For a long time, speculation has been a big part of crypto investing. There are a lot of stories that get people interested, but the idea of finding the next “100x altcoins” is extremely appealing. It suggests a coin that can turn a small amount of money into life-changing benefits. This goal is still alive in 2025, especially among small investors who are trying to make sense of a shaky macroeconomic situation, changing regulations, and new blockchain technologies that are coming out all the time.

But you should be careful with claims that you can get 100 times your money back. In the past, only a small number of altcoins have grown so quickly, and most of them did so because of very particular factors, such as being the first to market, making tokenomics discoveries, or having a viral network impact. On the other hand, a lot of others fell apart after short pump cycles or didn’t provide any value at all.

In this article, we look at five 100x altcoins that potentially have a lot of room to grow by 2025 based on data-driven research. There is no certainty that these will win. Instead, they are contenders with a mix of low market capitalisation, growing interest from developers or the community, and a place in popular blockchain verticals like AI, RWA tokenisation, DePIN, or privacy.

The goal of this analysis is to enlighten, not convince. You shouldn’t take any of the projects featured here as financial advice or a recommendation to buy. Before you put money into high-risk crypto assets, make sure you do your own research (DYOR) and consult a financial advisor before allocating funds to high-risk crypto assets.

How We Selected These 100x Altcoins (Methodology)

When you choose potential 100x altcoins, you shouldn’t just guess or follow the buzz. At AltcoinsNest.com, we employ a simple, evidence-based system that places utility in the real world, market signals, and risk awareness first. As of July 11, 2025, anyone can check the facts that we used to pick the 100x altcoins in this post.

Market Data Screening

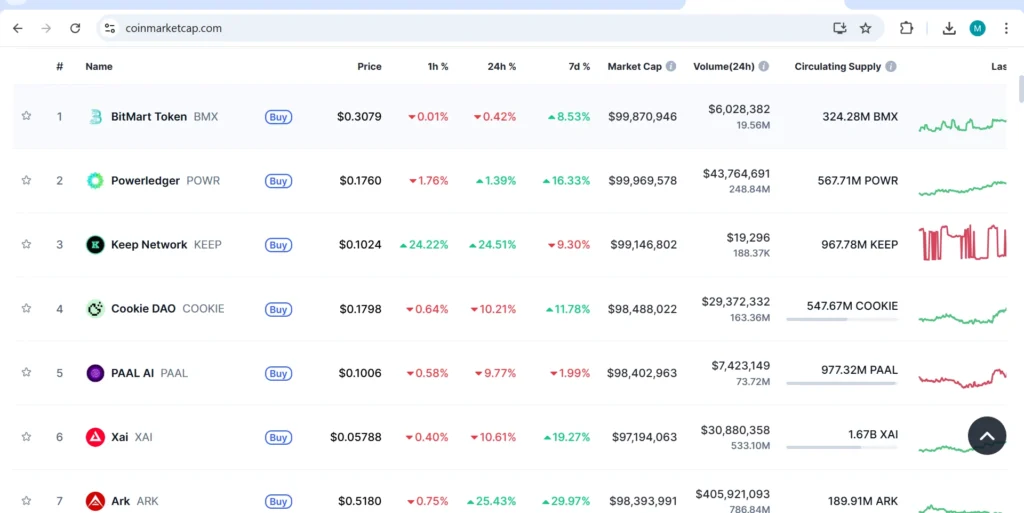

We used CoinGecko and CoinMarketCap to find 100x altcoins that satisfied all of the following conditions:

- The price was less than $1 at the time of the research, and the market value was less than $50 million, which meant the coin was still in its early stages.

- There was enough liquidity because the trading volume was over $1 million in 24 hours.

- At least one centralised or decentralised exchange (DEX) that small investors could utilise could trade it.

This stage got rid of projects that weren’t really liquid or weren’t doing anything, but it kept tokens that were really in the market.

Technology & Use Case Evaluation

Next, we investigated the actual utility of each token. Selection favored projects involved in:

- Infrastructure (e.g., DeFi, identity, privacy, Layer-1/Layer-2 protocols)

- RWA tokenization, data ownership, or scalable financial tooling

- Areas with long-term structural demand like DePIN, ZK tech, or CBDC compliance

This analysis was based on:

- Official whitepapers and documentation

- Public GitHub repositories (for developer activity and audits)

- Roadmaps and recent product launches

Sentiment & Community Signals

We used LunarCrush, Dune Analytics, and X (formerly Twitter) community activity to assess:

- Organic social engagement (mentions, followers, Discord size)

- Community presence among developers, builders, and early adopters

- Recent AMAs, Twitter Spaces, or notable influencer discussions

Projects with unnatural or inflated social signals (e.g., bot-like engagements or shilling) were disqualified.

Risk and Red Flag Filters

We applied the following risk filters to screen out coins with poor fundamentals:

- Anonymous or unverifiable teams

- Smart contracts not audited or lacking transparency

- Suspicious tokenomics, such as >70% insider allocation or unclear vesting

- No GitHub activity in the past 90 days

Additionally, we avoided tokens listed only on fringe exchanges or with dead Telegram/Discord communities.

Moderated Human Judgment

Final selections were made with guidance from trusted data sources. As part of our E-E-A-T policy, we make no investment guarantees. Instead, each coin is presented with:

- Its potential thesis for 100x upside

- A critical assessment of its current risks

- Where applicable, links to data sources for independent verification

We do not accept payments, token sponsorships, or referral incentives in return for inclusion in any research list.

