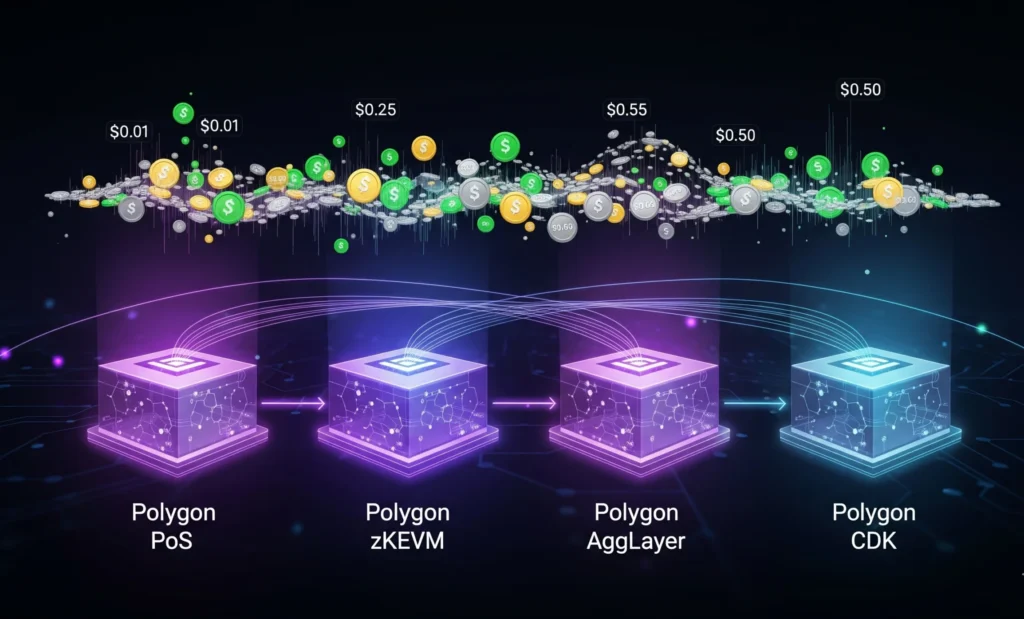

In contrast to rival Layer 2s such as Arbitrum and Optimism, Polygon has positioned itself as a multi-solution scaling hub running PoS, zkEVM, Supernets, and CDK (Chain Development Kit). Its interoperability with Ethereum means that when you build on Polygon, you can access the enormous liquidity of Ethereum with a faster and cheaper experience. This two-fold benefit is a perfect asset addition to Polygon as an altcoin incubator, particularly for low-cap, high-growth assets that have yet to surpass $ 1.

- Ideal Ground for Retail-Friendly Polygon Altcoins Under $1.

There is a psychological value to cheap coins. Low prices correlate with high upside in the minds of retail investors, and Polygon is a frictionless gateway. As the market offers convenient staking alternatives, low-cost trading, and liquidity bonuses, Polygon’s altcoins priced under $1 are purpose-built to experience speculative surges during altseason.

👉 Bottom Line: In 2025, Polygon combines Ethereum-level security, billion-dollar liquidity, and real-world adoption making it the perfect launchpad for altcoins under $1. To shrewd investors, this ecosystem has been both a business of making money on speculation and a business of acquiring a token that has the potential to evolve into a mainstream application at an affordable price today.

If you’re also tracking broader opportunities beyond Polygon, our guide to the top 7 altcoins under $1 to watch in 2025 gives a wider snapshot of this year’s undervalued plays.

How Polygon Supports Cheap Altcoins: A Quick Ecosystem Breakdown

Polygon architecture has been designed specifically to enable developers to launch low-cost, high-utility altcoins at a price point of under $1. With its stacked infrastructure, it will reduce the barriers to meme coins and game tokens, and even real-world asset projects.

Essential Building Blocks that support Growth.

- PoS Chain (to DeFi and lightweight tokens): Applications such as QuickSwap or Aave take advantage of the low-price, low-latency environment provided by PoSeg, allowing people to make frequent trade-offs and micro-incentives that keep tokens affordable.

