If you’ve ever scrolled through CoinGecko wondering why some of the most talked-about gaming altcoins under $1 still dominate the charts, you’re not alone. From fantasy RPGs with $3M in daily trading volume to idle clickers with tens of thousands of active wallets, these tokens sit in a strange zone: mass appeal, but micro caps.

For retail investors, the formula often sounds simple:

“It’s a gaming token. It’s cheap. It might explode.”

But the reality? Much messier.

Many gaming altcoins under $1 tokens initially appear exciting, with flashy websites, teaser trailers, and Discord hype. But dig deeper and you’ll often find:

- Unlocked token supply dumping on retail

- Ghosted GitHub repos

- Inflationary tokenomics with no actual sinks

- Roadmaps that haven’t moved since 2022

This guide isn’t a hype piece. It’s a reality check.

At AltcoinsNest.com, we specialize in uncovering undervalued opportunities, but only the kind backed by actual data, product progress, and transparent economics. Every token on this list was filtered through five core criteria (we’ll explain them next) to eliminate:

- Abandoned metaverse projects

- Illiquid GameFi tokens

- PR-fueled launches with no gameplay

Because here’s the truth:

In 2025, the right gaming altcoin under $1 could 10x with user growth, but the wrong one might go to zero in 3 months.

This post is for retail investors who want exposure to the next generation of crypto-native games, but don’t want to get burned.

It’s not sponsored. It’s not copy-pasted.

Just raw research from one investor to another.

Gaming Altcoins Under $1: Explosive Sector, Brutal Failure Rate.

There’s no denying it, blockchain gaming is one of the most emotionally charged sectors in crypto.

It’s easy to see why: it mixes money, entertainment, culture, and community into a single high-risk, high-hype cocktail.

And yet, the data is sobering.

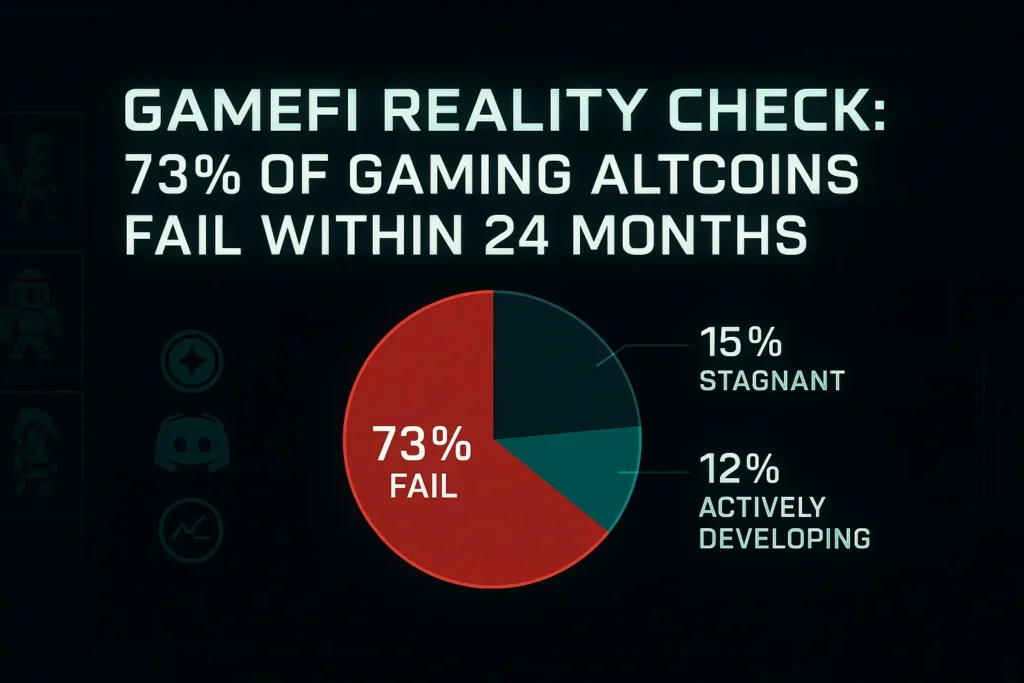

According to DappRadar’s Q1 2025 Blockchain Gaming Report, more than 73% of crypto gaming projects launched in the last 24 months have either stalled or disappeared. Token charts don’t just bleed, they flatline. Discords go silent. Game clients remain in “alpha” forever.

So why are investors still pouring in?