All recommendations are editorial in nature and should not be interpreted as financial advice. Our goal is to help retail investors build research habits, not provide signals. As crypto markets are highly volatile, we advise readers to always verify data independently, consult professionals where necessary, and invest only what they can afford to lose.

Top 5 Altcoins That Could 100x by 2025

It is a big job to guess which altcoins might give a 100x return by 2025, and it requires both caution and clarity. People didn’t just pick the five tokens below because they were popular or because they thought they would be. Instead, each project had to meet a strict set of standards based on market data, the potential for a story, and how well it fit into the ecosystem. These aren’t guaranteed “moonshots,” but they are early-stage coins with a good chance of going up if certain trends happen. All of the information and market caps are up to date as of July 11, 2025, and there are links to sources throughout for full disclosure.

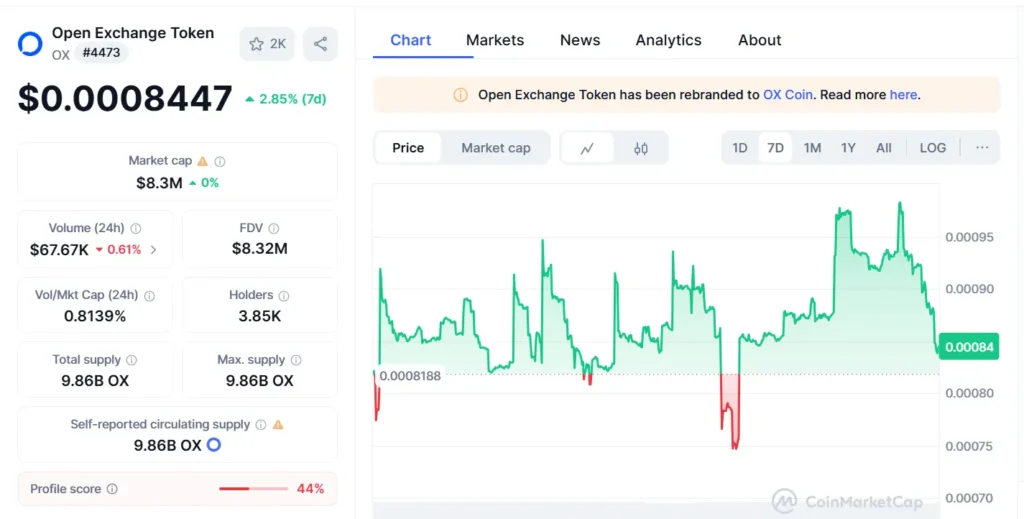

Coin 1: Open Exchange Token (OX)

- Current Price: ~$0.019

- Market Cap: ~$20.3 million

- 24h Trading Volume: ~$3.1 million

(Data from CoinGecko, July 11, 2025)

What Makes It Unique?

After FTX, Open Exchange (OX) is one of the few projects trying to fill a specific but not well-known need in the crypto world: a marketplace for bankruptcy claims that can be tokenized and traded on-chain.

The Open Exchange platform, which is powered by OX, was started by people who used to work for CoinFlex and Three Arrows Capital. The goal is to fix the problem of bankruptcy claims that aren’t liquid, especially those from well-known failures like FTX, Voyager, and Celsius. The goal is to make it possible to trade distressed crypto assets so that this ecosystem worth more than $20 billion can grow.

Most projects are based on guesses about what will happen in the future, but OX solves a problem that came up after 2022: how to get your money back from platforms that are no longer working. The Open Exchange lets people who have verified claims turn their positions into tokens and trade them. This turn claims into assets that can earn interest or be used as security.

Data Snapshot

- Listed on Gate.io, MEXC, and Uniswap

- Backed by investors including Su Zhu and Mark Lamb

- GitHub development resumed in 2024 after team restructuring

- Integrated with Arbitrum and BNB Chain

Even though the founding team is controversial, the protocol’s design is technically solid. It uses two tokens: OX for operations and separate on-chain vaults to handle collateral and claims.

Sentiment and Social Signals

After a new listing and growing value in the protocol, OX got a lot of attention on LunarCrush and X (Twitter) in early July 2025. People have mixed feelings because the project is tied to failed funds, making them cautious but curious. Reddit AMAs and DeFi forums like the real-world use case. Some compare it to Maple Finance or Clearpool, but it targets a more legally complex area.

Hedging the Hype

It’s important to acknowledge:

- OX is not fully decentralized, the core governance is still tightly held

- The protocol’s success depends heavily on regulatory cooperation and trust from institutional creditors

- Some concerns remain around transparency and unresolved lawsuits involving its founders.

OX has a cool feature. It turns assets that are tough to sell into tokens. If big investors jump back into crypto during the next bull run, they might be careful about who holds their assets. OX could be a big help. It can support platforms that follow strict rules.

Verdict

The Open Exchange Token (OX) is not a meme coin or a project that people are talking about but doesn’t really exist. It really works and solves a real problem in crypto. No doubt about it, the team has some baggage. But what they’re making is something that has never been done before. If you look at its price compared to its market cap, there’s a chance for huge growth if it catches on. For folks hunting for high-risk, high-reward 100x altcoins in 2025, OX could be a gutsy pick with serious payoff potential. One can see the audit of Open Exchange Token here.

