We’re seeing a fresh market interest in governance altcoins under $1, small, tradable tokens that still give holders real voting power. This tendency is driven by the growing adoption of retailers and a new wave of DeFi, which CoinDesk has identified as one of the key themes for 2025.

The concept of affordable governance has become increasingly prevalent in most token launches and airdrop plans, with a continued focus on cheap governance tokens.

Why does governance matter? In other words, governance tokens are used to rationalize how a protocol changes through the decisions of communities. They are allowed to vote on upgrades, use of treasury, and the use of risk rules. Nowadays, CoinDesk’s guide provides a clear and unambiguous example of a primer, simplifying the practical purpose of these recently popularized tokens in DAOs and DeFi.

Most of the DAOs execute off-chain voting systems such as Snapshot, which allow communities to capture preferences before they are on-chain implemented, reducing costs and friction on the side of token holders.

Why focus on tokens under $1? There are three big reasons. First, accessibility per-token price may be low enough to allow the retail wallets of a larger proportion of the population to have a unit of voting portions without major investments. Second, there is a behavioral interest because a low price can usually attract speculators and other active communities on a project, particularly to use retroactive airdrops or on-chain incentives. Third, diversity – a great number of L2s, Cosmos chains, specialized DeFi protocols, and other issuers are providing growth capital through the issuance of governance tokens with less than one dollar value, yet feature real governance mechanisms.

If you’re exploring beyond governance, check out our analysis of the Top 7 Altcoins Under $1 to Watch in 2025, which sets the stage for this trend.

A word of haste, governance tokens, and DOAs are subjected to the shifting legal environment as highlighted in Reuters’ analysis of DAO liability. The regulators and courts continue to experiment with the concept of how DAOs should be incorporated into existing laws, which can impact token holders. We consider legal and regulatory uncertainty a significant risk.

Disclamier: This paper is purely informative. It is neither financial, tax, nor legal counsel. Always research on your own (DYOR).

If you’re exploring governance altcoins under $1 in 2025, you’ll find that affordability doesn’t mean irrelevance. Tokens like

Curve DAO (CRV), Arbitrum (ARB), dYdX (DYDX), Osmosis (OSMO), Ethena (ENA), Secret (SCRT), and KernelDAO (KERN) all provide

real DAO voting power, letting retail holders shape protocol decisions. These sub-$1 tokens balance accessibility with risks such as volatility and whale dominance, but they represent a growing movement where everyday investors can actively influence the future of DeFi governance.

What Are Governance Tokens?

Definition and Role in DAOs/DeFi

In their most basic form, governance tokens are pieces of electronic property that entitle their owners to participate in a protocol or active virtual organization. In contrast to traditional tokens, which can be used to pay or get staking rewards, governance tokens come with voting abilities regarding such decisions as upgrades, treasury distributions, or the release of new products.

Decentralized Autonomous Organizations (DAOs) are based on these tokens to maintain decentralized control. As an example, in the Arbitrum DAO, holders of ARB tokens can vote on changes to parameters in protocols, management of the treasury, and election of committees. Likewise, the CRV, which is Curve Finance technology, is utilized in voting for pool incentives, gauge weights, and protocol upgrades.

In DeFi, governance tokens are not just symbolic. They determine the rates of interest, liquidity stimulus, and even risk parameters. The voting process for stability fees and collateral types, utilizing tools like MKR from MakerDAO, may directly impact protocol users.

How Voting Power Works

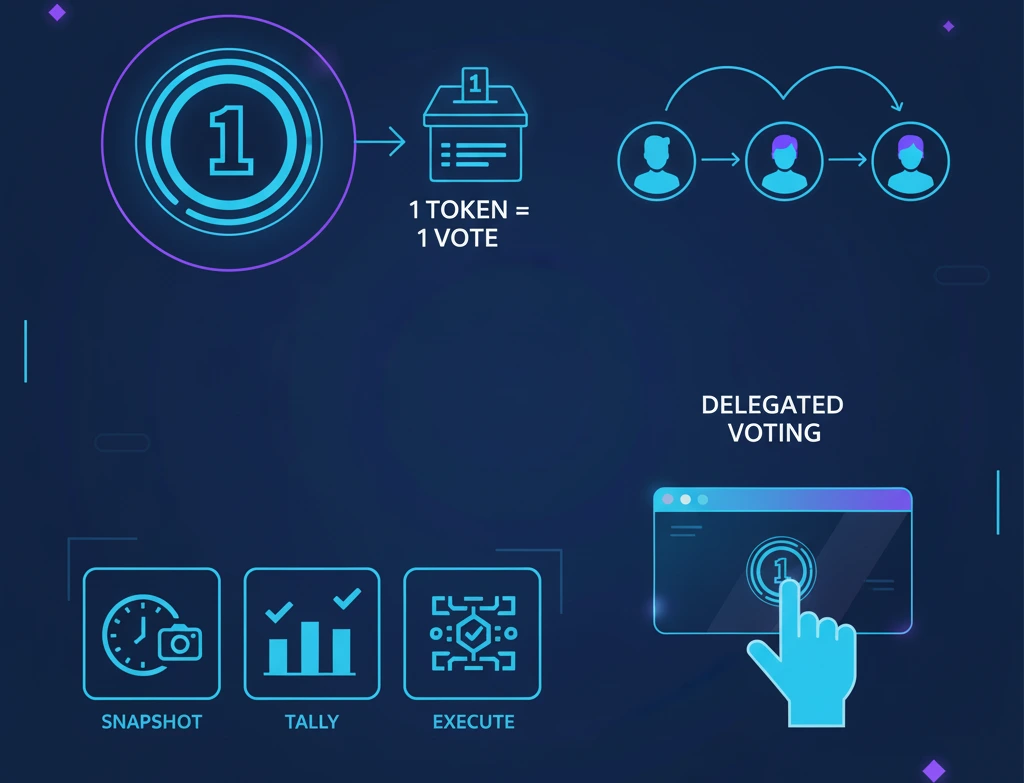

The voting in DAOs is typically based on the number of tokens that an individual owns. Simply put, 1 token = 1 vote, even though there are always exceptions in the form of DAOs where guests can delegate their votes and leave the voting process to another person. This is facilitation as regards those who are not able to follow all suggestions.

