Introduction to Eco Friendly Altcoins

The crypto industry has long been hailed as a financial revolution, but in recent years, one big question has loomed larger than ever: is crypto sustainable? As headlines criticize Bitcoin’s energy consumption and regulators focus on environmental factors, the need for green blockchain solutions is becoming increasingly indisputable. This is where eco friendly altcoins step in.

The new versions of cryptocurrencies are created to minimize their negative environmental impact while preserving the benefits of decentralization, transparency, and innovation. Whether through energy-efficient consensus mechanisms, carbon offsetting initiatives, or partnerships with renewable energy providers, eco friendly altcoins are shaping the narrative that crypto can coexist with sustainability.

These projects are not intended to be part of the problem. The goal of these projects is to make the blockchain industry part of the solution to move into a future where the needs of financial freedom and the environment can coexist.

As investors search for greener blockchain options, many are also looking into altcoins under $1 that combine affordability with sustainability.

Why Sustainability Matters in Crypto Right Now

Sustainability can no longer be seen as a niche issue- sustainability is now core to the future of finance and technology. Traditional blockchains, such as Bitcoin and pre-merge Ethereum, used a Proof-of-Work (PoW) system, in which a large amount of energy was consumed as miners were vying to simultaneously solve complex puzzles. According to the Cambridge Bitcoin Electricity Consumption Index, Bitcoin consumes over 100 TWh of electricity annually, a footprint comparable to entire nations. This massive energy demand has triggered global concerns about crypto’s environmental sustainability.

The amount of energy consumed by Bitcoin mining alone is enough to power various countries, and consequently results in huge carbon discharges.

The cost to the environment was met with backlash by the governments, as well as environmentalists, and even big companies. In 2021, Tesla halted payments in Bitcoin due to energy concerns. It was also around this period that countries such as China began to clamp down on crypto mining, citing, in part, the carbon footprint.

Investors, too, are getting more aware. Investors are increasingly becoming more conscious. A lot of institutional funds are considering the adoption of ESG (Environmental, Social, and Governance) criteria in their investment activities. This implies that projects that fail to embody environmental responsibility would fail to attract an influx of large capital. Crypto projects, on the other hand, that focus on sustainability, such as Cardano, Algorand, and Hedera Hashgraph, are becoming credible as investments and alternatives to questionable projects.

In sum, sustainability in crypto is not merely a PR box; it is a competitive advantage that will keep a firm above the risks of going under in a world moving toward more sustainable technologies.

The Criticism of Energy-Hungry Blockchains

Uproar over energy-intensive blockchains has been loud and mostly meritorious. Critics believe PoW blockchains contribute to climate change, put an extra burden on the power grid, and generate electronic waste. As an example, Bitcoin mining rigs are characterized by a rather short lifecycle, as the hardware will be regularly upgraded as part of the ever-growing world e-waste issue.

A report by Digiconomist Estimates claim that every transaction of Bitcoins could generate an equal amount of carbon footprint to hundreds of thousands of credit card payments. Although these statistics are somewhat controversial, they give us an idea of just how significant the problem is and the common inclination of people to regard coins that get more energy as being less favorable.

Besides, this criticism jeopardizes mainstream use. Governments experimenting with Central Bank Digital Currencies (CBDCs) are in no position to associate with or support blockchains that can be labelled as environmentally unfriendly. Likewise, corporations seeking blockchain integrations may choose eco friendly altcoins over Bitcoin-like systems to avoid reputational risk.

The silver lining? The criticism resulted in the demand for alternatives. This pressure is exactly what gave rise to eco friendly altcoins, which aim to combine crypto’s disruptive potential with environmental accountability.

TL;DR — Eco-Friendly Altcoins in 2025

Eco-friendly altcoins cut energy use and align with global sustainability goals. Unlike Bitcoin’s proof-of-work, green networks rely on efficient consensus (e.g., proof-of-stake) and, in some cases, carbon offset programs.

- Who to watch: Cardano (ADA), Algorand (ALGO), Hedera (HBAR), Tezos (XTZ), Stellar (XLM).

- Why it matters: Lower energy footprint, improving ESG appeal, and growing real-world use cases.

- What to weigh: Scalability trade-offs, price volatility, and adoption headwinds in a Bitcoin-led market.

- Bottom line: Promising for a greener crypto stack, but research fundamentals, dev activity, and roadmaps before you commit.

Educational only-this is not financial advice.

The Environmental Issues with Traditional Cryptocurrencies

Cryptocurrency has revolutionised how we perceive money, but it has not done so without its share of controversy. Among the greatest criticisms is the amount of energy consumed by traditional blockchains. Before we go into the eco friendly altcoins that can help in solving this issue, it is important to know why older models, such as Bitcoin and Ethereum (before its Merge), were so energy-intensive.

Proof-of-Work vs. Eco Friendly Alternatives

Where this controversy is concerned, in the question of the heart is the consensus mechanism, namely the mechanism that blockchains use to confirm transactions and secure the network.