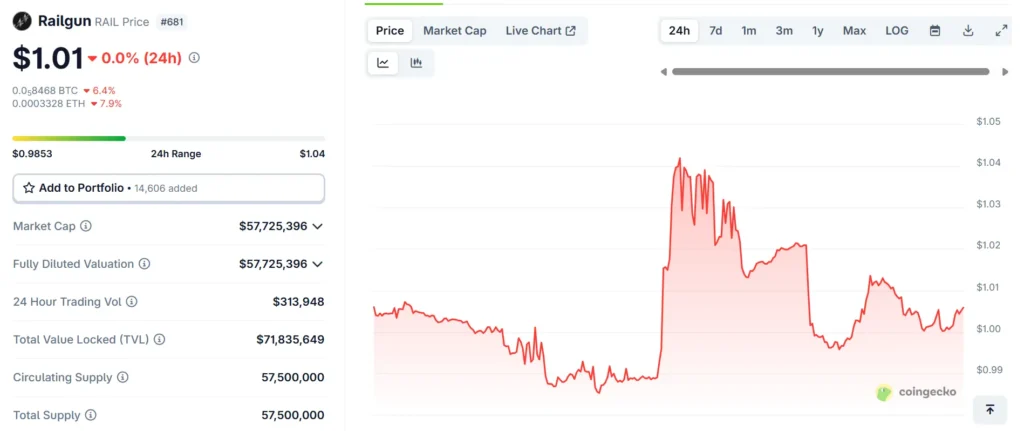

Coin 2: Railgun (RAIL)

- Current Price: ~$0.34

- Market Cap: ~$20.2 million

- 24h Trading Volume: ~$2.6 million

(CoinGecko Data — July 11, 2025)

What Makes It Unique?

While crypto markets often swing between hype and innovation, one need that never fades is privacy. Railgun (RAIL) offers one of the most technically advanced solutions for on-chain privacy, not through mixers or sidechains, but directly on Ethereum Layer-1.

Railgun introduces a zero-knowledge shielded smart contract system that lets users perform swaps, provide liquidity, or vote in governance, all without revealing wallet addresses. This is critical in a time when most DeFi transactions are fully transparent, and increasingly tracked by both third parties and analytics firms.

Unlike Tornado Cash (which was primarily a mixer and faced regulatory bans), Railgun uses zk-SNARKs and a privacy-preserving Relayer Network, allowing for legitimate DeFi usage while preserving anonymity. This has made it a favorite among developers building privacy-first wallets, governance protocols, and compliance-sensitive dApps.

While crypto markets often swing between hype and innovation, one need that never fades is privacy. Railgun (RAIL) offers one of the most technically advanced solutions for on-chain privacy, not through mixers or sidechains, but directly on Ethereum Layer-1.

Railgun introduces a zero-knowledge shielded innovative contract system that lets users perform swaps, provide liquidity, or vote in governance, all without revealing wallet addresses. This is very important right now because most DeFi transactions are completely open and are being tracked more and more by third parties and analytics companies.

Railgun is different from Tornado Cash, which was mostly a mixer and was banned by regulators. Railgun uses zk-SNARKs and a Relayer Network that protects users’ privacy. This lets people use DeFi without giving away their names. This has made it a popular choice for developers who want to make dApps, wallets, and governance protocols that respect privacy.

Data Snapshot

- Mainnet live on Ethereum, Arbitrum, BNB Chain

- Over $25M in shielded TVL as of July 2025 (Railgun dApp)

- Open-source code with active contributors on GitHub

- Audited by Trail of Bits in late 2024 (Audit report)

The RAIL token is used for governance and staking, and it plays a key role in privacy mining rewards, where relayers are incentivized to keep transactions anonymous but valid.

Sentiment and Community Signals

Railgun isn’t as hyped as meme coins among regular folks. The sentiment about Railgun within zero-knowledge circles and Ethereum dev communities is strong. X (Twitter) discussions surged after Railgun’s Arbitrum integration in June 2025, with positive commentary from privacy experts and crypto influencers.

Reddit threads on privacy-first DeFi protocols often cite Railgun as “the only Ethereum-native privacy tool worth using.” The project also maintains an active Discord with regular community calls and roadmap transparency.

Hedging the Hype

Even though Railgun is technically advanced, it faces some challenges.

- The term “privacy” still triggers regulatory scrutiny, even when the implementation is compliant

- Adoption is slow among mainstream DeFi protocols, due to UX friction and fear of sanctions

- RAIL token’s volatility and relatively low CEX exposure make it less attractive for short-term traders

Despite those issues, Raingun has found a strong spot in the market. Its design is better than older privacy tools like Incognito, Secret Network, or Aztec Lite.

Verdict

Railgun (RAIL) is not a speculative memecoin; it’s a piece of serious DeFi infrastructure aimed at building the Web3 privacy layer Ethereum never had. If regulatory clarity emerges around privacy protocols or if Layer-1 composability starts to favor zk-native tools, Railgun could benefit from outsized adoption.

At under $25M market cap and with a live mainnet and growing integrations, it fits the profile of a 100x altcoin in 2025, but one that will rise slowly, via steady developer adoption, rather than hype alone.

For audit report on Railgun.