- zkEVM (privacy, meets efficiency): zk-rollup The zk-rollup version of Polygon will silently submit transactions safely, enabling developers to issue and redeploy altcoins on Polygon at very low costs.

- AggLayer & CDK (custom chains + liquidity): Polygon’s liquidity aggregation and Chain Development Kit enable teams to spin up branded chains, no-fly-zone economies, game economies, meme token communities, and RWA ecosystems.

Collectively, these building blocks can bring together an ecosystem in which launching/trading sub-$1 tokens does not seem like an uphill endeavor.

Why It Matters for You

- The cost of launching is low, so tokens do not require substantial prices to feel expensive enough to create space for the meme culture and niche communities to take off.

- Random access means that Polygon allows transactions between cheap tokens to occur quickly, turning its liquidity into profits without incurring gas fees from Ethereum, which would otherwise act as a hidden tax. Based on our tracking, this frictionless environment cannot be pitted with small-cap upside plays.

Polygon Ecosystem Momentum for Cheap Altcoins.

- As of 2025, Polygon PoS has processed over 5 billion transactions (~2.5 million daily on average), while its zkEVM has already surpassed 100 million transactions, demonstrating remarkable throughput and developer adoption.

- Stablecoins not tied to the USD are on fire here. There are 23 assets with a weekly transaction count exceeding 20,000, and Polygon processes ~70% of that amount, predominantly in Latin America.

- Polygon was below the radar, but in April 2025 alone, the blockchain had over 134 billion stablecoin transfer volume and 7 billion P2P transfers.

Top Polygon tools for Polygon altcoins under $1 hunting.

- QuickSwap & Aave (liquidity)

- Structures such as the Polygon CDK (custom chains).

- zkEVM bridges (privacy + low cost)

- Aggregation of AggLayer (across chain liquidity)

Top 7 Best Polygon Altcoins Under $1 to Buy in 2025

Polygon was encircled by a significantly larger ecosystem than an Ethereum scaling project: it is also a span of lower-cost altcoins that can be implemented into practice. By 2025, there will be a handful of Polygon-based or highly integrated tokens trading under $1, allowing retail users the chance to sample small high-potential projects. Below, we rank 7 of the best Polygon altcoins under $1, ordered by potential ROI versus entry price, along with practical insights for research-minded investors.

Why POL is the Best Under-$1 Polygon Altcoin

- Price on 1st September 2025: ~$0.28 (CoinGecko)

- Category: Layer 2 native token

- Why under $1: High total supply with gradual staking adoption.

- Utility: POL fuels Polygon’s governance, staking, and network upgrades. Its AggLayer adoption is designed to unify liquidity across chains, potentially boosting demand for POL.

- 2025 Potential: POL remains the flagship of Polygon altcoins under $1. It could double to ~$0.56 with increased staking and protocol adoption.

- Risks: Competing L2 tokens (Optimism, Arbitrum) may capture liquidity attention.

💡 Bang-for-buck: Strong core hold with moderate upside for conservative investors.

Why QUICK is the Best DeFi Polygon Altcoin Under $1

- Price on 1st September 2025: ~$0.025

- Category: Decentralized exchange (DEX)

- Why under $1: Token inflation + high circulating supply.

- Utility: QUICK is one of the earliest Polygon altcoins under $1 powering DeFi. QUICK powers QuickSwap, Polygon’s primary DEX, enabling low-fee swaps and liquidity farming.

- 2025 Potential: Could 5x to ~$0.125 if Polygon DeFi TVL continues growing (current TVL ~$1.23B, DeFiLlama).

- Risks: Competition from Ethereum-native DEXs and cross-chain bridges.

💡 Bang-for-buck: Best ROI play in Polygon DeFi for speculative small-cap exposure.

Utility remains a big filter when sorting through cheap coins, and our breakdown of the top utility altcoins under $1 in 2025 dives deeper into projects solving real-world problems.

