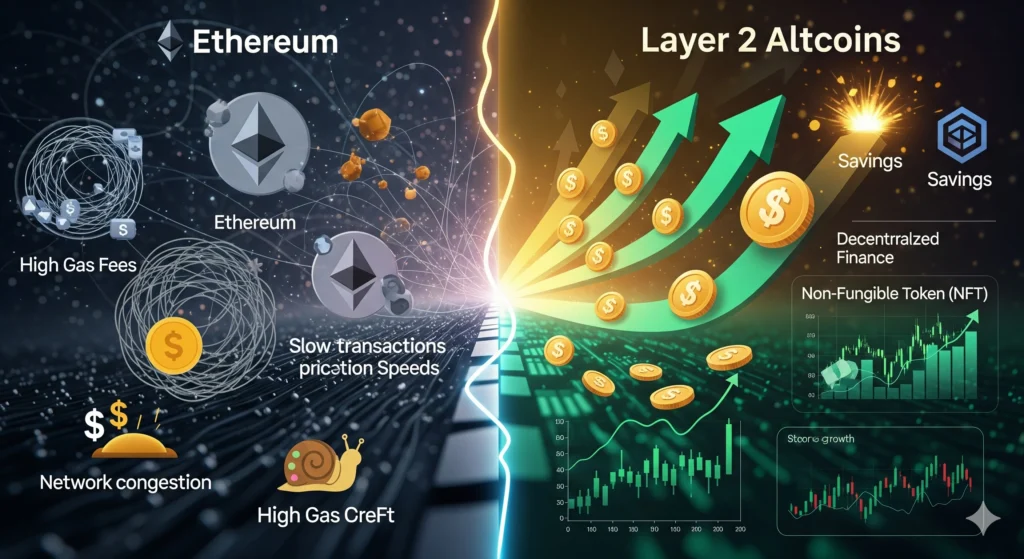

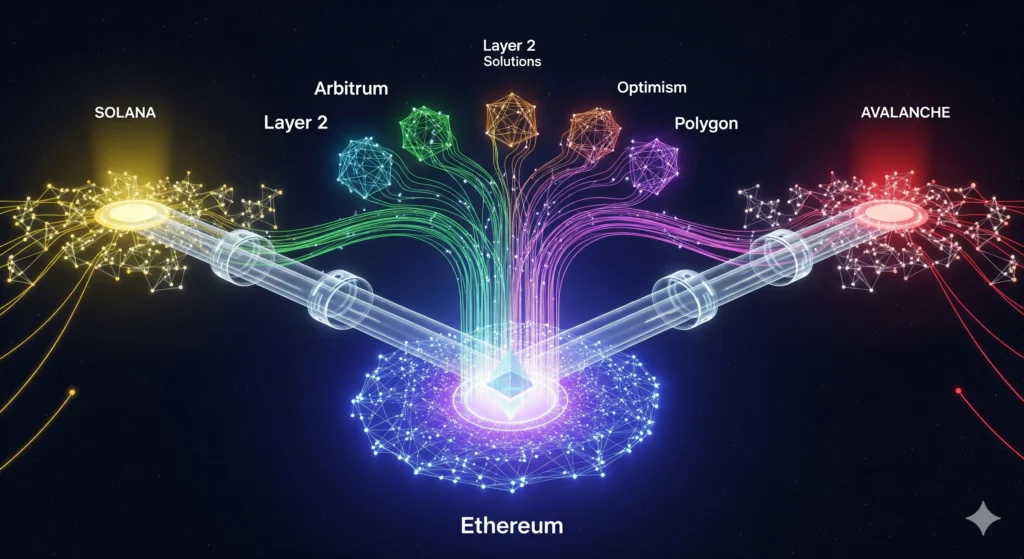

Blockchain technology has already transformed the world of finance and gaming, and it has created a digital version of ownership. However, scalability has proven to be a significant setback to the Ethereum and Bitcoin networks. During the Ethereum boom in early 2024, transaction costs for complex transactions reached upwards of $10 – $30 (peaks in early 2024) post-Dencun averages $1–$5 in 2025, making even small trades prohibitively expensive and a hindrance to mainstream adoption of Ethereum. Blockchain is held back by high transaction fees and slow transaction speeds, which puts off users, whether that is NFT collectors, DeFi traders, or just people who want to send some money to an address.

Enter layer 2 altcoins: the “express lanes” of blockchain networks. Layer 2 applications enable transactions to be processed off the main chain, and this vastly reduces the costs and enhances speed with the same or better security benefits as Layer 1. By 2025, Arbitrum, Optimism, and Polygon will be used to power DeFi, NFTs, games, and payments on a larger scale and continue to make blockchain and Web3 more accessible to many new users. This guide explores how layer 2 altcoins work, their benefits, risks, and top projects to watch, including top 7 altcoins under $1 to watch in 2025.

What Are Layer 2 Altcoins?