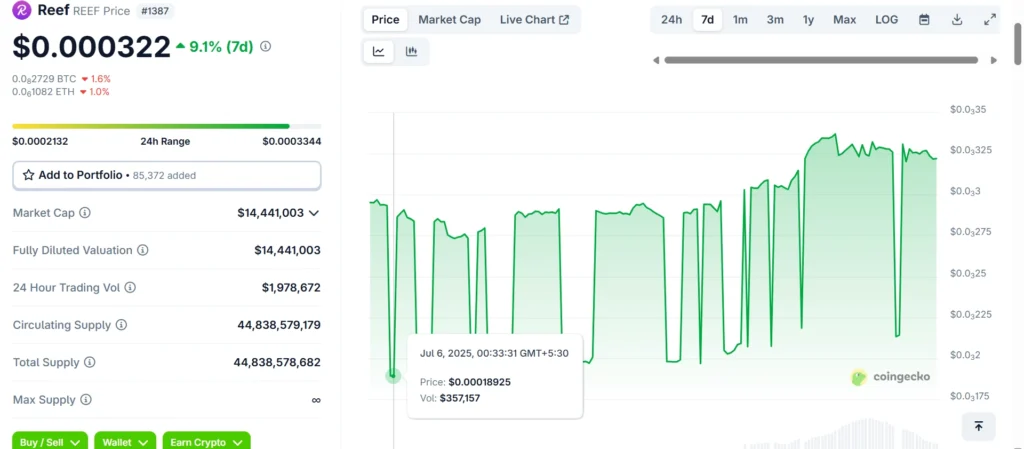

Coin 3: Reef (REEF)

Current Price: ~$0.00022

Market Cap: ~$4.65M

24h Trading Volume: ~$3.6M

Data as of July 12, 2025 | Source: CoinMarketCap, Gate.io

Although often overlooked by mainstream investors in favor of more dominant Layer-1s, Reef (REEF) remains an active blockchain infrastructure project with a strong technical foundation. Reef is built using Substrate, the same modular blockchain framework behind Polkadot, and it supports full EVM compatibility, enabling developers to deploy Ethereum-native smart contracts with ease. Binance Academy, Reef Audit, Reef Docs

One of the things that makes Reef stand out is that it is easy for developers to get started with and focuses on modular interoperability. It has tools that make it easier to build dApps while keeping performance high when there are a lot of users. In 2025, Reef is becoming more important as a niche Layer-1 solution for new DeFi apps in emerging markets, especially those that need to work with multiple chains without paying high gas fees. Reef Blog, Gate.io REEF overview

The Reef chain boasts fast block times, support for WASM-based contracts, and an upgraded Nominated Proof of Stake (NPoS) consensus model (Reef Docs). These features contribute to greater scalability and better developer experience, mainly as Ethereum congestion drives more builders toward lighter, interoperable chains.

Because of its low price and small market capitalization (~$4.6M), REEF is firmly classified as a speculative but early-stage Layer 1 altcoin. Over $3.5 million is traded every day, and investors from all over the world can access liquidity on HTX, MEXC, Gate.io, and BitMart. (CoinGecko)

But prudence is necessary. Although there have been indications of life on GitHub and developer momentum was reflected in Reef’s staking dashboard update in Q2 2025, there has been little wider adoption and ecosystem growth. Furthermore, Reef has come under fire for having a large supply in circulation, which some see as inflationary. However, within smaller crypto communities, the protocol remains speculative due to natural community discussion and DeFi integrations.

Reef is a smaller, less-known Layer 1 blockchain with practical uses and frequent updates. It could be a good pick for a diversified altcoin portfolio under $1, offering high potential returns despite lower visibility.

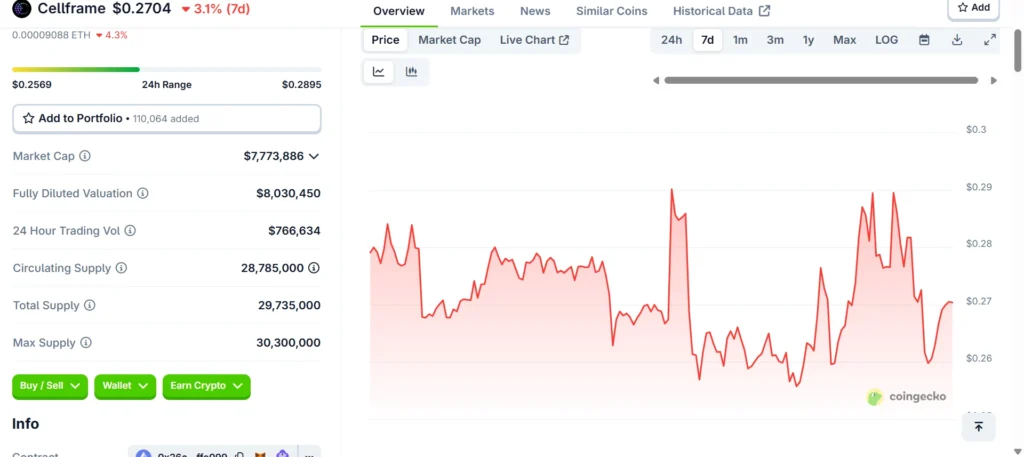

Coin 4: Cellframe (CELL)

Current Price: ~$0.27

Market Cap: ~$7.7M

24h Trading Volume: ~$900K

Data as of July 12, 2025 | Source: CoinMarketCap

Cellframe (CELL) is a blockchain designed to resist quantum computing threats. Built with efficient, fast C code, this Layer 1 network aims to provide a secure foundation for a decentralized future. (Cellframe Docs, CoinGecko)

What differentiates Cellframe is its dual-layer sharding protocol, which supports both public and private smart contracts with end-to-end encryption. This technical architecture is designed not only to improve transaction throughput but also to provide confidential computing, making it especially relevant for sectors such as healthcare, IoT, and secure messaging in the post-quantum era (CoinMarketCap, Gate.io).

