Utility altcoins under $1 are rare, and most so-called “cheap gems” don’t actually do anything useful.

If you’ve ever dug into the sub-$1 crypto space, you know what I mean. It’s a sea of dead Discord servers, flatlined GitHub repositories, and “ecosystems” where the only utility is staking to earn more of the same sub-$1 crypto token. But buried in that mess? A handful of projects that actually function as real-world platforms solving real problems, still trading under a dollar.

These are the low-cap utility tokens we’re after. Not hype coins. Not narrative plays. But protocols with verifiable utility powering file storage, cross-chain infrastructure, payments, and other services that crypto users already rely on. Most people scroll past them because they have not mooned yet. But long-term? These are the ones to watch.

In this post, we’ll walk through how we evaluated dozens of ulility altcoins under $1 claiming “utility,” applied strict filters (no vaporware, no paused dev repos, no fake usage metrics), and ended up with five utility altcoins under $1, and still doing the job they were built to do.

Because utility doesn’t follow the market, utility survives it.

What Makes Utility Altcoins Under $1 ‘Useful’?

In crypto, “utility” is one of the most overused and least understood words.

Just because a whitepaper says a working crypto token has utility doesn’t mean anyone is using it. Just because a coin can technically be staked, swapped, or burned doesn’t mean it’s delivering any real-world value. If that were the bar, every airdrop farm functional altcoins on Solana would be classified as a functional asset.

So let’s set a higher standard.

To qualify as one of the utility altcoins under $1, a project has to do more than just exist. It needs to power something measurable and do it in a way that benefits actual users, not just traders. That could mean:

- Processing file uploads on a decentralized network

- Paying for on-chain data feeds

- Fueling transactions in a real application (not just a testnet)

- Acting as the native currency in an ecosystem with active demand

The keyword there? Demand. Utility means people need the blockchain tokens with real use, to use the product. Not to speculate. Not to stake for an APY. But to actually do something and preferably, do it often.

This distinction matters because when a utility token is priced under $1 and usage grows, you’re looking at organic upward pressure. You’re looking at a fundamental driver not just narrative noise.

So that’s our focus: crypto assets that function today, not someday.

Also Read : Undervalued Altcoins under $1 with Market Cap Under $50M

How We Chose These Utility Altcoins Under $1 : Our Selection Process

It’s important to note that not all crypto tokens that are called “utility” are actually useful.

We didn’t want to see hazy use cases hidden in roadmap slides or tokenomics models that depend on “future demand.” We looked for utility altcoins under $1 and provide something useful right now. Not in theory. Not after the mainnet. Not when “Q4 sometime” ships v2.3.

We started by looking at more than 60 low-cap altcoins under $1. Then we used five strict criteria to narrow it down:

A product that is live and has activity on the chain

There is no use if there is no product. Period. We used tools like DappRadar and Footprint Analytics to check that every coin we choose is already being used for something, such file storage, payments, or running smart contracts.

How Functional Ultility Altcoins under $1 Work

We sought for utilily altcoins under $1 that have a meaningful use in their ecosystem for transactions. That means:

Gas or access sub-$1 crypto tokens, which are used to pay for services

Spend and burn cycles, not only staking

Use on the developer side (API credits, data calls, and smart contract fuel)

A public GitHub or technical roadmap

We didn’t include anything that developers couldn’t see. If you are creating infrastructure and can’t provide us changes, technical documentation, or ongoing issues, we don’t want to work with you. Bonus points for tools that are open source and for being active on a regular basis.

No Ponzi schemes

We marked projects that had reward loops that couldn’t last, emissions that were too high, or tokens that were 70% or more of the supply still locked behind VC cliffs. It’s not useful if the only reason to hold the token is to get more of it. It’s bait.

Price under $1 with real volume

At the time of writing, all of these Utillity tokens were selling for less than $1, not just for a flash crash, and they had a lot of volume on respected exchanges (CEX or DEX). We didn’t include ultra-low caps that had a volume of $5,000 per day and no liquidity.

After using all five filters, only five projects passed all of them. These are all sub-$1 utility tokens that power something useful and are still being worked on in the middle of 2025. These aren’t moonshots that are “just in case.” These are crypto tools that work but aren’t worth as much as they should be.