Because the potential upside is just that massive.

When a game gets it right, real players, actual token utility, meaningful in-game sinks, it can generate both retention and revenues without ever needing to go viral on Twitter. We’ve seen it before with Axie Infinity, Gods Unchained, and more recently, Pixels on Ronin. These weren’t just pump cycles; they were product-led explosions (at least for a while).

But the failure rate is brutal.

Here’s why most gaming altcoins under $1 don’t survive:

- No real game, just trailers and tokenomics

- Over-minted supply with zero burns or player sinks

- Bot-driven DAU metrics that collapse when rewards dry up

- Dead GitHub repos or outsourced development

- Ponzinomics disguised as play-to-earn loops

Case Example: Monsta Infinite (MONI)

- Launched as an Axie competitor

- Peaked at over $300M fully diluted cap in late 2021

- By early 2025, MONI trades under $0.01, with <1,000 active players

- Game servers are often down, and the whitepaper has been removed from the website

This isn’t an outlier. It’s the template for failed GameFi.

But now for the good news.

2025 is showing signs of a second wave it’s quieter, less hyped and more product-first. Studios are rethinking token utility. Governance is being de-emphasized. Modular game frameworks are emerging across chains like Arbitrum, Polygon, and Ronin.

Some of the gaming altcoins under $1 we found have:

- Actual players (tracked via blockchain + app metrics)

- Hybrid revenue models (NFTs + in-game spend)

- Leaner tokenomics with long vesting cycles

- Builders still shipping (public GitHub commits in the last 60 days)

Those are the ones we’ve shortlisted.

Methodology – How We Chose These Gaming Altcoins Under $1

Before we get into the actual gaming altcoins under $1, let’s talk about how we filtered them because that’s the part most people skip.

Going through a “Top 10 Gaming Altcoins Under $1” post that lists whatever’s trending on CoinMarketCap is pointless. Crypto gaming coins under $1, pump for various reasons, like influencer hype, airdrop farming, and early investor unlocks. None of that tells you if the project will survive two cycles from now.

So instead of going after market buzz, we started with a blank list and built upward using five strict filters, each designed to weed out short-term plays, zombie projects, and VC rugs hiding behind flashy branding.

Our Filters

- Prices of the Gaming Altcoins under $1

We made sure that every token we picked had to be trading under 1 USD at the time of writing, not just temporarily during a flash crash. This gave us a low-entry barrier but still filtered out meme-tier coins trading at fractions of a cent with zero liquidity.

- Active Development & GitHub Commits

We only included projects with public GitHub repos (or verifiable technical roadmaps) that showed real development of filtered Gaming altcoins under $1 from the first stage, in the last 60-90 days.

If a team hasn’t shipped code in months, the token doesn’t belong in anyone’s portfolio, period.

- Third Step : Gameplay First, Token Second

This step was non-negotiable for us. If a token didn’t tie into actual gameplay mechanics and was just there for governance or staking, it was out.

We looked for games where the token is earned, spent, or burned through real in-game actions.

- On-Chain Player Activity or Social Proof

DAU (Daily Active Users) is tricky to fake at scale. We cross-referenced DappRadar, CoinGecko, GitHub watchers, and project discords to see if real people are actually playing, not just farming rewards or joining giveaways.

- Finally : Circulating Supply vs. Total Supply (Inflation Risk)

GameFi altcoins with over 70% of supply still locked or with aggressive unlock schedules were red-flagged.

We prioritized coins where a fair chunk of the total supply is already circulating, or at least locked through multi-year vesting plans.