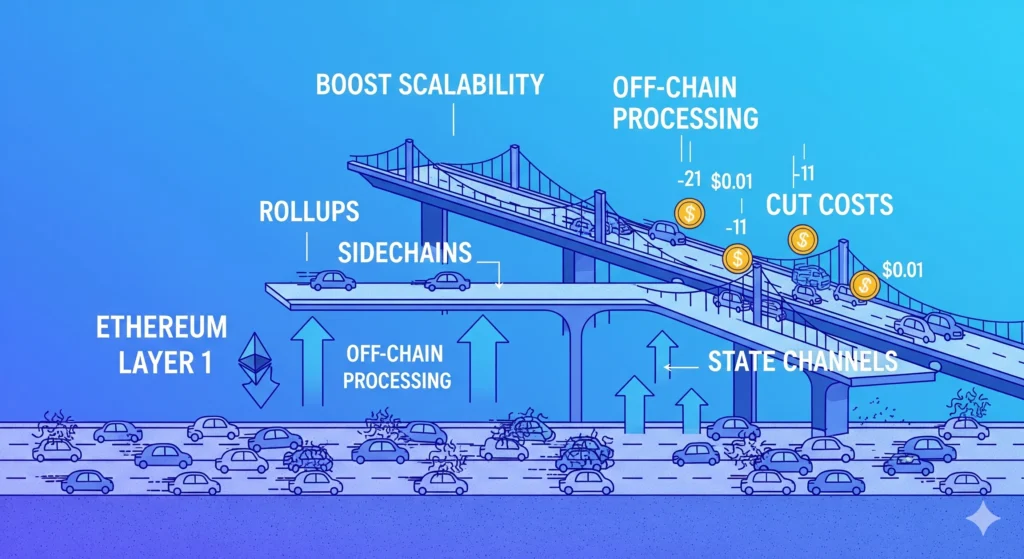

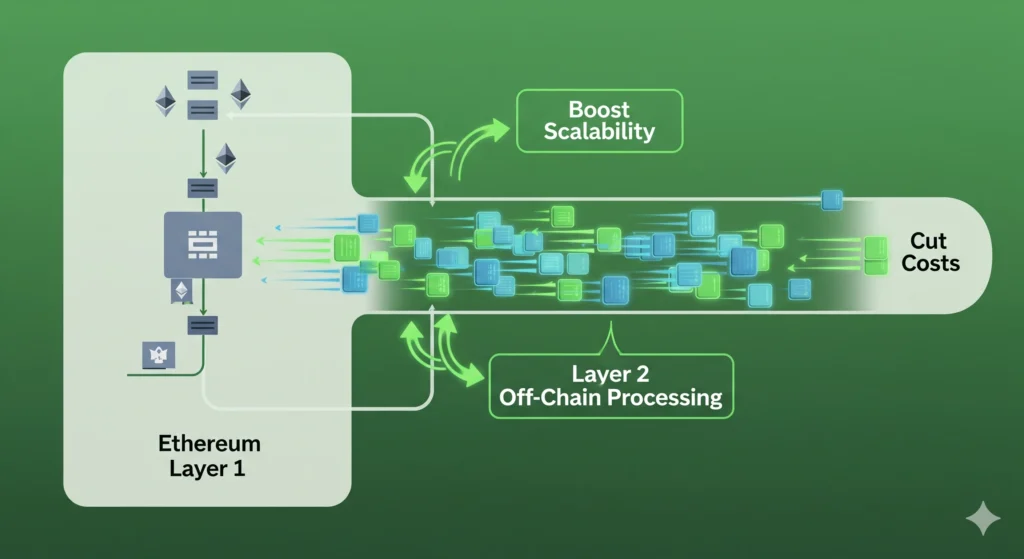

Layer 2 altcoins are cryptocurrencies tied to solutions built on Layer 1 blockchains like Ethereum, designed to boost blockchain scalability and cut costs. They offload transactions by doing much of the transaction processing off-chain and safely finalizing, like a side road unloading vehicle traffic in an otherwise crowded highway. To give an example, the Total Value Locked (TVL) on Arbitrum peaked at $19.52 billion as of August 27, 2025, as it powered DeFi apps like GMX and Uniswap V3. The examples of Polygon (0.2453) and Optimism support NFTs and gaming; for more on NFTs and gaming-focused options, check our top gaming altcoins under $1 with 10x potential. Layer 2 remedies, rollups, and sidechains play a crucial role in scaling the blockchain in 2025.

How Do Layer 2 Altcoins Work?

Layer 2 altcoins power blockchain’s scalability revolution. They do it in a way that earns trust.

Off-Chain Processing & Scaling

Arbitrum and other layer 2s, such as Arbitrum off Ethereum, submit proofs to have their transactions validated. Arbitrum supports thousands of updates an hour, reducing congestion and capitalizing on the security of Ethereum.

Efficient Batching and Lower Fees

A type of game-changer is transaction costs, which can be as low as $0.20 compared to Ethereum, which was $10-$30 in early 2024, post-Dencun averages $1–$5. The metrics of optimism indicate low charges even when there is a surge of DeFi.

Security by Inheritance

Ethereum provides a consensus to layer 2s. Rollups, such as Optimistic for Optimism ($0.7108) and ZK for zkSync ($0.06274), bundle transactions into proofs that are verified on Layer 1, ensuring they are trusted.

Bridges for Asset Movement

Bridges transfer this number of assets to Layer 2s such as Polygon (0.2453). ETH is locked and minted on Layer 2; however, security considerations are crucial regarding bridges.

Real-World Performance Proof

Optimism has served millions of wallets every day, and in August 2025, $7.7 billion of TVL (according to L2BEAT) has been powered by zkSync.

Why This Matters

Layer 2 altcoins make, rapid, inexpensive, and scalable. Curious about top projects? See our list.

