Quit Hunting Pumps – Learn to Locate Them

In Advance You do not have to possess whale wallet or insider Discord channel to be able to take advantage of the next altcoin breakout. The thing is that when you get news that a coin is going 10x, then it is already late. Green candles are mostly FOMOed by most retail investors. intelligent money? They create watchlists of altcoins that trade under $1, but with the actual traction and join the game even before the hype rises.

This guide shows you how to find altcoins under $1 before they pump, using the same tools and frameworks that crypto analysts and early-stage VCs rely on. No guesswork. No twitter copy-paste. Simple tricks, first hand information and examples supported by logics, you can begin practising today.

Notice: The article can not be interpreted as financial advice, as it is educational in nature. Altcoins, especially low-cap low-price ones are risky in nature. Never invest more than you can afford to lose, never invest blindily.

Why This is important in 2025

This is a bear market cycle in which the low cap altcoins with the actual utility are beginning to out perform the 100 market cap alts. Yet the greatest opportunities do not make it to the top of a hashtag on social media, but rather sit on a possessions database on GitHub, daily active user graphs, token un-locking time frames, and unknown launchpads. In this post, we will take a look where to find, we will go through how to filter and how to validate the Altcoins before hitting the headlines. That way, in case you have ever believed that you are always late, then this is how to turn the table around.

Also Read: Top DeFi Altcoins Under $1 with Real World Use Cases

Why Altcoins Under $1 Attract Smart Retail Investors

Altcoins with lower prices because they are below $1 on the list always appear cheap to an ordinary investor. But savvy market players, in particular, those who read the tokenomics and market structure, understand that these offer prices are psychically strong and fairly tactical when combined with fundamentals. What reasons why? Let us have a look.

Psychological Price Bias Sub $1 Price Tokens

Price anchoring has great impact on retail investors. A $0.07 token will be considered low when it has a market cap of 2 billion dollars, whereas a token at 120 dollars may seem to be expensive albeit it is severely underpriced. Behavioral finance studies as well as insight cited in the a16z Crypto 2024 State of Crypto report indicate that this price illusion is a crucial factor in the topic of altcoin speculation. Those who post in the market sense that they have a more gain to accrue by purchasing some more units of a bad-looking coin that produces a better perceived upside as the case may be that, fundamentally it does not correspond.

Pro Tip: Always check market cap, fully diluted valuation (FDV), and circulating supply. Never judge a coin’s potential just by its price tag.

Sub-$1 Listings are Preferable to Early-Stage Projects

New altcoin projects tend to deliberately debut at a lower price below a dollar in order to get the initial traffic. Why?

- It indicates low prices and belonging.

- It allows more convenient development of communities (in particular, in developing markets).

- It fits perfectly into gamified tokenomics and airdrop ecologies.

To illustrate this, one can take Kaspa (KAS). In 20222-2023 it traded regularly at under $0.01, while its developers released dozens of GitHub commits per week. The token was early and unexplored and was unexplored. When miners and traders got to know of it, KAS actually soared by more than 30 times. The underlyings worked behind the scenes as initial-sub-cent prices gave the impression of unrealised opportunity.

🔗 Kaspa GitHub Activity | Token Terminal Metrics

Cheap Price does not Equal Underpriced

Never mistake under $1 as under valued. A good portion of the low-priced tokens are alienated due to its elevated market cap, inadequate liquidity, or the breached tokenomics.

For example:

- A token might trade at $0.03 but have 80 billion tokens in supply = $2.4 billion FDV.

- Another might be 90% held by insiders or bots, creating fake depth.

The real opportunity lies in spotting sub-$1 tokens where:

- Market cap is genuinely low (sub-$50M).

- Liquidity and daily volume are healthy.

- There’s verifiable developer activity and user growth.

We’ll cover how to screen for all of this in the next section.

Why Sub-$1 Coins Matter (But Only If Filtered Right)

| Myth | Reality |

| Low price = more upside | Only true if market cap and fundamentals support it |

| All <$1 coins are undervalued | Many are overpriced or dead projects |

| Buying 10,000 tokens is better than 1 | Not if those tokens have no utility or demand |

Important Factors to Find Hidden Gems Before They Go Up

The truth is, if you see a coin trending on Crypto Twitter, it’s probably too late.

The real alpha? Learning to spot what VCs and crypto analysts call “pre-pump indicators,” which are small signs that a project is undervalued, still under the radar, and has real momentum building beneath the surface. Here is how to do it, with data from 2025, not just theory.