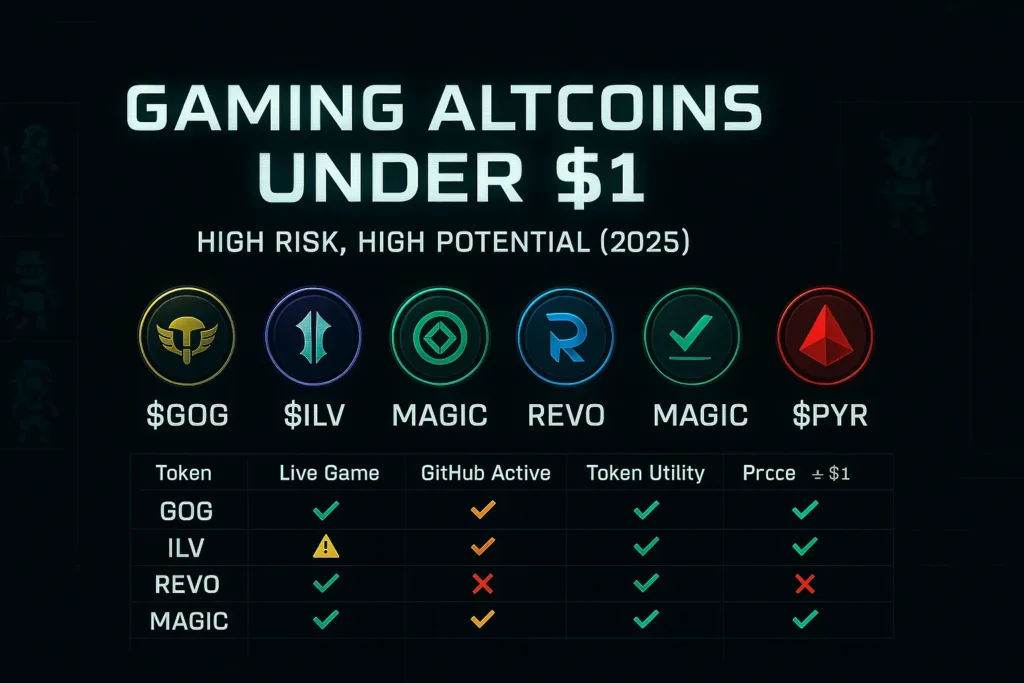

We started with a pool of 40+ gaming altcoins under $1, including many from our broader altcoins under $1 research. After applying these filters, just five gaming altcoins under $1 were chosen.

After applying these filters, just five of these gaming altcoins under $1 were choosen.

These are the ones we’ll analyze in depth, not because they’re guaranteed to moon, but because they pass our sniff test for long-term product potential.

Coin-by-Coin Reviews of Gaming Altcoins Under $1

Below are our detailed reviews of five gaming altcoins under $1 that passed at least 3 of our core screening criteria: real gameplay, active development, working tokenomics, and verifiable community engagement. These aren’t endorsements, they’re research-backed snapshots of projects that are live, liquid, and still in the game. Each review balances product health, investor logic, and market context.

Coin 1: GOG (Guild of Guardians)

Price at Time of Writing: $0.16

Source: CoinGecko – GOG

What It Is

Guild of Guardians is a mobile fantasy RPG built on Immutable X where players collect heroes, raid dungeons, and earn rewards via NFTs and token-based economies.

The game blends Diablo-style combat with team-based strategy, and it’s playable.

The closed beta launched in Q2 2024, and the public mobile release is expected in late 2025.

GOG Token Utility

- Used to craft in-game assets

- Pay fees, upgrade heroes

- Used in governance (although limited in scope)

- Core currency in Guild Raids and PvP matchmaking

Unlike many other GameFi tokens, GOG actually has ways to spend within the game, rather than just being limited to staking pools.

Strengths

- Backed by Immutable X, one of the most developer-friendly L2 chains in gaming

- The game has already been demoed with a real app, real footage, and real mobile builds

- Tokenomics include gradual unlocks through 2027, with transparent schedules

- Active player interest on Discord and X (Twitter)

- Dev updates are regular, with GitHub activity here

Red Flags for GOG

- It is still in soft-launch, no open App Store availability yet

- Token supply inflation could increase after full launch

- High expectations due to Immutable backing (could work against them if it flops)

- It”s mobile-first game design limits the hardcore PC user base

Our Opinion

GOG isn’t a bet on speculation, it’s a bet on execution.

The project sits at the edge of being mainstream-ready, but it’s not quite “there” yet.

If the game launches cleanly in 2025 and player retention is solid, GOG at $0.16 could be one of the few gaming altcoins under $1 that survive the cycle.

We include it because:

- Game exists

- Gaming tokens are used in real mechanics

- Builders are still active

- It’s not just a narrative plan

Coin 2: ILV (Illuvium) – Game Assets & Subtoken Plan

Price at Time of Writing: $0.89

Source: CoinGecko – ILV

What It Is

Illuvium is an open-world auto-battler RPG that blends Pokémon-style monster collection with strategy combat but with AAA visuals and Unreal Engine 5 design. The ecosystem includes multiple game modules:

- Illuvium Arena (battle autochess)

- Illuvium Overworld (exploration + capture)

- IlluviDEX (marketplace)

- Zero (land & resource game)

It runs on Ethereum and Immutable X, with gasless in-game actions for smoother UX.

