Have you ever been afraid of those large corporations stalking your online shopping habits? We all do sometimes. When personal data is leaked on a regular basis, concealing your personal information is more valuable than ever. That’s why we’re talking about privacy altcoins under $1, affordable cryptocurrencies designed to shield your transactions from prying eyes.

In contrast to Bitcoin, where all transactions are published on the blockchain, privacy altcoins employ various methods to obscure information about who and how many. You can think of them as electronic cash that is not tracked. However, recent studies indicate that privacy coins are gaining traction, and projects such as Pirate Chain and Beldex remain below the one dollar mark, dedicating themselves to more robust anonymity capabilities. Privacy tokens are also beginning to gain renewed interest as market analysts perceive that users are seeking alternative ways to secure data in 2025.

For everyday investors, privacy altcoins under $1 act as a low-cost entry point into crypto privacy. Why bother with less than a dollar, though? It is made more easily accessible to many people interested in learning about privacy coins without a considerable monumental DNS expenditure. No flash here, as we will present things as they are. In the following parts, we will describe what privacy altcoins are, how they work, present real-time examples in the future (2025), and discuss possible drawbacks. And because crypto is uncertain, like in the privacy arena where regulators are increasingly restricting enforcement, we will adopt a more cautionary didactic prism throughout. This article focuses on privacy altcoins under $1 that make data protection more accessible.

If you want to explore the broader landscape of low-cost tokens, we’ve also reviewed the Top 7 Altcoins Under $1 to Watch in 2025, which includes some projects with strong community traction.

What Are Privacy Altcoins Under $1 & Why They Matter?

Privacy altcoins are cryptocurrencies designed to conceal aspects of transactions, such as the sender of the funds, the recipient, and the amount transferred. They are not just concerned with being fast or flashy. Privacy coins utilize specialized cryptographic tools in such a way that portions of the blockchain ledger are hidden by a coin changer or encrypted.

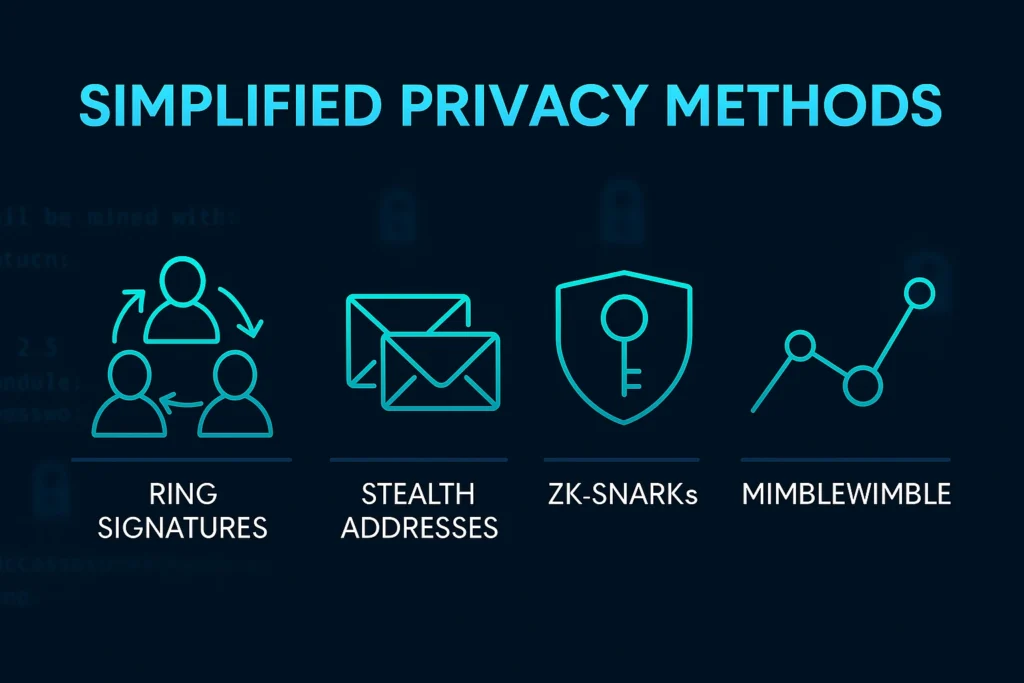

The following are some of the typical privacy techniques, discussed in straightforward terms:

- Ring signatures: Suppose you put your signature on the bottom of the permit along with a number of people, and no one could tell who signed this permission. How ring signatures are used, one signature is real, but which one, you just do not know. In use by Monero and its closely related systems, to conceal senders.