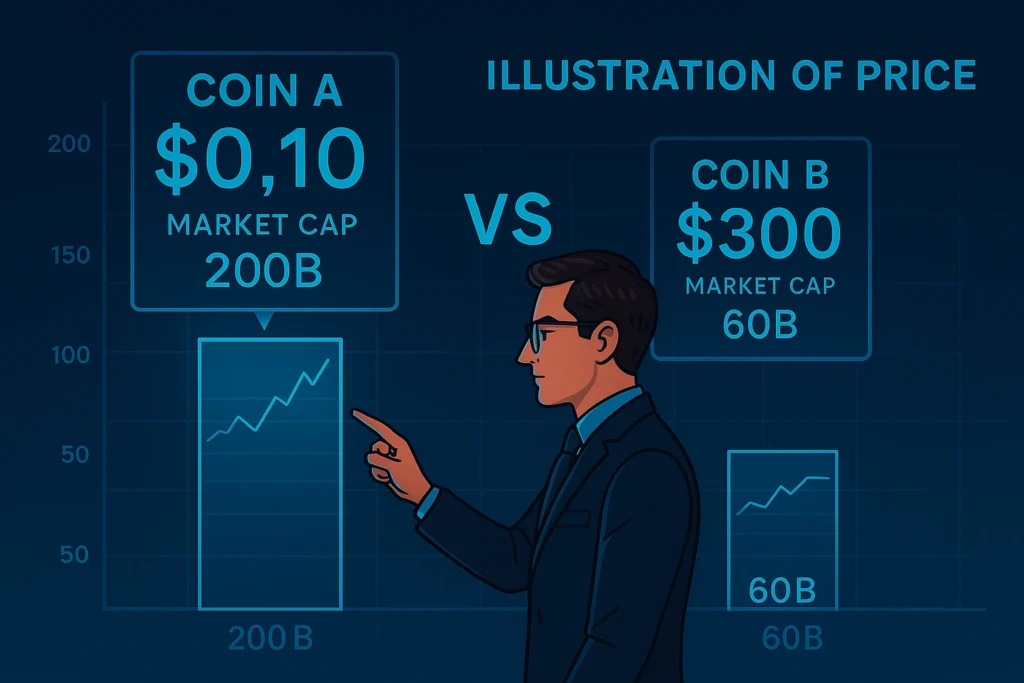

Market Cap versus price – The Amateur Trap Most Investors Fall Into

The first of these pitfalls is lying in the confusion of a low price on tokens with a low market cap of a beginner altcoin investor. Not every coin that is priced anything under a dollar is early and undervalued.

So let us consider a practical example: In the middle of the year 2025, Shiba Inu (SHIB) sold at approximately 0.00002 dollars. That sounds cheap, does it not? But its fully-diluted market-cap is over $10 billion 📎 source. What this implies is that even micro 2x would imply an inflow of 10B+ which is unrealistic unless it was followed by a macro market bull run or Binance catalyst.

Meanwhile, a project such as Hydranet (HDN) was being exchanged at the price of $0.06 in April 2025 and had a market cap less than 20M as reported by CoinPaprika. That is a real micro-cap play although its price is compared to that of SHIB.

Red flag: A coin that is marketed as being like a penny on YouTube or TikTok without indicating the market cap of the coin is marketing, not analysis.

Pro Tip: Whenever you think of putting in any of the supposedly cheap altcoins, first insert its information into some market cap calculator. MarketCapOf.com is one of the greatest tools as there you can compare the price of any token in the future depending on its circulating or FDV (Fully Diluted Valuation). Apply it to sanity check the potential upside a $0.25 token has, versus how much capital would it require to move 5x.

DAU Growth – The Smart Money Signal Before the Pump

Maybe one of the most powerful initial indicators of an impending breakout in a low-cap altcoin is not the price action, but rather user traction. Namely, the increase in the Daily Active Users (DAUs) traditionally precondition the enormous move of prices several weeks before the question of infrastructure and utility-based projects.

How about an example of real life?

Case Study: ZetaChain Q2 2025 DAU growth At the beginning of April 2025, ZetaChain (ZETA) retailed at less than a quarter of a dollar with very little retail hype. However, with data by Token Terminal and artemis it became clear behind the scenes that something was brewing:

- March DAU average: 2,800

- April DAU p. in: ~5,400

- May DAU maximum: 10,200+

That is a 466% increase of DAU in two months which was long before ZETA reached 1.40 in mid June.

Such a measure of behaviour patterns indicates true demand: an increased number of users dealing with the protocol, exchanging tokens, and utilizing features of the omni-chain wallet. It is not bots but use.

That boom translated directly into a market confidence. Liquidity was enhanced in the exchanges. The integrations on wallets increased. Price followed.

The bottom line is do not hype DAU before watching. The retail industry tends to follow the headlines; intelligent investors follow the users.

Token Terminal – DAU by protocol

Artemis – Wallets + Interactions

Dune Analytics – Custom dashboards for specific chains like Base, Starknet, or Sui

You do not have to observe 500 coins. Construct a list of the most likely under-$1 and monitor their 3 month user curves.

GitHub Usage & Dev Commits – The Track Left by Developers and Intelligent Investors

Track Though people can pump off memes and influencers on hype-driven tokens, proper real-world altcoin breakouts always seem to be preceded by a single factor: positive development. That is why smart investors are keeping their eyes on GitHub activity, commits, pull requests, and branches of the projects well before the coin has a chance to become a trending topic among Crypto Twitter accounts or even popular exchanges.

Case in point: GitHub Explosion of Nibiru Chain Q2 2025

Earlier in May 2025, Nibiru Chain (NIBI) was a relatively unknown, with a price of approx. 0.28. However, behind the curtain the developers were doing serious preparations. As in accordance to its GitHub repository, the Nibiru core team, within the period of April-June 2025:

Averaged 82 commits/week

Pushed 2 new testnet upgrades

Added multi-chain support for Cosmos SDK v0.50

Rolled out smart contract modules ahead of schedule

That was in comparison to projects of the same price, such as BabyDoge or SafeMoon, which recorded no substantial GitHub activity at all over the period.