- Proof-of-Work (PoW): Used by the Bitcoin network, PoW requires miners to race in solving complex mathematical puzzle. Such a mining process requires huge volumes of computational power and consumption of electricity. The Cambridge Centre of Alternative Finance says: The energy expenditure of the Bitcoin network alone is over 120 TWh of electricity per year that can represent the energy consumption of an entire country such as Argentina.

- Proof-of-Stake (PoS) and other models: From harnessing the brute computational power, PoS and other systems do not do this. Rather, the validators are selected according to how much cryptocurrency they stake. This cuts the energy needed to a fraction of what it was is PoW, rendering its PoS-based chains thousands of times more efficient. Other options, including the Proof-of-Authority (PoA) or hybrid consensus only refine efficiency and sustainability.

This transition to staking-based system as opposed to the use of mining-based systems is the crux behind the emerging popularity of eco friendly altcoins. They are also very secure and decentralized coupled with low energy demands.

While Proof-of-Work consumes vast amounts of energy, even some deflationary altcoins under $1 are experimenting with low-power models to stay competitive.

Carbon Footprint Comparison

Energy use is just half of the picture; in fact, the energy consumption of cryptocurrencies, what part it plays in the carbon footprint of the industry has found itself under the spotlight. Most mining activities use fossil fuels and thus their emissions can be overwhelming in some areas.

Bitcoin energy consumption: As of October 2021, Bitcoin energy consumption accounts for an estimated 218.93 TWh per year (based on a Bitcoin energy consumption rate of 1061.91 Wh/Tx (transaction)). Estimates found that Bitcoin mining could be producing over 60 million metric tons of CO₂ every year. That is equivalent to the carbon footprint of an entire country such as Greece.

Proof-of-Stake networks: By contrast, PoS networks, like Cardano or Algorand, use only a fraction of that. An example of a report on Ethereum.org 2022 reported an 87% increase in average daily volume this year over last year.

The study pointed out how the transition of Ethereum to PoS led to cutting 99.95% of its energy footprint overnight. Simile statistics are reflected in research by Cardano, which estimates that less energy is used by its network than by a small office building.

This data illustrates one painful truth: not every cryptocurrency is equally good. Whereas existing blockchains power-drain severely, eco friendly altcoins show that it is feasible to scale blockchain technology without damaging the planet.

Key Features of Eco Friendly Altcoins

Proof-of-Stake and Other Low-Energy Consensus Mechanisms

One of the biggest shifts driving the rise of eco friendly altcoins is the replacement of energy-hungry Proof-of-Work (PoW) with low-energy alternatives such as Proof-of-Stake (PoS), Delegated Proof-of-Stake (DPoS), and Proof-of-History (PoH).

- Proof-of-Stake (PoS): PoS enables validators to secure the network by staking their coins, rather than by solving computational puzzles. This reduces the requirement of immense power and hardware to an absolute minimum compared to PoW; the energy consumption is thus further reduced to more than 99% of that of PoW. In 2022, Ethereum switched to PoS. After Ethereum completed “The Merge” in September 2022, the network’s energy usage dropped by more than 99.9%, from roughly 84 TWh per year to just around 0.01 TWh annually.

- Delegated Proof-of-Stake (DPoS): Employed by such platforms as EOS and TRON, DPoS means that coin owners can vote for validators, making the process of reaching consensus even more efficient and revealing more support for scaling.

- Proof-of-History (PoH): Merged by Solana, PoH is a method of transaction time stamping that can be used to come up with a verifiable sequence of transactions, which, when put together with PoS, enables high throughput using low energy consumption.

The models are relevant as they serve specifically to respond to one of the primary critiques of crypto, which is environmental harm. By eliminating the necessity of excessive energy use, the eco friendly tokens are gaining trust in regulators and investors wary of sustainability questions.

Many undervalued altcoins under $1 are adopting proof-of-stake because it offers both energy efficiency and long-term scalability.

Renewable Energy Integration and Carbon Offsetting

The other important characteristic of environmentally conscious cryptocurrencies is that it incorporates renewable energy resources and carbon offsetting schemes. In turn, some projects are not only scaling back energy needs but also neutralizing their impact.

- The collaboration with Veritree: Cardano (ADA) plans to use its connections to benefit the world, and one way it has chosen to do so is by engaging in a partnership with Veritree.

- The launch of a tree planting program has seen Cardano become carbon neutral. By 2023, the project had already made more than 1 million tree promises, becoming a source of real-life changes and sustainability.

- Algorand (ALGO): Algorand is the first blockchain to be carbon negative, which means that it produces less CO₂ than it removes. It collaborates with ClimateTrade, a carbon offsetting program, to make sure that every transaction results in the attainment of environmental objectives.

- Renewable partnerships: Other altscoins are also looking into direct integration of renewable-energy sources, using solar and wind power to run validator nodes, and thus becoming self-contained and green.

And this emphasis on sustainability in blockchain is not only branding, but a competitive advantage. Within the scope of the projects that can involve carbon-neutral blockchain strategies, it is not an exaggeration to say that they are in a better position to be brought into mainstream use as governments across the globe strengthen ESG (Environmental, Social, Governance) regulations.