- Stealth addresses: imagine stealth addresses as one-time mailing addresses. Each time a person sends you crypto, the nearest amount is created with a new one-time address based on yours to ensure that the viewers cannot recognize which various payments belong to you.

- Zero-knowledge proofs (zk-SNARKs / zk-STARKs): ZKs are more advanced. They allow you to prove something was true (e., you have enough balance) without telling you what the actual numbers or identities are. Zcash is one well known snarf using zk-SNARKs.

- MimbleWimble / Confidential Transactions / Mixing: Other constructions that limit or obscure metadata (such as amounts or outputs). They can also compress the data or combine multiple transactions to make tracing it more difficult.

Not every sub-$1 altcoin focuses on privacy, some are built for apps, payments, and decentralized platforms. For example, our guide to the Top Utility Altcoins Under $1 in 2025 highlights coins driving real-world use cases.

Why focus on privacy altcoins under $1?

The point of not targeting higher-priced altcoins is not that they will potentially triple in value, just that accessibility, experimentation, and visualization of risk are more reachable. And this is interesting about that price threshold:

- Less money needed to use: When a coin is less than a dollar, novices can test their devices without leaving much money behind. It makes participation democratic.

- Possibility of hidden utility: Smaller or cheaper privacy projects tend to experiment with new features, adapt features, or address niche user requirements not served by large projects. The digestion of this information can yield insights into privacy tech trends.

- The tradeoffs are more obvious: Low-price privacy coins tend to expose struggles earlier, such as inadequate liquidity, audit deficiencies, or pitiable dev teams. There is no need to read much about them to understand what works and what does not in raw form.

Important caution: growth without promises

We don’t want to fall into hype. Privacy is becoming more relevant, yes. However, privacy coins that do not yet cost more than one dollar will not make someone wealthy. The cryptosphere is volatile. An attractive project may fail; regulatory reforms can have a profound impact on the treatment of these coins. We aim here only to listen to how such technologies and communities work, rather than speculatively selecting a winner.

Potential Risks and What to Watch For

Exploring privacy altcoins under $1 is exciting, but it also comes with unique challenges that we need to talk about openly. These projects can come with anonymity and accessibility promises, but crypto risks are never too distant. The most important issues can be deconstructed.

Volatility and Market Liquidity

Local coins in the new range typically attract low prices and are mostly associated with small-cap ventures. This implies that the dwelling through which they can fluctuate is over hours or even minutes. They are also more susceptible to price manipulation due to their thin trading volumes. This is, as CoinDesk’s market analysis on small-cap altcoins indicates, that liquidity gaps can exaggerate profit and loss. Anyone analysing these tokens must have the concept of volatility in mind.

Of course, volatility cuts both ways, some privacy projects may stall, while others remain undervalued with room to grow. We covered a few of those in Undervalued Altcoins Under $1 with Market Cap Growth Potential.

Regulatory Scrutiny

Privacy coins are painted under a magnifying glass. They have raised warning bells all over the world among regulators, who consider it makes it easy to transfer money anonymously, which some governments fear would further facilitate illegal activity. Indeed, the guidance on virtual assets issued by the Financial Action Task Force (FATF) specifically identifies privacy-enhancing coins as a factor of concern. More recently, the news reports have also indicated how exchanges have delisted privacy tokens due to compliance factors, including CoinTelegraph, reporting exchange delistings in Europe.