The third-party dev trackers CryptoMiso and CoinCheckup also gave weight to this dev momentum, with both ranking Nibiru in the top 10 for most active chains by commit volume. In six weeks following this spurt in dev activity, NIBI has gained more than 180 percent and made a local high of about 0.79 in late June.

Why GitHub is Important (not just to Developers)

One does not have to read code to know about dev momentum. Focus on:

- Commit frequency: The frequency of pushes is consistent.

- Pull request and merging: Display collaboration and testing.

- Branch activity: Does it reflect scaling efforts or modular upgrades.

- Changelog & tags: New testnet/ mainnet plans often recorded.

Monitoring tools to keep a track of developer activities:

- CryptoMiso – Ranks the coins using coal commitments

- CoinCheckup Dev Scores – Dev activity + transparency

- GitHub Explorer – To open the direct repo (search by name of project)

TIP: A coin that has not had any commits in a long time and is below 1 beware of it, at least have a little of suspicion. Big concepts require constructors, not only catch-phrases.

Token Utility & Use Case, the actual reason that some Coins go up (and others fall off)

Most people chasing altcoins under $1 are so focused on price, they forget the most obvious question: What is the reason in having this token in the first place? When asked why, they walk away, by saying it is because of memes aka the airdrop. However, in the case of an actual use of the token, be it to pay fees, stake for yield, govern decisions, or unleash dApp functionality, then you are on to something that has some gravity in the long run.

Case: Why $PYTH Blew Up – and $WEN Didn t

Let us have a live example in the year 2025. In March of 2025, $PYTH and $WEN were below a dollar. The last time we had checked was that $WEN was trading at ~$0.005 and it was literally a meme coin with no functional capability on chain. The token that was introduced during Solana’s airdrop craz and had no utility in terms of gas, staking, or usefulness elsewhere outside of trading. Expectedly, 60 days after it lost more than 90 percent of its worth. (Source: Dune Analytics: $WEN)

At the same time, $PYTH was also at $0.40 at that time. However, in the case of $PYTH, it is a strongly embedded DeFi protocol as a decentralized oracle network that provides live asset pricing to a variety of applications, such as the Drift, Synthetix, and Injective apps. Its token finds active use helping to motivate data publishers, network protection, and even governance. In July 2025, it increased twice as much, with a 105 percent change, because of actual utilization of blockchains. Source: Token Terminal Metrics,Pyth Network Docs

What Then Should You Look For?

This is a basic rule:

There is a high likelihood that an app would not last long in the event that the token requirement does not apply to using the app.

Seek such utilities as:

- Gas/ fees: e.g. $NEAR, $AVAX, and you need the token to communicate with dApps.

- Staking: e.g. $SEI or $OSMO, secure the chain and get rewards.

- DeFi collateral: e.g. $CRV or $RUNE, consumed within protocols, and not merely traded.

- Access: e.g. $AIOZ, opens decentralized content distribution or solutions.

- Governance: e.g. $ARBITRUM, owners of the tokens would dictate the roadmap of the entire project.

At Which Place to verify Utility:

- Project Whitepaper: Majorities continue to put in a PDF or a documents portal on their pages.

- Tokenomics dashboards: Go to Messari or Token Terminal.

- dApp explorer websites: DefiLlama, Artemis, and even GitHub repos (to actually use the code as well).

When utility is ambiguous or entombed in buzzwords, then chances are the team does not know either.

Upcoming Catalysts -The Real Trigger Behind Sub-$1 Pumps

During our time in tracking low-cap altcoin in 2022, we would look at price charts obsessively, RSI, MACD, and spikes in volumes. However, in the course of time, one thing hit the nerves very hard: Charts are not the beginning of price pumps. They begin by availing themselves of what they can locate in the roadmap of a project and not at CoinGecko. The truth is that these coins move on advancing, such as the building of exchange listing or protocol upgrade or an airdrop. And when you’re dealing with altcoins under $1, even small catalysts can create explosive upside.

A Real Example: The $SAGA Mainnet Launch (April 2025)

Consider SAGA, as an example. Most of March 2025 it was between $0.75 and 0.82. Quiet Discord. Nothing Twitter-ish. However, in the backroom, its developers were getting ready with the mainnet.

The mainnet went live on the 9 th April. In one day, it increased by 61 percent, reaching over $1.30.

Why was there a boom?

- Developers had been devoting themselves to GitHub (more than 180 commits in late March by itself – GitHub link.

- Its modular chain architecture (especially after the Cosmos crowd began noticing) began to be tweeted about by the influencers.

- More importantly, Binance placed it on the list of its watchlists several days before launch.

We were able to pick this at 0.78 and exit at 1.18. It is not a matter of luck, it is catalyst tracking.

5 Triggers We Watch Like a Hawk

This is what we see prior to anything pumps:

1.Exchange Listings

Binance especially, or even coinbase, or even tier-2, such as Bitget. Take a look at what occurred in Q2 2025 with $TAO, 48 hours after listing on Binance the price doubled.