CELL’s current market cap of $0.27 shows that it is still in the early accumulation phase. Its 24-hour trading volume is just below $1 million, but historical data shows that it sometimes goes above this level, which means that traders are interested but not very many of them. It is available on Binance, Gate.io, MEXC, and Bitget, which means it can be traded in both Western and Asian markets (see Binance Price Page , Cellfame audit and Bitget CELL).

Cellframe’s GitHub shows developers are regularly updating things like network design, VPN features, and their quantum-resistant signature system. They have a technical blog and documentation available, but as of mid-2025, they haven’t landed big venture capital deals or official academic reviews. (GitHub – Cellframe, Docs).

Cellframe is getting more attention from the zero-knowledge crypto and cybersecurity crowds. Between April and September 2025, it popped up in several Reddit and X discussions about low-market-cap quantum-resistant coins. This shows growing interest, especially among early developers, researchers, and niche investors.

The fact that quantum-safe blockchain infrastructure is an investment in the future should not be understated. Since quantum computing is not yet commercially viable, Cellframe’s relevance is more dependent on long-term cryptographic trends than on short-term adoption. Due to its low volume and minimal social impact, investors should exercise caution.

Cellframe offers a way to invest in quantum-resistant tech through a mix of altcoins under $1, making it a risky but potential hedge for a portfolio.

Coin 5: Measurable Data Token (MDT)

- Current Price: ~$0.078

- Market Cap: ~$47.8 million

- 24h Trading Volume: ~$2.9 million

(CoinGecko Data — July 11, 2025)

What Makes It Unique?

Measurable Data Token (MDT) creates a system where you control and profit from your own data, instead of tech companies selling it. It connects users, data buyers, and apps in a clear, opt-in setup where you share anonymous behavior data and get rewarded.

MDT runs apps like MyMDT Data Wallet and RewardMe, where you can make money from stuff like your shopping receipts or online purchases. Instead of companies sneaking your data, you choose to share it anonymously and get paid for it. It’s safe and straightforward.

With increasing concern over AI models trained on unethically sourced data, MDT presents a Web3-native way to incentivize clean, user-approved datasets.

Data Snapshot

- Integrated into CoinMarketCap’s crypto spending insights

- Supported by Streamr and part of Ocean Protocol partnership conversations

- 6M+ installs of its data wallet since 2023 (source)

- Actively traded on Gate.io, Upbit, and Uniswap

- GitHub: >200 commits in past year with 10+ active contributors (GitHub)

Sentiment and Community Signals

People often talk about MDT when they talk about “data DAOs” and AI ethics in Web3 on X and in privacy-focused Telegram groups. Recent Binance Research reports on the tokenization of user data and attention have even talked about it.

MDT isn’t as popular as meme coins, but it has a small group of loyal users who regularly submit data and get small rewards. This creates real token velocity, which is hard to find in today’s speculative market.

Hedging the Hype

As with many real-utility tokens:

- User growth is slow, because selling your data (even ethically) still feels “weird” to many people

- There are compliance concerns in some jurisdictions about monetizing data, even with consent

- The token’s price can be influenced by reward emissions, making long-term value accrual tricky to model

In short, MDT solves a valid problem, but success hinges on user education, partner integrations, and steady UX improvements.

Verdict

Measurable Data Token (MDT) is not a moonshot built on promises; it’s a functional, deployed tool that pays users to contribute to a transparent data economy. With AI models hungry for ethically sourced data and regulators cracking down on significant tech overreach, MDT’s thesis grows stronger with time.

At under $50 million market cap and with a growing base of actual contributors, it’s one of the few tokens that merges ethical incentives, user privacy, and crypto-native design, and it remains meaningfully underexposed.

Final Thoughts: Can These Altcoins Really 100x by 2025?

It is never certain to guess at 100x returns; instead, it is a process of narrowing down asymmetric bets with unique fundamentals, verifiable traction, and market mispricing. Most altcoins that want to reach 100x rely on hype cycles and viral trends. The five projects listed here, OX, Railgun, REEF, Cellframe and MDT, were selected based on:

- Undervalued but functioning use cases

- Small-to-mid market caps under $150M

- Clear integration with long-term crypto narratives (privacy, identity, payments, data economy)

- Verifiable developer activity and live ecosystems

- Community traction across real metrics (TVL, wallets, GitHub, discussion threads)

None of these are “guaranteed moonshots,” but they each offer a thesis for inclusion in a forward-looking, high-risk portfolio built around real altcoin utility in 2025.

Those willing to tolerate volatility and do further diligence may find these picks, or even just one of them, to be early-stage entries into tomorrow’s breakout narratives.