Off-chain platforms such as Snapshot and Tally are now used in many processes of governance. Snapshot records preferences in token holders with no gas charge, whereas Tally relates off-chain ballots with on-chain proposal execution. This pyrite framework decreases the entry barriers and makes the decisions implementable.

Little holders also have an opportunity to influence the direction of protocols through delegation and token-weighted voting by merging voting power. In practice, this means even governance altcoins under $1 can offer real participation, as tokens are often widely distributed among the community.

Why Focus on Tokens Under $1?

It is not in vain that there are numerous examples of decentralized autonomies that provide motivational tokens at lower than one-dollar prices. First, accessibility: in smaller denominations, retail users can become meaningful without making a very big investment. For instance, a similarly priced token could offer the Osmosis DEX the opportunity to stake and vote at a fraction of the price of comparable competitor offerings.

Second, tokenomics and incentives to participate are considered. Less expensive tokens may also be combined with a staking reward, an airdrop, or retroactive rewards to get people to participate in the community. This has the potential to generate active communities in their governance despite low token value domestically.

Last but definitely not least, there is perception vs reality: A low-cost token does not necessarily mean low influence. Part of the sub-slot Governance is token holders having real control over the protocol treasury or high-impact parameter values to have the power to influence the ecosystem. This renders them appealing to community-oriented investors who desire to participate as well as have exposure to the protocol development.

The same accessibility logic applies to other categories like utility altcoins under $1 and gaming tokens under $1, where retail-friendly pricing encourages participation.

Methodology: How We Chose the Governance Altcoins

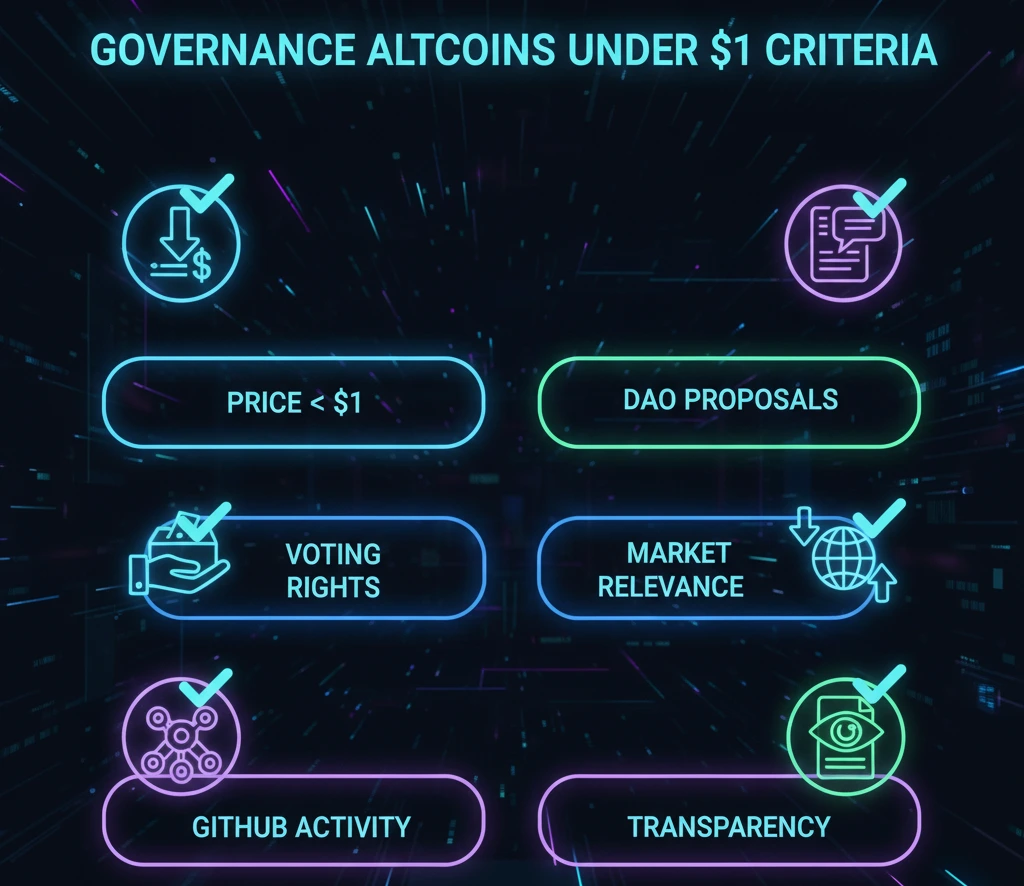

Price Requirement (Must Be Under $1)

We put a very strong condition that we would limit to tokens that are below a price of one dollar at the time they are being written. CoinMarketCap and CoinGecko were used as visual fluid market feeds to verify the prices. This ensures our list truly reflects governance altcoins under $1 that are accessible to retail investors.

Governance Role & Voting Power

Not all token prices are at low prices that govern. We only included tokens with documented DAO voting rights. As an illustration, protocol proposals and treasury allocation with ARB token in Arbitrum and incentive distribution and upgrades with dYdX token in dydx are the domains of tokens. Stake holders with no actual voting rights were left out.

Active Development & Interaction with the Ecosystem

Good governance cannot thrive without development. We had fetched GitHub commits, roadmap actions, and DAO proposal timeline. Active upgrades pursued by projects such as Osmosis include community voting, and Curve Finance often provides pool incentives via DAO votes. The list included projects that are clearly active.

This mirrors what we’ve seen in the growth of Layer 2 altcoins in 2025, where ecosystems evolve quickly with strong governance support.