Benefits of Layer 2 Altcoins

We have witnessed directly how Layer 1 networks tend to crumble under load, Transaction costs explode, and user experience is disrupted when congestion sets in. Layer 2 altcoins intervene as trusted express lanes, unlocking benefits that are transforming the blockchain frontline in 2025:

- Dramatically Lower Fees

With the Dencun upgrade of Ethereum, it experienced staggering returns on decreases in gas costs using Layer 2 networks. The rates on Optimism have dropped to around $0.05, compared to Ethereum rates, which were typically $1–5 averages, with peaks up to $10–30 post-Dencun, representing an 80-90 percent decrease in aggregate over that period. Such fee efficiency represents a game-changer to DeFi, NFTs, and micropayments; explore our top DeFi altcoins under $1 with real-world use cases for examples.

- Faster Transaction Speed at Scale

We have seen Layer 2s alleviate congestion on the Ethereum mainnet. For example, L2s have become capable of supporting between 9,000 and 200,000 TPS with nearly no gas, is significantly higher than Bitcoin and even Solana (Ether, due to their isolated L2 Revolution feature). Such speed advantage allows DeFi protocols and games to develop without being throttled by Layer 1.

- Real-World User Growth & DeFi Usage

Statistics indicate a high density of Layer 2s beyond the theory to ecosystems. The volume of transactions on Ethereum layer 2 accounts for ~65% of all Ethereum transactions, as well as at least $150B+ projected in annual DeFi transactions in 2025; nonetheless, this indicates that L2s are deeply integrated into everyday blockchain usage. Such throughput is significant and it is constantly increasing; for more on low-cap options, see our undervalued altcoins under $1 with market cap under $50M.

- Microtransactions, Gaming, and unlocking NFTs.

Low charges and high-speed Layer 2 are fuelling novel applications. It is now viable to run gameFi titles and NFT platforms smoothly. NFT minting takes just a couple of cents, rather than dollars, and creators and gamers flourish. Parallel to that, microtransactions, such as in-game purchases or tips, become feasible and scalable: discover how in our top utility altcoins under $1 in 2025 with real use.

- Seamless App Experience & Developer Outreach

From our observations, Layer 2 improves UX for both users and builders:

The crypto exchanges operating on Layer 2 provide real-time trading with small commissions to boost the liquidity and retention.

Frameworks like Optimism’s OP Stack and Polygon SDKs provide an easier experience by helping developers streamline the deployment and maintenance of Ethereum-compatible applications.

Why This Matters to Us

This is no ordinary technology talk; it is impact in action. Layer 2 altcoins are changing blockchain from professional DeFi to cheerful NFTs and all the in between. As vulnerability and fragmentation, as with all other Risks to security and efficiency, persist, the current advantages of Layer 2 and its enhanced speed and ease of use, along with widespread adoption by users, render it a backbone of scalable and usable blockchain.

Risks and Challenges of Investing in Layer 2 Altcoins

We are fond of Layer 2 altcoins to make blockchain transactions faster and cheaper, and more efficient. We should also discuss the flip side, when real risks require our attention. The following is what we should take into consideration:

- Liquidity Fragmentation and Ecosystem Consolidation

As users and developers move to major networks such as Base, Arbitrum, and Optimism, many newer and smaller Layer 2 networks have gone through a 98% revenue decline between March and May 2025. The corresponding trend is increased fragmentation and short-sightedness of under-supported chains.

Further worsening the situation, Gemini analysts purport that the existence of multiple Layer 2 chains can atomize liquidity. This isolates capital, and it becomes difficult for users and dApps to create a smooth interoperability among networks.

- Security Risks-Bridges, Sequencers, and Upgradeability

A significant vulnerability is left in cross-chain bridges. Bridges have deep security constraints, as Vitalik warns; your money is as safe as the weakest link in the chain. The risk has been highlighted in Layer 2 ecosystems through several hacks that have collectively cost more than $100 million; learn more in our altcoins under $1 to avoid in 2025: 7 red flags exposed.

Even rollups themselves are not safe; their upgradable smart contracts are vulnerable in case rogue or suspicious upgrades are uploaded. In case of a worst-case scenario, there are also Layer 2 chains, the majority of which have the ability to upgrade the contracts in real-time, which may lead to immediate and total loss of capital.

- Withdrawal Delays and Usability Frictions

Arbitrum and Optimism are optimistic rollups that rely on a period between withdrawals (usually several days, a period called the period of fraud proof. This is not very practical among the users who want to access money at short notice, especially in fluctuating markets.

Usability is also a problem, as it is difficult to intuitively move assets between chains, particularly when traversing cash registers whose fee systems are not even related; this can become annoying and dangerous for beginners.

- Centralization and Operational Governance Risks

While many Layer 2 networks pledge decentralization, reality often differs. It is noted by critics that the sequencers (i.e., sequencing the list of transactions) are concentrated in a small number of hands; any failure or malpractice by them would put the activity to a halt. In the meantime, the governance designs are oftentimes interiorized or centralized, and the issue of sovereignty is a concern.

- Technical Constraints and Advanced Complexity

ZK rollups are efficient and harder to audit and build, both because of the complexity of their cryptographic primaries. The fact that few advanced actors are used in generating proof may create centralization and slow integration to mainstream dApp developers.