Coin-by-Coin Reviews of Utility Altcoins Under $1

Here are five utility altcoins under $1 that passed our filters. None of these are “sleeper gems” based on vibes or influencer posts, they’re active projects powering real functions. Some are infrastructure. Some are ecosystem-native utility altcoins under $1. But all are being used, not just held.

AR – Arweave

What It Does:

Arweave is a decentralised file storage technology that enables people upload material for good, so they don’t have to pay for it again. It was the first to come up with the idea of the “permaweb,” where data, apps, and even blockchains can be stored on-chain forever.

Utility:

You can only pay for storage on Arweave’s network with the $AR token. Uploaders utilise it directly to pay miners, and the costs change automatically according on how much space is available and how many copies there are. Arweave has backed up all of Solana’s ledger history, which proves that this is not simply a feature of the whitepaper, but one that is available in production today (source).

Why It Is Still Less Than $1:

During the crypto winter of 2022–23, $AR dropped below $1 and stayed there for months. Even yet, development stayed stable (GitHub), protocol usage stayed steady (data), and Filebase, Akord, and Solana keep building on it. This isn’t a big deal. It’s the infrastructure.

Final Thoughts:

Out of all the utility cryptocurrencies we looked at that cost less than $1, $AR has the clearest link between how blockchain tokens are used and how the system works. You pay $AR to keep your data safe. That’s all there is to it, and it works.

OCEAN – Ocean Protocol

What It Does:

Ocean Protocol is building the foundation for a decentralised data economy, which is a system where datasets may be tokenised, published, and sold without the need for a central authority. It is aimed at AI developers that need access to training data but want to keep their privacy and control over the data.

How to Use It:

You can use the $OCEAN token to publish datasets, pay for access, and manage data markets. The utility altcoin under $1 not only represents value, but it also helps with on-chain economic cooperation. Ocean also uses it for governance and to reward people who stake.

So far, adoption has been

Ocean has worked with SingularityNET, added support for tokenised datasets for machine learning, and kept up a steady stream of development effort in 2025 (GitHub repo). Ocean is now the back-end data plumbing for a number of ecosystem apps.

Why It Still Sells for Less Than $1:

Just because something is useful doesn’t mean it will be popular. $OCEAN has significant traction, but it has stuck in the $0.20–$0.60 range mostly because the problem it solves is so complicated. Still, usage in the actual world keeps going up.

Why It Should Be on Our List:

The ocean isn’t a story; it’s a way to solve one of the biggest problems in Web3: getting to decentralised, monetised data that you can trust. It gets its usefulness the hard way.

REQ – Request Network

What It Does:

Request functions as a decentralized invoicing and payment system almost like Stripe but for web3. It is designed for businesses, freelancers, or DAOs to make crypto payments to automate payment tracking on the blockchain.

Functional Utility:

Indices for payment metadata, invoice automation, and premium features like encrypted invoices and fiat-to-crypto conversion are all covered by the $REQ token. It also plays a role in staking for spam resistance and governance. In short, it works behind the scenes to make Web3 money flow cleaner.

Traction & Ecosystem:

For their DAO payroll and recurring compensation, MakerDAO, AAVE and Gnosis have all utilized Request. They also have active integrations with accounting software enabling invoicing in several crypto and cross-chain. GitHub shows consistent activity in 2025 across modules (Request GitHub).

Why It’s Still Priced Under $1:

The lack of attention that $REQ has garnered is astonishing, especially considering the “real product” use. It trades between 0.06 and 0.10, with low volatility but rising on-chain volume according to CoinGecko. In this case, it being a “hype coin” is very beneficial for them.

What Stands Out:

REQ quietly addresses one of the most frustrating problems in Web3: invoicing and bookkeeping. This is particularly useful for treasury managers, crypto-native startups, and freelancers who don’t want to resort to complex spreadsheets just to receive payment.

SC – Siacoin

What It Does:

Siacoin is an example of one of the earliest pioneers in cloud storage centers. Unlike Dropbox or Amazon S3 which are centralized, Siacoin enables users to buy encrypted peer-to-peer storage or even rent excess hard drive space.