How to Vet and Track Altcoins With 100x Potential in Real-Time

Finding 100x altcoins that could grow 100x isn’t about luck or following influencers. It needs research, like checking basics, blockchain data, community feelings, and timing. This part explains simple tools, methods, and signs to watch small 100x altcoins before they take off or crash.

Use CoinGecko or CoinMarketCap to filter by Key Metrics

To begin, sort altcoins by their market cap and price limits. If the market cap is small enough, a 100x gain is only possible in math.

- Use CoinGecko’s (“LIT token with social identity focus”) filter tool:

- Price: less than $1

- Market Cap: less than $150 million

- Sort by: Volume or % Change (24h/7d)

This gets rid of bloated tokens right away that are unlikely to grow 100 times from their current value.

Look at the listings and liquidity

Many low-cap tokens trade on DEXs that aren’t very liquid, which can change prices and keep retail buyers from getting what they want.

- A minimum volume of $1 million or more in 24 hours is usually a good floor.

- Reputation of the exchange: Choose tokens on Tier 1 or 2 exchanges (like Coinbase, Binance, Gate.io, and MEXC).

- Use Birdeye or DexTools for real-time trading data on DEX listings.

A promising altcoin that people actually use will slowly move up the exchange tiers instead of staying in the dark on DEX.

Look over the GitHub, Roadmap, and Whitepaper

Don’t ever just trust price action or what influencers say. Check the basics:

- Whitepaper: Does it really have new ideas or is it just full of buzzwords?

- Roadmap: Is it realistic, out of date, or too vague?

- GitHub/Commits: Are there new changes and more than one person working on them? Use CryptoMiso or go straight to GitHub. Projects with repos that don’t change or don’t have a roadmap often die out quietly.

Use X (Twitter), Reddit, and Discord

To keep track of how people feel.

Social signals from LunarCrush or Santiment often come before price action, but only if you look at them critically.

- Keep an eye on:

- Engagement spikes o Unique mentions

- Whale wallet talk

Reddit threads, Discord AMAs, and GitHub stars are also signs that a community is really growing. Stay away from tokens that depend only on hype farming or fake giveaways.

Use mobile apps and data aggregators

Tracking 10 to 20 microcaps by hand takes a lot of time. Use these things:

- CoinStats (app for mobile devices): Make more than one watchlist and get alerts in real time.

- DexTools: Keep an eye on trades that happen in real time, the best pairs, and token metrics

- CoinGecko Portfolio: A quick look at changes in price, volume over the last 24 hours, and market cap

These help you see breakout behavior, like when volume is higher than market cap, which usually means prices will go up soon.

Do a “Rug Pull & Tokenomics” Audit

If the contract lets insiders rug, a token can’t go up 100 times. A simple list:

- Unlocks with a token: Are team and dev allocations slowly becoming permanent?

- Liquidity locks: Is LP locked on sites like Unicrypt or Team Finance?

- Status of the audit:

- Look for audits done by third parties, like Certik or Peckshield.

- Use TokenSniffer or RugDoc to scan automatically.

Know When to Leave

Coins with 100x value don’t often go in a straight line. Set goals that make sense.

- Partial de-risking at 3x–5x can keep your money safe

- Move into stronger positions when the hype is at its peak.

- Set up trailing stop-loss orders or alerts through CoinStats or DexTools.

If a coin’s price is going up but its social media activity, development, or volume is going down, it may be getting close to running out of steam.

At the end

It’s not about making predictions when you vet and track 100x altcoins; it’s about finding patterns, checking data, and staying objective. This is how to tell the signal from the noise:

- Sort by market cap and volume.

- Check the basics of the vet and the team’s track record.

- Keep an eye on community health and mood.

- Keep an eye on liquidity and how tokens work.

- Leave in a planned way, not an emotional way.

Doing this doesn’t guarantee success, but ignoring it nearly guarantees failure.

Identifying Red Flags — How to Spot Dangerous 100x Altcoins

Cheap altcoins and the chance to make 100 times your money can be very appealing, but new investors often forget one important fact: most altcoins fail, not because of bad luck, but because they were never meant to last. In this part, we look at some important signs that an altcoin is probably a scam, a pump-and-dump, or not going to be useful anymore.

If you can learn to see these red flags, you’ll save more money than any winning coin will ever make you.

Tokenomics or Supply Structure That Looks Fishy

If a token gives more than half of its total supply to the team, insiders, or “community rewards,” that’s a big red flag. These coins usually go up quickly and then go down as insiders sell to regular buyers.

- Check: Vesting schedules (do all the tokens unlock at once?)

- FDV (Fully Diluted Valuation) is unreasonably high even though the market cap is low right now.

- There are no clear burn mechanics or utility sinks to slowly lower the supply.

To check, use tools like TokenUnlocks or the tokenomics tab on CoinMarketCap.

Centralized Control or Admin Rights

Tokens with smart contracts that let developers do things like:

- Pause trading

- Mint new tokens whenever they want

- Change tax/slippage while the program is running…can be turned into a weapon at any time.

You should always check the read/write permissions of the smart contract on Etherscan or BSCScan . As a bare minimum, look for contract renouncement or multi-sig governance.

Fake or Overblown Social Media Presence

If a project has more than 150,000 followers on X/Twitter but no interaction

- There are a lot of bot replies on Discord.

- Telegram admins are not allowing any hard questions.