Technical Limitations

Not all privacy technologies are made equal. A few coins choose privacy as optional but not default, undermining the overall anonymity provided, as only a small number of users use it. Others can be using test cryptography that has yet to be properly audited. As documented in the review of privacy practices conducted by Decrypt, a trade-off exists between the ease of use, ability to scale, and the effective power of anonymity. For example, zk-SNARK systems should be implemented with careful attention to prevent vulnerabilities.

Bottom Line

While studying privacy altcoins under $1, it’s important to keep a balanced view: they can be innovative and educational, but also fragile. Rules can come and go, thin markets can disappear in a short time frame, and trial codes can fail. That is not our aim here, but enlightenment – thus enabling the reader to treat such projects with the discerning care they deserve.

Selection Criteria for Privacy Altcoins under $1

Before diving into the specific privacy altcoins under $1, it’s worth clarifying how we selected them. We only included privacy altcoins under $1 with active development communities. Choosing privacy altcoins under $1 means balancing accessibility with real use cases. This is an educational review, not an investment recommendation, and as such, it has a more transparent, operational, and usable orientation, rather than hype.

Price Threshold

Any coin that we mentioned with a value of less than $1 at the moment of writing was only because of the live market data available on CoinGecko crypto price tracker. Prices change, and what is qualified today is not necessarily so tomorrow, but the snapshot provides us with a reasonable starting point.

Active Development and Community

A privacy coin is dodgy unless it is updated regularly. We checked GitHub issues, community discussion boards, and ecosystem activity to make sure that projects are not abandoned. The library of crypto research by Messari highlights that the speed of development is the most significant factor in gauging altcoins, as opposed to their price.

Unique Privacy Features

None of the privacy coins does it the same way. Others use ring signatures or stealth addresses, and still others are testing with zk-proofs or hybrid systems. We have settled on coins that implement transparent privacy over dubious assertions. The failure of these approaches may be observed in the Investopedia guide to privacy coins.

Accessibility and Learning Value

Lastly, we included the ease of use of each coin for novice learners. Better subject to case analyses are coins found on various exchanges, including wallets and documentation. That does not imply that they are less risky as an investment, just that they are easier to experiment with.

5 Privacy Altcoins Under $1

Verge (XVG): The People’s Privacy Coin That Refuses to Disappear

Among privacy altcoins under $1, Verge stands out for using Tor and I2P. The history of Verge (XVG) regarding the privacy coins is a curious one. After building a hype as a less expensive version of Monero, Verge has turned to the anonymity wearable technologies such as Tor, I2P to obscure the IP addresses as a digital cash in real world usages. Its grassroots appeal boosted the explosion in popularity during the 2017 bull run, but also drew backlash because of its safety lapses and excessive promises.

Current Price Snapshot

As of 6 October 2025, Verge trades at around $0.007, a fraction of a cent, but still actively traded actively on a number of mid-level exchanges. Keep up with its current market action at the Verge page of CoinGecko.

Development Pulse

Verge has not abandoned GitHub, likely in contrast to certain micro-cap projects. Gitters have been rolling out updates containing wallet enhancements and protocol fixing, but the pace at which this occurs has decreased somewhat since its main years of operation. On the official GitHub repository, you can view the code progress.

Use Cases and Milestones

The primary application of Verge has been for backdoor, speedy, and inexpensive transactions, as well as integrations into online stores and a few adult content sites during its prime. It achieved its most significant milestone when it signed a payment agreement with Pornhub in 2018, briefly putting it into the public limelight. Although this collaboration has since lost its relevance, the coin continues to be marketed as a privacy-focused competitor for small peer-to-peer transactions.

Risks & Red Flags

The primary concern with Verge is its spotty history of security. The network has been hit by several 51 percent attacks in 2018 and 2021, casting its stability in doubt. Liquidity in the market is also fairly thin, which can increase volatility. And with regulators expanding their review of privacy instruments, it may become impossible to use or list something like Verge in the future.

Bottom Line

Verge is an app left behind in a previous era of privacy coins, and it currently provides a very low fee to those interested in trying the space. Yet its small cost is met with oversized risks: little adoption, spotty security, and an uncertain legal future. It must be seen as more of a case study in the history of cryptocurrency rather than a sure-to-win example given to investors.