Market Relevance in 2025

We focused on tokens that would be used in 2025, according to recent reports in the industry and we have been discussing over time. CoinDesk shows how governance tokens are constantly evolving as DeFi protocols grow in Layer 2 ecosystem. Dormant and otherwise less visible projects in this year were filtered out.

Diversity of Use Cases

Good list must cover the varying forms of governing ecosystems. This is why we added tokens of DeFi (CRV, DYDX), Layer 2 (ARB, ENA), and cross-chain ecosystems (OSMO, SCRT, KERNEL). Such diversity demonstrates that governance has no single niche. Nowadays, according to Messari, there are DAOs in DeFi, gaming, and infrastructure projects.

Transparency of Data

Lastly, we were restricting ourselves to the data that had a reliable socially credible verification. The market data was checked through CoinGecko and CMC. Governance proposals have been ratified via formal democracies via Snapshot, Tally, and Commonwealth. This will make it possible to put aside the fact that every fact we included is debunkable by the reader.

Top 7 Governance Token Altcoins Under $1 in 2025

Here’s our detailed look at seven governance altcoins under $1 that give holders real voting power in their respective DAOs and ecosystems. Each token is evaluated for price, market cap, governance model, and active development.

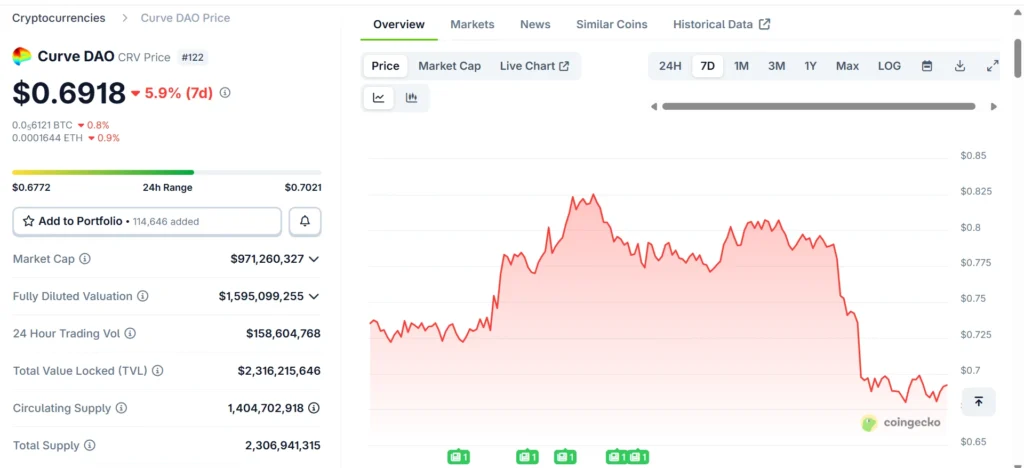

Curve DAO (CRV)

- Price : $0.69

- Market Cap : $971M

- Total Supply : 2.3B

The CRV token of Curve can sell below $1; however, it should not be taken as a sign of misguidance. CRV is referred to as the kingmaker of liquidity in DeFi circles. Why? To possess CRV, you must understand how and why power speculation is used rather than speculation itself; this is an effort to govern the flow of incentives in the ecosystem of stablecoins.

This will be important in the year 2025. One of the busiest in DeFi is still Curve DAO. In 2025, Curve DAO governance debated incentives between Frax pools and Lido staked ETH. The debates depicted that the changes in vast liquidity can even be made by small holders. As a point of reference, this number of votes represents a significant volume of trading, amounting to thousands of billions of dollars.

In terms of development, Curve is not in suspension. The team saw the release of Curve v2, which is not limited to stablecoins and supports volatile assets, with governance votes still refining incentive design. That mix of ongoing development and active governance keeps CRV relevant, even if the token price feels underwhelming.

Naturally, this has trade-offs. CRV supply is high, and the issue of token inflation has been there for a long time. This has been contested by some critics, claiming that the wild beasts monopolize the votes in the gauge. However, entry prices remain low, which simultaneously kept the retail participation alive and provides CRV with a distinct power influence and access to its DAO governance.

- Pros:

• Highly mature governance model (veCRV) that influences billions in liquidity incentives.

• Active community debate on major features (emissions, new pool rewards).

• Significant institutional attention and usage. - Cons:

• Whale voting & ve-locking tend to favor large holders.

• Inflation / emissions have historically raised concerns.

• Price under $1 may hide deeper issues around long-term sustainability. - Potential:

• Innovations in reward sharing or yield products may increase appeal.

• If DeFi continues growing, CRV remains central to stablecoin pools & AMM design.

• Possible rebalancing of protocol incentives in favor of smaller participants.

It’s worth comparing governance design with payment altcoins under $1, where protocol mechanics prioritize transactions rather than decision-making.

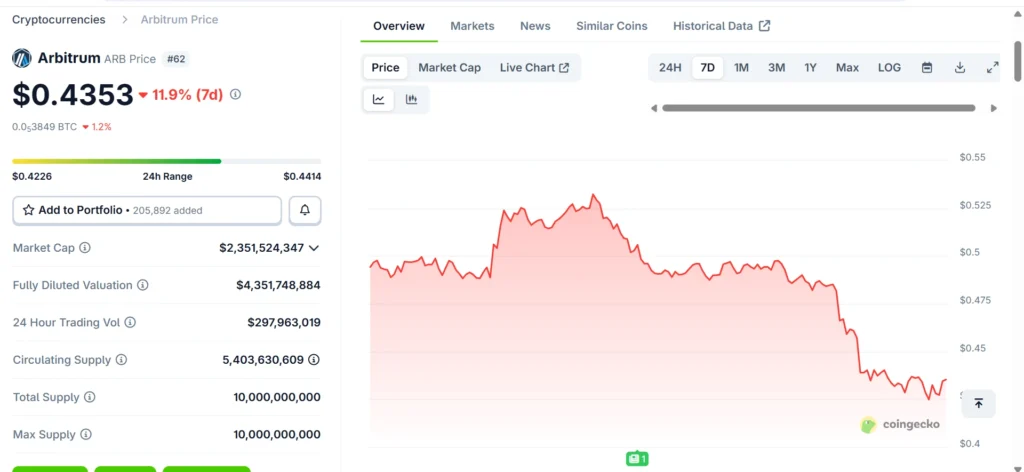

Arbitrum (ARB)

- Price : $0.43

- Market Cap : $2.3B

- Total Supply : 10B

The Arbitrum’s ARB token entered the headlines with its extreme airdrop and became the subject of active forward governance since then. ARB gives holders a voice in one of Ethereum’s busiest Layer 2 ecosystems, even at a price of less than $1 in 2025.