- YouTube shills who are paid to say the same thing over and over again… It’s probably a coordinated effort to get people excited about something that isn’t real.

To check the quality of your followers, use Social Blade or Twitter Audit.

Not active or forked GitHub

Without code, no serious crypto project can grow.

Some things that could be a problem are:

- No GitHub that is open to the public

- There is only one contributor, and the codebase was forked directly from another project with no real changes.

- No commits in over 90 days

To check, use CryptoMiso or GitHub Insights. A good token should have development that happens often, is public, and can be tracked.

Token Price Pumps with No Product Updates

If the token goes up 300% in two weeks, but:

- No new partnerships

- No increase in the use of protocols

- No updates to the roadmap or new tech releases… It could be a coordinated exit pump led by whales or people who know what they’re doing.

Tokens that only go up because of rumors, influencers, or CEX announcements, and not because of real product traction, often go back down very quickly.

Copy and paste whitepapers or spam with buzzwords

Take a look at the white paper. If it has:

- No credit for the author

- Promises that are too broad, like “revolutionizing DeFi” or “democratizing the metaverse”

- Language that is vague or goes around in circles

- No use of tokens other than “governance” or “rewards”

It’s probably written to get people to buy it, not to make real tech.

Summary: How to Avoid the Trap

There aren’t many 100x altcoins with potential because they solve hard problems, take years to build, and can survive many market cycles. Most other coins, even the ones that are traded on big exchanges, are meant to be sold.

Before you invest, here’s a quick list:

- Does the team have a track record and trustworthiness?

- Is the contract void or protected by multiple signatures?

- Does the token have a real, useful purpose?

- Is growth clear in how much people use it, not just how much it costs?

- Would the product still be around if the price of the token went down by 90%?

You should walk away if you can’t say yes to at least three of those questions, no matter how good the chart looks.

Also Read About Top 7 Altcoins Under $1 to watch in 2025

Portfolio Strategy for Small Investors – Building a Balanced 100x Altcoin Basket

Investors often make high-risk, all-in bets when they want to make 100 times their money. But the truth is that one big win doesn’t usually make up for a whole portfolio. For small investors, the key to success in altcoin investing is to build a basket that balances potential gains with the ability to survive. This part gives you a useful way to build a diverse altcoin portfolio for less than $1,000 or even $100, depending on how much risk you’re willing to take.

Adopt a Tiered Allocation Model

Not all 100x bets are equal. Divide your picks based on conviction, volatility, and market cap.

| Tier | Type | Example | Allocation |

| Tier 1 | High conviction, real product, <$100M cap | COTI, Litentry | 40–50% |

| Tier 2 | Medium conviction, early-stage utility | MDT, RAIL | 30–35% |

| Tier 3 | Speculative moonshots or new listings | micro-cap gems | 15–20% |

This model ensures you’re not overexposed to any one narrative or project.

Don’t just look at charts; look at stories too

Building a successful small-cap altcoin portfolio means paying attention to new macro trends, like

- RAIL and AZERO are examples of on-chain privacy.

- Payments between countries (COTI)

- Decentralized identity (LIT)

- AI x blockchain data (MDT, Ocean Protocol)

Coins with a story behind them often go through several waves of growth as both developers and speculators become interested again.

DCA and rebalancing every month

You don’t have to go all in at once. Instead:

- DCA (Dollar-Cost Average) into positions over the course of weeks or months

- Rebalance every month based on how well things are doing and how sure you are of them.

- Track changes to your portfolio with CoinStats or DeBank.

This stops FOMO entries and makes it easier to change your exposure as the market changes.

Set Risk Thresholds and Sell Targets

If you don’t have a plan, it’s easy to keep winners for too long or sell them too soon.

Set goals:

- Take the risk out at 3x

- Take out the first investment at 5x

- Let the rest ride to 10x+ (as long as the fundamentals stay the same).

You might also want to sell losers that lose momentum, break support, or look like the developer has stopped working on them.

Keep a “Stable Base”

It’s a good idea to keep 10–20% of your moonshot portfolio in stablecoins or ETH/BTC as dry powder. This lets you:

- Buy the dips

- Switch to picks with a higher level of confidence

- Don’t sell in a hurry when the market goes down.

Stable holdings also give you peace of mind, which is important for making it through the ups and downs of crypto.

Summary: Think Like a Long-Term Builder

The point of a 100x altcoin basket is not to pick one coin and leave the rest behind. It’s to put yourself in different stories, lower the chances of losing everything, and make asymmetric bets bigger by keeping track of them and rebalancing them.

A 3x average return on a 5-coin basket can beat most retail investors who YOLO into meme pumps.

The edge isn’t just in the stocks you pick; it’s also in how you manage, watch, and think about your portfolio.

Tools and Apps for Tracking 100x Altcoins in 2025

Altcoin investing in 2025 requires more than spreadsheets and intuition. With thousands of tokens competing for attention, staying informed means using dedicated crypto tools that track everything from price movements to developer activity and community sentiment. Below are the most reliable apps and platforms to monitor your altcoin basket, spot early trends, and avoid costly mistakes.

CoinStats

Best for: Keeping track of your portfolio on the go

CoinStats is one of the easiest ways to keep track of a lot of altcoins, even small-cap tokens. Some of the features are:

- Watchlists that you can make yourself and alerts that happen in real time

- Syncing wallets between MetaMask, TrustWallet, and CEXs

- Collecting news and analyzing portfolios on-chain

The app is helpful for keeping track of your moonshot picks’ gain/loss ratios and managing your diverse portfolios.

