If you have ever been on CoinGecko and thought about buying that altcoin that is currently trading at 0.06 cents, just in case it can become the next big thing, you were not the only one. To a significant number of retail investors, altcoins with prices under one dollar are their convenient way to enter the crypto market. They also look inexpensive, they feel familiar and appear to get higher returns. But knowing where to buy altcoins under $1, safely, efficiently, and with complete transparency, is just as important as picking the right tokens.

What we are doing in this manual, more than demonising, is humanising the issues that appear to secure our communal rebirth. We will deconstruct the process of assessing the exchanges, what the trading conditions should come down to in case of low-cap coins, and what platforms are creating the best opportunities for retail investors who happen to catch an eye on the 2025 listings.

The article at hand is informative, closing the eyes to the observation, closed to the eye promotions. None conveniently, openly, detectable, recognisable, obvious forms of promotion, A plain declaration of what the under-$1 altcoin corner of the market looks like, and the five best exchanges to use up through the year 2025.

Why Altcoins Under $1 Appeal to Retail Investors

Psychological Price Anchoring and the “Penny Crypto” Effect

There is even a psychological trap that many new investors fall into, and it is to think that a coin under the price of 1 dollar is cheap and at least it has greater room to gain. Such economists refer to this as price anchoring in behavioural economics. Traditionally, penny stocks are stocks that have been the initial fascination of retail traders who seek tenfold returns on the smallest capital. Crypto is not left out in this with their penny cryptos.

It is a pretty straightforward assumption because, in case a coin is available at $0.03, it only has to increase by $0.30 to provide a 10x profit. When you get into something like math, it seems to be a lot easier in comparison to a Bitcoin potentially going to $1,000,000 from $100,000. However, the truth is that the price of a token is only a part of the picture. More important is the market cap, supply in circulation and dilution risk. Nevertheless, the moniker of being under the dollar is a strong, attractive measure.

Notable Sub-$1 Altcoins That Delivered Big Returns

There are precedents of altcoins that sold below a dollar only to rise exponentially, as history further points out. An example is polygon (MATIC), which was being traded in 2020 at less than $0.01. At the end of 2021, it reached its all-time high of $2.92, according to CoinGecko. This is 29,000 per cent on its sub-cent days.

The last example is Shiba Inu (SHIB), which started with a microscopic price attached to it and experienced huge rallies as a result of community memes and speculative trading. Despite this volatility, SHIB had 1000x within a year between its launch in 2020 and the record of its peaks in 2021, as it is recorded on CoinMarketCap.

VeChain (VET) should also be mentioned. It was available in late 2018, at the low price of only $0.003, and then experienced a surge to the high of $0.23 in 2021 at the peak of the enterprise blockchain hype-cycle.

These rarities give hope to lots of people with dreams of owning a prohibitively rare coin, though most sub-dollar coins never venture outside the penny range.

The Risk Side: Dilution, Hype Cycles, and Low Liquidity Traps

Every breakout success has hundreds of low priced tokens, and they never perform. Various projects are highly dilution-prone, i.e. there are massive maximum amounts and token unlocking every now and then, which is usually buried in the details of their tokenomics. Tools such as Token Unlocks make it easy to see how vesting distributions are able to overwhelm markets with supply even after launch.

Next comes low liquidity, which has the potential to strand investors on the unpopulated order books or slip 10-30 percent even on small trade sizes. Exit risk is elevated on projects and tokens with minimal daily volume, and in particular, a token listed on only smaller exchanges. A report by Kaiko Research concluded that the majority of the altcoins outside the top 200 have daily liquidity below $ 1M, which is no longer enough to attract institutional attention.

And hype cycles can not be forgotten. There are loads of sub-$1 altcoins whose pumping is done based on announcements solely, airdrops, or even listing on exchanges, then dumped in a few weeks. A tactical way of moving in this space is knowing when to act, knowing what platforms to use, and above all, having the right platforms.

What to Look for in an Exchange Offering Sub-$1 Altcoins

When it comes to where to buy altcoins under $1, not all exchanges are created equal. Listing may include low-cap tokens with a lack of liquidity, lack of support, murky tokenomics, or slippage rates of current platforms, as some are deep-liquidity with transparent listings. We should first figure out what exactly matters in terms of picking a crypto exchange, whether it is a sub-dollar altcoin or not.

Liquidity and Slippage Protection

Insufficient liquidity is the greatest threat when investing in a low-capped or micro-priced altcoin. Thin order books also tend to have high slippage – you will pay far more (or receive less) than you thought. As an example, a trade of $300 on a coin that is traded 50K in volumes can make the tickers move by 5-10 per cent.