Why SAND is the Best Polygon Gaming Altcoin Under $1

- Price on 01-09-2025: ~$0.27

- Category: Gaming/Metaverse

- Why under $1: Market-wide NFT/metaverse cooldown, despite active user base.

- Utility: The Sandbox uses Polygon for in-game land and asset purchases, reducing fees and scaling user adoption.

- 2025 Potential: Could triple to ~$0.84 if NFT/metaverse activity rebounds.

- Risks: Adoption depends on mainstream interest in gaming/metaverse assets.

💡 Bang-for-buck: Strong mid-tier bet combining established brand and NFT utility.

Why GHST is the Best Polygon NFT Altcoin Under $1

- Price on 1st September 2025: ~$0.42

- Category: NFTs & gaming

- Why under $1: Medium liquidity and niche community.

- Utility: Powers Aavegotchi, a staking + NFT game ecosystem on Polygon, offering yield opportunities.

- 2025 Potential: Could 4x to ~$1.76 if gaming/NFT demand increases.

- Risks: Niche audience; limited mainstream exposure.

💡 Bang-for-buck: Moderate entry price but strong utility; underrated sleeper token.

Why JST is the Best Lending Altcoin Under $1

- Price at the time of writing this article: ~$0.035

- Category: Lending / cross-chain

- Why under $1: Extremely high token supply.

- Utility: Expands Tron lending protocols onto Polygon, enabling cross-chain borrowing/lending with low fees.

- 2025 Potential: Could 10x to ~$0.35 if cross-chain adoption grows.

- Risks: Execution risk; Tron network reputation may impact Polygon adoption.

💡 Bang-for-buck: High-risk, high-reward “moonshot” play for speculative investors.

Why MANA is the Best Polygon Metaverse Altcoin Under $1

- Price at the time of writing this article: ~$0.29 (CoinGecko)

- Category: Metaverse/VR

- Why under $1: Token dilution + hype cycle cooling.

- Utility: Polygon integration enables cheaper Decentraland transactions, including VR land and digital assets.

- 2025 Potential: Could 3x to ~$0.87 if VR adoption accelerates.

- Risks: Competing metaverse platforms and user churn.

💡 Bang-for-buck: Brand recognition with moderate upside potential.

Why GALA is the Best Polygon P2E Altcoin Under $1

- Price on 01.09.2025: ~$0.016 (CoinGecko)

- Category: Gaming / play-to-earn

- Why under $1: Supply expansion + past bear cycle impact.

- Utility: Polygon integration allows low-cost P2E gameplay, attracting micro-investors and gamers.

- 2025 Potential: Could 8x to ~$0.13 as new games launch and ecosystem expands.

- Risks: P2E sustainability and past overhype cycles may limit returns.

💡 Bang-for-buck: Low price, high volatility—speculative “lottery ticket” token.

Gaming is one of Polygon’s strongest niches, tokens like SAND and GALA also feature in our list of the top gaming altcoins under $1 with 10x potential.

Our Take: Best Bang-for-Buck Polygon Altcoins in 2025

- Safe core bets: POL, SAND

- Speculative moonshots: JST, GALA

- Middle ground plays: GHST, MANA

- Highest ROI potential: QUICK, due to low price, DeFi utility, and TVL growth.

Disclaimer: These are educational insights only. Crypto prices are volatile; allocations should be small (<5% of portfolio) and verified on live platforms like CoinGecko or CoinMarketCap. This content does not constitute financial advice.

Comparison Table: Polygon Altcoins Under $1 (Aug–Sept 2025)

| Token | Current Price (Aug 2025) | Category | Why Buy Under $1? | 2025 Potential* |

| POL | $0.28 | L2 Native | Staking & governance | 2x to ~$0.56 with AggLayer adoption |

| QUICK | $0.025 | DeFi | Low-fee swaps on QuickSwap | 5x to ~$0.125 if TVL grows |

| SAND | $0.26 | Gaming/Metaverse | Sandbox land & assets | 3x to ~$0.84 on NFT/metaverse adoption |

| GHST | $0.42 | NFT/Gaming | Aavegotchi yields | 4x to ~$1.76 if gaming surges |

| JST | $0.035 | Lending | Tron–Polygon bridge lending | 10x to ~$0.35 on cross-chain adoption |

| MANA | $0.29 | Metaverse | Decentraland assets | 3x to ~$0.87 with VR/AR adoption |

| GALA | $0.016 | Gaming/P2E | Play-to-earn ecosystem | 8x to ~$0.13 with new launches |

*Upside projections are speculative and educational, always DYOR. Crypto prices are volatile.