More recent proposals of DAO have involved treasury allocation strategies and funding grants to Arbitrum-based DeFi projects. Those votes count: billions of dollars are locked in Arbitrum-based protocols, and governance decisions determine the success of dApps.

It also has a good developer pipeline. Arbitrum remains the leading Layer 2 scaling solution, alongside Optimism, ensuring ARB management is representative. What critics note is that the whale wallets and centralized foundations continue to have some disproportionate power. However, retail governance persists due to the low cost of the token and its strong activity, making ARB one of the potential governance altcoins.

- Pros:

• Strong ecosystem with many dApps already live on Arbitrum, governance votes can shift real infrastructure direction.

• Price under $1 makes participation possible even for smaller holders.

• High market cap adds credibility and stability relative to very low-cap tokens. - Cons:

• Large supply and ongoing unlocks may dilute voting power for early or small holders.

• Some centralization concerns, certain wallets or committees often carry more sway in proposals.

• L2 dependencies (Ethereum gas, security) may introduce external risks. - Potential:

• If ARB governance continues to delegate power to community sub-DAOs, we may see more grassroots proposals.

• Further drop in price could make ARB even more accessible, but also increase volatility.

• Expansion of rollups / interoperability could enhance the utility of ARB holders in cross-chain strategy.

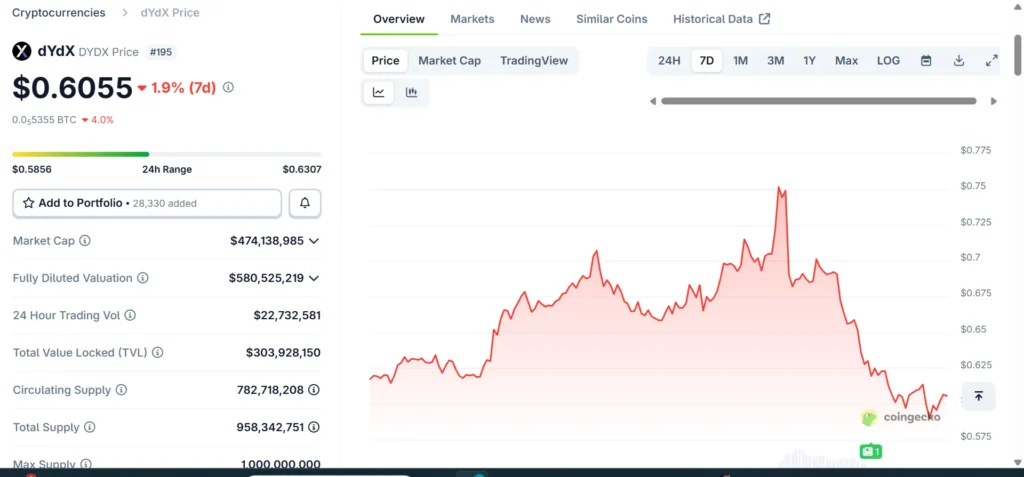

dYdX (DYDX)

- Price : $0.65

- Market Cap : $474M

- Total Supply : 958M

dYdX began as a centralized perpetuals exchange but has evolved to become a fully decentralized Layer 1 chain. Its DYDX token isn’t just for fees; it’s actually the backbone of its governance system. DYDX DAO in 2025 is one of the most technically sophisticated DAOs in DeFi.

For example, governance votes have been used to decide on validator incentives and treasury spending on the new Cosmos-based chain. This shows how DYDX holders are steering the project as it evolves beyond Ethereum.

Price-wise, DYDX has slipped under $1 during the period the governance influence remains powerful. As CoinDesk reported that the protocol’s full decentralization was a milestone for DeFi governance. Still, DYDX governance suffers from the problem of participation from voters, with voter turnout lagging behind the count of token holders. That said, for those who are willing to participate, DYDX does provide a very real voice in an advanced trading ecosystem.

- Pros:

• Governance active in parameter/tax/fee adjustment; decisions meaningfully impact users.

• Strong development activity, especially with its L1 chain.

• Moderate market cap and liquidity make governance practical for many. - Cons:

• Participation / voter turnout sometimes lags, especially in smaller holders.

• Derivatives & trading protocols have regulatory risk in many jurisdictions.

• Governance influence may be concentrated among validator or operator groups. - Potential:

• As the chain matures, governance might unlock more stakeholder incentives.

• If dYdX handles cross-chain derivatives well, value & usage could expand.

• Governance decisions that improve UX or lower fees could draw new users, enhancing token value.