Pirate Chain (ARRR): Privacy Locked Down & Always On

Pirate Chain is one of the most notable privacy altcoins under $1 with default zk-SNARK privacy. Pirate Chain (ARRR) is referred to as 100% private send – no optional privacy options, no half-baked alternatives. Every operation on the network is cloaked with zk-SNARKs, so by default, the sender, the receiver, and the size are unknown. Verge privacy by choice means Pirate Chain privacy by edict. It targets the crypto anonymity ideal of the gold standard.

Live Price & Market Snapshot

As of on 6 October 2025, Pirate Chain (ARRR) is being traded at approximately $ 0.315 on CoinGecko, which is below $1. You can look at its live price and market cap of Pirate Chain on CoinGecko indicates that it is currently circulating nearly 196 million ARRR.

Developer Activity & Open-Source Credibility

The source code of Pirate Chain can be found on GitHub under the PirateNetwork/pirate repository; this is the core repo for its network protocol.

It has an official wallet, documentation, mobile SDKs, and tools repositories, as well as the Pirate Android Wallet SDK. It is under active development. This is considered experimental, but it features continuous updates.

On-Chain Use Cases & Key Milestones

- Pirate Chain insists on privacy by default: The Pirate Chain (ARRR) transactions are not transparent at all but are instead shielded (with zk-SNARKs) – there is no transparent variant. That prevents the problems with privacy/transparency that are mixed with some coins.

- It also utilizes Delayed Proof of Work (dPoW), a system that relies on other blockchains (Komodo, Litecoin) to certify the Pirate blocks and helps to prevent a 51% attack.

- Wallet and UX improvements: A new “Treasure Chest” full-node wallet release added enhancements (node communication encryption, speed improvements, TLS to provide more private node-to-node communication).

Risks & What To Watch For

- Absence of third-party audits: Pirate Chain boasts high privacy standards, but these are not as publicly visible as those of other larger privacy names. That adds risk, particularly to security bugs.

- Volume and marketability are key considerations for small-cap coins, and Pirate Chain (ARRR) tends to trade infrequently. It implies that price moves can be violent and that it may not be easy to make large buys or sells without the order being slipped (moved) due to price changes.

- Regulatory pressure: Obligatory privacy may come under examination. Coins that conceal either a sender or a recipient entirely are subject to skeptical regulation in some jurisdictions or are delisted by exchanges.

- Trade-offs with usability: Full shielded transactions may have a more expensive cost to the resources (wallet syncing time, larger proofs), and they may be limited in the number of wallets available. Transparent chains can be faster than users.

Bottom Line

For those who believe privacy should be absolute, Pirate Chain (ARRR) stands out among privacy altcoins under $1. It is default anonymized, has strong developer credentials, and features newly introduced wallet upgrades and security enhancements. Privacy locked down, however, does not imply risk locked out. It requires slower adoption by the users, various regulatory friction, and a certain level of uncertainty about audits. The Pirate Chain is a powerful example of what privacy coins aim to achieve. It is not about shining profits but rather a hearty pledge: leave no traces behind.

Beam (BEAM): Can Private DeFi make it with less than $1?

Beam is not just another coin of privacy; it is an attempt to recreate the way DeFi functions in the case of money flowing without a trail. Beam shows how privacy altcoins under $1 can build advanced DeFi features. Introduced in 2019 on the MimbleWimble protocol, Beam obscures the details of transactions such as amounts, senders, and receivers by default. Imagine digital cash, but with an in-built dirty lending toolkit, token-minting toolkit, and atomic swaps. That is what differentiates Beam from privacy veterans like Monero or Zcash that deal primarily with payments.

At the time of writing, Beam trades at just around $0.008 on CoinGecko, making it one of the more affordable privacy altcoins under $1. Although that cheap price does not imply irrelevance, Beam’s roadmap has consistently aimed at the frontier of “Confidential DeFi.”