How to Buy and Invest in These Under-$1 Polygon Altcoins

Investing in Polygon altcoins under $1 is more accessible than many realise. All this is achievable because, with Polygon, the fees are on the low side, and the Ethereum support means that even a modest portfolio can venture into a wide range of tokens without being devoured by the high gas costs. This is how (and why) you can safely buy and hold your Polygon altcoins under $1.

- Set Up a Wallet

Creating a secure crypto wallet is the first one. MetaMask is supported and in complete compatibility with Polygon PoS, and zkEVM. Once installed:

- Secure your seed phrase offline.

- Add Polygon PoS to enable Polygon to be a network in MetaMask (RPC, chain ID, symbol, and block explorer URL).

- To be completely sure, hardware wallets such as Ledger or Trezor will be the way to go for bigger bets.

- Bridge Funds to Polygon

All or most of the Polygon cheap Altcoins are native or minted in large amounts on the Polygon chain. You would have to bridge between Ethereum or another chain to get them:

- Take the Polygon Bridge to move ETH or USDC from the Ethereum to the Polygon PoS.

- Commission charge in the very low case is minimal, in most instances, less than $0.01 to $0.10.

- Support of zkEVM is growing, but in the meantime, PoS is the simplest on-ramp to retail investors.

Pro tip: It never hurts to verify your destination address and to use small test transfers to preclude errors.

- Buy Tokens on DEX or CEX

When you have Polygon money in your wallet:

- DEX Option: QuickSwap is the primary DEX for Polygon. Swap ETH or USDC for under-$1 tokens like POL, QUICK, SAND, GHST, JST, MANA, or GALA.

- CEX Option: Binance and other major exchanges support some Polygon tokens. Buying on CEX may be easier for newcomers but comes with deposit/withdrawal fees.

LSI tip: DEX trading with liquidity pools and staking opportunities is the kind of space that Polygon DeFi supporters like to utilise.

- Stake POL and Compound Gains

There are numerous under $1 polygon (in particular POL) tokens that can be staked to yield, among others:

- Staking POL can generate between 5 and 10 APY depending on validator performance.

- Small allocations stack well together, and your micro-portfolio continues to grow as you hold low-priced altcoins.

Niche insight: When doing altcoin hunting, a Polygon token as the backbone will enable me to cheaply flip to other Polygon tokens without paying the high Ethereum gas fees.

- Allocate and Manage Risk

Though inexpensive Polygon altcoins have potential, they are highly volatile. To protect your capital:

- Never have more than 5% of your entire portfolio in high-risk under $1 altcoins.

- Keep an eye on Low-liquidity gems, they may take off or plummet.

- And by all means, do your original research (DYOR) by reading tokenomics, GitHub activity, and community participation before you invest.

- Invest in more than one Polygon altcoin in order to diversify between risky and safer speculative investments.

- Sample $100 Polygon Micro-Portfolio

Here’s a hypothetical allocation to illustrate a balanced approach for under-$1 Polygon altcoins:

| Token | Allocation ($) | Notes |

| POL | 30 | Stake for stable yield |

| QUICK | 20 | DEX trading, DeFi exposure |

| SAND | 15 | Gaming/metaverse play |

| GHST | 10 | NFT yield token |

| JST | 10 | Speculative cross-chain |

| MANA | 10 | VR/metaverse exposure |

| GALA | 5 | High-risk P2E |

This structure keeps the portfolio retail-friendly, focused on tokens with real utility, while still allowing speculative upside.