Top Eco Friendly Altcoins to Watch in 2025

Looking into more detail, the greater force driving eco friendly altcoins can be seen clearly when you begin to compare them not only on their green credential, but also on their overall performance, transparency, and developer activity. Our top picks in 2025 are several coins which offer the best balance of low energy consumption, cutting edge technology, availability, vibrant communities, and adoption in real life. Here is a breakdown of the ways through which we are going to break them down:

For each coin, we’ll cover:

- Tokenomics & Real-time Price (under $1 where applicable)

- Use Cases that highlight practical applications

- Developer Activity & Governance signals

- Sustainability Measures, including energy efficiency, carbon offsets, or renewable integration

- Live Links to Messari profiles, GitHub repositories, official documentation, or sustainability reports

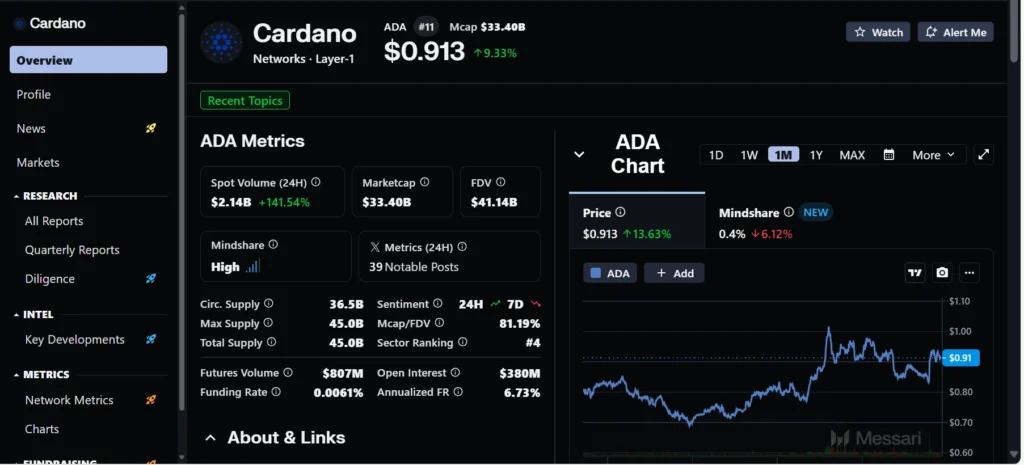

Cardano (ADA): Pioneering Sustainable Blockchain Growth

Having shed to a low of $0.91 (as on 23rd August,2025), Cardano (ADA) is one of the most watched value coins in the altcoin market. The ADA circulating supply is 35.7 billion tokens with a maximum supply limit of 45 billion, resulting in a good position between scalability and scarcity.

Cardano has developed its brand on the basis of thorough research and scientific peer-reviewed works, an academic blockchain. Its Ouroboros proof-of-stake system is energy-efficient, as it consumes less than 1% of its energy compared to proof-of-work chains, and is one of the few proof-of-stake systems to be supported by published research. That lends credence to ADA in an industry that has been alleged to move fast, breaking things.

Other than the technological field, Cardano has been aiming at implementation in the real world. Ethiopia has turned to the network through its Ministry of Education as a means of administering student credentials via a blockchain system, with sustainability projects such as Cardano Forest (a tree-planting initiative that relies on verification through the blockchain) indicating the group is aiming to be greener.

The attraction of ADA below $1 is thereby the confluence of its active developer community, with commits to projects such as Hydra and Plutus, and increased publicity of its blockchain-as-a-sustainable-solution backstory being added to the financial inclusion mantra. To the individual who is seeking out long-term plays and does not want to engage in silly memes and pumps, ADA remains a solid choice at a low entry point.

Cardano stands out for its sustainable model, but it also sits among the best altcoins under $1 that everyday investors can access easily.

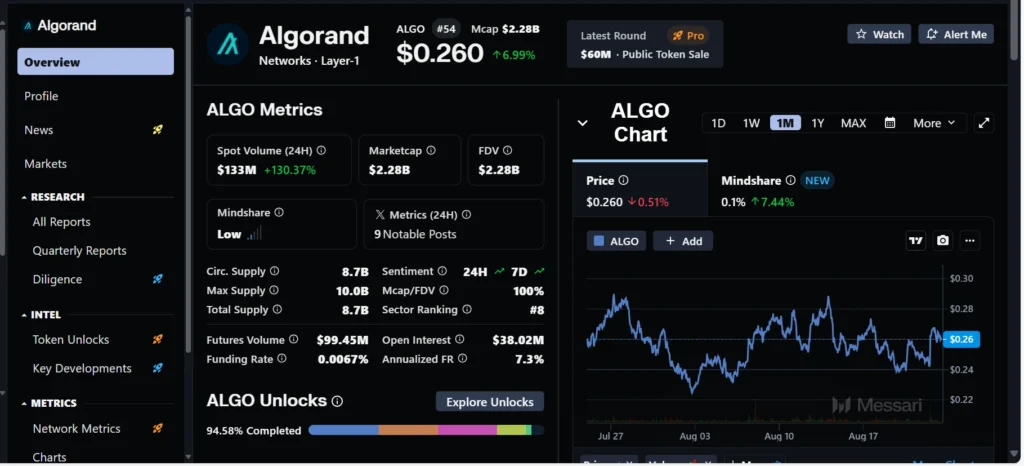

Algorand (ALGO): A Carbon-Negative Layer-1 Under $1

Why it matters: Algorand is breaking new ground among eco friendly altcoins by not just being low-energy, but carbon-negative, actively removing more CO₂ than it emits. Such an environmental policy, combined with a sub $1 price point, makes it an outstanding beauty.