The Tech: MimbleWimble & Confidential Assets

Beam’s privacy comes from MimbleWimble, the protocol that relies upon small-scale cryptography to strip the blockchain of unnecessary data. The outcome: smaller, faster, and private transactions. And on top of that, Beam added the Confidential Assets option, which allows whoever wants to issue tokens in which transfer and balances will be concealed. The Beam Foundation believes this clears the path to privately issued stablecoins, wrapped assets, or even NFTs.

The concept does not merely lie in its approach to obscuring payments, but rather the existence of an alternative DeFi ecosystem, in which all aspects, lending to swaps, maintain privacy by default.

Dev Activity & Community Signals

Beam’s code is open source under the BeamMW GitHub repo. The modules of the wallet, node, and confidential assets are continuously revised by developers. For example, the GitHub wiki describes the operation of Confidential Assets – Beam, which aims to be transparent in everything it designs, yet it seeks to drive privacy onto the blockchain.

Community efforts were also ambivalent. Beam Telegram and Discord are active, but the amount of trading is very low, in contrast to other, more popular privacy coins. Critics claim that the complexity aspect has hindered mainstream adoption, although developers continue to release incremental updates to wallets and SDKs.

Milestones and AP applications Piane

- Atomic swamps: Beam facilitates swaps of coins such as Bitcoin and Litecoin without using a centralized exchange.

- Confidential DeFi: The company has long-term plans that take into consideration smart contracts and confidential lending apps, but only a few are adopted at present.

- Wallet updates: Beam has developed desktop and mobile wallets, which include privacy features, such as in-wallet atomic swaps.

These are good measures, but a more significant question is whether users will move on to Beam, as big chains like Ethereum already consider privacy layers of their own.

Risks & Red Flags

Beam isn’t without hurdles:

- Thin liquidity: BEAM has consistently low volumes when it trades below a dollar, which increases the volatility of the price movements.

- Audit transparency: This information is present, but less than both GitHub and hasn’t gone through a security audit by third parties yet.

- Regulatory heat: The global watchdogs are losing confidence in full-privacy coins. Beam could encounter listing or liquidity challenges, as has been witnessed in other privacy assets where there is an exchange delisting.

Bottom Line

Beam is one of the most ambitious privacy altcoins under $1 because it isn’t satisfied with being “just another private coin.” Its creators are making wagering on a personal DeFi stack sensitive stablecoins, swaps, and resources, which are competing with an open economy on Ethereum. However, there are risks that go hand in hand with ambition; it will reduce the number of adoptees, the shadow of regulating processes will be hit, and the concept of advising users that privacy should be the default mode rather than an attendant has to be tapped.

So far, Beam is an experimental venture: inexpensive, scuttlebutt-laden, and fraught. It will stay a secretive treasure trove or disappear behind the scenes after determining how the crypto world cherished privacy, in view of the growing surveillance.

PIVX (PIVX): Privacy in Communities Under $1

If there’s a “grassroots” player among the privacy altcoins under $1, it’s PIVX. PIVX, a fork of Dash, was launched in 2016 and has, in the ensuing years, attempted to reconcile between private payments and community governance, as well as community governance with eco-friendly proof-of-stake. The name of the project, Private Instant Verified Transaction, is rather technical; nevertheless, its purpose is straightforward to improve. Everybody should be able to use crypto in a day-to-day use that is both quick and secure.

At the time of writing, PIVX prices are approximately $0.14 on CoinGecko.

Locked it in the area below one dollar. To long-time subscribers, this low cost is not a new thing; however, PIVX has seen highs and lows, but the cadre have been particularly resistant because of the buy.

The Tech: zk-SNARKs & Proof-of-Stake

In contrast to Bitcoin or Monero, a PIVX consensus system is Proof-of-Stake (that is, holders can stake coins to ensure network security and receive rewards). This renders it more economical than the privacy coin in proof-of-work coins. PIVX proves that staking models are possible in privacy altcoins under $1.