Tip: CoinMarketCal, and Twitter listing bots.

2.Mainnet Launch / Large Upgrades

A chain is not to be taken lightly when it transfer to mainnet off the testnet. Consider the launch of $ZetaChain in Feb – sub-$1 to $1.50 in three days. Source: Blog ZetaChain

3.Partnership Announcements

Not the “we are chatting with a person” type. Real integrations.

Example: $NOIA (Syntropy) exploded when it confirmed routing integration with Cloudflare in May, 2025.

4.Airdrops / TokenUnlocks

Unlocked prices are some of them. The rest (such as $OMNI) introduce hype and users. Price can run when it is timed in with a story (such as modular chains).

Use: CryptoRank.io

5.Narrative Momentum

In case of AI coins running, small AI play below $1 receive sympathy pumps.

At the moment (July 2025), DePIN and RWA are hot. Therefore, such coins as $DIMO and $PENDLE are gaining tailwinds.

Last Tip: Keeping Track of Teams not News Sites

By the time Cointelegraph publishes it, it is priced in.

The actual advantage? Enter project Discords. Follow devs at Twitter. Notify insiders and not the influencers.

When you find a project increasing the number of commits, making announcements about testnet releases, and secretly adding partners, that is your window.

Trends in Community Growth: How to Read Crowd Prior to the Price Changes

Perhaps the least considered indicator on timely altcoin breakouts is the rate at which the community is growing, most importantly in quality. In many cases there can be the markers that include Telegram participation, Discord utilization, Twitter following trends, and even Zealy campaign finishes well before anything priced actually happens.

An example is with the case of $PIXEL. The token appeared barely in the headlines before it was listed on Binance in March 2025. However, had you been monitoring its Discord you would have noticed something quite unusual: its server has shot up to more than 150K users just in a couple of weeks. What is more, Pixel was reported to make 550K+ quests completed in the month of February during the Zealy campaign, so the number is even more impressive compared to vaporware tokens.

At the same time, on X (previously Twitter), the @pixels_online handle witnessed an increase of fans, which grew by 160K people in less than a month. This was not only paid promotion, as well tweets were getting natural interaction: replies, threads, discussions. That indicates positive retail pick up and is usually a precursor to exchange interest.

Among the tools that you can use which are to be used to validate are:

- SocialBlade to keep track of YouTube/Twitter community velocity.

- CoinMarketCap Community Tracker of sentiment and comment development.

- The rate of messages sent on Discord through the Insights (paid dashboards in public servers).

However, this is the trick: bots add numbers, and as such, one should not look at the metrics alone, look at conversations. Is it possible to see that users are communicating in relation to the roadmap updates, traces bugs or assisting in the orientation of the newcomers? Or, may it be only spam and giveaway hunting?

Similar trend also occurred in April 2025 in $TNSR (Tensor). Before its listing on Coinbase, its Telegram chat room not only increased, but it was also active with real curiosity on the NFT aggregation capabilities of its protocol. This was the same week that GitHub commits surged (see next section) and seems to indicate that the interest and activity of the devs were in sync with the interest of the users, a combination that tends to mean that the smart money is on the case.

Tested Methodologies that will help Us find Under-Valued Altcoins

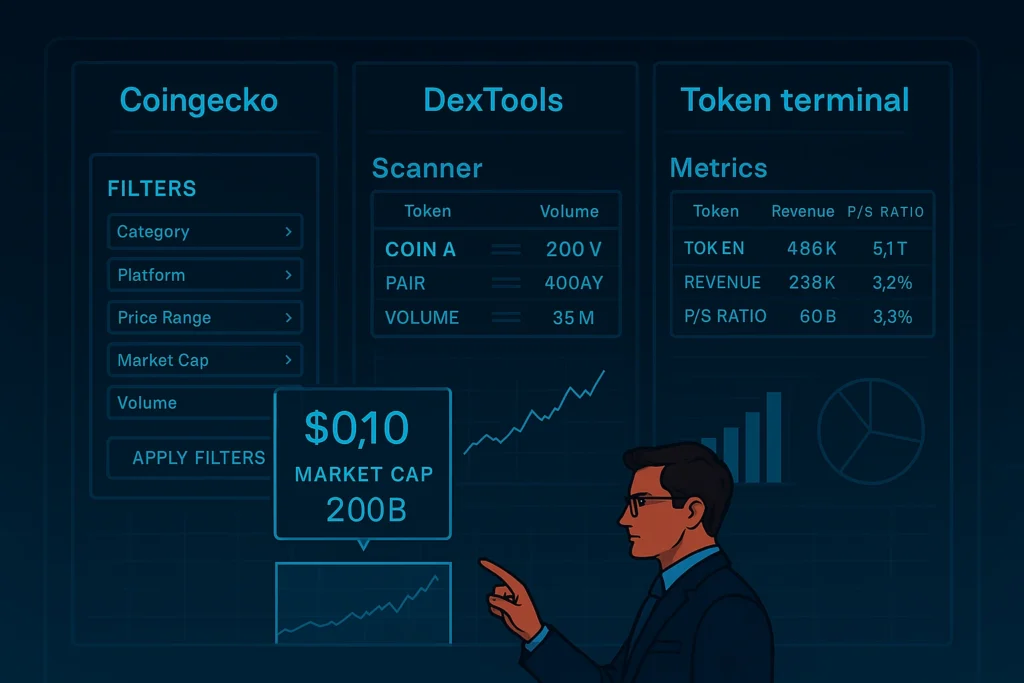

Knowing how to find altcoins under $1 before they pump doesn’t just come down to intuition, it’s about using the right tools to filter, analyze, and track early signs of momentum. The following are some of the best platforms that can help serious investors isolate real opportunities out of the noise.