ILV Token Utility

- Used for staking, yield farming, and DAO voting

- Functions as the governance token, not the in-game currency (sILV2 and other gaming altcoins used inside games)

- Shared revenue model: players who stake ILV earn yield from protocol-generated fees

This is important: ILV is more like a share in the Illuvium economy than a spendable coin in gameplay. But it still qualifies under our methodology because it ties directly to game health, protocol activity, and NFT marketplace use.

Strengths

- AAA production quality (built in UE5, arguably the best visuals in Web3)

- A multi-game universe with asset interoperability

- ILV staking rewards are tied to protocol revenue, not inflation

- Active GitHub activity (Illuvium GitHub), detailed whitepaper, and responsive governance

- Massive community on Discord + Twitter + ongoing live game demos

Weaknesses

- ILV isn’t used directly in core gameplay; the ecosystem uses multiple subtokens (e.g., sILV2), which confuses new investors

- it’s fully diluted valuation is still high (~$800M+), which limits upside

- Complex tokenomics make it harder to value for retail buyers

- There are delays in mainnet features and early access in some regions

Our Verdict

ILV is a macro bet on Illuvium’s ecosystem rather than the token you’ll earn inside the game.

One should think of it as holding equity in a studio, not coins in a backpack.

That makes it different from GOG, but equally relevant.

It passes our filters because:

- Builders are active

- Gameplay is real and shipping

- ILV links directly to revenue + ecosystem utility

- The token is already on major U.S.-accessible exchanges (Coinbase, Binance US)

At $0.89, ILV offers speculative upside only if the Illuvium ecosystem hits escape velocity in 2025. If not, it could stagnate as a governance-only ghost token.

Coin 3: REVO (Revoland) – Real-Time PvP with Live Player Metrics

Price at Time of Writing: $0.012

Source: CoinGecko – REVO

What It Is

Revoland is a MOBA-style PvP arena game, akin to Brawl Stars, built on the HUAWEI Cloud and integrated with MultiversX (formerly Elrond).

Unlike most blockchain games, Revoland is live and downloadable on mobile via both iOS and Android.

Players control heroes in 3v3 battles, with multiple modes (Deathmatch, Tower Defense, etc.), and earn crypto gaming coins through ranked play and tournaments.

REVO Token Utility

- Used for entry fees, upgrades, and NFT purchases

- Payout currency in PvP matches and in-game challenges

- Also tied to governance (though lightly used in that role)

Token is tightly integrated into actual gameplay economics, not just staking.

It’s strengths

- Fully launched game on mobile with an active download base

- PvP design gives the game a competitive edge, more sustainable than idle farming loops

- In-game token sinks (entry fees, upgrades) add a real use case for REVO

- Core development updates are pushed regularly. Revoland GitHub is semi-active

- Community active across Telegram and Asia-based esports circuits

Red Flags From Our Side

- Very low price, high volatility zone with whales potentially dominating liquidity

- The team has limited transparency, the docs are vague, and GitHub is not fully open

- Some in-game assets and modes are heavily monetized (could alienate F2P users)

- Community skewed heavily toward Asia, which could limit broader appeal to U.S. investors

Final Verdict

Revoland isn’t just a concept rather it is a game you can download and play today.

This alone makes it stand out in a landscape full of vaporware.

But this isn’t a blue-chip project; it’s a high-risk, high-activity altcoin with live usage and minimal Western coverage.

We’re including it because:

- It has real PvP gameplay

- The token is actively used in-game

- It’s under $0.02 with active markets and listings

- One of the few gaming altcoins under $1 that isn’t stuck in pre-alpha

It’s not a “safe “lay, but if you’re speculating with a small allocation, REVO is precisely the kind of coin that catches a second wind if it hits a user growth curve.

Coin 4: MAGIC (Treasure DAO) – The Gaming Layer of Arbitrum

Price at Time of Writing: $0.63

Source: CoinGecko – MAGIC

What It Is

MAGIC is the ecosystem token for Treasure DAO, a gaming-focused protocol on Arbitrum that serves as a decentralized game launcher, marketplace, and economy layer for indie Web3 games.