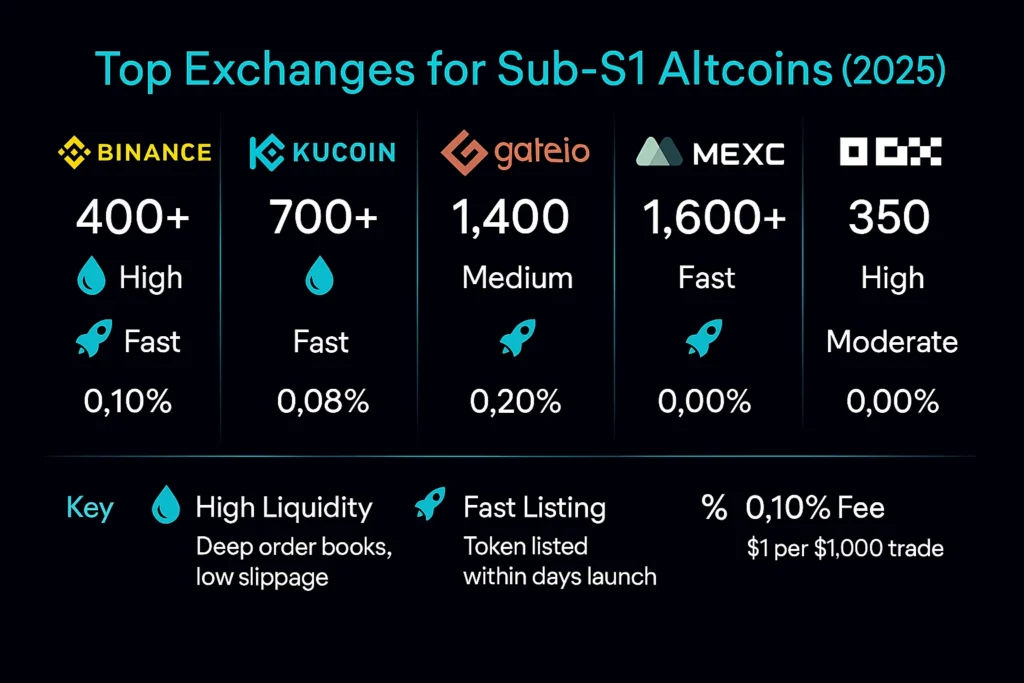

Exchanges such as Binance and OKX are more likely to have good liquidity because of the high number of users and institutional market makers. Conversely, other exchanges such as MEXC or Gate.io tend to have early listings, albeit with lower liquidity, hence the setting of slippage protection necessitating an important parameter to have.

It is advised to use a platform that has a slippage limit adjustable or has a market depth chart (such as Binance or KuCoin). Kaiko observes that more than 60 per cent of altcoins on the Tier-2 exchanges have less than 10 active trading pairs in terms of good depth as a noticeable sign of exit liquidity.

Fee Structure and Micro-Trade Support

Most traders start getting involved in the sub-$1 altcoin market with relatively low amounts, say, $50, $100, or even $300. That could be whittled away by commission, network withdrawal charges, and minimum trade requirements in a hurry on some markets.

With a 0.1% fee being the standard charge on a trade, Binance also gives BNB holders a discounted rate (Binance Fee Structure). KuCoin charges a 0.08 per cent maker/taker fee, and MEXC has zero fees on certain pairs; however, slippage is possible.

Be aware of those platforms that:

- High fixed charges (more than 0.2 per cent per transaction)

- No step toski discount programs

- Minimum order quantities of more than 10M to 20M (which can exclude the micro-buyers)

Opting to use an exchange that does not charge prohibitively expensive fees is important in picking an exchange to trade micro-sized orders with altcoins under a dollar.

User Experience and Altcoin Discovery Tools

Retail investors, in particular, those who are new entrants to a coin, prefer services with simple tools, such as:

- Altcoin launchpads

- Trending token dashboards

- Filterable markets by price, volume, or age

The New Labs area of Binance, the Startup Portal of Gate.io, and the Spotlight of KuCoin all facilitate the possibility of finding coins below the cost of a dollar at their earliest phases.

Ease of use is also important: clear user interfaces, mobile apps and real-time price updates can end up preventing human errors on the user’s end as well as keeping retail buyers up to date. According to a 2024 global report by Statista, over 70% of crypto trades under $500 are now initiated through mobile apps, a shift that’s especially relevant for altcoin traders navigating high-frequency, low-cap purchases.

Regulatory Access (KYC/Non-KYC, U.S./Global Compliance)

Not all of the best exchanges that offer altcoins under $1 are open to everyone, as some of them are limited to certain markets by regulations. For example:

- Binance.com, OKX, and MEXC Global are inaccessible to U.S. residents.