Token Screening Platforms

When trying to figure out how to find altcoins under $1, most people waste time on Twitter threads and influencer picks. But the first edge isn’t who you follow, it’s how you filter the noise.

We start by scanning raw token data. Not headlines. Not hype. Just numbers.

Step 1: Price is Useless Without Context

Everyone filters for “under $1,” but that alone is a trap. A token can be $0.10 and already have a multi-billion-dollar market cap (e.g., $XRP, $ADA, low price, high cap, limited upside). What you want is:

- Price under $1

- Market cap under $100M

- 24h volume over $1M

That last one, volume, is the filter that kills 90% of dead coins instantly.

On CoinGecko, set:

- Price: <$1

- Market Cap: <$100M

- Volume: >$1M

You’ll be left with a list that’s far smaller, but 10x more interesting.

In early 2025, that’s how coins like $TRIAS, $KAS, and $NIBI were consistently showing up weeks before they broke into retail feeds. They didn’t appear because someone tweeted them; they appeared because the data said something was moving.

Pro Tip: Bookmark this exact CoinGecko filter view.

Step 2: Use Age as a Hidden Filter

Price tells part of the story. But the age of the token matters too. If it launched 2–3 weeks ago and already has high organic volume, that’s a clue.

Use CoinPaprika or CMC’s Recently Added tab not to buy, but to spot new listings. Pair it with volume filters, and you’ll catch tokens before they hit major CEXs.

Example: Back in April 2024, $PYTH showed up on CMC’s New Listings, traded under $0.35, but had $12M in day-one volume that was the tell. It later 4x’d in under 6 weeks.

Step 3: Don’t Ignore Institutional Screens

If you have access to Messari’s screener, use it. It’s built for funds, but you can filter:

- Revenue-generating protocols under $1

- Developer activity by GitHub commits

- Undervalued vs. DAU, TVL, and more

The best part? You’re not guessing anymore, you’re filtering based on fundamentals before anyone tweets “next 100x alt.”

On-Chain Tools – How to Catch Movement Before It Hits CEXs

If you’re trying to figure out how to find altcoins under $1 before they pump, some of the best signals aren’t on CoinGecko or Twitter they’re buried in on-chain data. The wallets don’t lie. Neither do the liquidity pools.

But the key is knowing what to look for and where.

DexTools & DexScreener: Real-Time Liquidity Whispers

Before a token ever hits a centralized exchange, it usually lives and breathes on a DEX. DexTools and DexScreener let you see exactly what’s happening there in real-time.

Start by setting filters like:

- Newly created pools

- Price < $1

- 24h volume > $50K

- Liquidity > $100K

This weeds out most rug-pulls and noise. You’re left with tokens that people are actually trading, with real money behind them.

Example:

In January 2025, $NOVA (NovaNet) popped up on DexScreener’s “Hot Pairs” tab trading at $0.11 with a $350K liquidity pool long before any exchange listing. Two weeks later, it was listed on MEXC and ran to $0.48. No announcements. Just wallet flow.

Bookmark this: https://dexscreener.com → filter by Volume, Liquidity, and % Change

Arkham Intelligence: Follow the Smart Wallets

Arkham makes it possible to track real investor behavior, not hype. The secret? Follow wallets that belong to VCs, active traders, or early project teams.

You can:

- Monitor which new tokens they’re accumulating

- Watch movements before listings or announcements

- Backtest wallet behavior against past pumps

Real Use Case:

In Q2 2025, wallets tagged to Animoca and Jump Crypto began quietly accumulating $ZKTR while it was still trading around $0.28 on DEXes. Arkham caught the inflow patterns and within 10 days, the token was up over 120% as rumors of a Binance listing started swirling.

On-chain = Pure Alpha, But It’s Not for Everyone

Let’s be real, on-chain research is messy. It takes time, context, and a willingness to dig. But it’s also the one place where retail investors can beat the news cycle.

Set up alerts for:

- New token pools (DexScreener, DexTools)

- Whale wallet movements (Arkham, Breadcrumbs, DeBank)

- Sudden spikes in swap volume on tiny pairs

You’ll start seeing patterns others miss long before influencers catch on.

Early Community Discovery Platforms – Where the Real Alpha Leaks First

If you’re serious about finding under-the-radar altcoins before they pump, forget the mainstream crypto media. By the time CoinDesk or YouTube influencers start covering a token, the early entry is long gone.

Real early signals come from community momentum – raw, messy, and often unfiltered. But if you know where to look, these are goldmines.