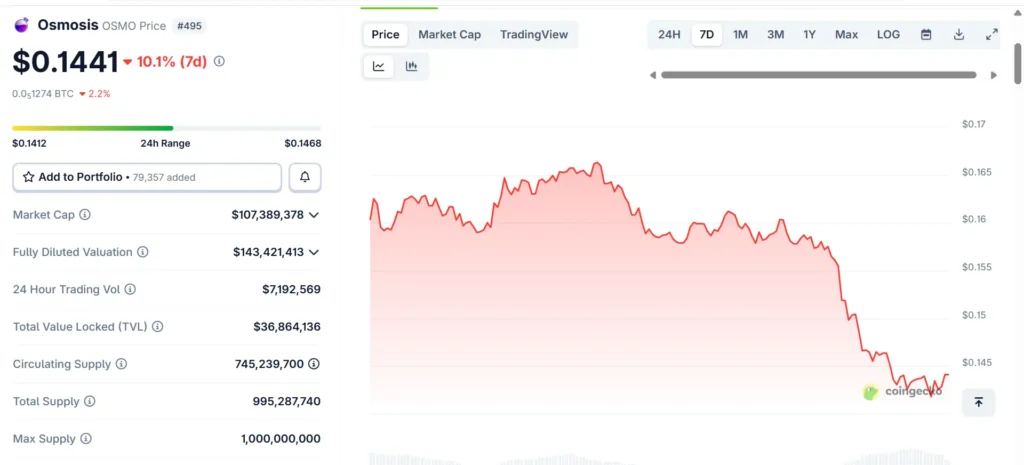

Osmosis (OSMO)

- Price : $0.14

- Market Cap : $107M

- Total Supply : 995M

Osmosis is the liquidity center of the Cosmos ecosystem, and incentives as well as government are driven by its OSMO token. With a price of less than $1, OSMO is one of the cheapest governance tokens that have an actual cross-chain liquidity impact.

Both the initial parameter modification and treasury grant proposals have an active history of being proposed by the Osmosis Governance Tracker. In fact, this year, the community was discussing the inclusion of new cross-chain assets in the DEX, which is an example of how OSMO holders influence the Cosmos adoption.

While interchain features continue to grow, governance has kept pace through voting activities, in which liquidity pools receive boosted incentives. The Osmosis governance is among the most participatory governance in Cosmos, according to the research by Messari on DAO. There are also risks, such as reduced liquidity relative to Ethereum-based DEXs, yet OSMO demonstrates that the governance of DAOs is much more expansive than Ethereum.

- Pros:

• Very low cost for participation; staking + governance is accessible.

• Strong community involvement in Cosmos ecosystem.

• On‐chain governance ensures transparency. - Cons:

• Smaller market cap means higher volatility & potential liquidity issues.

• Validator set / chain parameters can centralize influence in Cosmos chains.

• Less global visibility compared to Ethereum / large DeFi tokens. - Potential:

• Growth of cross‐chain DeFi could pull more users to Osmosis.

• More assets, more integrations mean governance decisions have more stakes.

• Governance improvements can unlock broader community involvement.

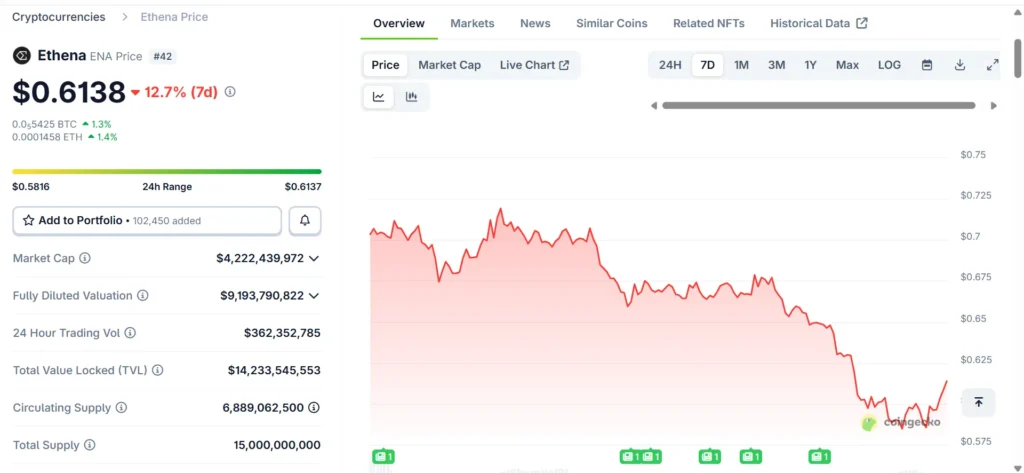

Ethena (ENA)

- Price : $0.61

- Market Cap : $4.2B

- Total Supply : 15B

In 2024, the ENA token Ethena entered the market with the new synthetic dollar, USDe. ENA below $1 has emerged as a governance token to monitor as the project implements new types of decentralized stability.

ENA holders have a vote on the collateral requirements, risk parameters and stability mechanisms, information of which is provided in Ethena governance documents. With that said, ENA is a one-of-a-kind type of governance token since it is directly connected to the operations of a synthetic dollar competing with stablecoins.

The project has been growing rapidly, with the USDe trading volumes increasing day after day in 2025. But there are risks. The artificial dollar models are speculative, and a wrong decision on governance could undermine the peg. Nevertheless, it remains one of the most interesting sub-$1 governance plays to date because ENA governance touches real-world financial primitives.

- Pros:

• Clear governance model (Risk Committee, voting on stability and collateral parameters).

• Strong market cap suggests investor confidence.

• Under-$1 price still allows entry for more participants. - Cons:

• Synthetic asset risk: managing collateral, oracles, and maintaining peg can fail in extreme stress.

• Regulatory exposure is higher for protocols dealing with synthetic dollars.

• Price volatility: ENA has had large swings from ATH, which can affect sentiment and participation. - Potential:

• If stablecoin usage (USDe) grows, ENA holders may benefit from fee revenue or usage fees.

• More proposals leading to revenue sharing could raise the intrinsic value of governance.

• Could become a benchmark for synthetic dollar governance if well managed.