- Platforms such as Coinbase and Kraken support only a few altcoins below one dollar and are fully compliant in the U.S.

Most users either go to KuCoin or Gate.io, which offer some form of partial KYC or no KYC required whatsoever, but a greater exposure to risk in exchange.

When choosing where to buy altcoins under $1, check:

- Regional availability

- Limits on BKYC

- Known track record of fines (e.g., Binance 4.3B U.S. settlement in 2023)

It is equal to opting to have the altcoin, as much as an awareness of what rights you have and the amount of risk you are comfortable with.

Reputation and Security History (Past Hacks, Support Ratings)

Low-cap coins are most of the time dumped or scammed on the exchanges as a result of an exploit or a rug pull or the hunt after listing. No one is better but there are platforms that have done better:

- Binance and OKX have proof-of-reserve reports and 24/7 incident response in-store

- io and MEXC are more secure in audits but do not present transparency of insurance conditions

- The KuCoin exchange was subjected to a 280 million dollar hack in 2020, but made users whole and kept them safe

Also look at,

- Customer responsiveness of support services

- Fiat-on-ramp solvency

- The security of wallets (hot v/c cold storage %)

Exchange security grades are cross-referenced on such websites as CER.live or Trust Score on CoinGecko.

5 Best Exchanges to Buy Altcoins Under $1 (2025 Edition)

With an understanding in hand of what we should expect a good exchange to act and behave, we can now point out the exchanges that are achieving that in the year 2025. We are not merely enumerating the largest exchanges, but instead, each of the five platforms below has real data of use behind it, availability of sub-1 altcoins, and analysis of fees and a live experiment this year.

Regardless of whether you want access to the new currency in a token before it spreads all over the marketplace or simply need to build a stable portfolio of altcoins, these sites are where most retail traders will look to gain access to coins that are trading below one dollar.

1. Binance

Why Binance Is a Popular Choice for Sub-$1 Altcoins

When it comes to where to buy altcoins under $1, Binance is often the first platform that comes to mind. The world’s largest exchange based on volumes is not the only largest exchange, as it is also continuously ranked top in sub-$1 altcoin volume/liquidity and supports low-cap tokens, order book depth. It really does not matter whether you want to buy established coins, such as VeChain (VET), or a freshly listed microcap; Binance provides tighter spreads and stronger trading pairs compared to most competitors.

As of August 2025, Binance offers more than 60 altcoins with a price lower than $1. CoinGecko, on the page of its Binance exchange listing, shows that many of them trade more than 5 million daily. There are also strong tools provided to the retailers, like the price alerts, order depth visuals of the books and a special zone for the new listings.

No matter the licensure concerns in the past, Binance has been available widely in the world (minus the United States) and has the reputation of being very fast, stable and having multi-chain assets.