PIVX initially utilised the Zerocoin protocol to conceal transactions to ensure privacy, but has since switched to more sophisticated zk-SNARKS. According to the project documentation, such a change was needed because of the weaknesses that were found in the implementation of Zerocoin.

The coin also enables instant transactions via one of its masternodes, which supports a faster and better-governed network addressing.

Dev Activity & Community

PIVX is free software and is developed in its PIVX GitHub repository. Work is still sluggish compared to more significant jobs, but things are being updated. As an example, the efforts of the team have been to improve the wallet and keep up with the current updates of the Bitcoin Core to enhance security.

The difference is in the format of governance, which PIVX initially offered: the right to vote on proposals is introduced to stakers and masternode operators, and on this model, initiatives in which projects receive treasury financial support are determined. This model keeps the project afloat even when there is a decline in interest by the market.

Milestones & On-Chain Use

- Treasury system: Some of the block rewards are allocated to a treasury fund, and the community decides how to spend them, all the way through marketing to development.

- Eco-friendly claim: PIVX is one of the oldest PoS privacy coins, so it has long promoted itself as eco-friendly in contrast to miners using a lot of energy.

- Privacy layer upgrades: Since the implementation of Zerocoin had been phased out, PIVX has been experimenting with implementing additional, more powerful zk-based solutions, but uptake of those capabilities has been inconsistent.

Risks & Red Flags

Regulatory chill: PIVX can always be delisted because of privacy options, as is the case with Pirate Chain and Beam. Regions such as Binance Europe delisted privacy coins prematurely, as some already officially recognized currency exchanges covered other parts of the globe.

Liquidity gaps: Trading volumes are modest, which means volatility can be high for even small trades.

Development bandwidth: Having a smaller dev team and working with voluntary methods, development can sometimes be outperformed by bigger privacy projects such as Monero or Zcash.

Past vulnerabilities: The retirement of the Zerocoin protocol also serves us as a reminder that privacy technology is fallible – and once it fails, trust is dealt a blow.

Bottom Line

PIVX does not focus more on glittering technology but rather on endurance. It remains one of the longest-running privacy altcoins under $1, sustained by its community treasury and a focus on eco-friendly proof-of-stake. Even though its privacy roadmap has gone through some ups and downs, the project remains a resilience case study: a lesson that, despite a packed landscape where projects fail, the community can keep projects afloat.

Navcoin (NAV): Privacy Meets Sustainability

Navcoin (NAV) is one of the older names in the privacy crypto scene, having launched back in 2014, long before “privacy altcoins” became a buzzword. Unlike newer players, Navcoin is more than merely a privacy coin, as it also seeks to provide a liberal blockchain that can allow anyone to use energy efficiently. With a dual process of using two blockchains, where one is the atop chain and the other an anonymous overlay, the NAV constructs transactions on a proof-of-stake (PoS) model, allowing access to the lease by one chain and the other to the confidential payment. Navcoin’s dual-chain architecture makes it unique among privacy altcoins under $1.

As of 6 October 2025, Navcoin is going at a price of $0.07 on CoinGecko. So it can be regarded as an affordable investment for novice investors who are interested in testing a privacy token but without investing lots of money.

Development Activity

Navcoin is an open source project and is operated by in-community contributors and not on a corporate team basis. The development is done on GitHub, and wallets provide updates to improvements on the anonymous transactions, which will be seen in the GitHub repository of Navcoin. Though activity is not as prevalent as newer projects, it has been speeding up its ethos of a community-led approach.

On-Chain Use Cases and Milestones

- Private Payments: With its anonymous subchain, users are capable of introducing untraceable transactions.

- Green Crypto Angle: NAV is energy efficient with a proof-of-stake, which is not a popular issue in blockchain yet.

- DAO Governance: Navcoin is subject to decentralized governance, through which the token holders are able to vote on proposals.

- Green Focus: NAV has oriented itself as the first eco-friendly, being called one of the first green-minded privacy coins.

One of the prominent achievements was introducing NavCash, which was a privacy wallet meant to be simple. Together with dual-blockchain architecture, it enabled the project to initially introduce features that new privacy altcoins only currently follow.