- Live price and tokenomics: The price of Algorand is now said to trade at about $0.26, (as on 23.08.2025) with a circulating supply of 10 billion ALGO to reconcile scarcity and utility.

- Consensus & Sustainability: Its pure Proof-of-Stake(PPoS) system utilizes minimal amounts of electricity. A third-party analysis by Crypto Carbon Ratings Institute (CCRI) suggests that ALGO’s footprint is around 265 tCO₂ per year, that is, around 7x that of Ethereum PoS and 300,000x lower than that of Bitcoin.

- Carbon-Negative: In 2021, Algorand partnered with ClimateTrade to launch the Green Treasury, a blockchain oracle that not only tracks the carbon produced but also locks the carbon credits on-chain as Algorand Standard Assets, effectively turning the network carbon-negative.

- Use Cases & Ethereum Alternatives: Algorand facilitates the issuance of green bonds, real-time supply chain management, and carbon credit exchanges, highlighting the practical applications of green crypto.

- Developer & Project Ecosystem: The network will also be the basis of PlanetWatch (global air-quality monitoring), Global Carbon Holding (carbon credit tokenization), and other sustainability aligned projects.

Why we are watching: Algorand brings triple tacks verified carbon-negative operation, utility-rich use cases, and affordability under $1. If we’re mapping eco friendly altcoins to watch in 2025, Algorand isn’t just ticking boxes, it’s defining a category.

Hedera Hashgraph (HBAR): Enterprise-Grade Efficiency That Won’t Cost the Earth

Live Price :

Hedera (HBAR) is currently (as on 23rd August, 2025) trading around $0.25, firmly under the $1 threshold we’re spotlighting for eco friendly altcoins.

Why We Are Watching Hedera

See a distributed ledger that isn’t a blockchain but that blows blockchain out of the water as far as energy consumption goes, that’s Hedera. It has a hashgraph algorithm, which, combined with asynchronous Byzantine Fault Tolerance (aBFT), provides not only very fast finality but also strong security and astonishing energy efficiency at the same time, none of that through brute forcing decentralization like PoW chains do.

Tokenomics & Governance

HBAR has a fixed supply of 50 billion, with approximately 70 percent in circulation as of mid-2024, prudently governed by the Hedera Governing Council that comprises the leaders of companies such as Google and IBM. Their use is an indication of heavyweight credibility.

Real World Use Cases

Hedera is not only green, but practical. It is facilitating sustainability dashboards, Corporate emissions tracking, and tokenized environmental workflows. A good example is Take B4ECarbon, a project with Chevron and ExxonMobil, whereby the carbon emissions and offsets are made immutable in a secure Hedera-based network.

Developer & Ecosystem Signals

In September 2024, its entire codebase was open-sourced under Apache 2.0 and became a part of the Linux Foundation across the “Hiero” initiative, where we opted into full transparency to developers. Hedera is not subject to the same level of hackathon churn as other chains, and institutional support, HIP proposals, and tooling development all demonstrate serious longevity.

The bottom line

Hedera is known as that distant racer who left all Musketters in the dust. It is not only a greener altcoin, but the combination of its power efficiency, an enterprise-level trusted network, real use cases, and the transparency of its governance is providing it with a credible role at the climate-conscious Blockchain table.

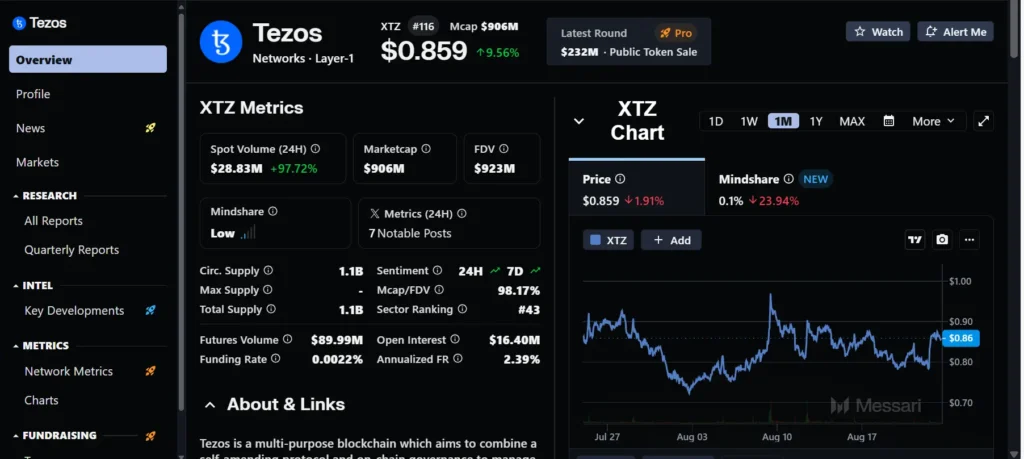

Tezos (XTZ): Liquid Proof-of-Stake, Low Carbon

Tezos trades today (as on 23.08.2025) at around $0.86, comfortably under our $1 spotlight for eco friendly altcoins. Not only is its Liquid Proof-of-Stake (LPoS) model more frugal of energy resources, but it also enables on-chain governance, which can change independently, without the use of hard forks. Such a combination of efficiency and adaptation is what makes Tezos interesting in the sustainable cryptocurrency field in 2025.