Summary Table: Risks of Layer 2 Altcoins

| Risk Area | What to Watch For |

| Liquidity Fragmentation | Funds spread across L2s, reduced capital access |

| Security Vulnerabilities | Bridge hacks, contract upgrades, sequencer control |

| Usability & Delays | Slow withdrawals, confusing cross-chain UX |

| Centralization Trends | Sequencer power, opaquely governed networks |

| Technical Exposure | ZK-rollup complexity and development friction |

Key Examples of Layer 2 Altcoins under $1

Optimism (OP): Can Layer-2 Scaling Tokens Still Deliver in 2025?

In 2021, after Ethereum gas prices surged to, at one point, more than $ 50 per transaction, many developers began to seek cheaper alternatives. This is the point when Optimism (OP) has made itself a leader in the Layer-2 rollup race, and has indicated being able to scale Ethereum without losing its security.

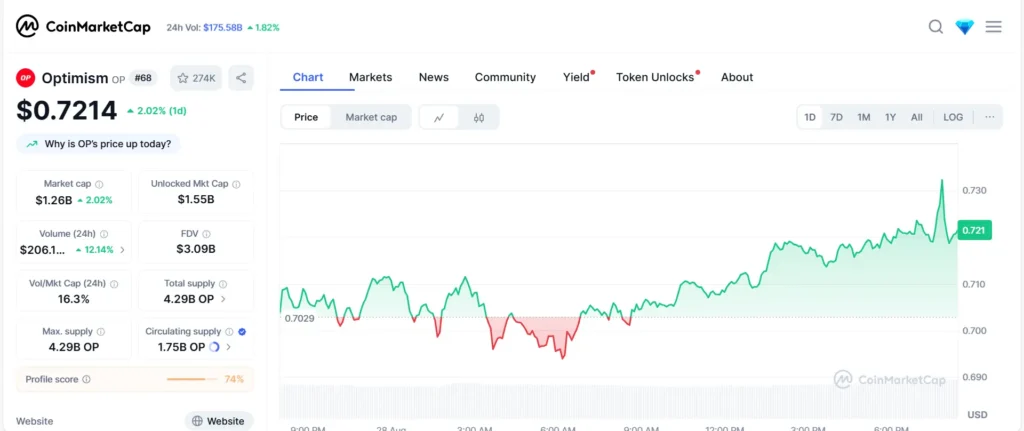

Fast forward to 2025, and the OP token unlike in 2022, when it soared above $3, it is currently (as of 28th August) trading at approximately $0.72 with a market cap of around $ 1.26 billion. Something this has brought up is a burning question to the retail investor: can Layer-2 scaling tokens still be bet on, or has the hype completely died?

Tokenomics & Adoption Pressure

The tokenomics of Optimism are strongly based on incentives produced in the ecosystem. Approximately 19% of the supply of OP was reserved for airdrops and governance grants, which generated early awareness but also selling pressure as beneficiaries cashed in. In the meantime, the new Danksharding roadmap of Ethereum may move the use of Layer-2s entirely, moving the Optimism moat long-term.

Yet adoption is not dead. In fact, DefiLlama data shows Optimism continues to rise more than $700M under the TVL, and the projects such as Velodrome and Synthetix are still generating liquidity. The same OP Stack was also submitted to the Base chain of Coinbase in order to justify the tech; it did not happen that the OP token holders gained directly.

Case Study: The Airdrop Effect

Take the OP Airdrop 2 in June 2023. The campaign had 11 million tokens that were distributed, which increased the temporary transactions by more than 60 percent weekly. However, within weeks, trading speed returned to its usual levels, a demonstration of the temporary sugar rush of false incentives against sustainable demand.

Investor Takeaway

Optimism is a paradox for investors with an alt-alpha mindset. It supports vital Ethereum infrastructure, but the capability of its token is restricted to a large degree to governance. Without stronger forms of value accrual (such as staking or fee-sharing), OP is likely to outperform poorly-performing competitors with direct-revenue connections.

Nonetheless, opportunism, priced in the negatives in the near term, remains one of the more liquid plays in Layer-2, a speculative trade that will continue to compensate investors willing to take this initial step as the future of Ethereum scaling unfolds. See our how to find altcoins under $1 before they pump.

Arbitrum (ARB): Can DeFi’s Most Dominant Layer-2 Hold Its Lead?

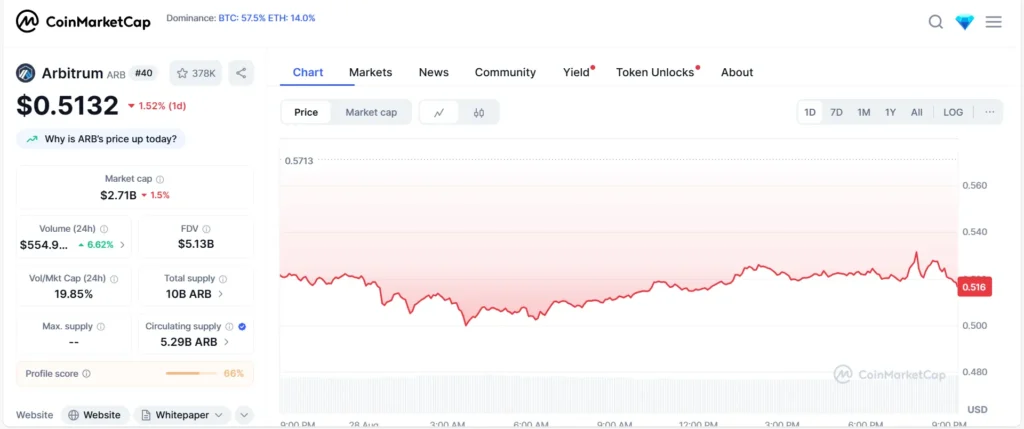

The skyrocketing gas fees of Ethereum had risen to tens of dollars, and customers and developers alike cried out in dismay. It was there that we, and so many others, resorted to Arbitrum a layer 2 altcoin and scaling system implemented on optimistic rollups, which aims to both keep fees lower and throughput higher, as well as to assure transaction finality on Ethereum.