It’s not tied to a single game. Instead, MAGIC fuels dozens of on-chain games built on Treasure, such as:

- Bridgeworld (resource farming + strategy)

- The Beacon (action rogue-lite with NFTs)

- Knights of the Ether (deckbuilding PvP RPG)

- Smolverse, BattleFly, and more

Treasure is like Steam, but for crypto games. It’s built with modular token rewards. The platform also uses loot economies and open infrastructure.

MAGIC Token Utility

- Used across multiple games for crafting, battles, rewards, and governance

- Staked in the Atlas Mine for yield

- Accepted in the Treasure marketplace for NFT trading

- Cross-game interoperability makes it unusually sticky for an altcoin

Importantly, MAGIC isn’t just governance fluff; it’s a spendable, earnable, burnable asset in the Treasure ecosystem.

Positives

- Multiple games already live, all interoperable via Treasure DAO

- Runs on Arbitrum G, as efficient, scalable, and EVM-native

- MAGIC has real token sinks and usage across several games

- Builders are constantly updating: GitHub – Treasure DAO

- Deep U.S. user presence, with MAGIC listed on Coinbase, Binance US, and Arbitrum-native DEXes

- Backed by strong player communities in The Beacon and Smolverse, not just degens

Negatives

- A complex ecosystem is confusing for new retail investors

- Volatility driven by individual game launches (ex, Bridgeworld’s recent drop)

- DAO governance can be slow, with competing priorities between game devs

- Still highly speculative, relies on the ecosystem staying alive through 2025–26

Final Opinion

MAGIC is one of the most legitimate gaming altcoins under $1, but it’s not for passive holders.

This is an ecosystem token that tracks the health of a growing universe of games, tools, and marketplaces. You’re not betting on a single game going viral. You’re betting on Treasure becoming the hub for indie Web3 gaming over the next cycle.

It made our list because:

- Real usage across 5+ live games

- Devs and the community are active and public

- Available on major exchanges

- MAGIC is used, not just farmed or staked

For investors looking beyond market trends and toward tangible gaming infrastructure, $MAGIC offers one of the more established sub-$1 ecosystems with real usage and ongoing development.

Coin 5: PYR (Vulcan Forged) – Cross-Game Utility Meets Centralized Execution

Price at Time of Writing: $0.92

Source: CoinGecko – PYR

What It Is

PYR is the native token powering Vulcan Forged, a centralized Web3 gaming studio with its own game engine (VulcanVerse Engine), custom blockchain (Elysium), NFT marketplace, and a growing catalog of games.

Their flagship titles include:

- VulcanVerse – a Greek-myth themed MMORPG

- Forge Arena – a PvP TCG-style game

- Berserk – fast-paced strategy card battler

- Plus land/NFT integrations and DeFi modules

The studio is building an entire game + infrastructure + economy stack, not just one product.

PYR Token Utility

- Used for land staking, NFT upgrades, entry fees, and tournament rewards

- Required to buy, rent, and upgrade items across all Vulcan titles

- Heavily used in the Vulcan marketplace, and locked through vesting + staking programs

- Gas token on Elysium chain (similar to MATIC on Polygon)

PYR is deeply integrated into all gameplay loops whether PvE, PvP, or land-based.

Pros

- The real games live right now, not in alpha

- Studio has built its own tech stack: chain, engine, assets, marketplace

- 10+ games share a single wallet and NFT inventory unusual in Web3

- Active GitHub, consistent updates

- Token has real in-game utility, not just governance fluff

- Available on major exchanges, including Binance and KuCoin

Cons

- Semi-centralized studio updates, token supply, and governance decisions come from core team

- Tokenomics are complex, with legacy vesting deals from 2021–2022

- Some games feel rushed or under-polished especially compared to Unreal-based projects

- U.S. accessibility can vary depending on regional listings and wallets

Verdict

PYR is the most Web2-style studio on this list tightly controlled, shipping fast, and aiming for revenue-first products.

It’s not a pure “crypto-native” ecosystem like MAGIC or GOG. But it works and in a space full of abandoned projects, that’s a competitive edge.

It made our shortlist because:

- Games are already live and functional

- The token has broad utility across the Vulcan ecosystem

- Team is still building, still updating, still showing up

- $0.92 gives it mid-cap exposure without high inflation risk

If you’re open to supporting a more centralized studio, you may get actual results in return. PYR is one of the few gaming altcoins under $1 with solid infrastructure. However, cryptocurrency investments are risky. Be sure to do your own research before making any decisions.