Energy Efficiency & Sustainability

Tezos is unique due to a thorough lifecycle analysis that was developed by PwC and Nomadic Labs in accordance with the ISO 14040/44 standards. The research observed that by operating a baker node yearly, around 161 kg of CO₂ is released yearly, and performing a single transaction only releases 2.5g of CO₂. At the network level, Tezos is on par in terms of carbon emissions with the emissions of 17 individuals per year. Then there is the efficiency optimisation that the latest upgrade, called Granada, brought about: energy per transaction was reduced by 70% despite a dramatic increase in on-chain activity levels.

Tokenomics & Consensus

Tezos (XTZ) has a dynamic supply governed by its Liquid Proof-of-Stake (LPoS) model. Token issuance occurs through staking (“baking”), with occasional burns tied to protocol activity such as smart contract fees. Governance and supply adjustments are managed on-chain by Tezos bakers and the community

Use Cases & Developer Activity

Whether it is offering Red Bull Racing NFTs or Manchester United NFTs, innovative climate-focused dApps, or DeFi platforms, Tezos has developed its use cases past the hype. The developer community is healthy, with new releases coming regularly out of Nomadic Labs, and its core protocol is visible at GitLab.

What Makes it Stand Out

Living up to its reputation of sustainable crypto, Tezos comes with quantifiable green credentials alongside practical adoption and greater governance capability. Its sustainability does not appear to be a marketing gimmick as it is a measurable, certified, and changing reality. As we track eco friendly altcoins today, Tezos consistently ranks as a smart pick for both impact-conscious investors and those valuing long-term resilience.

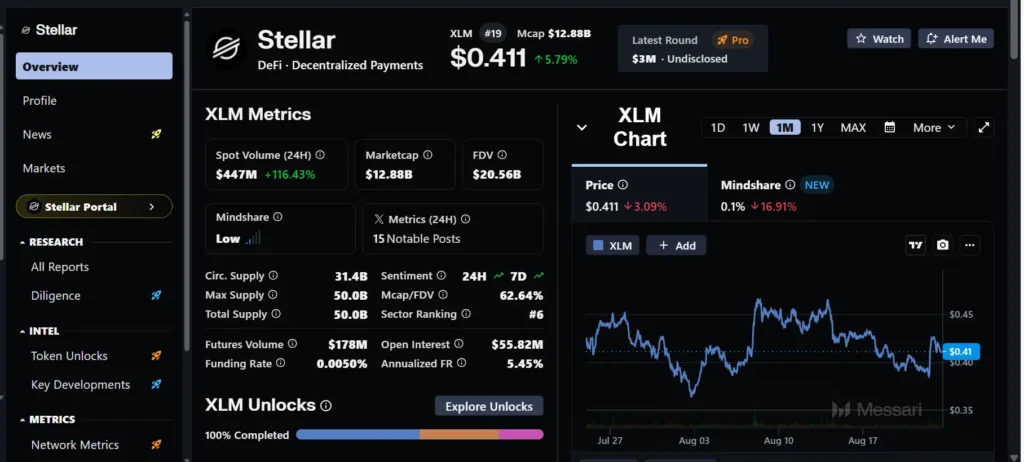

Stellar (XLM): Efficient Consensus for Cross-Border Transactions

XLM is trading around $0.41 as on 23rd August 2025, well below $1, making it a top candidate among eco friendly altcoins for both utility and accessibility.

Cross-border transfers are Stellar’s forte, but nobody talks about it. It has a consensus mechanism called the Stellar Consensus Protocol (SCP), a Federated Byzantine Agreement, or FBA. The SCP lets trusted nodes come to an agreement on a transaction quickly, typically in 3-5 seconds, without the energy use and mining associated with proof of work methods. That renders Stellar exceptionally energy-efficient in addition to fast.

Tokenomics & Governance

Stellar originally launched in 2014 with a supply of 100 billion XLM, but after a major supply reduction in 2019, the current max and total supply stands at 50 billion XLM, with about 31.4 billion XLM in circulation today. A vast amount of tokens is being burned through the Stellar Development Foundation in an attempt to lower inflation. Nowadays, the network is leaner and more balanced concerning the supply distribution.

Sustainability & Energy Use

Due to the fact that Stellar depends entirely on messaging and consensus, and not on computational puzzles, each transaction is also extremely energy efficient. One paper actually estimated a mere 0.222 Wh per transaction, projecting networkwide usage at a mere 20 or 25 kW, which scales very well as Stellar scales up.