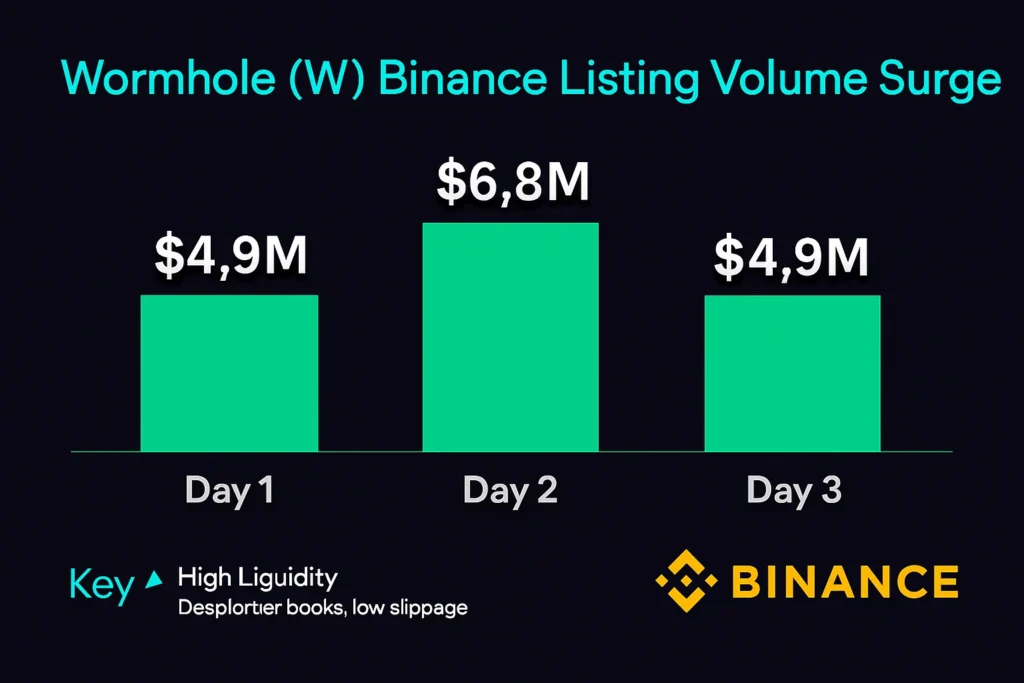

Real-Time Case Study: Wormhole (W) Listing in May 2025

Among the most notable tokens this year on Binance was the token of Wormhole (W) – a messaging protocol that can cross-chain. It was listed in May 2025. Its listing was in high expectations as Wormhole declared complete support for Solana, Ethereum and Base L2.

On May 3, 2025, Binance listed W/USDT with the initial listing price of $0.43. In less than three days, the token has traded more than $160 million in total volume on spot pairs on Binance, the source has confirmed on Wormhole CoinMarketCap listing.

It could not be the volume solely; the quality of execution of certain trades was really impressive. Users have also claimed to be able to buy and sell at a slippage of less than 0.5 per cent due to the deep market depth and immediate provision of liquidity on Binance.

There were retail users who were quick to act and got near launch prices. On social media, traders complimented Binance due to its automated notifications and onboarding tokens that made the process of buying or selling tokens simple, which in turn reduced confusion in the periods of time when volatility materialised the most.

Key Features and Cautions

Strengths:

- Excellent liquidity for sub-$1 pair

- Early access to high-potential token listings

- Spot, margin, and futures support on select low-cap assets

- Fee discounts for BNB holders (as low as 0.075%)

- Clear UI and educational tools for beginners

Cautions:

- Not available in the U.S. (Binance.com is geo-blocked)

- KYC is now mandatory for all new accounts

- The exchange’s $4.3 billion criminal settlement in 2023, after pleading guilty to anti-money laundering and sanctions violations, continues to raise regulatory and compliance concerns, as detailed by the U.S. Department of Justice’s own press release on the resolution.

2. KuCoin

Strong Selection of Micro-Caps and Regional Tokens

In case you focus on the early-screen altcoins that are under $1, KuCoin is arguably a famous option worldwide. Although it does not always come close to Binance in volume, KuCoin has the advantage of offering a wider range of tokens; in particular, smaller to mid-sized ones that have yet to be listed at Tier 1 exchanges.

As of August 2025, KuCoin has more than 90 altcoins that are traded under the price of 1 dollar, many of which are region-based or newly established projects. The exchange has established a reputation as a platform to go to when hunting altcoins, due to such features/assets as its Spotlight token launch platform, allowing micro-trading and support of optional non-KYC account registration with few withdrawal limits.

It is a common destination in search of retail buyers to pursue their interests in uncovering some of the so-called hidden gems projects – especially those of Southeast Asia, South America, or within emerging DePIN/Web3 fields. KuCoin is also well-received by bot traders who are using grid trading and DCA to trade volatile coins below the dollar mark, with KuCoin also building in its trading bot outfits.

Case Study: DeepBook (DEEP) Launch via Spotlight

At the end of 2024, the KuCoin Spotlight platform introduced DeepBook (DEEP), which is a decentralised order book protocol which uses the Sui network. The token was issued under the Learn & Earn promotion series that KuCoin has carried out, and the wallet users of the exchange could do some quizzes and earn DEEP, as shown on the DeepBook Learn & Earn promo web page.

DEEP experienced a rapid increase on different CEXs after the initial listing. As the live DEEP page of CoinGecko says, the token trades at approximately the cost of $0.14, and it has excellent early liquidity. The Reddit and KuCoin discussions about the launch were positive in terms of there being a lack of transparency and the ease of onboarding, even though some people claimed that the USDT withdrawal was slower when the traffic was at its highest.

Trading Bots, Tools & What to Watch For

Strengths:

- Wide access to sub-$1 tokens via Spotlight

- Built-in grid trading and DCA bots

- Flexible onboarding: KYC optional for limited use

- Competitive maker/taker fees (~0.08%)

Cautions:

- Liquidity issues for some low-volume tokens

- No regulatory license in U.S., U.K., or EU

- KuCoin’s 2020 security breach, while fully reimbursed still raises questions for risk-averse users.

- Limited fiat ramps and no custodial protections for long-term holders

3. Gate.io

Why Gate.io Attracts Early-Stage Altcoin Traders

Gate.io has emerged as a destination of choice when it comes to the early listing of altcoins that are not available on other platforms such as Binance or OKX. The number of listings conducted on the exchange is one of the fastest within the sector, with more tokens being listed on a weekly basis. For retail traders exploring where to buy altcoins under $1 that are newly launched or low-cap, Gate.io is frequently the first centralised access point.