How to Build a Balanced Gaming Altcoin Under $1 Portfolio

Let’s be real, investing in gaming tokens isn’t like buying ETH or holding BTC for five years. These coins move fast, break hard, and rely heavily on momentum, product delivery, and trend cycles.

So if you’re going to allocate to this niche, you need to treat it like a speculative satellite, not a core portfolio pillar.

Here’s how we approach it while keeping risks in mind.

Limit Exposure to 5-10% of Your Crypto Stack

This sector is characterized by high upside and a high collapse rate. No matter how bullish you feel, gaming altcoins under $1 should never be more than a small tactical allocation.

Treat them like venture bets: you expect a few to fail, but the ones that survive can 10x.

Diversify by Project Stage & Model

In our shortlist alone, you’ll notice diversity across:

| Token | Model | Status | Region | Chain |

|---|---|---|---|---|

| GOG | Game-first | In closed beta | Global | Immutable X |

| ILV | Ecosystem & staking | Early access live | Global | Ethereum / IMX |

| REVO | PvP live gameplay | Fully launched | Asia | MultiversX |

| MAGIC | Ecosystem token | Multiple games live | U.S./Global | Arbitrum |

| PYR | Studio token | Full stack shipped | EU/Asia | Elysium |

Don’t bet all on early-stage or all on PvP. Mix them.

Favor Utility Over Narrative

Tokens that are only used for governance or yield tend to get dumped.

What you want are crypto gaming coins that players spend, burn, or stake inside the game loop.

All 5 of the gaming altcoins under $1 we picked have active in-game or ecosystem utility, not just hype.

Use Trailing Stop-Losses, Not Blind HODL

Even the best gaming altcoins under $1 can lose 70% of their value in weeks if a game update flops. Set guardrails.

Use trailing stop-losses, take profits after 2-3x runs, and never marry your bags.

Tools to Track Gaming Tokens

We recommend keeping tabs on these (bookmark-worthy):

- DappRadar – Games

- CoinGecko – Play-to-Earn Tokens

- CryptoSlam – NFT Gaming Volumes

- GitHub + project Discords for dev activity

Gaming altcoins under $1 can outperform during risk-on crypto rallies. But they crash just as violently, often with no warning.

An innovative portfolio hedges this volatility by:

- Allocating small but strategic capital

- Favoring projects with live gameplay

- Watching unlock schedules and GitHub push frequency

- Taking profits when social sentiment peaks

We’ve tested all 5 coins listed earlier against these exact rules, which is why they made the cut.

Security Red Flags in Gaming Tokens

If you’ve been around crypto gaming for even a single cycle, you’ve seen this story before:

Flashy teaser trailer – Token launch – Influencer hype – Discord pumps. Then? Silence.

The truth is, most gaming altcoins under $1 don’t fail because they’re unlucky; they fail because they were never secure to begin with.

Let’s break down the most common red flags, not just technical ones, but behavioral and structural ones too. These are patterns we’ve seen in dozens of failed GameFi altcoins that once looked promising.

No GitHub Activity? No Confidence.

If you’re dealing with an open-source Web3 game, there’s no excuse for a silent GitHub.

Even if you’re not a developer, you can check for:

- The last code commit

- Number of contributors

- Whether the roadmap features are being shipped

If nothing’s moved in 30, 60, 90+ days, that’s not “early stage.” That’s abandoned.

Projects like CryptoBlades showed this pattern post-hype: no commits, no fixes, just token decay.

“Trailer-First” Projects (Without a Playable Build)

A massive red flag is when marketing outpaces development.

You’ll see high-budget trailers, cinematic cutscenes, influencer reviews, but no alpha. No beta. No live gameplay.

If you can’t click “Play Now” on the website or request access, you’re not looking at a product; you’re looking at a pitch deck with a token.

Wallet Concentration (And Unlocked Team Tokens)

Some gaming tokens launch with 70%, 80%, or even 90% of the supply in a handful of wallets. Many aren’t even vesting. That’s not tokenomics, that’s hostage-taking.

Before investing, always check:

- Top wallet holders on Etherscan, Arbiscan, or Debank

- Whether those wallets belong to the team, VCs, or centralized exchanges

- If the unlocks are publicly documented

If one wallet can crash the chart, it will. Eventually.

No Docs, No Whitepaper, No Team

Believe it or not, there are still gaming tokens launching in 2025 without whitepapers or even a one-pager.