Applications & Real-world coverage

The architecture of Stellar makes it appropriate for low cost international money remittances. Projects such as Do No Harm development projects, MoneyGram integrations, and IBM World Wire have helped to affirm the role of Stellar in a world without borders, financially speaking.

Pilot programs in Latin America have also shown significant reductions in the cost of remittances (upwards of 50 percent), due in large part to the faster transaction rails that stablecoins can offer.

Why We Like It

Stellar does not put on airs- it is functional, reasonably priced and eco friendly. For eco friendly altcoins under $1, it aligns technical efficiency, environmental responsibility, and financial inclusion in a package that’s hard to overlook. Its application in the real world in global remittance systems speaks volumes more than even any marketing slogans.

Other Emerging Eco Friendly Altcoins

Let’s spotlight a group of lesser-known but promising eco friendly altcoins that are carving green paths in crypto, each with unique tech, practical use cases, and sub-$1 accessibility as of today:

Nano (XNO): Digital Cash That’s Nearly Energy-Free

Price: Around $0.98, just under our $1 threshold.

The block-lattice architecture of Nano and the innovative Open Representative Voting mechanism allow users to spend assets immediately or instantaneously zero-cost transfers and to consume a large amount of energy totaling only 0.0007 kWh per transaction. That is tens of thousands more efficient than Bitcoin.

Why We Watch It: Nano is an environmentally friendly cryptocurrency, a simplistic, fast alternative to traditional currency; a solution that suits well for everyday online transactions.

VeChain (VET): Sustainability Built for Enterprises

Price: A steady $0.025 today (23rd August).

The VeChain is based on the Proof-of-Authority blockchain, on which 101 validated nodes approve transactions. Its 2022 carbon footprint amounted to 4.46 tCO₂e/year, making it one of the lowest power-intensive networks in terms of the number of transactions (~0.000216 kWh).

The enterprise application cases are also bright- VeChain allows organizations to trace their supply chains, ensure green claims, and provide structured tokenized green actions in real-time.

Harmony (ONE): Lightweight Blockchain, Heavy on Sustainability

Price: About $0.067 as of now.

Harmony Proof-of-Stake with adaptive thresholds reduces the amount of computational resources required to secure the network. The result? Extremely low carbon footprint compared to conventional systems.

Why It Matters: Harmony is a strong early indicator of how eco friendly altcoins can deliver performance without compromising on sustainability, ideal for scalable applications.

IOTA (MIOTA): Green IoT Infrastructure with the Tangle

Price: Around $0.21

Not running on a blockchain, but powered by the Tangle (DAG structure), IOTA also has no fees when performing transactions. It is designed to handle IoT ecosystems, and this has been attributed to a study showing that its design is energy-light and can be used to support sustainable agriculture and resource tracking.

Edge: IOTA represents how eco friendly altcoins can underpin real-world tech with minimal environmental cost.

Polygon (MATIC): Scaling Ethereum with Green Commitment

Price: It is around $0.25.

Green Manifesto and its sustainability fund (20M) led to the retirement of 104,794 tonnes of CO₂ through carbon credits, bringing the chain to carbon-neutral/positive.

Takeaway: Bridging the gap between Ethereum utility and serious environmental intent, Polygon has its eyes on future scalability and sustainability.

Why These Matter

Together, these eco friendly altcoins under $1 demonstrate diversity in approach, from minimal energy protocols to carbon-offset strategies. Each has a different depth of grip on the utility of digital assets, aligning with the demands of the environment (without letting utility or price point suffer).

Benefits of Investing in Eco Friendly Altcoins

Investing in eco friendly altcoins isn’t just a feel-good vibe, it’s smart, sustainable, and increasingly aligned with the bigger financial shifts reshaping markets in 2025.

Environmental and Ethical Advantages

More investors are aligning their portfolios with purpose, and eco friendly altcoins offer a rare bridge between digital assets and environmental stewardship. ESG funds–assets that pass Environmental, Social, and Governance tests– have topped $18 trillion in assets worldwide, with Europe alone having trounced a whopping 84% of this green capital asset.

Adding eco friendly altcoins to that mix taps into a narrative that investors and regulators are warming to: symbolism backed by substance. These coins offer low carbon impact, visibility, and in several cases direct climate effect projects, getting both the profit and the planetary objectives.

Potential for Long-Term Growth and Adoption

The world is moving beyond rhetoric- governments, companies, and consumers are seeking low-carbon solutions. Sustainable digital assets are potentially primed to capitalize on this interest shift to mainstream audiences.

For instance, the energy savings unlocked by Ethereum’s move to Proof-of-Stake (slashing energy use by 99.95%) sent shockwaves through the market, setting expectations that eco friendly altcoins will be the norm, not the exception.

Additionally, the ESG use cases driven through blockchain, such as the tracking of renewable energy or tokenized carbon credit, are opening new layers of utility associated with trading these altcoins. The EU/U.S. could further incentivize green outcomes, and under such circumstances, such tokens would serve as a delivery mechanism to provide feedback on sustainable finance innovation.