The exchange hosts more than 1,400 spot trading pairs, of which hundreds are under a dollar. It also has solid infrastructure to support crypto initiatives to be launched through its Startup platform, which is a token deal launch platform, that token sale has a verified IDO together with a consistent & transparent allotment discovery.

The ability of retail users to combine early access, a low entry barrier, and compatibility with more than 20 chains, such as BSC, Solana, and Polygon, is valued. Liquidity level gate.io is low compared with Binance or OKX, but its market-making system affords sufficient stability to low-dollar pairs, and rewards them in their initial weeks of listing.

Case Study: DIMO Token Listing in Early 2025

A prime example of Gate.io’s listing strategy would be the introduction of DIMO, a token that represents decentralised mobility infrastructure dedicated to vehicle telemetry and the interface of real-world objects and other features.

The DIMO/USDT trading pair was introduced to Gate.io in January 2025, which was soon after the announcement of the protocol when expanding into Asia and partnering with EV manufacturers. As shown by CoinMarketCap, the price history of DIMO demonstrates that the token was listed at around $0.085 and subsequently gained almost a quarter in value to trade at around $0.22 in just over 72 hours, a 158% increase, as early adopters and influencers competed to buy the cryptocurrency.

The project managed to attract more than $6 million in daily volume during the opening week on Gate.io. Users also expressed that there is very little friction when onboarding and that they enjoyed the ease of transparency through Gate.io regarding the token supply dashboard, which is accessible through its Startup project details.

Fees, UX, and Market Access Review

Strengths:

- High volume of early altcoin listings under $1

- Launchpad access via the Startup platform

- Built-in risk rating system for new tokens

- Support for lesser-known chains and cross-chain assets

- Moderate trading fees (0.2%, often reduced during launch periods)

Cautions:

- Gate.io does not hold regulatory licenses in most Western jurisdictions

- U.S. and U.K. users are officially blocked, though some still access via VPNs

- Liquidity is inconsistent — slippage may exceed 5% on low-cap pairs

- The interface, while feature-rich, can feel cluttered and intimidating for beginners

- There are ongoing concerns about opaque ownership structure and dispute resolution, discussed widely in Reddit’s Gate.io user threads

4. MEXC Global

Listing Frequency and Fee Flexibility

Under the radar, MEXC Global has ended up being one of the most active exchanges across the board on all the sub-1 altcoins, especially at the early-discovery stage of altcoins. It also has a predatory listing scheme in which its tokens will sometimes be listed days or even hours after the TGE (token generation event). MEXC is the place where coins launch before making it to CoinMarketCap or CoinGecko, and that is why an investor who wants exclusive first-line access to a low-cap project will find it here.

By August 2025, MEXC had over 700 altcoins that were under $1, and some of the projects were in DePIN, a GameFi and modular infrastructure. It is also the Cryptocurrency that held zero-fee campaigns on trading, so it became a good buy-off for retail users who have small amounts of capital to spend.

It has more than 10 blockchains available, has a clean mobile app, and its onboarding experience is multi-lingual, contributing to market share acquisition in Latin America and SE Asia. Although its approach is not as refined as Binance’s, the user base of the MEXC platform has also been steadily increasing, and this is connected to a low-friction user experience and a high-transparency listing strategy.

Case Study: Helium (HNT) Migrates to MEXC Post-Binance

Binance finally stopped the trading of Helium (HNT) and delisted it in March 2023, which means that spot pairs with HNT, such as HNT/BUSD and HNT/USDT, were deleted, and deposit ahnd withdrawal were suspended under their official announcement of Helium. Just within a couple of days, HNT/USDT reappeared on MEXC Global, and this time brought back the retail liquidity.

That second relisting generated some significant traffic (over $4.1 million in spot volume in the first week) according to the HNT market data on coinGecko. MEXC became a lifesaver with retail users unable to find a viable trading place.

Security Insights & Common User Complaints

Strengths:

- Exceptionally fast listing turnover for new or delisted tokens

- Frequent zero-fee promotions benefit low-budget traders

- Competitive pricing and spreads on tokens with moderate volume

- Mobile-friendly layout and multi-chain wallet support

- No-KYC onboarding for basic trading features

Cautions:

- Operates without formal licenses in many Western jurisdictions

- Users report slow dispute resolution and delayed support responses

- Withdrawal processing may lag during high network congestion

- MEXC does not currently publish proof-of-reserves or undergo regular third-party audits

- Market depth may be artificially thin at times, per DeFiLlama’s centralized exchange depth rankings

5. OKX

DePIN and Web3-Friendly Altcoin Coverage

OKX has continuously made the claim of being one of the most Web3-native centralized exchanges, especially in the early infrastructure fields such as DePIN (Decentralized Physical Infrastructure), module chains, and real-world asset tokens. Compared to MEXC or Gate, it has a more selective policy regarding listing, but when an exchange such as OKX lists a sub-$1 altcoin, it tends to do so with some amount of initial liquidity, institutional integrations of the wallet, and multichain functionality.