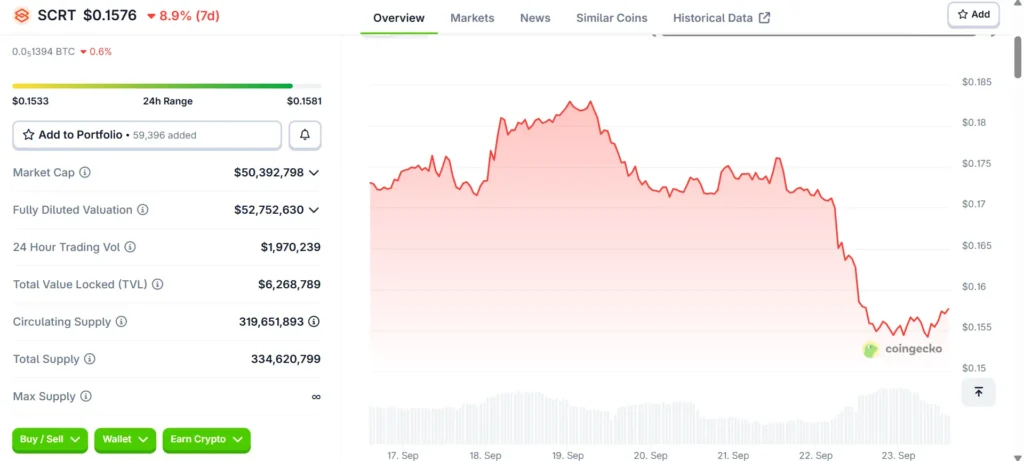

Secret (SCRT)

- Price : $0.15

- Market Cap :$50.3M

- Total Supply : 334M

Secret Network’s privacy secrets in smart contracts have long been an advocated goal, and the Secret Network SCRT token, worth less than a dollar, remains a source of expansion and governance. The unique difference of SCRT is that the question of privacy-preserving technology used to govern is often unique, and few DAOs address such matters.

Secret Network has discussed governance proposals on its governance portal, including proposals to change validators, upgrade protocols, and provide grants for privacy-enhancing dApps. These discussions are important, as Secret exists in a regulatory grey zone, and it is not only difficult to control but also a necessity.

The network has received substantial funding for developing privacy, according to the report by CoinDesk. However, voter turnout has been low, and liquidity to SCRT is low. Still, in the eyes of users who value their right to privacy in blockchain, SCRT governance is an uncommon means of leverage.

- Pros:

• Unique focus on privacy smart contracts, this differentiates it from many other sub-$1 governance tokens.

• Low price + small market cap give potential upside if privacy demand rises.

• Active governance in real technical scope (validator sets, upgrades) shows it’s not just speculative. - Cons:

• Very low liquidity compared to larger tokens, harder to buy/sell without slippage.

• Regulatory risk for privacy-focused blockchains can be significant and unpredictable.

• Voter turnout and participation historically fluctuate, which can centralize power. - Potential:

• If privacy regulations remain favorable / clear, SCRT may see renewed interest.

• Technical developments (e.g. enhanced privacy contracts, zero-knowledge proofs) could attract new developers.

• Partnerships with projects needing privacy for DeFi/NFT/gaming could expand usage and governance activity.

KernelDAO (KERN)

- Price : $0.21

- Market Cap : $50.5M

- Total Supply : 1B

Kernel (KERN) is a smaller project compared to the rest of the projects here, but it represents the experimental edge of DAO governance. At less than $1, KERN is intended to be a governance-first token, meaning that the most important use case for KERN is to allow holders to determine the direction of the protocol.

On Commonwealth, KERN holders have argued for the raising of treasury allocation and educational programs funding. Unlike many tokens where governance is secondary, for Kernel, the focus is on community decision-making.

Though trading volumes are thin, through an emphasis on education and open governance, Kernel has distinguished itself in DAO research circles. KERN carries a higher risk, due to its callouts relating to small size and lack of liquidity, but it’s an interesting case study of what “pure governance tokens” look like.

- Pros:

• Designed as governance-native: governance is a core function, not a side feature.

• Low price gives potential for community growth & grassroots participation.

• Active proposals show real decision flows (rewards, ecosystem incentives). - Cons:

• Small size means risk of low liquidity and high price impact.

• Less tested – fewer historical proposals; more risk of governance missteps.

• Higher vulnerability to token concentration or early holder advantage. - Potential:

• If Kernel builds more partnerships or ecosystem projects, its governance may gain broader relevance.

• Could serve as a testbed for governance experiments.

• Risks are high, but upside for early users if governance matures.

Comparison of the Best Governance Altcoins Under $1 (With Voting Power in 2025)

| Token | Price (Live*) | Market Cap | Governance Mechanism | Key Benefits | Main Risks | Potential |

| Arbitrum (ARB) | ~$0.43 | ~$2.3B | Snapshot, DAO proposals | Large L2 ecosystem, frequent votes, strong liquidity | Token unlock dilution, whale influence | Growth with Ethereum rollups, DAO treasury expansion |

| Ethena (ENA) | ~$0.61 | ~$4.2B | Risk Committee + DAO voting | Tied to synthetic dollar stability, transparent structure | Regulatory risk, synthetic asset volatility | If USDe adoption grows, governance becomes financially powerful |

| dYdX (DYDX) | ~$0.63 | ~$474M | On-chain governance on dYdX Chain | Trading parameters, validator incentives, active dev | Regulatory risk, validator concentration | Expansion of derivatives governance, strong cross-chain role |

| Curve DAO (CRV) | ~$0.69 | ~$971M | veCRV lock & vote-escrow | DeFi liquidity incentives, high community engagement | Whale domination, inflationary tokenomics | Still central to DeFi stablecoin pools, AMM innovation |

| Osmosis (OSMO) | ~$0.14 | ~$107M | On-chain voting in Cosmos | Low entry cost, strong community, Cosmos growth | Small cap = volatility, validator concentration | Growth of cross-chain DeFi, more integrations = higher influence |

| KernelDAO (KERNEL) | ~$0.21 | ~$50.3M | Governance-native protocol DAO | Community-driven, grassroots, experimental | Low liquidity, small size = higher risk | Could pioneer new DAO governance models |

| Secret Network (SCRT) | ~$0.15 | ~$50.5M | On-chain voting, validator participation | Privacy-first smart contracts, niche governance | Regulatory pressure, low liquidity | Rising demand for privacy tech, unique niche in DeFi |

How to Participate in Governance Voting

Being involved in governance is what makes decentralized networks more decentralized finance. The difference between shareholders in an enterprise and the involvement of token holders is that it directly affects the development of protocols: whether the structure of their fees or a proposal to provide these funds is to be approved. I will take it bit by bit.