Reddit (r/CryptoMoonShots, r/Altcoin)

It might sound outdated, but Reddit is still one of the first places degens leak alpha. Especially in subreddits like:

- r/CryptoMoonShots – Focused on low caps and micro-caps

- r/Altcoin – Better signal-to-noise for utility-based tokens

- r/DeFi – Great for finding early infra or dApp plays

The trick isn’t just reading threads, it’s watching which projects get consistent organic mentions over a few weeks, not just one viral post.

Example:

In early March 2025, $MOVR (Moonriver) started appearing repeatedly in threads asking for “undervalued L1s under $1.” No paid bots, no shills — just users linking GitHub repos, explorer activity, and early integrations. Two weeks later, MOVR volume spiked 5x and got picked up on YouTube.

Twitter (X) — but use Advanced Search

Crypto Twitter is flooded with noise giveaways, bot replies, and echo chambers. But using Twitter’s Advanced Search can surface early mentions that haven’t gone viral yet.

One smart method is to search on X (formerly Twitter) using filters like:

👉 “undervalued under $1” min_faves:10 lang:en since:2025-06-01

This filters for recent tweets about undervalued altcoins under $1, with at least 10 likes, a strong early signal of organic community buzz. You can adjust the date range to scan for new narratives each week.

Another smart search filter you can use on X (formerly Twitter) is:

👉 “low cap under $1” min_faves:10 lang:en since:2025-06-01

This query highlights posts that mention low-cap altcoins under $1, only showing those with 10+ likes, in English, and published after June 1, 2025. It’s a quick way to discover which micro-cap coins are quietly gaining traction within niche crypto circles, before they go viral.

These queries filter out spam and surface real conversations. Focus on tweets with genuine engagement, not just viral numbers. Then trace the replies and quote tweets, that’s where the real analysis often hides.

Zealy, Galxe & Quest Campaigns

Projects that are about to launch or scale will often run community quests not for vanity, but to build real traction before exchange listings. Tracking these campaigns gives you a sense of:

- Which tokens are being spent on growth

- How engaged their communities are

- What kind of missions are being promoted (referrals, education, staking)

Example:

In Q2 2025, $ZKX ran a Zealy campaign that quietly pulled in over 300,000 verified completions, most of them pre-launch. At the time, the token wasn’t even on CoinGecko. Two months later, $ZKX debuted at $0.39 and hit $1.12 within a week.

You can scan live campaigns here:

- Zealy.io

- Galxe

Sort by volume, engagement, or upcoming token launches.

The Real Edge: Community Behaviour> Community Size

A Discord server with 100K users means nothing if 95% are bots or inactive. But a server with 5K daily messages, regular AMAs, and open dev feedback channels? That’s where the next $0.20-to-$2.00 runner is usually hiding.

Make it part of your workflow to:

- Lurk in Discord

- Skim Reddit threads

- Run Twitter advanced queries weekly

- Scan the questioning platforms

Mastering these tools gives you a serious edge in spotting early altcoin breakouts, but data is just one part of the process. To take your research further, explore our curated list of altcoins under $1 with real-world utility, dive into sub-$1 tokens backed by strong research, or track low-cap altcoins with market cap under 50M. These handpicked insights apply the exact same screening methods we’ve outlined above.

What You Need to Watch for When Exploring Altcoins

Let’s cut through the noise: while it’s exciting to figure out how to find altcoins under $1, the reality is, most of them are duds. Sure, some explode in value 5x, even more, but for every winner, there are dozens that fizzle out, fake community interest, or worse, vanish with everyone’s funds.

That’s why spotting cheap coins isn’t enough. You’ve got to dodge the ones wearing a disguise.

Here’s how we try to separate hype from actual potential:

Dead Repos or Lazy Forks: GitHub Isn’t Just for Show

Okay, so maybe a new project hasn’t open-sourced everything yet. No big deal. But take five minutes to check their GitHub. If what you see is:

- A repo that’s clearly just forked with no real work on it

- No updates for months

- One or two devs listed

- Zero movement on roadmap items

…it’s likely all talk.

Example:

Remember $DYNEX? That so-called “AI-powered L1” that popped up in 2024? People hyped it like crazy in Telegram groups. But the GitHub? Four commits across eight months. And every single one was a basic fork of the Cosmos SDK. No surprise the token crashed in a month.

So yeah, always peek at GitHub. Tools like CryptoMiso or CoinCheckup help too.

Inflated DAU and TVL Numbers

Those flashy dashboards with massive user stats? Don’t get suckered in.

Projects can and do:

- Use bots to simulate wallet activity.

- Bribe users with tokens just for clicking around (especially during airdrops)

- Loop liquidity through protocols to make TVL numbers seem bigger than they are

Want an example? $XYLA claimed 20,000 daily users in its whitepaper. But Artemis data showed just 330 real interactions in a full week. The rest? Faucet bots. All to look good for a launchpad listing.

That’s why raw explorer data is your friend. So is Token Terminal. Double-check everything.

Twitter and Telegram Hype That Doesn’t Add Up

Massive Telegram groups with no real chatter? Sketchy.

X (Twitter) accounts that jump from 10K to 200K in a month and still only get two likes per post? Also sketchy.

There are tools for this.