Regulatory and Market Trends Favoring Sustainability

Regulatory frameworks are fast catching up. The EU Markets in Crypto-Assets (MiCA) law which enters into effect at the end of 2024, requires transparency and risk supervision of crypto issuers. Energy-efficient tokens are going to be more sustainable and thus likely to have an advantage under this new regime.

At the same time, the EU Green Deal and the taxonomy of sustainability financing are increasing expectations on the institution. The rapid evolution of sustainability disclosures means that many firms will soon be required to make sustainability disclosures.

Back across the Atlantic, U.S. policy figures are showing various signs of crypto toleration, including talk of pieces of legislation like the FIT21 Act and the Digital Commodities Consumer Protection Act (DCCPA). Despite these laws being in their infancy, the indication is that there might be regulatory certainty in the making, hopefully to the benefit of low-emitting versions.

Meanwhile, financial regulators throughout the world (e.g., the Basel Committee) are also encouraging more realistic, risk-based bank crypto holding standards and challenging the over-conservative capital requirements.

Why It Matters

Put simply, eco friendly altcoins are positioned at the intersection of climate awareness, innovation, and shifting policy. Given the ethical alignment (ESG appeal), future growth possibilities (sustainable use cases), and regulatory trends, it is an attractive value proposition to investors as well as institutions.

The overlap between sustainable coins and cheap altcoins with long-term potential shows how affordability and eco-consciousness are aligning in 2025.

Challenges Facing Eco Friendly Altcoins

Scalability and Performance Trade-Offs

One of the biggest hurdles eco friendly altcoins face is the scalability vs. performance trade-off. The vast majority of green projects are built on Proof-of-Stake (PoS) or hybrid consensus models, which are substantially more energy efficient than the Proof-of-Work (PoW) network like Bitcoin. Nonetheless, the skeptics criticize PoS by stating that it can sacrifice security and decentralization in comparison with PoW. For example, even though Ethereum PoS (The Merge) marked an 80-fold and over 99% reduction in energy consumption, it is uncertain how the network will fare under rugged stress and whether or not it has been sufficiently decentralized. Eco friendly altcoins need to prove they can balance sustainability with transaction speed, network security, and decentralization if they want to win mainstream trust.

Market Volatility and Competition

The other issue is the inherent volatility of low-cost coins. Many eco friendly altcoins, from Algorand (ALGO) to Harmony (ONE), trade under $1, making them highly accessible to retail investors but also more prone to wild price swings. Add on the competition with other established giants such as Ethereum and Cardano, and the road to adoption is even more difficult. Investors seeking sustainability could consider that the green edge of this project needs to be enough to carry the project in such an already saturated and competitive arena. A strong narrative alone will not help a company survive crypto winters.

This is especially true for low market cap altcoins under $1, which face the double challenge of volatility and competitive pressure.

Adoption Barriers in a Bitcoin-Dominated Space

Third and finally, there are the ecologically-friendly coins, but these are an uphill climb against Bitcoin hegemony. However, regardless of how realistic and sustainable these initiatives are, the challenge is that Bitcoin is the reference with institutional investors and the mass media. This is because market inertia, liquidity, and brand name recognition make it difficult for the smaller green projects to break through. Even with global sustainability goals and regulatory pressure pushing for greener solutions, eco friendly altcoins must still work overtime to educate users, attract partnerships, and prove real-world utility before they can stand toe-to-toe with BTC in investor portfolios.

How to Get Started with Eco Friendly Altcoins

Choosing the Right Wallet and Exchange

If you’re considering dipping your toes into eco friendly altcoins, the first step is figuring out where to safely store and trade them. In comparison to the traditional banking system, crypto provides two fundamental options centralized exchanges (CEXs) such as Coinbase, Binance, or Kraken, and the decentralized wallets (DEXs) like MetaMask or hardware ones like Ledger.

The centralized exchanges are convenient for beginners because they provide custody, security layers, and customer support. However, remember that when using it, you are not actually in possession of your own keys; access may be limited in the event of the platform shutting down or encountering regulatory risk.

On the positive side, decentralized wallets and hardware support mean you have full access to your personal keys including the full hold true to the “not your keys, not your coins” saying. For investors looking to store green cryptocurrencies like Tezos (XTZ), Algorand (ALGO), or Stellar (XLM) in the long term, or those seeking self-sovereign control, hardware wallet storage or decentralized storage is generally the most viable and sustainable option.

And you can think about it as a rented house, centralized exchanges, and an owned house, decentralized wallets. Each is a tradeoff; the matter is how comfortable you feel compromising security, control, and convenience of use.

Tips for Sustainable Investing

Investing in eco friendly crypto projects requires a bit more diligence than chasing meme coins on Twitter. A few tips that can keep you grounded:

- Avoid the hype cycle: Just because a coin is trending on social media doesn’t mean it has lasting value. Focus on projects with a track record of consistent development.

- Check developer activity: Open-source blockchains thrive when devs are actively shipping updates and fixing bugs. Tools like GitHub activity trackers or Messari research can help verify this.

- Study the roadmap: Eco friendly blockchain projects that align with real-world use cases (like supply chain optimization with VeChain or carbon-neutral DeFi apps on Algorand) have stronger adoption potential.