Obtaining and Retaining Government Bonds.

Firstly, one must have governance tokens in order to participate in a vote. These have exchanges such as Binance, Coinbase or even decentralized platforms such as Uniswap. We are always required to verify whether a project suggests using a token storage in a self-custodial wallet (such as MetaMask or Keplr) or a protocol-specific wallet.

In most DAOs, you must keep tokens in your personal wallet and not on the centralized exchanges, which prevents you from owning the tokens to become eligible to vote. As a case study, during the initial period of the launch of Arbitrum and its DAO, community members had to acquire and deposit ARB in individual wallets and had the opportunity to vote in initial governance.

Case Study: Arbitrum’s Token Unlock and Governance Participation

In April 2023, Arbitrum launched its first governance project, AIP-1, focused on distributing a large amount of its treasury funds. But the community voiced objections regarding the size and openness of this proposal. Therefore, the Arbitrum Foundation chose to separate the proposal into small, manageable units to respond to the community feedback.

Platforms and Tools for Voting

The management is not thrown out of thin air, but rather enabled by a connoisseurial platform. The most common include:

- Snapshot: Underutilised: Gasless, off-chain voting systems among DAOs. It is cheap and available to people without relying on on-chain transactions, instead of the wallet signatures.

- Tally: Also known as Butcher DAO, an on-chain voting system built to wrap DAOs you provide fee-free, like Compound and Uniswap, and display proposals, votes, and the outcome plan on a screen, thus offering it a real-time experience.

- Commonwealth: It integrates discussion forums with governance, allowing users to debate and then vote.

Case Study: dYdX’s Transition to On-Chain Governance

In 2023, dYdX switched to its Layer 1 chain based on Cosmos, rather than Ethereum Layer 2. Along with this transition, a governance ballot was held to transform the use of dYdX as the native token on the new chain. This change made governance mechanisms more decentralized and scalable.

When you are a first-time participant

There is fear of knowledge when it comes to governance, especially when you are new. Here are some tips to ease in:

- Enter small: Check out some past proposals on Snapshot or Tally to get a feel of how debate works.

- Contribute to conversations: Fetch Aeyn has open forums or even Discord. It encourages one to ask questions.

- Send in case you are not sure: There are sites where you can delegate the voting to other members of the community whom you know. As an example, in dYdX v4 governance, the smaller holders tend to delegate to the more experienced holders (validators).

- Be predictable: in the industry. DAOs have vacuums, leaving whales at risk of controlling the situation. Even a few regular electorates can change the results.

Case Study: Ethena Governance/Fee-Sharing Structure

Ethena owns a token called ENA that enables recipients to make important decisions regarding protocols. One such suggestion concerned locking in a fee-sharing scheme that would allow those who hold ENA to share in the income of the protocol. This project raised awareness of multiple authors and resulted in a 43% price increase of ENA, making it quite obvious that the value of tokens changes substitution by governance decisions.

Benefits and Risks of Governance Tokens

The issue with governance tokens that appear cheap but are not powerless in practice. These tokens will enable you to have a seat at the decision making table of DAOs and DeFi protocols, up to and including billion dollar liquidity markets. Nevertheless, as is the case with anything in crypto, there exists a set of advantages and disadvantages.

Benefits: Community Power, Transparency, Protocol Influence

One of the biggest appeals of governance altcoins under $1 is the sense of community power. An example is Take Uniswap (UNI): in 2023, individuals who hold tokens on Uniswap discussed developed proposals to change fees on the Snapshot governance layer of the platform, where a decision could have transferred millions in the platform’s revenues. Although numerous ideas did not reach the final support, the procedure demonstrated the effectiveness of open dialogs on the chain.

In the same way, the governance of the AAVE has had an impact on the significant protocol modifications (such as the addition of GHO stablecoin), which were overseen via Aave DAO governance proposals. These instances reveal the lack of governance tokens that can influence the course of the whole ecosystem, as the holders of the tokens do.

Some governance models even tie into staking, giving them a dual role much like staking altcoins under $1.

Risks: Voter Apathy, Whale Domination, Liquidity Issues

There are also genuine challenges in the governance tokens. No evidence of participation in Compound (COMP) was discovered, with a turnout of less than 7% of circulating tokens, even though such a turnout was under 75% of the total holders, as observed in a scholarly article about Compound DAO governance (2023). That’s voter apathy at scale.

Next, we have the well known Curve Wars. Other protocols, such as Convex, won the vast portion of CRV, which they locked under veCRV to occupy the votes in the form of gauge weights. That left smaller holders with little practical influence, as shown in recent Curve DAO proposals where Convex dominated voting. It is an excellent example of the dominance of whales over the voices of the grassroots.

Liquidity can also be a risk. Other governance entitlements are below the size of $1, and these do not trade on a thin pool, so small investors can hardly leave without slippage.

Price Fluctuations and Market Volatility

The tokens of governance do not avoid volatility. As an example, MKR, the token of MakerDAO, fell in value to less than $500 at the end of 2022, having been priced above $2,000 in early 2022. However, a discussion on the types of collateral remains active in the governance board of MakerDAO. Active participation. This fluctuation in price has the negative effect of deterring active participation, because active participants may be reluctant to lock or assign tokens or to delegate when they perceive the price moving downward.

Regulatory Concerns

Last and most momentous is regulation. In 2023, Lido DAO (LDO) faced pressure from critics who questioned its staking governance, drawing regulatory scrutiny. The debate on whether to self-restrict shareholding in Ethereum stakes is openly recorded in Lido’s governance forum. This underlines the spill-over of the external legal issue in the world of token governance.

Macro Trends Shaping Governance Tokens in 2025

In 2025, the world of governance altcoins under $1 isn’t just about price tags; it’s about power, scale, and evolving structures. There are some not-so-grateful trends in the way governance operates, including how people receive a seat at the table and the extent of legitimate decision-making. These are the trends we currently see taking shape.