Actual Low-Cap Utility Token Usage:

Siacoin’s economic model enforces storage contracts. Thus, renters only pay for storage that is capped at the verified uptime and during the period data is locked for. The currency used to pay hosts for storage is $SC, the native token of Siacoin. Siacoin also features dynamic pricing along with redundancy models to guarantee file availability (Sia Docs).

Development Track Record:

2017 tokens came and went, but Sia, like most tokens, never died. Also, the project allowed Web3 developers to build applications on top of Sia via Filebase which provided an S3 compatible interface powered by Siacoin.

Why It’s Still Under $1 (By a Lot):

Having $SC trade below $0.01 suggests oversupply along with early inflationary tokenomics being the cause, rather than a lack of product. Active storage users, on the other hand are steadily growing and fully diluted value has stabilized.

Silly Little Tokens Show Their True Value:

Most sub-dollar altcoins are still in beta-testing. Sia is an exception: it has been live for years, fully functional, and even used in production. While it doesn’t garner the greatest attention, it is one of the few utility altcoins under $1 that delivers on the original promise of Web3: functional infrastructure that is fully decentralized.

XCUR – Curate

What It Does:

Curate is a mobile first NFT marketplace for trading NFTs, digital collectible items, and shopping across different chains. It provides the services of a Shopify and OpenSea at once, enabling users to buy, sell, mint and manage digital goods in a single app without the need for separate wallets, marketplaces, or bridges.

Where the Token Comes In:

Within the Curate ecosystem, $XCUR can be used to pay for marketplace fees, accessing loyalty payments, staking for reduced gas fees, and receiving affiliate payments. The low-cap utility token also powers an on-chain discount engine where a portion of the purchase can be paid back in $XCUR. (Curate Docs)

Product & Traction:

The Curate mobile app is live on both iOS and Android, with support for ETH, BNB and XCUR transactions. While still niche, the app sees active commerce volume and is integrated with Trust Wallet and WalletConnect. $XCUR can also be tracked across exchanges via CoinGecko.

Why It’s Priced Under $1:

As with most utility altcoins under $1, Curate suffers from market underexposure and exchange limitations. $XCUR typically trades between $0.03 and $0.08 with low liquidity, but high protocol specificity.

What Makes It Different:

Unlike most e-commerce altcoins which are vaporware or limited to browser use, Curate has developed a working mobile commerce app with real sellers and purchasers, tangible token mechanics, and advancing affiliate systems. This is more than what most utility altcoins in this price tier can claim.

ALSO READ : Top 7 Altcoins Under $1 to watch in 2025

Risks – What Breaks Utility Altcoins Under $1

A project claiming to offer ‘utility’ is no guarantee that it will thrive. Some of the largest explosions in crypto came from altcoins that had a real counterpart but lacked true demand, misaligned incentives, or unsustainable emissions.

When looking into utility altcoins under $1, these are the most common insufficiencies to be mindful of:

Utility Without Urgency

If a sub-$1 crypto can be utilized but doesn’t require to be utilized, demand declines. Many utility altcoins under $1 suffer from optional token logic where you can stake it, or pay with it, but there is no strong incentive to do so. Structural utility is the only form of utility that works.

Emissions Outpace Adoption

Even useful utility altcoins under $1 can collapse when inflation runs wild. Projects that unlock 5% of supply monthly, or reward farmers at unsustainable APYs, often see price bleed regardless of usage. Having a working product is never enough when supply mechanics are broken.

Protocol Usage ≠ Token Usage

This is quite subtle, yet important. Some projects may have popular dApps, but those projects do not require the under-the-radar crypto projects for access. Accessing the product through stablecoins, wrapped assets, or complimentary tier access renders the native token useless. That disconnect can destroy value.

Abandoned Roadmaps or Paused Dev

While silence on GitHub is concerning, team inactivity is equally troubling. Auxiliary utility altcoins under $1 require perpetual innovation. If the project team has been silent for the last 6 to 9 months, it is safe to say the utility is depreciating rapidly.

External Dependencies and Broken Incentives

At times, the fate of a functional altcoin relies completely on a singular partnership, integration of a different chain, or subsidized rewards. The economy of the token fails completely when that singular piece fails or departs. If it is functional solely in one heavily controlled environment, it is not decentralized; it is brittle.