- Balance risk and reward: Low-cost altcoins can be tempting because you can buy a large amount for cheap. But remember, volatility cuts both ways. Only allocate what you can afford to lose.

And here’s the balanced disclaimer every serious investor should keep close: This isn’t financial advice. Eco friendly altcoins are still highly speculative assets, and while the environmental case is strong, the market case can be unpredictable. Think long term, diversify, and always do your own research (DYOR).

The Future of Eco Friendly Altcoins

Innovations on the Horizon

One of the most exciting aspects of eco friendly altcoins is how quickly innovation is moving. Quite a number of green blockchain projects are already playing around with Layer 2 scaling solutions- just as in the case of Ethereum rollups. Layer 2 networks alleviate the burden created in the limit chain in order to decrease the power consumption per exchange, as well as to increase the limit. This is particularly critical to projects such as Polygon (MATIC) that originally started as a scaling solution but have since become a core pillar of the sustainable crypto ecosystem.

The carbon credit tokenization is another potential progression. Using dockets can enable carbon credits to be more transparent, trackable, and available globally instead of the traditional slow-moving carbon markets. Think of buying and selling real carbon offsets as simple as Bitcoin or Ethereum onesetrichell. Ranked #1 in the 2021 Sustainable Technology category. Projects like Toucan Protocol have already laid the groundwork here, and we’re likely to see eco friendly altcoins integrate these mechanisms directly into their ecosystems. Taken more broadly, this has the potential to translate green cryptocurrencies not only into instruments of investment but also into instruments of actual climate action.

Role in Global Climate Goals

Eco friendly altcoins aren’t operating in isolation, they’re aligning with broader sustainability targets set by organizations like the United Nations. The UN climate targets, especially the goal of achieving net-zero emission targets by 2050 have become a matter of global action and here blockchain stands to feature prominently. As a hypothetical example, open carbon books on a distributed ledger may aid governments and corporations in satisfying requirements of industry reporting standards, and minimize fraud in carbon markets.

Institutional investors, who have to cope with ESG demands, are also keeping an eye on this area. If eco friendly altcoins can prove themselves both technically scalable and environmentally responsible, they could see adoption not only among retail traders but also in global sustainability frameworks. Or differently put, the same technology that in the past has been criticized as an energy hog may someday prove to be a solution to the climate change problem.

The take away? The future of eco friendly altcoins looks like a mix of innovation, regulation, and global cooperation. The question is not whether these tokens will have an impact on sustainability- it is how significant their role will be in creating the future of crypto usage.

Final Thoughts: Are Eco Friendly Altcoins the Future?

Eco friendly altcoins are no longer a niche trend, they’re quickly becoming central to how the crypto industry reinvents itself in response to global climate concerns. Whether it is proof-of-stake networks that cut the energy requirements, or carbon credit tokenization that will bring us an opportunity to make a difference in the real world, the green crypto initiative has already demonstrated that profitability does not have to come at the expense of sustainability.

This is an opportunity for investors. Projects that are eco friendly, but not all will be successful, and it may be a good idea to invest in those that operate in accordance with scalable climate goals and transparency. It appears that the trend toward environmentally friendly crypto is on the rise as more regulators, institutions, and individual traders are starting to require more clean blockchains.

At the end of the day, investing in eco friendly altcoins isn’t just about chasing gains, it’s about supporting a vision of a blockchain ecosystem that’s both innovative and climate-responsible.

👉 What do you think? Will eco friendly altcoins become the standard in crypto, or remain a niche? Comment below with what you think. And on the off chance that you are researching which coins to monitor, do not overlook our manual on Altcoins Under $1 and Next 100x Altcoins.

FAQ Section

Q1. What are eco friendly altcoins?

Eco friendly altcoins are cryptocurrencies designed to minimize environmental impact by using energy-efficient consensus mechanisms like proof-of-stake (PoS), delegated proof-of-stake (DPoS), or other low-power solutions. These coins differ to Bitcoin proof-of-work mining in that their objective is to provide both blockchain security and scalability, without the need to consume enormous levels of electricity.

Q2. Are eco friendly altcoins profitable investments?

Profitability is project-specific, time-specific and market-specific. Some eco friendly altcoins like Cardano (ADA) and Polygon (MATIC) have gained strong adoption, while others are still experimental. Individuals ought to do their due diligence and investigate the application of the project, the developer and collaborations. Never forget: green is not always equal to guaranteed profits.

Q3. How do eco friendly cryptocurrencies help fight climate change?

Energy-efficient cryptocurrencies use less energy in the blockchain by eliminating the need of mining. Other projects use carbon offset schemes or even allow the tokenization of carbon credit certificates directly in accordance with the UN goals on climate and global sustainability objectives.

Q4. Which wallets are best for eco friendly altcoins?

Most eco friendly altcoins are supported by both centralized exchange wallets (like Binance or Coinbase) and decentralized wallets (like MetaMask or Trust Wallet). Centralized wallets are more simple for first-time users, whereas decentralized wallets offer complete control of the keys and minimise dependency on third parties.

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.