Risks & Caution

Navigant NAV has challenges, although in its history:

- Competition: As newer coins such as Firo and Pirate Chain gain more attention, Navcoin is not able to keep up with the news.

- Liquidity Problems: The trading volumes are low relative to larger privacy coins, and big buys or sells may therefore be problematic.

- Regulatory Risks: Like all privacy-oriented components, Navcoin is not protected against potential exchange delistings.

NVAV to those interested should not be based on a short-term hyped agenda but rather reflect a long-term ideological orientation or community good, that is, privacy, sustainability, and community governance.

Privacy Altcoins Under $1: Quick Comparison

Choosing between different privacy altcoins under $1 can feel overwhelming, especially since each project uses its own method to protect transaction data. To simplify the situation, the following is a comparison snapshot of the five privacy altcoins under $1 that we have discussed. Here is the table proposing their live price span, central privacy technology, creators’ action, and priority of their caution. The prices shown here are at the time of writing this article on 6th October 2025. It is not an account of financial advice but a sort of initial education so that the readers can have brand differences analyzed as a window view.

| Altcoin | Live Price (As of on 6th Oct 2025) | Privacy Tech | Dev Activity (GitHub) | Key Strength | Main Risk |

| Verge (XVG) | ~$0.007 | Tor + I2P Routing | Active but modest | Fast, low-cost payments | Past security breaches |

| Pirate Chain (ARRR) | ~$0.31 | zk-SNARKs (Zcash fork) | Steady updates | Full anonymity default | Exchange delistings |

| Beam (BEAM) | ~$0.008 | MimbleWimble + Lelantus | Strong, ongoing | Private DeFi potential | Regulatory headwinds |

| PIVX (PIVX) | ~$0.145 | zk-SNARKs + Masternodes | Active governance | Energy-efficient staking | Small market cap volatility |

| Navcoin (NAV) | ~$0.07 | Dual-chain privacy | Modest but alive | Simple staking, dual mode | Liquidity challenges |

Real-World Case Studies of Privacy Altcoins under $1

When we talk about privacy altcoins under $1, the tech sounds cool but real tests come from how they fare in the wild. Exchange delistings often affect privacy altcoins under $1 first, due to their smaller market caps. Grassroots adoption shows that privacy altcoins under $1 can still thrive in niche communities. The following are some of the examples when privacy coins have come under the literal pressure, and what they tell us about the ecosystem.

In 2023, Binance announced it would delist several privacy coins in EU nations (France, Italy, Spain, and Poland), an action attributable to the legal restrictions. That step caused significant backlash in the community. Binance had to backtrack on some of that ruling later, indicating that it would rescind its move to delist some privacy assets in Europe.

Privacy coins have also been flagged in broader regulatory forecasts. The new European Union rules of AML would crown anonymous accounts and privacy coins with significant constraints by 2027, a move that may pressurize their use by reputable platforms. (EU Anti-Money Laundering regulations prohibit non-reality accounts and privacy coins)

Closer to our price range, Firo (though slightly above $1 at times) was explicitly mentioned when Binance extended its privacy policy to include possible delisting of privacy assets like Firo under new compliance regimes.

Based on these cases, we learn something: privacy technology is not evaluated based on cryptography only, but on its interaction with institutions and regulatory frameworks.

- The case of delisting highlights how platforms may block even privacy coins with a price of less than $1 so as to remain readmitted.

- The upcoming privacy and AML laws of the EU are an indication that, potentially, privacy in crypto might be barred not necessarily by technical barriers, but by a legal barrier.

- Even coins of high privacy design might be coerced into compliance or changes in their features.

In short, privacy altcoins under $1 operate in tension; they promise anonymity, but their real-world success depends on exchanges, law, and adoption complementing that promise.

How to Verify Facts Yourself

One of the best habits when exploring privacy altcoins under $1 is learning how to fact-check claims directly. Unknown to all, crypto is swift, and overnight, prices, affected development, or even exchange listings, may alter. It is not enough to check the raw data based on headlines.