If there’s no transparency about:

- Team bios (even pseudonymous devs should be consistent and active.

- Tokenomics schedule

- Game mechanics and vision

…then you’re buying a ghost and hoping it becomes real.

Ponzi Game Loops Disguised as Play-to-Earn

The problem isn’t just “token emissions.” It’s what those emissions are trying to mask.

If players are only active when token rewards are high, and disappear the second emissions slow, you’re looking at a game-shaped yield farm.

A few signs you must look for :

- No reason to play other than “earning”

- No sinks (burn mechanics, crafting, in-game utility)

- Dead Discord activity post-airdrop

Monsta Infinite is a fine example which collapsed like this. Players logged in for rewards, but when the value dropped, so did everything else.

“Multichain” Theater (But Zero Liquidity)

Don’t be fooled by projects boasting “multi-chain” listings on Arbitrum, Polygon, BNB Chain, etc.

If each listing has:

- No liquidity on DEXs

- No active community presence on those chains

- No gameplay or staking support cross-chain

… it’s not a multi-chain expansion. It’s a distraction.

No Burn, No Sink = No Floor

One of the most basic rules in GameFi altcoins design: if users can only earn and sell, the price has no floor.

Smart GameFi projects design a loop of friction:

- NFT fusions or upgrades

- Marketplace taxes

- PvP tournament entry fees

- Item repairs, gas fees, etc.

If none of that exists, the token is just an inflation machine.

At the End : If It Walks Like a Rug, It’s Probably a Rug

Security isn’t just about smart contract audits. It’s about visibility, accountability, and actual delivery.

Ask yourself before buying:

- Do I know who is building this?

- Can I see what is being built?

- Does the token serve any purpose for players?

Suppose the answer is “no,” step back. Wait. Observe.

You don’t need to catch every gaming moonshot. You need to avoid the obvious landmines.

Also Read – Top DeFi Altcoins Under $1 with Real World Use Cases

Tools Every Gaming Token Investor Should Use

There’s a huge difference between “DYOR” and actually doing real research.

Most people in GameFi still confuse due diligence with watching a 60-second TikTok clip or checking if their favorite YouTuber made a bullish thumbnail.

That’s how you get rugged. If you’re putting even $100 into a gaming altcoin under $1, you owe it to yourself to use tools that show what’s really going on, not what the marketing team wants you to believe.

Below are the ones we use at AltcoinsNest, not because they’re perfect, but because they give us an edge.

First Check Point: CoinGecko + CoinMarketCap

Yes, they are basic. But they are still where the fundamentals live:

- Max supply vs. circulating supply

- Fully diluted valuation

- Historical price trends

- Real trading volume vs. wash trading

The trick is knowing what to ignore. Most “trending” lists are useless. What matters is the depth of listings, volume legitimacy, and on-chain confirmation of token stats.

Always grab the contract address from these sources, never copy from social media. Mistakes here = scams.

Search For What’s Actually Being Built? → GitHub

You don’t need to write code to spot a dead repo.

A healthy open-source gaming project should show:

- Commits in the last 30–60 days

- Roadmap activity (not just marketing decks)

- Multiple contributors, not a solo dev ghosting everyone

Use GitHub as your build signal. No commits = no commitment.

🔗 GitHub

Find Out Who is Actually Playing? → DappRadar

Forget DAUs shown on pitch decks. You want blockchain-verified usage. That’s where DappRadar comes in.

It lets you filter by:

- Chain (Arbitrum, Polygon, Ronin, etc.)

- Genre (PvP, NFT, RPG)

- User count and smart contract activity

If a game claims “50,000 players” but has 12 active wallets on-chain, you have your answer.

Take The Signal from the Noise → Discord & Telegram

You learn a lot about a project not from the whitepaper… but from the chatroom.

Here’s what to listen for:

- Are mods engaging or just deleting concerns?

- Do users talk about the game or just the low priced crypta?

- Is there anger about missed deadlines or missing features?

Silent Discord = dying project.

Over-moderated Discord = panic behind the scenes.

If it feels dead in there, it probably is.

Crypto Gaming Coins Locks & Vesting Schedules → Gaming TokenUnlocks

Most gaming altcoins under $1 fail because of one thing: supply unlocks.

You need to know:

- When early investors can sell

- How much the team is still holding

- What % of the supply is hitting the market soon

We’ve seen gaming altcoins under $1 crash 70% overnight because nobody was watching the cliff unlocks.