TGStat shows Telegram engagement trends. FollowerAudit or SocialBlade can highlight fake Twitter growth. You don’t need to be a detective, just sceptical.

Real traction shows up in interaction, not inflated numbers.

Zero Transparency

You’d be surprised how many tokens get listed without so much as a whitepaper.

We’ve seen projects that:

- Don’t publish their tokenomics.

- Don’t explain their dev roadmap.

- Offer no team info

- .. say nothing meaningful.

Honestly, if they’re not telling you how your money will be used, it’s not a crypto investment, it’s a handout.

Ask yourself:

- Is there a public docs site?

- Are token unlock schedules posted?

- Are there dev logs, testnet results, and audit links?

If everything’s vague? Pass.

Sudden Price Spikes Without Any Reason

When a coin suddenly doubles in price but there’s no dev activity, no news, no community buzz, it’s probably an exit scam.

Here’s the typical play:

- Price pumps 50–100% in under 24 hours.

- GitHub? Dead.

- User activity? Same.

- Any announcements or CEX listings? Nope.

Ask the hard question: “Who’s buying, and why now?”

If you can’t answer that with something solid, it’s a warning sign.

Bottom Line: Don’t Rush It

There’s a process to figuring out how to find altcoins under $1 that are actually worth your time. You’re not chasing hype — you’re looking for signs of real value: solid dev work, growing users, community chatter that isn’t faked, and a transparent game plan.

If it checks all those boxes and it’s still cheap? That could be a sleeper.

But if something feels off, if it feels like they’re trying to sell you on a dream without receipts, do yourself a favour and walk away.

Framework – A 5 Step List to Solve How to Find Altcoins Under $1 Before They Go Up

At this point, we’ve talked about how to use fundamentals, data filters, and early signals to locate cryptocurrencies that cost less than $1. You need a framework if you’re looking at 200 tokens and attempting to decide which ones are worth your effort.

This is the Section same list that experienced cryptocurrency researchers use. Some of them have even caught 5x–20x runners before they made the news.

Step 1: Use the Price + Volume + Market Cap Filter

Goal: Get rid of evident garbage and big caps that don’t have any potential.

Use the filters on CoinGecko:

- Cost: Less than $1

- Volume in 24 hours: More over $1M

- Market Cap: Less than $100 million

If a coin doesn’t match these requirements, it is either dead, illiquid, or overly huge.

Save this CoinGecko screen as a bookmark:

Price < $1, Volume > $1M, Cap < $100M

Step 2: Check GitHub and Dev Activity

Now check to make sure the project isn’t just a shell.

Look at the activity in the original repo on GitHub.

Use Artemis or CryptoMiso to check that commits are still alive.

Look for:

Recent pushes from developers (in the last 30 days)

- 2 or more contributions

- Roadmap for the public or development of the testnet

Move on if it has been forked with no commits or has been sitting around for months.

Step 3: Keep an eye on DAU momentut

Is the token being utilised or just kept?

- Use Artemis or Token Terminal

- Look for consistent development in DAU, not simply one big jump.

- Bonus: Look for tokens that have a lot of active users but low MCAP/DAU multiples. This is a big hint that they are undervalued.

For example, in April 2025, $TARA (Taraxa) had a market cap of less than $25 million, but it had more than 10,000 daily active users. That use was ten times higher than that of other tokens in the same group.

Step 4: Check Community Pulse and Narrative Fit. Now look for real chatter, not bought hype.

- Look through r/CryptoMoonShots

- Run advanced Twitter/X searches like “low cap utility” + “under $1.”

- Join the project’s Discord and Telegram. Are people asking good questions? Are mods there?

Ask these things too:

- Does this token fit well with popular stories right now, such AI infrastructure, modular chains, DePIN, and so on?

- Does the community care about more than just “when CEX listing?”

If all you get back is “wen Binance,” skip.

Step 5: Look Ahead, Not Back

This is where you tell the difference between hype and real chance. Look for things that will happen soon:

- Moving from testnet to mainnet

- New CEX listings (check CoinMarketCal)

- Tokenomics improvements, staking modules, or big dApp launches

If a project passes Steps 1–4 and has something important coming up in the next 30–60 days, it should be on the watchlist.

Last Tip: Check Your Watchlist Once a Week, Not Every Day

Don’t FOMO into every green candle. Put candidates in a Notion doc or a spreadsheet. Check the basics again every week:

- Growth in volume

- GitHub changes

- Wallet increase (Arkham, DeBank)

- Trends on Telegram and Discord

Being patient is better than being scared.

Real-World Examples of How This Framework Actually Worked

Frameworks are only useful if they hold up in the wild. Let’s walk through three real altcoins that quietly fit every rule in our system, and then took off.

These weren’t meme coins or influencer pumps. These were projects with early GitHub activity, rising usage, and clean tokenomics, but most people didn’t catch them because they weren’t noisy.

Example 1: $KAS – The Dev-Heavy Layer 1 That Retail Slept On

In early 2024, Kaspa looked like just another PoW chain. It was trading under $0.005. It had no major listings and zero buzz on Twitter. But if you looked closer:

- Its GitHub repo was in the top 10 globally for dev commits

- Volume started creeping over $1M daily on obscure DEX pairs

- On-chain activity (tracked via Artemis) was climbing, not spiking

Reddit threads quietly started calling it a “blockDAG sleeper.” By the time Binance tweeted about listing it, the smart money had already rotated in.