The Market Snapshot: What Are the Numbers and Where Do They Start?

As of 28th August, the native token of Arbitrum, ARB, is priced at approximately $0.51, with 5.3 billion tokens in circulation and a market cap of around $ 2.6 billion, all of which can be verified on the latest ARB listing on CoinGecko. Ecosystem growth is also strong: According to DefiLlama there is more than $3.28 billion in DeFi TVL. $5.6 Implemented in Arbitrum, hard facts of actual application and solvency. On the broader metric of Total Value Secured (TVS),L2BEAT lists over $19 billion in value secured.

How It Is Used: Mini Case Studies that tell a story.

We have witnessed that GMX is already a consistent exchange superpower on Arbitrum, providing high trading volumes at micro fees, which is evidence that DeFi traders favour efficiency. Meanwhile, Uniswap v3 has moved key pools over to Arbitrum, which offers users cheaper swaps without losing liquidity or confidence in the Ethereum execution layer.

These are not merely anecdotes: they are everyday, quantifiable changes that demonstrate how a layer 2 altcoin can redefine the user experience.

Tokenomics & Governance – How ARB Powers the Ecosystem

The ARB token is the governance core of the Arbitrum DAO, as it allows its holders to influence all aspects of the treasury, including future improvements. Arbitrum governance documentation suggests the following.

The ARB is fixed at 10 billion, and inflation is limited to 2% per year.

This inflation helps in community-funded grants and ecosystem development. Besides, the economic model is anchored with the long-term alignment and decentralization commitment, as nearly 43% of the tokens are allocated to the DAO treasury, 27% to the team and advisors, 18% to the investors, and approximately 12% of the tokens are airdropped.

Why It Matters – The Layer 2 Altcoins Angle

We refer to ARB as a layer 2 altcoin not only because it is an L2 solution, but because it is based on a token economy that rewards network expansion, governance engagement, and real-world crypto usage. In contrast to fee-only models, ARB provides a voice to the community and, once so arranged, a vested interest in future developments. Here’s where to stake altcoins under $1 safely.

Polygon (POL): From Sidechain Fame to zkEVM Underdog

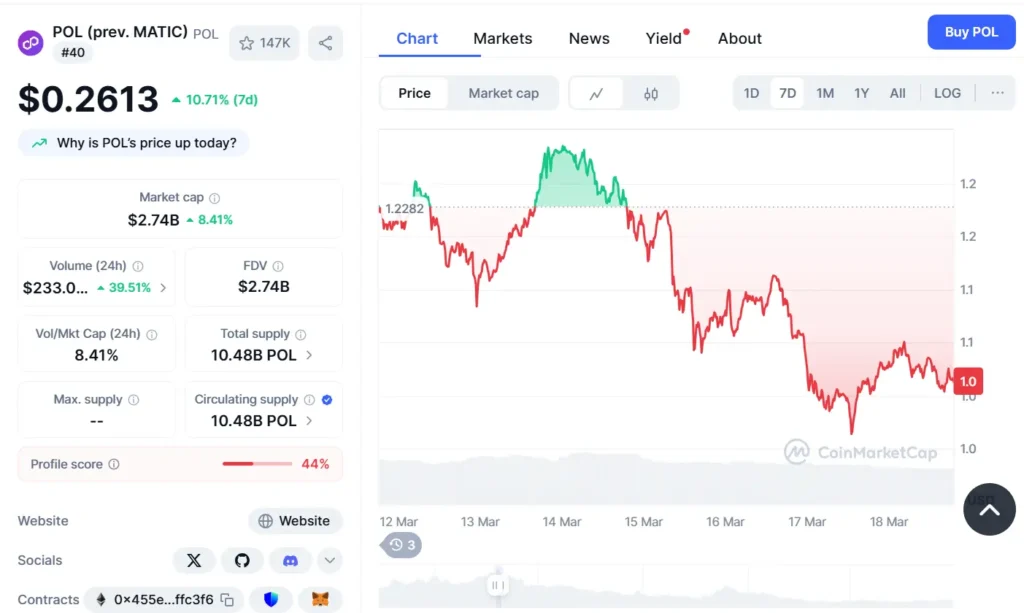

Previously the star of enterprise and NFT projects, Polygon (POL) as on 28th August traded around the $0.26 range, with a market cap of $2.74 billion, and investor sentiment cooled following the peak of MATIC. Nevertheless, its shift to zkEVM and brand deals that it retained have kept it on watch.

Tokenomics & Adoption Pressure

The POL token facilitates easy staking, gas, and governance on Polygon networks. Reported capped supply of 10 billion, and no additional emissions are planned; rather, the protocol operates with a fixed 2 percent emission split between validator rewards and treasury funding. With $1.19B DeFi TVL on DefiLlama as of August 28, 2025, Polygon supports NFTs and gaming.

Case Study: NFT Minting Economies

The Big Digs in the collection, such as Courtyard on Polygon, sold more than 17 million NFTs weekly, outperforming much of the competition on Ethereum in this respect. Such a spike highlights the fact that Polygon remains committed to providing low-cost blockchain experiences.