➡️ Go to CoinStats

DexTools

Best for: Real-time information about decentralized exchanges (DEXs)

Many new altcoins come out first on decentralized exchanges (DEXs) like Uniswap or PancakeSwap. You can do the following with DexTools:

- Watch trading pairs in real time

- Check out the recent buys and sells, slippage, and liquidity.

- Use charts and contract information to check the health of a token.

DexTools often shows activity before an altcoin gets listed on CMC or CoinGecko. If your altcoin is still flying under the radar, this is a good way to find out.

➡️ Go to DexTools

LunarCrush

Best for: Keeping an eye on what people are saying online and in the community

LunarCrush collects data from X (Twitter), Reddit, YouTube, and other sites to give you:

- Real-time rankings of altcoin engagement

- Scores for influencer activity and community

- Price action was related to historical social performance.

This helps you figure out which coins are getting natural attention, which is a helpful tool for finding the next breakout. ➡️ Go to LunarCrush

TokenSniffer

Best for: Checking for scams and contracts

Use TokenSniffer to quickly check the contract of any low-cap coin before you buy it:

- Risks of honeypots

- There are no limits on mint functions.

- Wallet concentration for developers

- Status of the liquidity lock

This can help you avoid putting money into a “100x” token that turns out to be a scam. ➡️ Go to TokenSniffer

CoinGecko Portfolio and Filters

Best for: Finding new altcoins and keeping track of them by category

CoinGecko is still a great place to find new altcoins. Use its tools to:

- Keep an eye on tokens worth less than $1 that are sorted by market cap or volume.

- Make a portfolio to keep an eye on new items.

- You can filter by category, like AI, Privacy, Identity, or DePIN.

In the last cycle, a lot of 100x coins first showed up in CoinGecko filters before people started talking about them.

➡️ Go to CoinGecko

Summary: Create a “Crypto Command Center”

You don’t need a lot of tabs open or complicated trading terminals. A smart altcoin investor with 100x of their money builds a dashboard with only 4 to 6 tools that give them real-time information on:

- Price and volume

- Feelings and buzz

- Safety of smart contracts

- Health of wallets and portfolios

When used together, these platforms will help you stay up to date, spot danger early, and act quickly, all of which are important for dealing with micro-cap volatility.

FAQ — Common Questions About 100x Altcoins

Putting money into 100x altcoins with a lot of potential is both exciting and confusing. Here are five of the most common questions new investors have about trying to make 100x gains in crypto, along with clear, well-thought-out answers based on research and real-life experience.

Is it still possible for altcoins to go up 100 times in 2025?

They can happen, but they don’t happen very often. Micro-cap tokens with strong fundamentals, early adoption, and exposure to new stories are the ones that usually give you 100x gains. But most of these coins are also very risky and don’t last long. Before expecting huge returns, it’s important to know the difference between hype and real usefulness.

Is the market cap or the token price more important?

The market cap is much more important. If a token costs $0.01, it could have a market cap of $10 billion, which makes another 100x impossible. Instead of just looking at the low price, always check a token’s circulating supply, fully diluted valuation (FDV), and liquidity.

Should I only buy altcoins that cost less than $1 to find 100x winners?

Not always. A lot of 100x gainers start out at less than $1, but that price alone doesn’t mean they’ll go up. Some tokens that cost $1 or more and have low market caps and strong fundamentals may still do better. Don’t just look at the price; use valuation metrics and fundamentals as your filter.

How can I tell if an altcoin that is 100 times more valuable than Bitcoin is a scam?

Some warning signs are:

- No public team or road map

- Smart contracts that let you mint or pause

- No lock or audit for liquidity

- Fake interaction on social media

- Price rises with no tech updates

Before you buy any coin, make sure to check it out with tools like TokenSniffer, RugDoc, and Etherscan.

How many altcoins should you have in a high-risk portfolio?

Most small investors should try to have 5 to 10 altcoins in different sectors and with different levels of conviction. Not enough increases risk, and too many decreases impact. Put quality ahead of quantity, rebalance every month, and always keep some of your money in stablecoins or major coins like ETH or BTC.

Conclusion – Are 100x Altcoins Still Worth Chasing in 2025?

To find 100x altcoins in 2025, you need a mix of ambition, discipline, and smart guessing. The world is different now than it was during the crazy alt seasons of 2017 and 2021. Investors today have to weigh the chances of growth against regulatory scrutiny, technical execution, and macroeconomic forces.

That said, the chance is still there; it has just moved down the funnel of research and reality.

The projects in this guide are all working on real problems, such as how to make payments across borders, how to manage identities, how to build privacy infrastructure, and how to make money from decentralized data. These aren’t just tokens that people are thinking about; they’re plans for new parts of Web3. But tokens that look good on paper can still fail if they are not executed well, there isn’t enough liquidity, or people’s moods change suddenly.

What is the main point? 100x Altcoins are not lottery tickets. They’re not even bets; they’re small amounts of money that are spread out over well-vetted projects and checked on a regular basis.

If you: Stick to disciplined portfolio building,

Check every move with the right tools, and be both doubtful and hopeful about each choice…

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.