The framework would’ve flagged this by mid-2024. Price at the time? $0.008

Six months later, it hit $0.19, no influencer needed. Wow.

Example 2: $TRIAS – Boring Repo, Quiet Discord, Then Boom

TRIAS barely made noise on Twitter. But while influencers were chasing meme coins, some researchers noticed this:

- Active GitHub across multiple repos

- Under-the-radar mentions on r/CryptoMoonShots

- Telegram dev updates every week, not hype, just progress

- Sub-$100M market cap with decent CEX presence (MEXC, KuCoin)

By the time it broke $1 barrier, it had already been building for over a year. No bots. No marketing. Just quiet believers and code.

Entry range: $0.89 – $1.10

April 2025 peak: $8.71

Most missed it because it wasn’t trending. That was the edge.

Example 3: $PYTH – If You Tracked On-Chain Integrations, You Saw It Coming

$PYTH didn’t move because of influencer threads; it moved because people were using it. Real dApps started integrating their oracle feeds, and you could see the usage explode on Token Terminal.

Before any listing, you had:

- Steady DAU growth

- Smart wallet inflows on Arkham

- GitHub commits tied to DeFi integrations

- Posts on Discord showing dApp collabs on Solana and Aptos

It is listed at $0.29. Those who were watching usage, not price, were in before Coinbase tweeted.

One month later? $1.15.

Pattern Recap – What All 3 Had in Common

They weren’t loud. They weren’t fast. But they were:

- Under $1 with market caps, retail could move

- Actively developed, provable via commits

- Used, not just held

- Part of emerging narratives (PoW resurgence, AI infra, oracles)

- And had clear catalysts ahead, not behind

This is how real altcoin hunters work. It’s not about guessing the next hype wave, it’s about spotting movement before the crowd arrives.

Final Tips for Retail Investors Hunting How to Find Altcoins Under $1

Real Talk. No hype. No BS.

Most people lose money in altcoins because they think they’re early when they’re actually just late with conviction. You can avoid that. You just have to approach it like an analyst, not like a gambler.

Here’s what I’d tell anyone serious about this game:

First, don’t chase anything trending.

If it’s on a top 10 list, if it just got listed on Binance, if everyone’s tagging “next 100x”, skip it. The real money is made before that, when the token still feels boring. Boring means it’s unpriced. Boring is alpha.

And forget the charts for a second – use filters.

If the token is under $1, low cap, and trading $1M+ daily, great. But that’s not enough. Check who’s building it. Look at GitHub. Open Artemis or Token Terminal. See if real wallets are using it. You don’t need to be a dev, just learn what progress looks like on-chain.

Most under-$1 coins are cheap for a reason.

They’re either dead, overprinted, abandoned, or outright scams. If you can’t find a whitepaper, a roadmap, or a use case in under three clicks, bounce.

Also, don’t buy in the first hour you discover a coin.

That’s how most wrecks happen. Instead, create a watchlist. Track a token for a few days. Look for movement, not noise. If you see commits, user growth, and upcoming catalysts, and it’s still under the radar, that’s your moment.

Oh, and one more thing: Never fall in love.

The best plays are ones you can exit without emotion. If a coin 2x-es and you don’t know why, trim. If fundamentals change, walk away. Don’t defend bad bags just because you liked the logo.

We’re not here to make every trade perfect. We’re here to stack asymmetric bets that actually make sense.

Evaluating payment speed, adoption, and fees is key if you want to spot the best payment altcoins under $1 early.

Frequently Asked Questions (FAQs)

Q1: What’s the best way to find altcoins under $1 before they explode?

The most creative approach is to use a combination of on-chain services (such as DexScreener, Token Terminal) and GitHub activity checks, and the community monitoring (Reddit, Twitter, Discord). Pay attention not only to cheap coins but also to cryptocurrencies with actual applications and near catalysts.

Q2: Do cheap altcoins under $1 have better profit potential than high-priced ones?

Not always. A 5 cent token with a 5 billion market cap, is not cheap. The price per coin is not as important as the total market cap, and daily volume and the level of undervaluation of the project in comparison to usage or fundamentals.

Q3: Where can I track under-the-radar altcoins before they get listed on exchanges?

On the listing, starting at DexTools, DexScreener, CoinMarketCal, then overreach with GitHub, Arkham Intelligence, and Artemis to monitor wallets activity, development, and DAU momentum. And chances are youre late to the party when it already reaches X, once it goes viral.

Q4: Should I buy every altcoin that fits the checklist?

No, even good set ups go wrong. The framework is not a buy signal but a filter. Then, make sure that you receive several signals (active GitHub, increase in DAUs, vibrant community, etc.) prior to yours. And take your stand as small size, then first risk.

Q5: How often should I update my watchlist of altcoins under $1?

Preferably, once a week. The stories shift quickly in crypto. A project that you thought was dying a month ago may now be too cool to miss and it could be AI infra, modular L1s, or restaking. Continue monitoring the volume, wallet accumulation and timing of the catalyst.

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.