DAOs Managing Larger Treasuries

DAO treasuries are expanding at a rapid rate, and as they increase in size, so do their duties (as well as their liability).

There is Take Uniswap DAO, which is a treasury that handles hundreds of millions of dollars in the form of its own token UNI. Its size also imposes actual governance strain: including the big treasury, electoral proposals, auditing, and treasury administration become a significant aspect of governance, discussed on 101Blockchains in its guide to treasury management in a DAO.

The count of DAOs with treasuries of over $1 million is also holding up. Such wealth not only enables governance but also implies greater accountability by the community and regulating agencies.

Governance Expansion into Layer 2 Ecosystems

It is no longer concentrated on the Ethereum mainnet; its governance is diffusing. Layer 2 (L2) networks, such as Arbitrum, are not only experiencing an increase in the number of transactions and users but also becoming actively governed.

As an example, L2 governance documentation has become publicly available to allow many tokens to decide on upgrades, rollup parameters, and fees to L2s. Turning cheaper to participate through lower costs of gas is bringing that system to a layer 2 ecosystem as a second front of governance innovation.

For governance altcoins under $1 minted on or operating via L2, this means potential access to cheaper voting, more frequent proposals, and faster iteration.

Real-World Assets (RWA) and DAO Governance

One of the most rapidly developing tendencies in 2025 is tokenizing the real world. According to the RedStone report on 2025, actual real-world assets in DeFi On-chain transactions in the RWA initiative have increased by ~260% in 2021 alone during the first half of the year, compared to other prior years, from ~$8.6 billion to over $23 billion.

So why does this issue governance tokens? With RWAs available, SPEs face real estate, bonds, and personal credit issues, as well as governance decisions, risk, legal, and valuation concerns. Even the audits are carried out in the way they are voted upon by the token holders concerning how the assets should be held, where the revenue should be distributed, and so on. It now combines micromanagement with reality.

It also means that some governance altcoins under $1, if involved in RWA projects, must deal with regulatory disclosure, custody, and KYC/AML concerns, even if the token itself is cheap.

Regulatory Outlook for Governance Tokens

Governing icons are scrutinized better than ever. In most locations, these tokens give the right to vote and controlling protocol economics are verging on the border of utility token/securities.

Who questions projects: Who has control of the protocol? Is there a timelock on stakes? Are suggestions uniquely presented? Are the smallholders sufficiently informed? A recent study on platforms to govern DAOs by Yellow.com (2025) indicates that being a DAO user is increasingly becoming a mature product. However, currently, voting is still nearly at the same stage; the top 10% of token holders tend to affect most voting results.

For governance altcoins under $1, this regulatory pressure means you need to double-check project transparency: tokenomics, legal disclaimers, and how governance is structured. Developed due to the fact that even the token characters can feel the effect when they are interfered with by their regulators.

This overlap between governance and fundamental value resembles the case of undervalued altcoins under $1, where market price doesn’t always reflect long-term importance.

Conclusion

Watching the last two boards of directors is not about low price rates, but rather community engagement on a grand scale. Only holders who are in a position to afford participation in the conversation are more likely to make the claim of being genuinely decentralized and democratic.

All along this article, we followed the major trends that define the space in 2025; self-managed billions of dollars on the limitlessly expanding Layer 2s, governance being made to flow into genuine assets, and the regulatory environment only getting its bearings. The trends are obvious: governmental tokens become more mature, yet they are still sloppy, contentious, full of contradiction and creativity.

That translates to a moderate look on the part of investors. Low-price governance tokens could be a first-time entry to mechanisms that are shaping and defining Web3 on the one hand. On the flip side, hazards are actual, voter apathy, whale domination, and a change in regulations can easily destroy the concept of decentralized decision making.

When you are considering the governance tokens whose underlying is below $1 take them superspeculatively. They represent an opportunity to influence the process of protocol evolution, and warn against the fact that in crypto, the boundary between opportunity and risk is often so thin.

FAQs

What makes a governance token valuable?

A governance token is important because it provides those holding it with direct impact on the critical protocol decisions. The bigger and more impactful the use of the treasury, rewards, or improvements is, the more utility it will have. Notably, the UNI token of Uniswap enables voting to receive liquidity incentives that determine protocol revenue. Even governance altcoins under $1 can hold value if their communities are active and decisions impact real-world usage.

How do governance tokens give voting power?

The voting power mostly depends on the quantity of tokens possessed, in proportion, for example, 1 token = 1 vote. There are also numerous cases where delegated voting is supported by the many DAOs, targeting the ability to delegate voting by smaller holders to acting representatives. Since Snapshot and Tally have tools that allow participants to propose ideas, vote, and access results in a transparent manner, the user base can efficiently reach large numbers of citizens worldwide. This ensures that even governance altcoins under $1 provide meaningful ways for retail holders to influence decisions.

Why are some governance tokens priced under $1?

The price does not have to be low, and the importance is not so high. Many DAOs and DeFi protocols issue governance altcoins under $1 to make participation accessible for retail investors. Only a high supply and a high inflation rate, utilizing a tokenomic mechanism, can ensure the price is kept low. Alternatively, the tokens will be distributed during a young enough phase to count as influential voting power and be asked to make a decision in the community.

Where can I check governance proposals?

The majority of governance proposals are provided via official Dao boards or discussion boards. To illustrate this, Uniswap utilizes Snapshot,, which communicates with its governance,, while MakerDAO has its own governance forum,, and Curve DAO maintains governance records on the blockchain. Anyone holding governance altcoins under $1 can access these platforms, read proposals, and track how decisions are made.

Do governance tokens generate passive income?

Although our governance tokens are staked or revenue-sharing, there is no guarantee of this occurrence. Some rewards (such as Curve DAO with its veCRV holders distributing tokens when locking), and some are simply governance (as is the case with UNI). It’s essential to research each project carefully, as holding governance altcoins under $1 may provide influence, but not always passive income.

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.