- Continue Learning and Observation.

Polygon has an active ecosystem with features such as support of zkEVM and AggLayer liquidity modifications. Track:

- TVL growth (DeFiLlama Polygon)

- NFT & gaming adoption trends (Sandbox News)

- Governance updates for POL and other tokens

Frequent reviews allow you to see open investment opportunities below $1 or sell volatile account options in a timely manner.

Bottom Line: Buying and investing in Polygon altcoins under $1 is straightforward but requires careful research and risk management. As Polygon has MetaMask, Polygon Bridge, and DEX/CEX features, small players can become a part of the Polygon DeFi, game, and NFT ecosystems. You can use the low fees and high liquidity of the chain to learn, as well as to generate potential increase with a buy-in at POL and a slow conversion into cheap altcoins.

If you want to sharpen your process for discovering hidden gems, check out our strategy guide on how to find altcoins under $1 before they pump.

Disclaimer: This content is purely educational. Prices are volatile and reflect Sept 1, 2025. Always DYOR and verify live data on CoinGecko or CoinMarketCap before investing.

Risks, Predictions, and Why 2025 is the Year for Polygon Altcoins Under $1

If you’ve been following Polygon altcoins under $1, you know this ecosystem is quietly shaping up to be a goldmine for retail investors. But let’s break it down candidly, there’s opportunity, yes, but also risk.

Why We’re Excited About Polygon in 2025

The thing is as follows: cheap tokens on Polygon are not mere inexpensive trinkets. They have served as a low-cost point of entrypoint of entry to a $1.23B+ DeFi economy, offering incredibly low fees (~$0.01 per transaction) and throughput (65,000 TPS on PoS, approximately 2,000 TPS on zkEVM).

We’ve been tracking tokens like POL ($0.28), GALA ($0.016), and QUICK ($0.025). Their low prices aren’t accidental they’re a reflection of supply, ecosystem design, and Polygon’s ability to support micro-cap, high-utility projects. As zkEVM and AggLayer liquidity upgrades become a reality in 2025, the design of the protocols is physically structured to ensure that cheap altcoins thrive without being hindered by gas charges or traffic.

To us, this is the sweet spot of sub-$1 Polygon altcoins: entry barriers are low, liquidity is high, and the chain is evolving at a faster rate than most retail investors are aware of.

The Risks We Can’t Ignore

Saying this, nobody is supposed to dig their grave. Here’s the reality check:

Layer 2 Competition: Chains like Arbitrum and Optimism are competing over the same developers and liquidity. Polygon is not the only one, and the market share wars may affect the result of tokens.

Volatility is Real: A cheap price does not guarantee a safe price. Overnight, a large number of sub- $1s may spike 3-5x and come crashing down. We have already experienced it with the smaller gaming and meme tokens.

Low Liquidity Traps: Low liquidity altcoins of the micro-cap can exist. That is all it would take is a small sell order, and the price would tank – never invest without looking at the pool depth.

Speculative Nature: The very fact that a token goes below one dollar may not necessarily herald speculation. You must do your own research, must read GitHub activity, community, and usefulness before you can (or should) use your money.

Our 2025 Predictions

This is what we have researched, learned, and thought about:

- POL could average $0.47 if AggLayer adoption continues and staking participation grows.

- Gaming/NFTs, such as GALA and SAND, could achieve moonshot opportunities if the Polygon ecosystem reaches new heights – imagine a $ 10 billion TVL, further uptake of NFTs, and deeper integration of the metaverse.

- Simple, retail-friendly tokens, priced under $1, might outperform higher-priced altcoins simply because low fees on Polygon allow small investors to explore opportunities freely and enjoy speculative gains without a massive capital investment.

Bottom Line:

Based on our observations of these initiatives, we believe that 2025 will be another defining year for Polygon altcoins under $1. Low fees, liquidity, real-world adoption, and consistent network upgrades provide the altcoins with cheap alternatives to scale within a fertile environment. If Polygon’s TVL hits $10B, several Polygon altcoins under $1 could see breakout momentum. With that being said, be cautious: eat small portions, handle risks, and keep chasing hype.