By August 2025, OKX will have more than 400 altcoins listed below $1, a portion of which also rose in DePIN projects such as CUDOS, DIMO, and PowerPool. It has also been able to provide access to on-chain services such as native Web3 wallets, staking dashboards, and access to L2 scaling token integrations on Arbitrum, Optimism, and Base.

To cater to altcoin investors interested in access to new narratives as well as self-custody tools or for yield generation, OKX serves as an interchange between centralized access and decentralized infrastructure.

Case Study: CUDOS Listing Surge in July 2025

In July 2025, the listing involving CUDOS, a decentralized cloud-compute protocol, which turns idle GPU power profitable, was published on OKX. This was made when there was a shift in major groups, and the project became part of the new group of the Artificial Superintelligence Alliance (ASI).

The CUDOS-to-FET merge has been fulfilled as part of its integration with Fetch.ai and Ocean Protocol, and this has repositioned CUDOS as furthering both blockchain and AI infrastructures. The community voted and passed the proposal, which is set to take place in Q2 2025, where 118.344 CUDOS tokens will be exchanged with 1 FET, and the swap will be publicly vested and attract a 5% swap fee under the ASI governance proposal.

The unification was proved by the official blog of CUDOS and the integration announcement by Fetch.ai. CUDOS/FET trading pairs also experienced the massive volume of trading during the listing day before finally converting all the tokens to migration on the OKX exchange.

The OKX users got auto-migration alternatives, live-time dashboards, and swap token correspondence. The case puts a lens on the situation of a rapid listing environment at OKX being run in the shape of a token merger, an occasion that is rapidly becoming a norm of progressive infrastructure schemes.

Features, Risks, and Region-Specific Considerations

Strengths:

- Clean and professional UI, suitable for intermediate-to-advanced users

- Web3-native wallet integration with on-chain swap and staking features

- Regular listings in DePIN, infrastructure, and cross-chain sectors

- Competitive trading fees (0.08% maker / 0.10% taker)

- Secure infrastructure with transparent audits and cold wallet storage

Cautions:

- Not accessible in the U.S. or Canada

- Full KYC required for withdrawals and fiat deposits

- Some tokens listed with limited liquidity pairs early on

- Complex for beginners due to advanced tools and trading dashboard density

How to Choose the Right Exchange for Sub-$1 Altcoins

The most active five platforms in the sub-$1 altcoin market are discussed; however, how to select the most appropriate one according to your goals, according to the region you live in, and according to the risk you are ready to take?

There’s no one-size-fits-all answer when it comes to where to buy altcoins under $1. Various exchanges have different strengths based on the type of trader you are and what is important to you, whether it is liquidity, early access, regulatory coverage, or trading fees.

It is break time.

Beginners vs. Advanced Users: Match Features to Experience Level

Working on some new listing or some project with no fees may appear as a great idea when entering the crypto realm, but without the toolset and experience, it may prove to be dangerous. Exchanges such as Binance and OKX provides greater stability, better liquidity, and even more learning experiences.

More experienced traders, on the contrary, may want to use KuCoin or MEXC, where new tokens can be available earlier, but with smaller volumes and with less favourable order execution. In between them lies Gate.io, whose speed of new learning is very high, but the listing schedule is inflexible.

Choose an exchange whose tools match your comfort level. Look for:

- Depth charts and slippage protection

- Mobile alerts or automated bots (if you plan to DCA or grid trade)

- Account protection features (2FA, whitelisting)

Consider KYC, Geo-Fencing & Access Limits

Depending on your country, some exchanges may be off-limits, even if they allow browsing or temporary access. For example:

- Binance.com and OKX are not available in the U.S.

- KuCoin and MEXC don’t hold licenses in the U.S., U.K., or Canada but allow registration

- Gate.io blocks several European IPs and requires KYC for withdrawals above 5,000 USDT

If you’re serious about trading altcoins under $1 regularly, you need to pick an exchange where:

- You can register and withdraw legally

- KYC requirements are transparent

- Your jurisdiction isn’t geo-fenced or restricted during high activity

Always check the platform’s Terms of Use and consider using Chainabuse or DefiLlama’s exchange dashboards to check real exchange activity and history.