Deeper On-Chain Analysis → Messari & Artemis

If you want to go full analyst mode, use:

- Messari for token metrics, ecosystem comparisons, and macro-level insights

- Artemis to compare GameFi platforms by DAU, TVL, emissions, and more

These are not beginner tools, but if you’re allocating more than 5% of your crypto stack into gaming, they’re essential.

Bonus: Google Isn’t Dead Yet

Here’s something underrated: old-school Googling.

- Search “[Project name] + rug pull”

- Search GitHub + project name

- Search “[token name] + criticism” on Reddit

You’ll often find threads from angry ex-players, early investors, or former mods that reveal what the landing page won’t tell you.

Final Thought: Tools Don’t Help if You Don’t Use Them

Everyone says they want the next 100x gaming altcoin.

But very few people spend 15 minutes checking:

- If the team is real

- If the game exists

- If the token has a reason to exist beyond farming

If you’re reading this post, you’re already ahead of most retail investors. Use these tools to stay that way.

Also Read : 7 Best Wallets for Altcoins in 2025 (Secure, Multi-Chain Ready)

FAQs About Gaming Altcoins Under $1

We get it. Gaming tokens are messy. They’re part entertainment, part finance, part speculation, and most of them don’t make it.

But for those willing to ask the right questions before buying in, there’s still real opportunity hiding in the volatility.

Let’s answer some of the most common (and misunderstood) questions from crypto investors diving into this niche.

Are gaming tokens just meme coins with better trailers?

It depends. Some are.

But the legit ones have:

- Playable games with token-linked mechanics

- Actual player bases you can verify on-chain

- Token sinks (entry fees, item upgrades, etc.) that reduce inflation

The red flag? When the game still doesn’t exist after a year of marketing, and all the volume is coming from CEX speculation.

Real gaming tokens don’t just exist for traders. They exist for players. And players don’t care about price action; they care about gameplay.

Why are so many gaming altcoins under $1?

Because the market caps are small, and the supplies are often massive.

A low priced gaming token trading at $0.03 might have:

- A circulating supply of 300M

- A total supply of 10B

- A fully diluted valuation that looks reasonable or terrifying

Just because a coin is “cheap” doesn’t mean it’s early.

Always check FDV. A token with a $700M FDV at $0.05 is not low-cap.

Is it safer to invest in gaming tokens that have already launched?

Generally, yes, but it’s not a guarantee.

Live games at least have:

- A build you can test

- Community feedback, you can analyze

- Revenue data, you can attempt to track

But post-launch doesn’t mean post-risk. Many tokens pump hard at launch, then bleed out over months as emissions outpace utility.

Best-case scenario? You find a game that’s post-launch, underexposed, and still building. That’s rare, but that’s what we try to surface.

Can a gaming altcoin under $1 really go 100x in 2025?

Mathematically, yes, especially if it’s micro-cap and undervalued.

But realistically? It depends on:

- Player retention

- Token burn mechanics

- Studio execution

- Chain support

- Market cycle timing

The last bull run saw games like Axie Infinity, GALA, and Thetan Arena post triple-digit or 1,000x gains.

Most crashed just as fast.

100x is possible. But it’s not probable — and it’s rarely sustainable.

How do I know if the token has real players?

Don’t trust headlines. Use on-chain data:

- DappRadar

- Footprint Analytics

- Token Terminal (for advanced DAU + revenue data)

- Discord server activity — not just numbers, but actual gameplay discussion

A token with 10,000 “users” but zero in-game chatter is likely farming with bots.

Let gameplay, not tweets, be your buy signal.

Conclusion: Speculation Is Cheap – Research Isn’t

It’s easy to get pulled in.

The trailers look incredible. The Discord’s buzzing. Influencers are calling it the “next Axie.” And the token? Just $0.03.

But cheap isn’t the same as early, and hype doesn’t mean product-market fit.

If you’ve read this far, you already understand the truth:

Most gaming altcoins under $1 will fail. Some quietly. Some spectacularly.

But the few that survive, the ones with real users, real mechanics, and real teams, could define the next generation of crypto gaming.

That’s where we focus.

That’s what AltcoinsNest is here to find.

So go ahead: take a position. But take it with your eyes open, your portfolio balanced, and your research deep.

Because of GameFi? The fun begins when everyone else logs off.

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.