Question for you: Which Polygon altcoin under $1 are you most excited about in 2025? Comment below, we would like to know which of the gems our readers are following!

Some Polygon tokens may still be overlooked despite strong fundamentals, similar to what we flagged in our report on undervalued altcoins under $1 with market cap upside.

Conclusion: Why Polygon Remains a Hotspot for Under-$1 Altcoins in 2025

Once digging deep into the ecosystem of Polygon, one understands why it is a haven for altcoins priced below $1. With the native initial POL token (~$0.28) becoming part of the SAND (~$0.28) and QUICK projects (~$0.05) and other projects that sales managers believe will continue winning thanks to its low fees, high transaction volume, and increasingly liquidated Total Value Lock (TVL) of $1.23B, these tokens are distinctly available to retail investors.

Based on our preceding Layer 2 reflections, the PoS chain of Polygon, zkEVM rollup, and AggLayer liquidity applications build a world in which small-cap altcoins can flourish. New projects can be started with less than $1 due to low barriers, allowing investors to enjoy the opportunities of staking, gaming, and utilizing NFTs and DeFi without being hindered by Ethereum gas costs.

Of course, risks remain. The volatility of markets, competition with other Layer 2s such as Optimism and Arbitrum, and low-liquidity traps need to be carefully managed within a portfolio and researched. Smaller sums, diversifying a portfolio, and tracking changes in the ecosystem are some of the major ways to approach this space with responsibility.

To the brave who explore the Polygon under-$1 gems, they have a real opportunity: low-priced, high-utility tokens with an a priori chance to appreciate, on top of a successful, scalable Layer 2 infrastructure.

Call to Action: Subscribe to more Polygon altcoin guides, follow developments within ecosystems, and go small – starting with POL staking, flipping low-price tokens (such as QUICK), or gaming and NFT projects could be your first entry point to the accessible Polygon altcoin ecosystem.

FAQs

Q1: What are the best Polygon altcoins under $1 in 2025?

A1: Some of the top Polygon altcoins under $1 include POL (~$0.28), QUICK (~$0.05), SAND (~$0.28), GHST (~$0.42), JST (~$0.03), MANA (~$0.28), and GALA (~$0.016). These will be the most affordable access points with potential applications in the Polygon ecosystem, whether in DeFi applications like QuickSwap or gaming and NFT applications like Decentraland and Aavegotchi.

Q2: Why is Polygon ideal for under-$1 altcoins?

A2: The Ethereum scaling solution will have low transaction costs (around 0.01 each), high throughput (65,000 TPS on PoS, approximately 2,000 TPS on zkEVM), and EVM compatibility at Layer 2. This is achievable because developers will be able to issue low-cost, high-structure tokens, thereby maintaining the liquidity and availability of these tokens for retailers.

Q3: How can I safely buy Polygon altcoins under $1?

A3: For a safe investment, a wallet compatible with Polygon, such as MetaMask, is established, and tokens are purchased on a DEX, like QuickSwap, or a CEX, like Binance. Never buy based on contract addresses only checked in PolygonScan, and conduct basic research on the availability of tokens, staking, and developers of certain tokens.

Q4: What are the risks of investing in cheap Polygon tokens?

A4: There are risks of market volatility, liquidity, rug pulls, and a threat of other Layer 2s, such as Arbitrum and Optimism, competing successfully. Even a token under $1 with considerable potential can be hit sharply. Never stop with DYOR (Do Your Own Research), and all assets should be in the smallest part of your portfolio.

Q5: Can under-$1 Polygon altcoins really grow in 2025?

A5: Yes, according to the modern tendencies and development of ecosystems. The predicted increase in altcoins like POL (or any other zkEVM altcoins) or GALA may result from Polygon liquidity upgrades, zkEVM adoption, and PoS staking incentives that are inexpensive and may rally significantly during the altseason. However, there is also speculative growth, which is subject to adoption, liquidity, and network development.

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.