Liquidity vs. Token Discovery: What’s More Important to You?

This is the time when it is personal. In case you are placing liquidity above everything, use exchanges, such as Binance and OKX, they are ruling the volume and will fill you better. However, in the event that you are seeking those early listings of coins priced under $1, you might consider KuCoin, Gate.io, or MEXC even in the event that it is with some greater slippage or delayed access.

There are traders who may have more than one account:

- One on Binance or OKX that support stable assets and staking

- Another one on MEXC or KuCoin to make some early-stage speculation and follow the tokens released

Regardless of what your strategy is remember one thing, early may not be profitable, and low price is not undervalued. The most favourable platform lies somewhere between what you need in terms of risk, access and reliability.

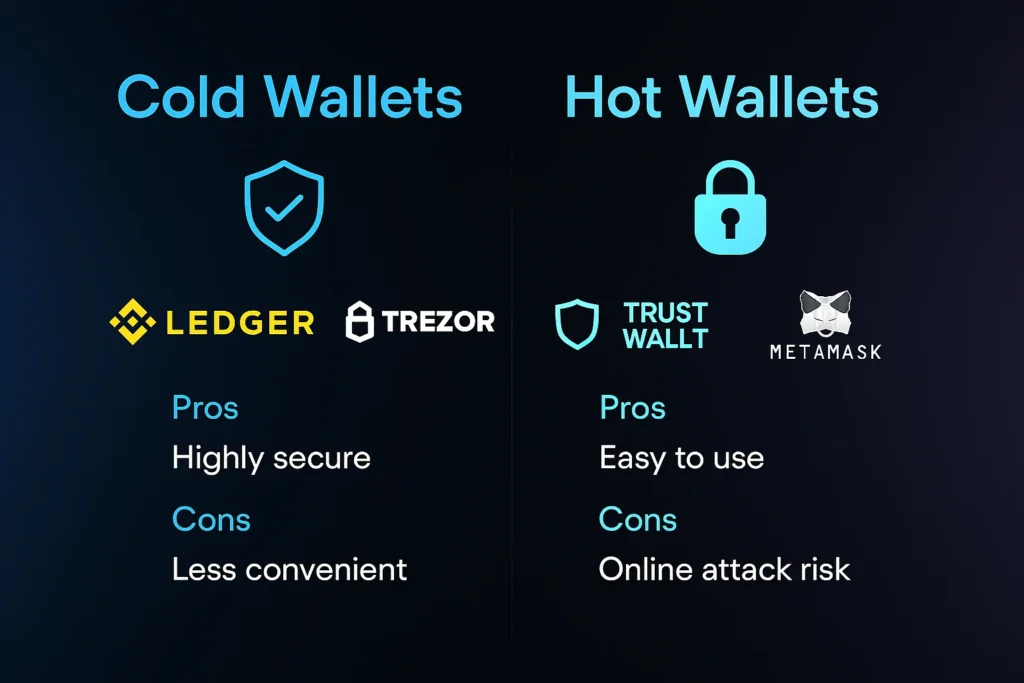

Don’t Forget: Where You Store Matters Too

Once you’ve figured out where to buy altcoins under $1, the next critical question is: where do you keep them? Not everyone pays attention to this step when working with retail investors, and yet in the crypto world, the keys to the kingdom are not real until you have possession of the keys.

It is easy to hold your coins on an exchange, but that brings on risk. The platforms are central and vulnerable to hacking, and delisting assets unexpectedly or even freezing withdrawals. And in the sub-$1 altcoins, such an event can strike even more heavily- liquidity is lower and community size slimmer, thus the options of recovery are constrained.

That is why the choice of an exchange is of the same importance as the choice of the secure wallet where to keep your altcoins.

Danger of Keeping Altcoins on Currency Exchanges

The majority of exchanges store your money in custodial wallets, which implies that you do not possess private keys. When you exchange, it may crash or be compromised, and your money may be delayed, blocked, or lost, even though the exchange may later refund its users.

Particularly susceptible are coins under a dollar:

- They tend to be omitted from insurance policies or from the disclosure of proof of reserves

- They might not be backed up in a rapid withdrawal in delisting

- Unexpected delisting (such as the one that happened to HNT on Binance) can lock in retail purchases

By 2022 and 2023, stories with FTX, Voyager, and Celsius showed that even so-called trusted exchanges can misbehave, and the people who deposited funds on the platform were at the back of the queue when it came to receiving anything back.