Always check live data when researching privacy altcoins under $1. Avoiding expensive market aggregators, the first visit is typically the trusted CoinGecko live market, where you can check live price, trading volume, and the market cap. This can assist you in viewing the level of activity of a project or simply a ghost listing.

For readers interested in digging deeper, our guide on How to Find Altcoins Under $1 Before They Pump expands on research strategies for spotting emerging projects early.

Then there is developer activity. Verifying GitHub activity is crucial for spotting whether privacy altcoins under $1 are still actively developed. A vast majority of privacy coins maintain their code on GitHub. The number of commits/releases will give an idea of whether or not the team is producing drops or taking a halt due to a lack of development. Missing observation: A good indication of an idle project, but not always.

Technical papers and audits are also important. Security audits or explanations are often published on the official websites of many projects. Reading these (or at least the executive summary), you have an idea about the transparency of a team.

Lastly, check the exchange status always. One coin may be listed today and delisted the next day because of compliance. Publishing announcements on the most popular exchange platforms, such as the blog of Binance, can help you stay updated.

It is not aimed at becoming a full-time analyst, but rather to remain skeptical, not make restrictions, or have all the statements about the existence of a privacy coin being supported somehow.

Conclusion

In short, privacy altcoins under $1 are fascinating but complex. Exploring privacy altcoins under $1 shows us both sides of crypto’s privacy story. On the one hand, relatively low-cost projects are a way to test out technologies added to secure sensitive transaction data, be it through zk-SNARKs, MimbleWimble, or arrangements based on dual-chain. They must deal with legitimate real challenges, on the other hand, including the lack of liquidity, as well as growing regulatory scrutiny.

The reality is that privacy coins are not naturally a purchase and hold type of story. They are complicated instruments that lie in the nexus between personal liberty, compliance discussion, and emerging blockchain technology. This is why this article is just educational, but not financial advice. Before making conclusions, it is advisable for everyone with an interest to either see live prices on realistic data systems like CoinGecko, see what is happening regarding the changes within the code, and monitor announcements at the exchange in general.

The key thing to do is to remain questioning and critical. Privacy in crypto is an evolving conversation, and privacy altcoins under $1 are a valuable entry point into that world. Browse the sources we have provided, visit project documentation, and continue digging. The further you ask and dig, the better prepared you will be to shed the noise of innovation from any real insight in this area. Readers should see privacy altcoins under $1 as learning tools, not guaranteed investments.

Frequently Asked Questions On Privacy Altcoins Under $1

Are privacy altcoins under $1 safe to invest in?

Privacy altcoins under $1 can be affordable to explore, but they carry risks like low liquidity, regulatory pressure, and limited adoption. Such projects are more of testing privacy technology rather than ensuring profits. Never think of making any move before verifying the live prices on CoinGecko and the activity of the developers on GitHub. Remember, this is educational insight, not investment advice.

Why are some privacy coins delisted from exchanges?

There are oftentimes regulatory requirements in exchanges of full-anonymity coins, which can make it challenging to list. As an example, Binance reversed and, at the same time, limited the listings of privacy coins in some parts because of compliance regulations. This affects trading availability, even for privacy altcoins under $1. One should adhere to regional policies and announcements of exchanges.

How do privacy altcoins differ from Bitcoin?

Bitcoin payments can be examined on the blockchain, thus tracing them with proper tools. Privacy altcoins under $1 use methods like zk-SNARKs, ring signatures, or MimbleWimble to hide transaction details such as sender, receiver, and amount. That makes them more private cash, like digital cash, which is more difficult to launder into the regulated transactions.

Can privacy altcoins under $1 survive regulation?

The transformations of the laws define life or death. Their utilisation on central systems could be limited by the forthcoming AML regulations of the EU and U.S. debates on privacy tools (EU AML proposal). Nonetheless, numerous projects proceed to be developed in open-source communities, implying pressure to keep privacy technology alive no matter the constraints of the exchange.

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.