Finally

So many utility altcoins under $1 collapse not due to bad ideas, but rather due to the economic design considering the token not aligned. Real demand must stem from genuine usage. Anything else is a mere whitepaper and speculation.

Methods for Monitoring Real-World Applicability

If there’s one thing crypto doesn’t lack, it’s marketing.

Every project markets its token as ‘utility-driven,’ however, once you scratch the surface, it becomes apparent that the vast majority is just fluff. Utility emerges from friction, work, developer effort, demand geometry of protocols, and ecosystem health. It does not stem from whitepapers.

That’s how we actually confirmed whether these utility altcoins under $1 are being actively traded or are stagnant in some liquidity pool.

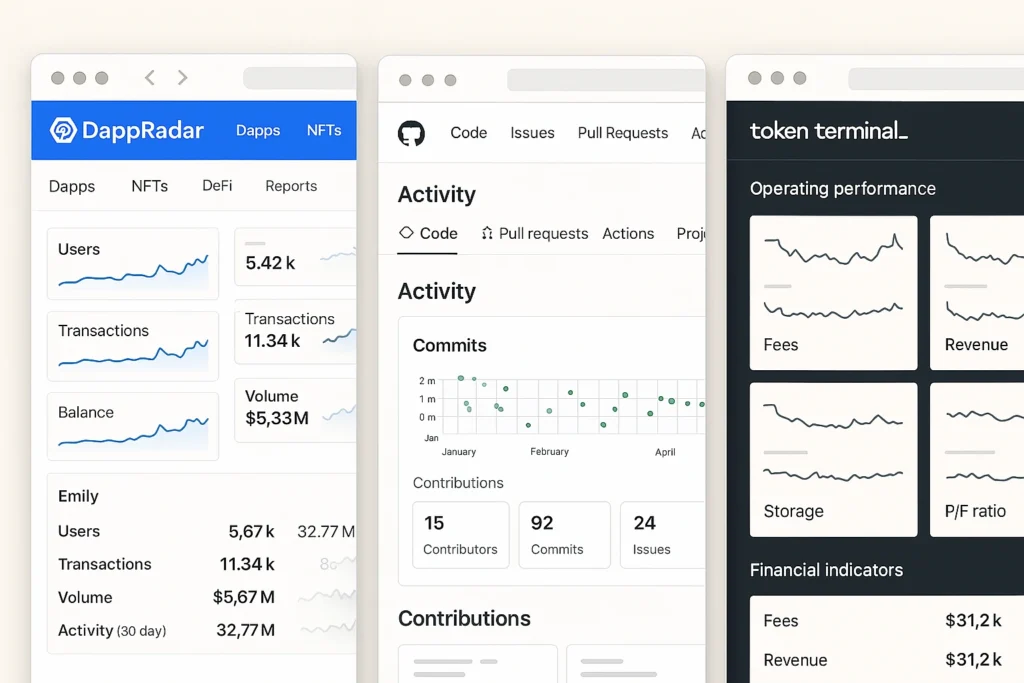

DappRadar: Use ≠ Utility

To verify some of the usage claims from Curate and Guild of Guardians, we analyzed their data on DappRadar. GOG had approximately 7,000 DAUs which is pretty decent. The problem, however, was that very few of those users were engaging with the token. They were simply… playing games.

Curate had lower raw traffic, but actual spending behavior linked to $XCUR suggest otherwise.

Lesson: Active user counts can be misleading and misrepresent reality. Always follow the activity to the token, not just the surface interactions on the UI.

Token Terminal: Where’s the Revenue?

REQ and Ocean both made bold claims about usage so we ran them through Token Terminal to verify whether they were actually generating protocol revenue.

Ocean emphasized dataset publishing and staking mechanics, while REQ showcased DAO payroll activities. These projects had legitimate activities integrated with their tokens and not mere speculative trading.

Not every utility altcoins under $1 will make it here. However, those that do will definitely warrant serious consideration.

GitHub: The Truth Layer

GitHub stands out as the most trustworthy metric in crypto.

We collected commit history on Sia, Arweave, and Request Network. Arweave in particular displayed solid development velocity through 2025. Sia surprised us with continuing to release infrastructure fixes at a $0.003 token price.