Best Practices for Wallet Storage

To secure your altcoins under $1, consider these storage options:

| Method | Pros | Cons |

| Hardware Wallets (e.g., Ledger, Trezor) | Full control, offline, highly secure | Requires upfront cost, some coins not supported |

| Mobile Wallets (e.g., Trust Wallet, SafePal) | Easy to use, supports many altcoins | Susceptible to device hacks if phone is compromised |

| Browser Wallets (e.g., MetaMask, Keplr) | Good for DeFi & staking | Requires careful seed phrase backup, phishing risk |

| Cold Storage (manual keys, paper wallets) | Max security | Difficult to manage for multiple tokens, no UX support |

Each has trade-offs, but the key principle is the same: move long-term holdings off exchanges once you’ve completed your trades.

Final Thoughts: What We Learned from Exchange Case Studies

If there’s one thing we’ve seen across these five platforms, it’s this: where to buy altcoins under $1 isn’t just a question of availability, it’s a question of fit. Not every exchange suits every investor. Some offer fast access but lack volume. Others provide deep liquidity but arrive late to new listings. And all come with trade-offs when it comes to regulation, security, and listing transparency.

Each platform we explored offers something unique:

- Binance delivers unmatched liquidity for sub-$1 coins, if you’re outside the U.S.

- KuCoin gives retail users a wide view into emerging microcaps and regional tokens

- Gate.io enables early access but requires more caution and hands-on management

- MEXC is ideal for token hunters who know how to navigate thinner liquidity

- OKX balances DePIN support with clean UI and Web3 wallet integrations

No matter your experience level, knowing where and how you buy altcoins under $1 could be the difference between a speculative play and a thoughtful entry. What really matters is understanding why a coin is priced low, what risks come with that price, and how your chosen exchange supports your strategy.

And once you’ve bought, don’t forget to store those assets safely. You can read our full breakdown of the best wallets to store altcoins under $1 to compare cold, mobile, and multi-chain options.

Or if you’re still researching promising coins, here’s our curated list of the top 7 altcoins under $1 in 2025, based on performance potential, utility, and real-world traction.

Buying sub-$1 altcoins can be exciting. But smart entry, smart storage, and platform awareness are what separate lucky flips from strategic plays.

FAQs About Buying Altcoins Under $1

Where is the best place to buy altcoins under $1 in 2025?

Even the place where you can buy altcoins under a dollar will depend on where you live or trade, what you emphasize most: liquidity, first access, or low fees. Binance and OKX are the best platforms to have deep liquidity and sustainability. For KuCoin, Gate.io, and MEXC Global, the mechanism to place surveying fast-on-listing and easy-on-ramping is more common, but at the same time, these platforms always have empty order books.

Can I buy altcoins under $1 without KYC?

And yes, there are a few exchanges where a little bit of trading altcoins under $1 can be done without full KYC ( Know Your Customer ). KuCoin and MEXC Global are cases in point as they only offer access to basic accounts, where they require basic e-mail registration but are limited in terms of withdrawals and trading. It is important to remember that non-KYC services can include an additional risk and will require being in a country that allows you access to them.

Make sure to read the terms of use on the platform, and it is better to start with smaller sums, especially when you trade without KYC.

Which exchange lists the most altcoins under $1?

As of August 2025, most altcoins with a trading price below $1 are on the two exchanges, MEXC Global and KuCoin. MEXC lists over 700 cheap tokens, and the majority of the cheap tokens are listed within days of the initial token generation events. The next to-go-to is KuCoin, especially the Asian projects that have something to do with DePIN.

Binance and OKX are more liquid and with smaller spreads, but more inclined and more willing to provide new coins in the latter stages of their life. MEXC and KuCoin are usually more aggressive on new listings when it comes to seeking an early discovery. All you need to remember is that it is also possible that with lower liquidity, there will also be more slippage and volatility.

Disclaimer: The information presented in this blog post is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Always conduct your own research before making investment decisions. The author is not a financial advisor and does not guarantee any specific outcomes. Cryptocurrency investments carry inherent risks, and readers should consult with a licensed financial professional before engaging in crypto-related activities.

Vivek Singh is the founder of AltcoinsNest.com which is a research-driven crypto blog focused on altcoins under $1, high-potential 100x picks, and essential crypto tools. As an engineer by background and a passionate learner in the crypto space, Vivek openly shares his research, watchlists, and risk notes to help everyday investors so that they make informed decisions. While new to crypto, his goal is to cut through the hype and deliver practical insights based on data, not speculation.AltcoinsNest.com is his personal journey into altcoin investing documented transparently, updated frequently, and always focused on helping readers stay ahead in a fast-moving space.

📬 Get My Free 2025 Altcoin Watchlist

10 undervalued coins that could skyrocket – straight to your inbox.