Investor Takeaway

POL is also among the most famous under-one-dollar Layer-2 altcoins. However, unless developer adoption and zkEVM usage take off, it will be labeled as bloated legacy instead of next-gen.

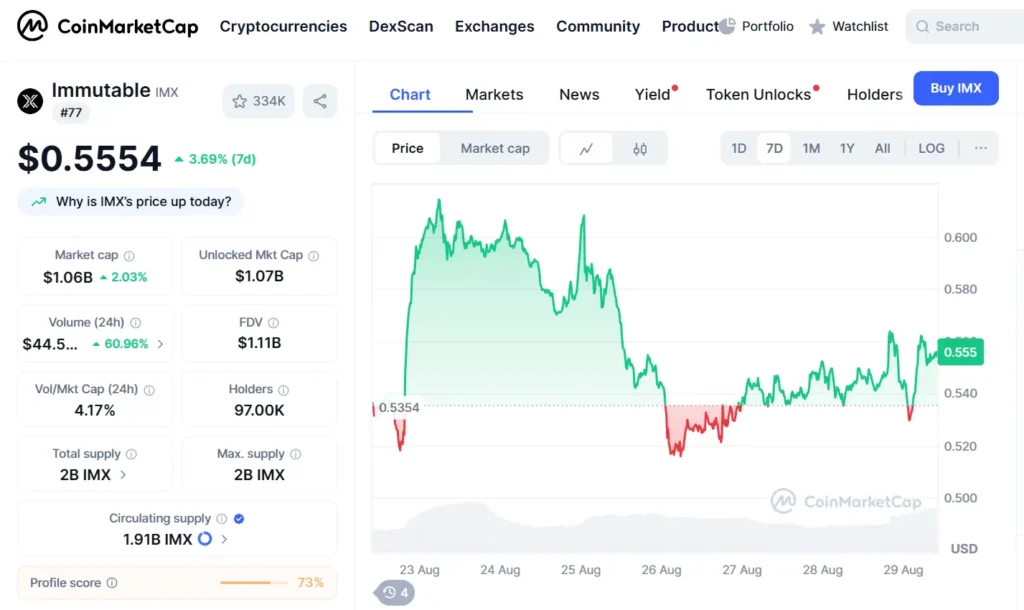

Immutable X (IMX): The NFT Gaming Highway-Can It Revive?

Immutable X, which as of 28th Aug, 2025 trades around $0.55, shot up amid its talk of gas-free NFT minting and quick transactions. That said, with speculation now gone, the question remains whether it can make a comeback through gaming partnerships and ecosystem strength.

Tokenomics & Adoption Pressure

IMX supports staking and transaction fees as well as zkEVM NFT infrastructure. Immutable also increased its transactions by 5.7% QoQ after Q1 2025, although NFT sales had declined slightly, showing that it is actively used even as the number of users keeps decreasing.

Surpassing Ethereum in NFT Volume Case Study.

By June 2025, Immutable had surpassed Ethereum in NFT sales in terms of monthly volume sold, providing evidence that layer-2 altcoins can outperform larger chains in the right setting.

Investor Takeaway

IMX is one to watch in breakout altcoins, but it’s a high-wire act. Its success hinges on sustained NFT adoption and continual user engagement.

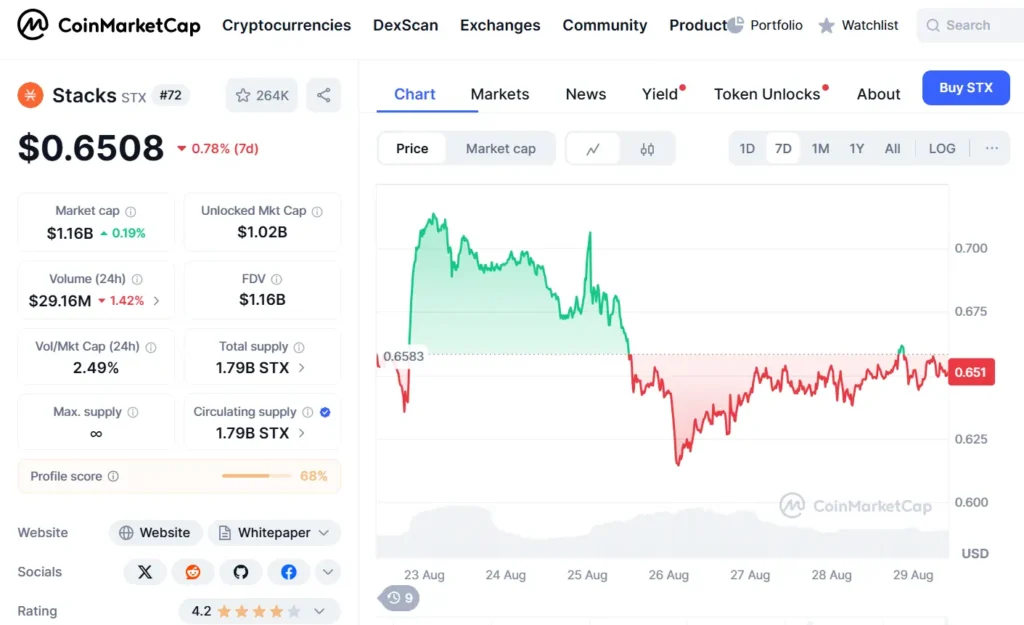

Stacks (STX): Bitcoin’s Layer-2 Gambit – Hit or Miss?