What you want to avoid? Projects that have not updated their last commit since 2023 but are still actively tweeting about updates. That lack of harmony kills pragmatism.

Footprint Analytics: When the Data Doesn’t Lie

Footprint Analytics assisted in answering one troublesome question about $XCUR: Is there any commercial activity associated with it?

Wallet-level redemptions and fee burn tracking proved this was indeed the case. While not substantial, volume demonstrated the token was indeed performing its intended purpose.

This is one of the few areas where you can check for sinks and not just movement. And for tokens priced under one dollar, hyps for sinks often matter more than hype.

Discord, Forums and Friction

To conclude, the last overlooked utility verification: observe the help sections.

Sia’s Discord channels are overflowing with tech and setup inquiries because people are configuring the bot. Compare that to the “utility” tokens we didn’t list, half of them had pinned messages from 2022 with no user interaction at all.

Activity creates disorder, which includes bugs, solutions, and comments. That’s an attribute, not an issue.

Last Verification Before Purchase

If you have a token in the crosshairs and it touts utility features, consider the following:

- Who is utilizing it?

- How frequently?

- For which purpose?

- Is that usage visible on chain to me?

If those can’t be answered with public and provable methods, tools, and resources, then it’s not a utility token, but rather a marketing effort.

ALSO READ: Top Gaming Altcoins Under $1 with 10x Potential

How to Make a Portfolio of Utility Altcoins Under $1

In fact, most utility altcoins under $1 appear a lot better on paper than they do when you put them in a wallet.

Arweave, Ocean Protocol, and REQ all have great foundations, real-world uses, and recent GitHub commits. But as soon as you try to place these coins into a portfolio, the picture starts to break apart.

Some of them don’t have any cash flow at all. Some people say they try too many new things. Some of them do give you real tools, but they only function for certain things in crypto mythology that might never become popular. That’s the frustrating paradox with utility altcoins under $1: they work, but the market rarely rewards them.

So, where do they fit in with the rest of your lineup?

With Arweave, we waited six months. Not because we started to doubt, but because we couldn’t think of a situation in which increased storage demand would instantly impact the value of the functional altcoins. The technology works, but it doesn’t grow very fast. Infrastructure that doesn’t rise too high; it merely stays there.

Because of this, we regard $AR as a patient hedge. It never goes into our trading basket. Instead, it rests in cold storage next to things we might really need, not close to things we expect to sell quickly to make money.

Instead of being a quick-trade rally, Ocean Protocol markets itself as a long-term idea. The goal is to combine AI and blockchain to make a data marketplace that anybody can use without asking for permission. That promise is huge, almost like a mountain. When you bet on Ocean, you don’t just think about one dataset or one contract. You think about how the infrastructure for machine learning has been rebuilt over the past ten years.

This isn’t a swing in terms of a portfolio. It looks like a thesis hold. We size Ocean small, take a long view, and plan to look away for two or three years, which is enough time for the story to either flourish or fail.

We were surprised that REQ was the only token on this list that we really utilized. Last year, we utilized it to send a payment to a DAO. It settled without any gas panic or RPC magic. The dashboard seemed empty, yet all the buttons worked.

If you work for yourself in crypto, REQ could be a good place to start. It’s not an investment star; it’s more like having credits on Stripe or a Notion Pro subscription. Utility comes first, and price chatter-rate comes second.

Sia is in the shrug-hold group. We appreciate the idea and respect the personnel, but we have never felt the need to get their tokens. Filebase stays connected, and developers keep sending out updates. The storage technology below still functions. The codebase still feels a touch nostalgic. Even if it comes back to life, it will only move after the market has long gone.

For now, Sia sits quietly in our cold wallet. It’s still alive, but we rarely even check the chart anymore.

Next is Curate. We find the idea of a pitch-mobile-first crypto-commerce supported by regular app usage to be interesting. The issue is that $XCUR functions like a small-cap stock on a narrow exchange right now: you can see swaps and real downloads, but as soon as you try to buy more, the liquidity disappears almost immediately.

So, our advice is simple: keep a watch on the release notes, keep track of how many users they get, and be ready to act if they secure a large partnership or become listed on a Tier-One exchange. XCUR is just a working utility currency with genuine volume but no self-reinforcing flywheel yet.