A higher-value token, Stacks (STX), which as of 28th August trades at an approximate price of $0.65, with a market cap of $2.74 billion, provides Bitcoin-native DeFi through its Proof-of-Transfer (PoX) model. It is not competing with the Ethereum crown; it is based on the Bitcoin platform.

Tokenomics & Adoption Pressure

STX tokens can be stacked to lock tokens and receive BTC rewards. Its economics are similar to those of Bitcoin because its supply is capped at 1.79 billion, which is predictable.

Case Study: Bitcoin-Aligned DeFi

Some Stacks-based projects, including CityCoins, gained momentum during the Ordinals boom and demonstrate how Layer-2 innovation can unlock the utility of Bitcoin without modifying its underlying layer.

Investor Takeaway

STX is a unique altcoin story with a foundation in Bitcoin, developer innovation, and yield on real BTC. Its niche nature, however, implies that it can only grow so far unless the wider DeFi on Bitcoin takes root.

Quick Recap Table

| Layer 2 Altcoin | Live Price & Market Cap (as of 28th Aug) | TVL Overview (as of 28th Aug) | Key Usage or Growth Insight |

| Arbitrum (ARB) | Price $0.51 & market cap $2.71 billion | $3.22B DeFi TVL on DefiLlama • $19.33B Total Value Secured (TVS) on L2BEAT | GMX and Uniswap v3 drive heavy trading and liquidity. |

| Optimism (OP) | Price $0.72& market cap $ 1.26 billion | $3.61B TVL on L2BEAT, $1.2B DeFi TVL on DefiLlama | Low fees (<$0.10) and growing adoption, especially via OP Stack integrations. |

| Polygon (POL) | Price $0.26& market cap $2.74 billion | $1.19B DeFi TVL• ~$4.8B bridged value | NFT and brand use cases (e.g., Starbucks, Refund) keep it visible. |

| Immutable X (IMX) | Price $0.55 & market cap $1.06 billion | Not listed, but NFT volume on Immutable X surpassed Ethereum in June 2025 | Games like Gods Unchained drive gas-free adoption. |

| Stacks (STX) | Price $0.65& market cap $1.16 billion | Smaller ecosystem, but real BTC yields via stacking | Enables smart contracts and DeFi Layer 2 on Bitcoin, unique bridging use case. |

How Layer 2 Altcoins Differ From Each Other

The L2 (Layer 2) altcoins can be similar in purpose, sharing the same goal of scaling blockchain networks. Still, they have different approaches, consensus mechanisms, tokenomics, and adoption principles, which make them very different investment opportunities. We will examine the key differences between the five most popular Layer 2 tokens: Arbitrum (ARB), Optimism (OP), Polygon (MATIC), Immutable (IMX), and Starknet (STRK).

- Scaling Technology

Arbitrum (ARB): Optimistic Rollups, based on fraud proofs. The transactions are considered valid unless they are contested.

Optimism (OP): Yet again uses Optimistic Rollups, but focuses on modular governance and public goods financing.

Polygon (MATIC): Hybrid model- sidechains + zkEVM rollups. Provides numerous scaling solutions, as opposed to a one-size-fits-all approach.

Immutable (IMX): An NFT/gaming platform based on zk-rollups (StarkEx) to enable trading with instant finality and no fees.

Starknet (STRK): Starknet is built on zk-STARKs, which are faster and more secure than zk-SNARKs and do not require trusted setups.

Note: Optimism and Arbitrum are similar in how they work as rollups; however, zk-based systems (Starknet, Immutable, Polygon zkEVM) can be more future-proof as Ethereum becomes more of a zk-dominant system.

- Ecosystem & Adoption

Arbitrum: Holds ~40% of the Ethereum L2 market share with protocols like GMX and Radiant.

Optimism: The OP chain is well-suited for Coinbase (the Base chain is OP Stack), which would be appealing to institutional users.

Polygon: Nike, Reddit, and Meta use Polygon, as well as deep DeFi + NFT ecosystems.

Immutable: Web3 game developer; collaborated with GameStop, Illuvium, and Gods Unchained.

Starknet: With the support of Ethereum co-founder Vitalik Buterin, developer enthusiasm in Cairo smart contracts is rising.

Takeaway: Polygon dominates brand adoption, Arbitrum dominates DeFi liquidity, Immutable dominates gaming, Optimism dominates infra partnerships, and Starknet dominates bleeding-edge cryptography.

- Token Utility & Tokenomics

ARB: Governance asset; inflation-adjustable, not yet staked.

OP: Governance + incentives to builders; inflationary, countered by ecosystem grants.

MATIC: chain secured through staking; deflationary through EIP-1559-style burning.

IMX: IMX is utilized in protocol fees, staking, and marketplace rewards. Fixed supply of 2B tokens.

STRK: Governs Starknet gas prices, governance, and staking (planned). Supply: 10B with a 4-year unlock schedule.

📌 Takeaway: The deflationary model of MATIC is the most attractive in the long run, and ARB and OP are governance-intensive. IMX and STRK combine utility and staking.

- Investment Profile

Arbitrum (ARB): DeFi powerhouse, less risky but slower upside.

Optimism (OP): Strategic bet on Coinbase adoption.

Polygon (MATIC): Blue-chip L2 with enterprise adoption.

Immutable (IMX): Small, yet could skyrocket in case of Web3 gaming success.

Starknet (STRK): A more risky-reward; zk-STARK technology could turn it into the supreme.

Investor Angle: A diversified L2 basket across these coins reduces risk and captures various narratives, including DeFi, gaming, zk-tech, and enterprise adoption.

The Future of Layer 2 Altcoins

Layer 2 altcoins are no longer just experimental solutions for scalability; they’re fast becoming a cornerstone of the blockchain ecosystem. The scaling tokens are emerging as the infrastructure behind the next wave of crypto adoption, as transaction volumes increase and networks grapple with high fees.

Growing Cross-Chain and Multi-Chain Adoption.

One of the most significant drivers for the future of layer 2 altcoins is cross-chain interoperability. Platforms like Polygon (MATIC) and zkSync are creating bridges to enable assets to flow across ecosystems. This change is important as retail users and developers do not want to be bound to a single chain- they need flexibility. Check our best cross-chain altcoins under $1 in 2025 for more.

An example: Polygon’s AggLayer is working to standardize liquidity across chains, and the ZK Stack of zkSync enables projects to spin up their own rollups, building a modular interconnected future.

Institutional Adoption Potential

Institutional players are starting to look at layer 2 altcoins not just for speculation, but as infrastructure bets. JP Morgan blockchain research indicates that scaling solutions will play the most important role in rendering Ethereum settlement institutional-grade. This new awareness places coins such as Arbitrum (ARB) and Optimism (OP) in a privileged position: not only do they operate DeFi and gaming dApps, but they are also drawing enterprise pilots to other applications, including tokenized assets and payments.

Competition With Fast L1s

The rise of fast layer 1 blockchains like Solana and Avalanche adds competitive pressure. These L1s provide high throughput without the required separate rollups. Nonetheless, the history of technology reveals that ecosystems with high developer traction (e.g., Ethereum and its L2s) tend to survive longer than speed-driven competitors. According to DefiLlama data, an example is that, despite Solana having a record TPS, Ethereum L2s have steadily taken the lion’s share of DeFi TVL.

Mixed Perspective: Open but still to develop.

Looking ahead, the outlook for layer 2 altcoins is promising—but not without risks. Concurrently, as they are resolving the congestion and fee issues, its adoption relies on security audit, user experience, and the sustainability of the economy over the long run. Projects continue to exhibit risks of centralization (e.g., sequencer control), and others are developing entirely decentralized governance frameworks.

In short, Layer 2 altcoins are likely to remain essential in the cryptocurrency landscape, bridging scalability gaps, fueling Web3 adoption, and competing head-to-head with fast Layer 1 challengers.

Final Thoughts

Layer 2 altcoins are no longer just experimental add-ons to Ethereum, they’re becoming essential infrastructure for scaling blockchain adoption. They reduce costs, accelerate, and offer new functionality to provide a link between the current limitations of the blockchain and tomorrow, when networks can be used in the mainstream.

With this said, the investors must keep in mind that not every Layer 2 solution is created equally. Optimistic rollups, zk-rollups, and scaling methods based on hybrid have various trade-offs in terms of speed, cost, and decentralization. To take some examples, whereas Arbitrum is doing well in terms of EVM compatibility and ecosystem depth, other projects, such as Polygon, are focused on zk technology and multi-chain expansion.

Exciting as this space may appear, we urge our readers to look into each project separately, whether it is reviewing tokenomics, checking on active developer activity on GitHub, tracking TVL on DeFiLlama, and making investment decisions directly based on official announcements.

The broader outlook remains positive: Layer 2 altcoins are driving blockchain adoption from a niche to real-world usability. However, like any rapid-paced industry, there are threats, be it in technological advances, security issues, or governmental changes. The best mode of negotiating this dynamic environment is to remain updated and diversified; start with our where to buy altcoins under $1: 5 best exchanges (2025).

At AltcoinsNest, we are committed to continuing to deconstruct these trends in simple, understandable terms, using verifiable data, so you can make more informed, evidence-based decisions in the crypto space.

FAQ Section

Q1. What are Layer 2 altcoins?

Layer 2 altcoins are cryptocurrencies built on scaling solutions that operate on top of major blockchains, such as Ethereum. They do not compete with the base chain but make it faster, cheaper, and more usable to DeFi, NFTs, and other Web3 applications.

Q2. How do Layer 2 altcoins improve Ethereum?

They minimize congestion by off-chain (or batch) processing transactions and then settling them on the Ethereum blockchain. It translates to reduced gas charges, quicker approvals, and additional capacity of dApps to scale without jeopardising the security of Ethereum.

Q3. Which are the top Layer 2 altcoins in 2025?

The Arbitrum (ARB), Optimism (OP), Polygon (MATIC), zkSync (ZK), and Starknet (STRK) are considered some of the most discussed Layer 2 projects in 2025. Both of them have different scaling and adoption strategies.

Q4. What is the difference between Optimistic and ZK rollups?

Optimistic rollups are designed assuming that transactions are right by default and count on the presence of fraud proofs to settle disputes.

ZK rollups produce cryptographic evidence (zero-knowledge) of each batch and are hence superior in security and performance, yet technically complex.

Q5. Are Layer 2 altcoins safer than Layer 1?

Not exactly. This means that Layer 2s share most of Ethereum’s security, although new risks such as bridge exploits, smart contract vulnerabilities, and upgrade bugs are introduced. They are largely safe; however, further development and careful studies are recommended.

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.