Last Thought

Every utility altcoins under $1 in your watch list has a reason for being there. Some are hedges, some are tools you use, and some are just things you watch from the sidelines.

When it comes to establishing a portfolio with utility cryptocurrencies that are selling for less than $1, there isn’t one method that works for everyone. But if your digital wallet is full of tokens that you don’t utilize, you might want to think about why those assets are still in your spend-stack. True utility doesn’t always guarantee a high market price, but it gives you a reason to hold, not because it might moon, but because it actually does something.

One of the strongest utility categories in crypto is payments, and that’s where the best payment altcoins under $1 shine.

Frequently Asked Questions

Q: Are utility altcoins under $1 less risky than meme coins?

Not always, just risky in slower, quieter ways.

Meme coins crash fast. Utility sub-$1 crypto tokens drift. You might not get rugged, but you can definitely get stuck holding something that goes nowhere for two years.

The upside? With utility tokens, at least you can trace usage. You can see GitHub commits, real DAU metrics, actual transactions. That doesn’t guarantee safety, it just gives you something to work with beyond hype cycles and influencer memes.

Q: How do I know if a utility token is actually being used?

Forget what the whitepaper says. Pull up DappRadar. Check Token Terminal. Scroll the project’s GitHub.

If the token is just sitting on a centralized exchange and the dApp has zero interaction with it, that’s your answer: it’s a ticker, not a tool.

One trick we use? Go into Discord. If people are asking for help using the app or staking the token, it’s probably legit. If it’s just giveaway bots and pinned announcements from 2022, it’s probably dead.

Q: What’s a smart way to size these in a portfolio?

Start small. Then go even smaller.

Just because it’s trading at $0.03 doesn’t mean it’s “early.” Some of these utility altcoins under $1 have a $900 million FDV and the tokenomics are brutal. Others are under-the-radar but barely liquid. Either way, don’t size based on the price. Size based on how much friction you see in real usage.

If it’s a protocol you actually use, like REQ for invoicing sure, hold a bit more. If not? Keep it at watchlist size.

Q: Can any of these realistically 100x?

Mathematically, yes. Realistically, not often.

You’re looking for the rare combo: tiny market cap, real product, sticky users, and token utility that doesn’t depend on hype. That’s not impossible, we’ve seen it with GALA and early Axie. But it’s rare. And when it happens, it’s messy.

Think of it this way: the best 100x returns usually come from unexpected utility becoming mainstream. If you’re betting on one of these to do that? Fine. Just size like you’re probably wrong. For more on this, read.

Q: Should I hold these long-term or just trade them short-term?

Depends on the token and your patience.

Sia? That’s a long-term infrastructure hedge. You’re not trading that weekly. XCUR? Feels more like a microcap with retail spikes, better watched than held. Ocean or REQ might fall somewhere in between.

Here’s the real question:

Would you still hold this if nobody talked about it on Twitter for six months?

If yes, it might belong in your cold wallet. If not? You’re probably in it for the wrong reasons.

Conclusion: Utility is Key. Price is Secondary.

This research crystallized the following imperative:

Underutilized tokens in the blockchain market do serve a profound purpose, provide functionality and gratification.

To some extent, we observed tokens with actual utilitarian functions, like file storage, data tracking, payment routing, and powering applications. Their GitHub activity was alive with commits, there were functional products, and even active users, yet in stark contrast, most of them do not behave like other assets. This is the harsh reality with utility altcoins below the one-dollar mark, there’s evidence they function, but they do not pay out most of the time.

This is where the interest lies in this market.

The tokens that fly under the radar don’t capture the attention of users on social networks. They do not occupy the trending sections. However, if you are constructing a portfolio that is not easily disrupted by volatility, these positions may yield significant value.

Not ignoring the fact that, at that moment, the market is flooded with built-up anticipation and glaring overhyped, hollowed promises, the valued attention those projects receive greatly outweighs their use.

The aforementioned statement should not be interpreted as a green check to buy without assessment. That means being cautious, persistent, and well-informed works best.

Suppose one of these tokens fully took off within the future,

You can rest assured that their price movements would stem from concrete reasons instead of empty momentum.

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.